Vermont Tenant Refitting Escrow Agreement

Description

How to fill out Tenant Refitting Escrow Agreement?

Are you presently in the location where you need documents for either business or personal purposes almost all the time? There are many valid document templates accessible online, but finding ones you can rely on isn't simple.

US Legal Forms offers thousands of form templates, including the Vermont Tenant Refitting Escrow Agreement, which are designed to meet state and federal regulations.

If you are already familiar with the US Legal Forms website and possess a free account, simply Log In. Then, you can download the Vermont Tenant Refitting Escrow Agreement template.

- Acquire the form you need and make sure it pertains to the correct city/county.

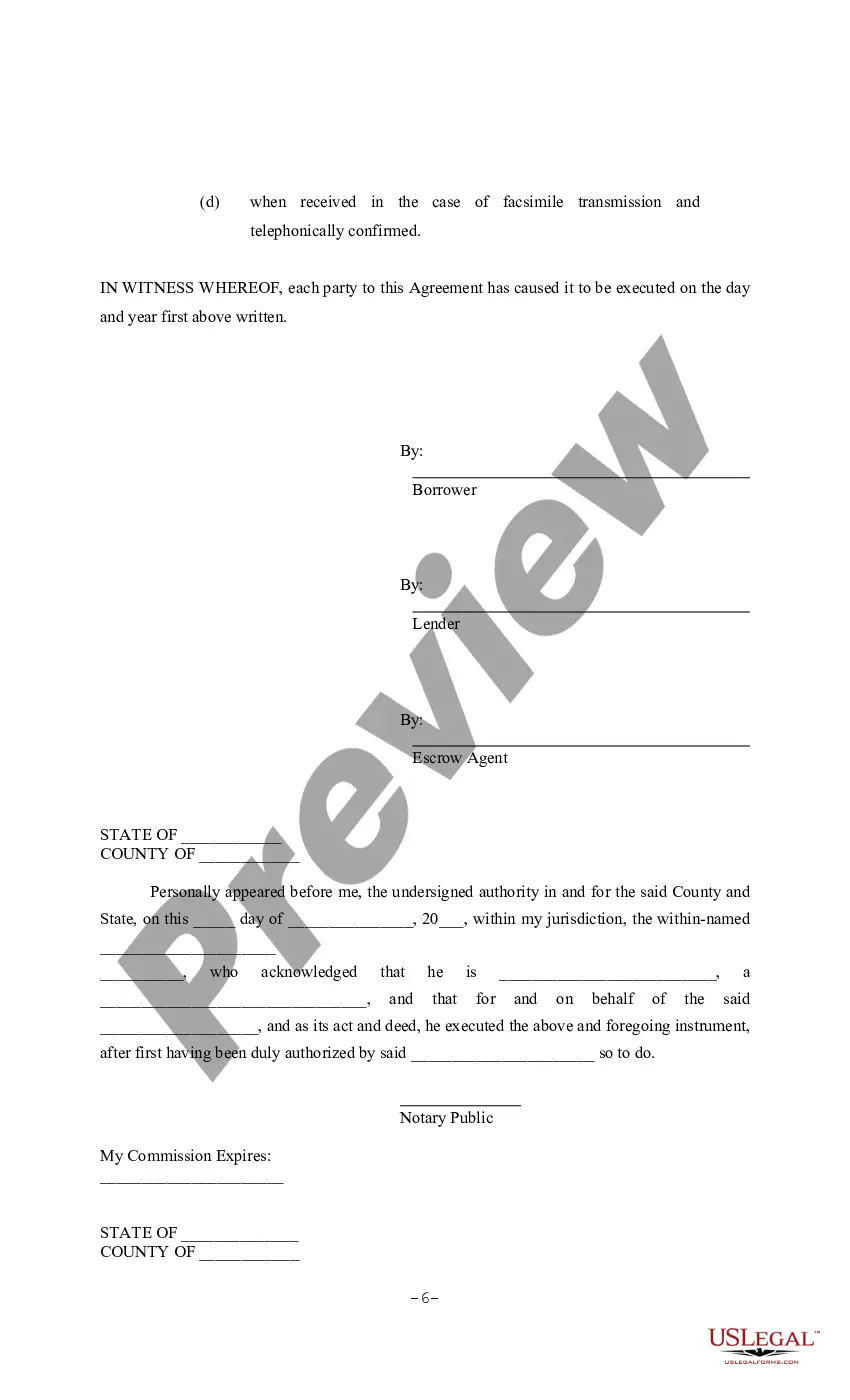

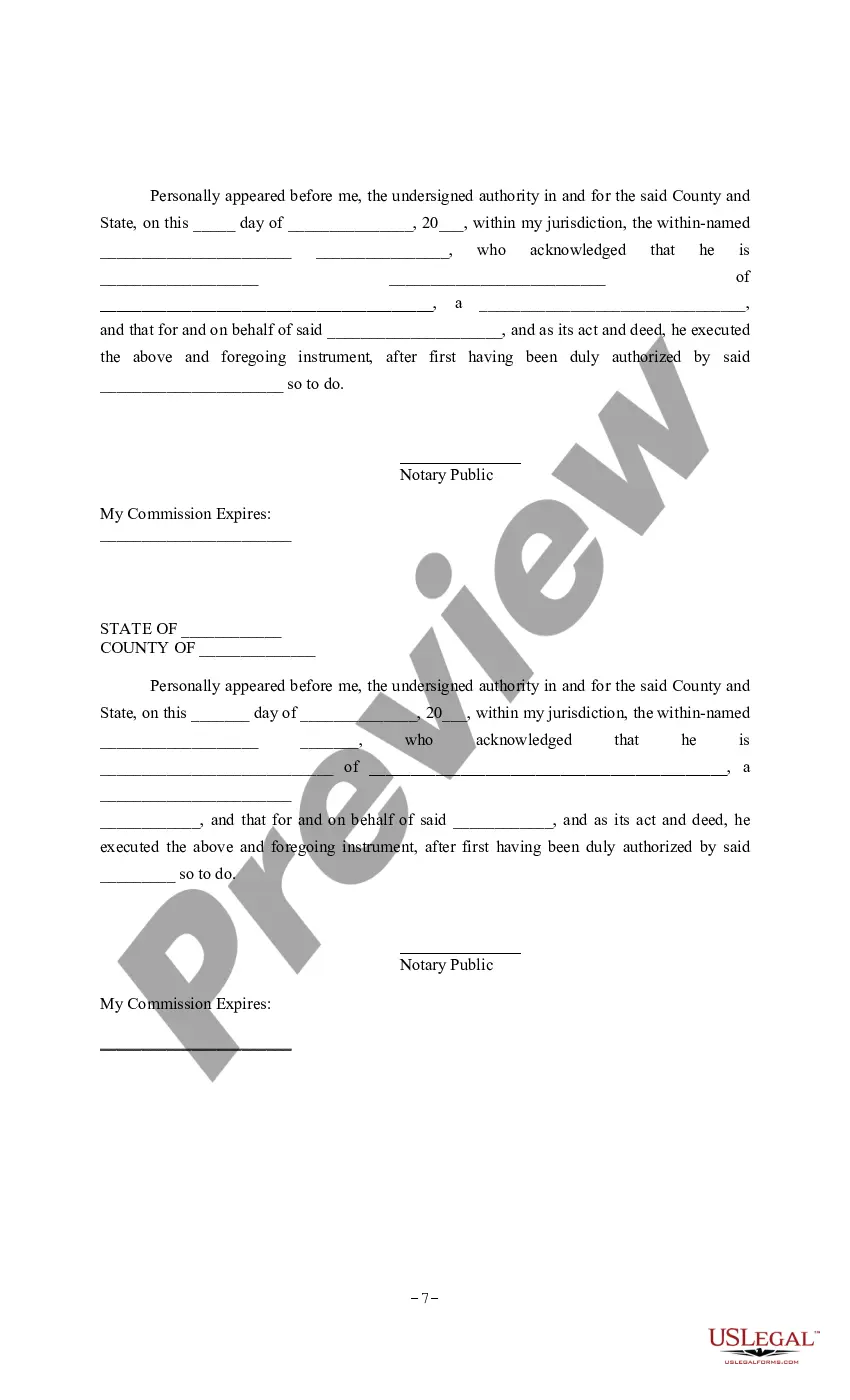

- Use the Review feature to evaluate the form.

- Read the description to confirm that you have selected the appropriate form.

- If the form isn't what you are looking for, employ the Search option to find the form that fits your needs and requirements.

- Once you find the right form, click on Buy now.

- Choose the payment plan you prefer, fill in the necessary details to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- Select a convenient document format and download your copy.

Form popularity

FAQ

In Vermont, it is generally acceptable for landlords to request first month’s rent, last month’s rent, and a security deposit from tenants. However, the security deposit amount cannot exceed one month of rent. Additionally, it's crucial for both parties to understand the terms outlined in a Vermont Tenant Refitting Escrow Agreement. This agreement helps clarify the responsibilities and expectations of both landlords and tenants, ensuring a smooth rental experience.

Statute 4467 in Vermont relates to the process of evicting tenants for nonpayment or lease violations. This law outlines the necessary steps landlords must follow to conduct a legal eviction. Familiarity with this statute can assist tenants in understanding their legal standing, especially in cases that involve agreements like the Vermont Tenant Refitting Escrow Agreement. Having the right information can make a big difference in challenging situations.

Legal Basics.Vermont landlords can charge any amount as a security deposit as long as it is listed in the lease agreement. It must be returned within 14 days of lease termination, otherwise the landlord will forfeit the right to retain any funds and be liable for double the withheld sum in damages.

1- VermontVermont has been one of the most tenant friendly states for years now. The state imposes a 60-day rent increase notice on landlords and sets a 14 -day deadline for returning security deposits. Moreover, the tenant is given a lot of latitudes when it comes to withholding rent and deducting expenses from it.

If the tenant intends to occupy the rental unit for more than one year, the security deposit should be reported as a long-term asset (or noncurrent asset) under the balance sheet classification "Other assets". The landlord that receives and holds the security deposit should report the amount as a liability.

You'll submit a cashier's check or arrange a wire transfer to meet the remaining down paymentsome of which is covered by your earnest moneyand closing costs, and your lender will wire your loan funds to escrow so the seller and, if applicable, the seller's lender, can be paid.

If a landlord fails to repair serious or dangerous problems in a rental unit, you have the right to pay your rent into an escrow account established at the local District Court. You will pay your rent money directly to the court, and the court will hold it until a judge hears your case and makes a decision.

Agreements can be verbal or written Any additional terms may not be enforceable unless you and the landlord have talked about them and agreed and then only as long as the RRAA does not prohibit the agreement. 9 V.S.A. § 4454.

Is Vermont a Landlord-Friendly State? Vermont is not a landlord-friendly state because of the strict notification policies and eviction rules.

Rental Property EscrowTo enroll in escrow, the applicant must complete an application and attach the necessary documents (rental documents, utility bills, and photo ID) online.Submission, the application is reviewed by BSEED for approval.Upon approval, an email is generated to ODFS for sub-account creation.