Vermont Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Irrevocable Trust For Future Benefit Of Trustor With Income Payable To Trustor After Specified Time?

You can invest hours online trying to discover the legal document template that meets the federal and state requirements you need.

US Legal Forms provides thousands of legal forms that can be evaluated by experts.

You can easily download or print the Vermont Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time from your service.

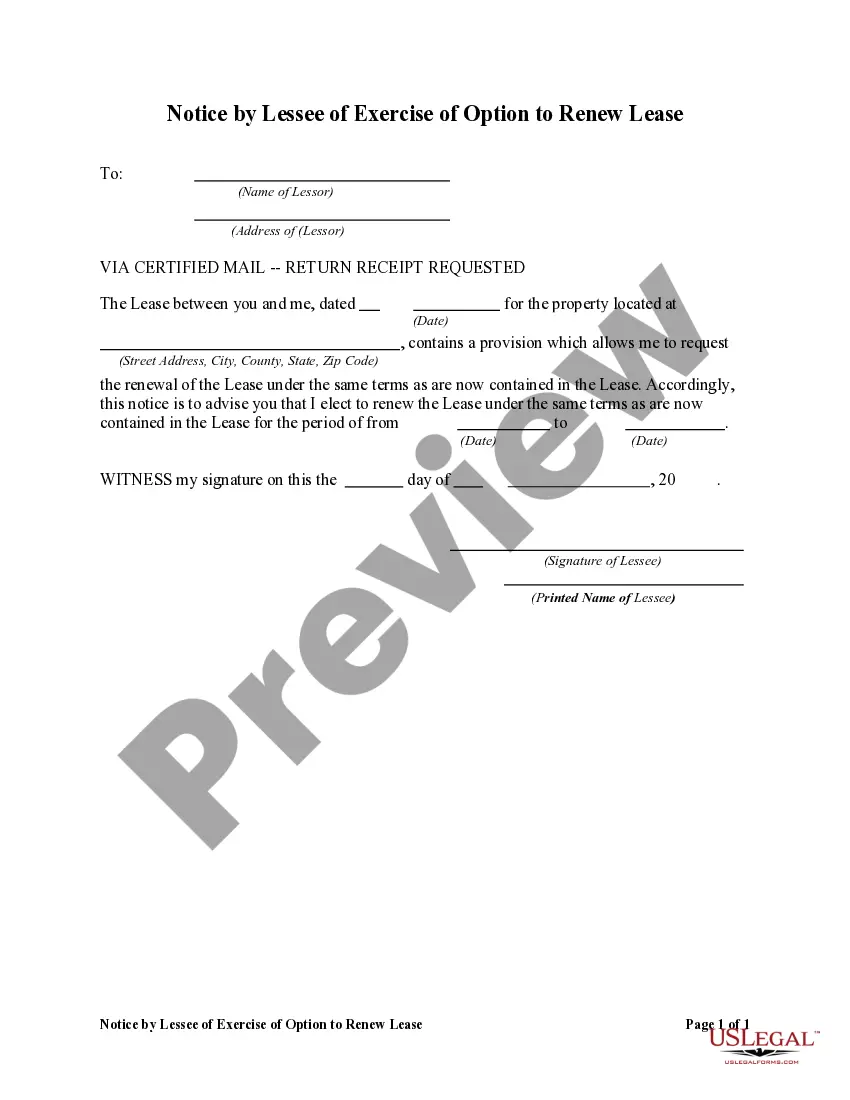

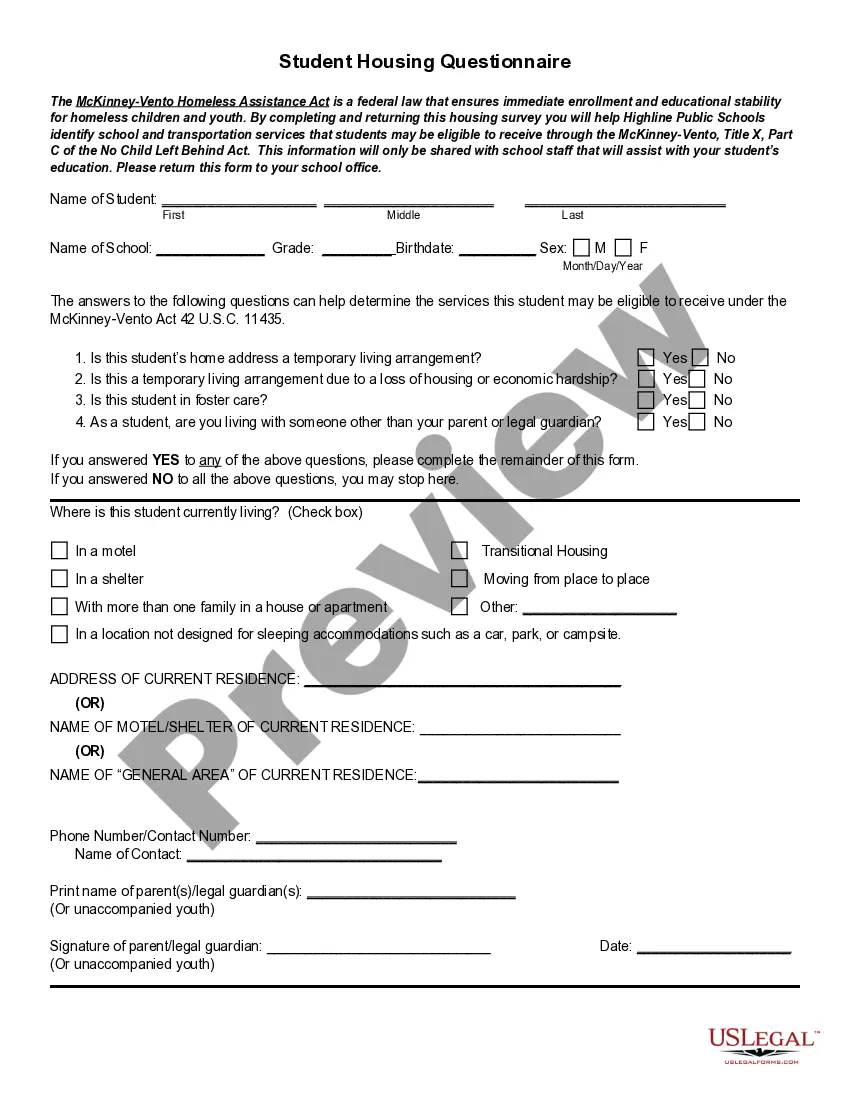

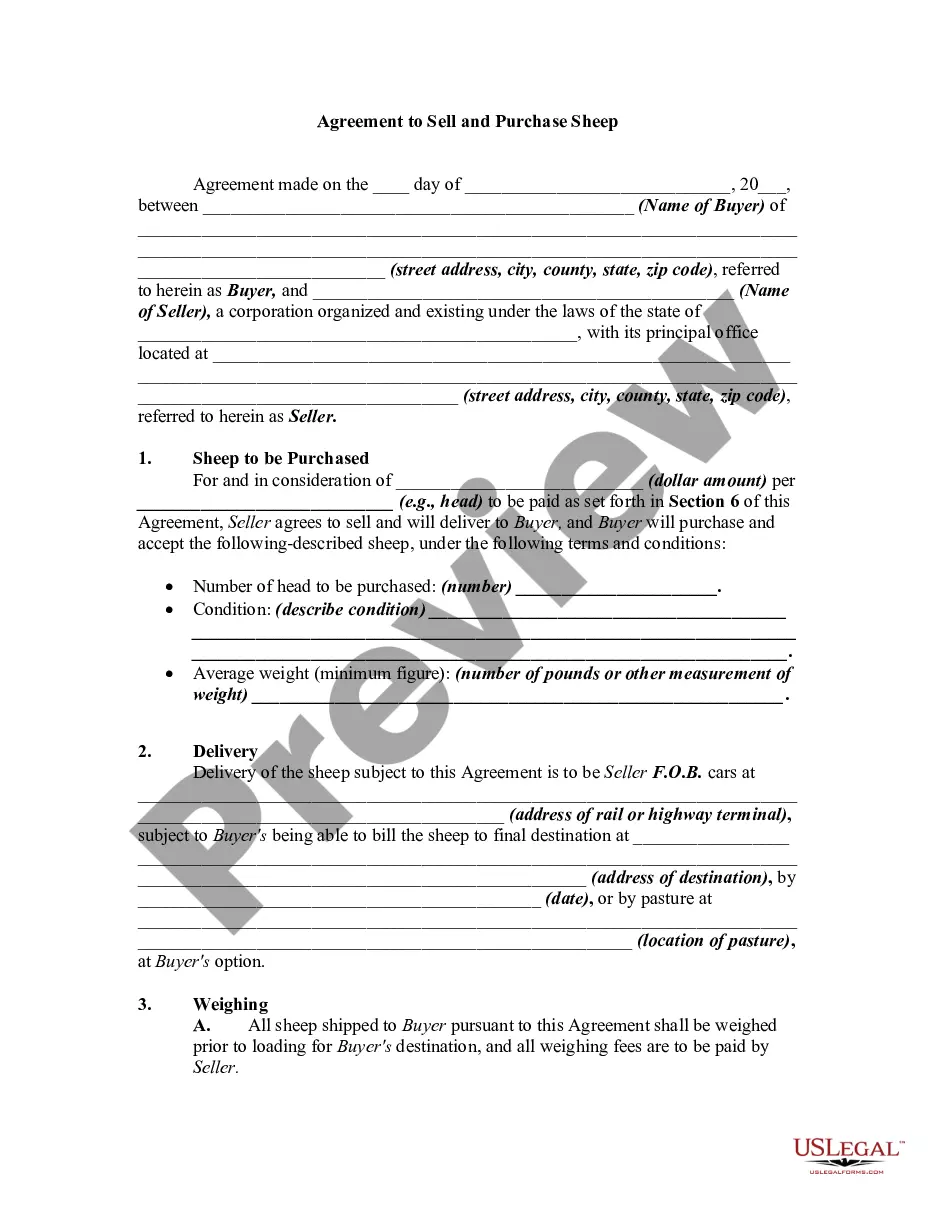

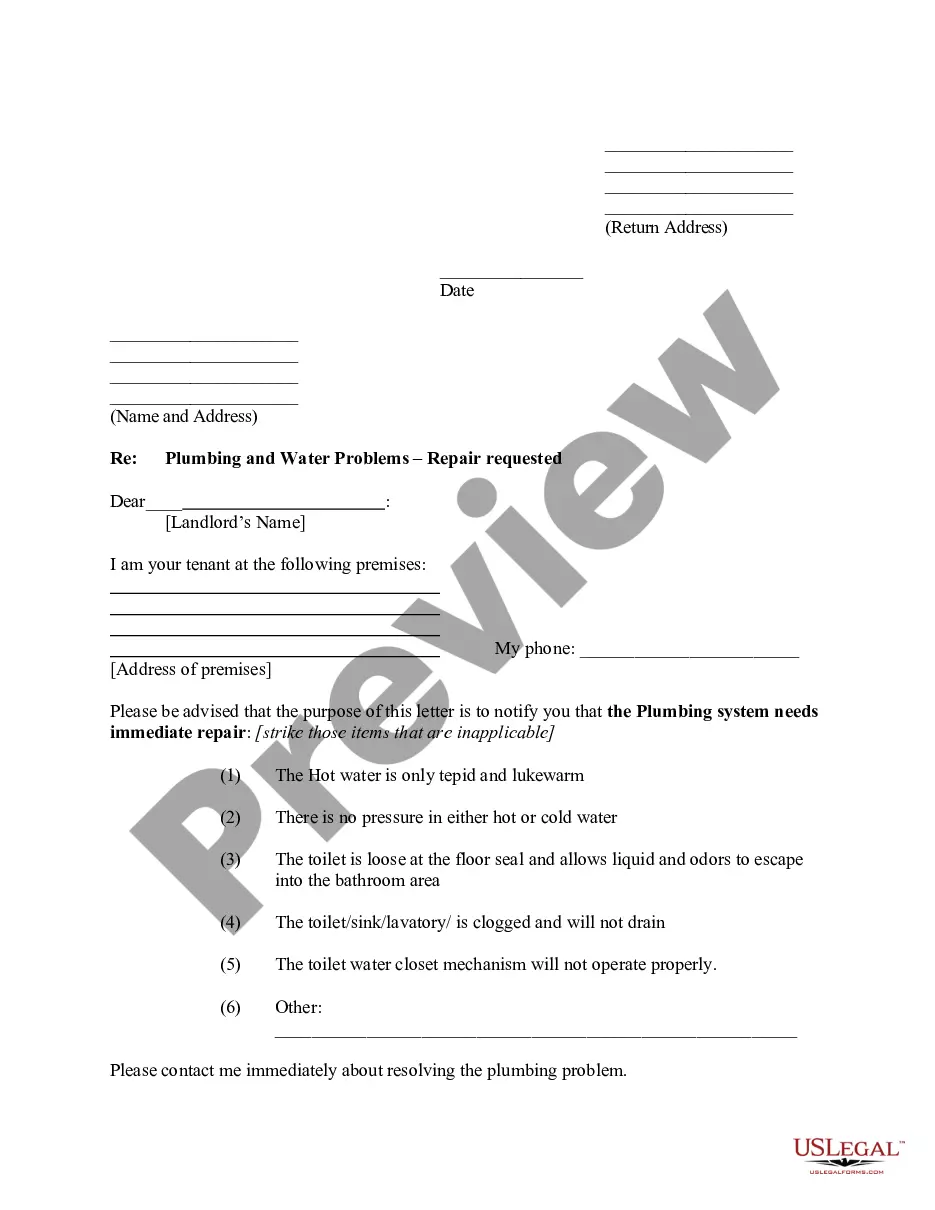

If available, utilize the Preview option to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the Vermont Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time.

- Each legal document template you purchase is yours for an extended period.

- To obtain another copy of the purchased form, visit the My documents section and click on the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines outlined below.

- First, ensure that you have selected the correct document template for the area/city that you choose.

- Read the form description to confirm you have selected the correct form.

Form popularity

FAQ

The 65-day rule relates to distributions from complex trusts to beneficiaries made after the end of a calendar year. For the first 65 days of the following year, a distribution is considered to have been made in the previous year.

An irrevocable trust is a very powerful tool for Medicaid Asset Protection, as it allows you to shelter assets from a nursing home after they have been in the trust for five years.

Generally, a trustee is the only person allowed to withdraw money from an irrevocable trust.

An irrevocable trust reports income on Form 1041, the IRS's trust and estate tax return. Even if a trust is a separate taxpayer, it may not have to pay taxes. If it makes distributions to a beneficiary, the trust will take a distribution deduction on its tax return and the beneficiary will receive IRS Schedule K-1.

But assets in an irrevocable trust generally don't get a step up in basis. Instead, the grantor's taxable gains are passed on to heirs when the assets are sold. Revocable trusts, like assets held outside a trust, do get a step up in basis so that any gains are based on the asset's value when the grantor dies.

The step-up in basis is equal to the fair market value of the property on the date of death. In our example, if the parents had put their home in this irrevocable income only trust, and the fair market value upon their demise was $300,000, the children would receive the home with a basis equal to this $300,000 value.

When a trust is irrevocable but some or all of the trust can be disbursed to or for the benefit of the individual, the look-back period applying to disbursements which could be made to or for the individual but are made to another person or persons is 36 months.

The step-up in basis tax provision protects the asset in a revocable trust from heavy taxation. Grantors and trustees can take advantage of this provision to reduce or eliminate capital gains taxes. The assets in a revocable trust appreciate and provide the grantor with a consistent stream of income in their lifetime.

An irrevocable trust provides an alternative to simply giving an asset to a beneficiary in order to reduce your taxable estate. With a trust, you can set the timing of distributions (i.e. when the beneficiary attains 30 years of age) as well as the reasons for distributions (i.e. for education only).

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. Their children or spouse would be the residual beneficiaries.