Vermont Receipt and Release Personal Representative of Estate Regarding Legacy of a Will

Description

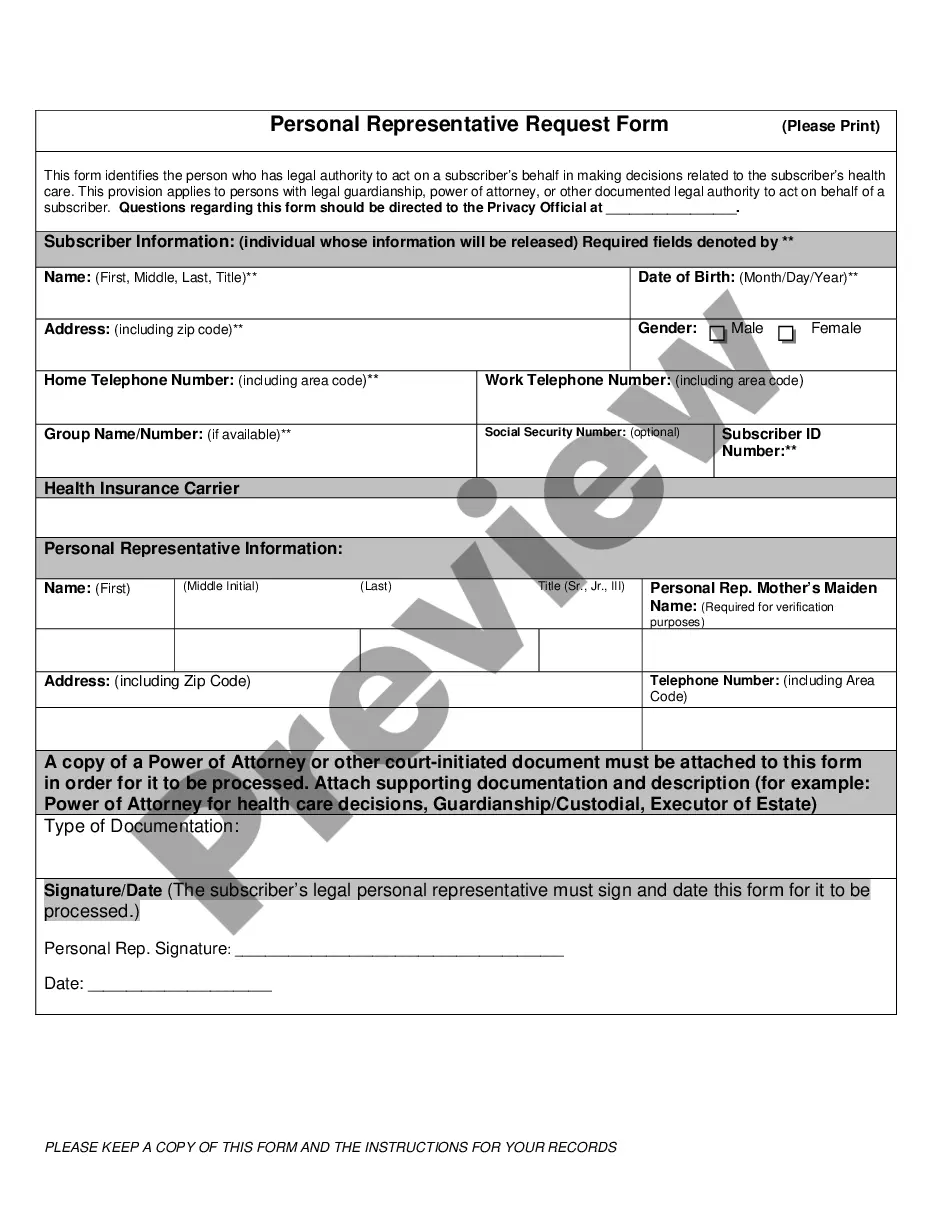

How to fill out Receipt And Release Personal Representative Of Estate Regarding Legacy Of A Will?

You may devote hours online searching for the lawful document format that meets the state and federal needs you want. US Legal Forms provides a large number of lawful forms that happen to be examined by experts. You can easily obtain or print out the Vermont Receipt and Release Personal Representative of Estate Regarding Legacy of a Will from your support.

If you currently have a US Legal Forms profile, it is possible to log in and then click the Download key. Following that, it is possible to comprehensive, modify, print out, or indication the Vermont Receipt and Release Personal Representative of Estate Regarding Legacy of a Will. Every lawful document format you buy is your own property forever. To get an additional copy of any bought kind, proceed to the My Forms tab and then click the corresponding key.

If you use the US Legal Forms internet site the first time, follow the simple recommendations below:

- Very first, make sure that you have chosen the best document format for that county/area of your choice. Read the kind explanation to ensure you have picked the correct kind. If available, make use of the Preview key to search with the document format also.

- If you want to get an additional model in the kind, make use of the Lookup area to get the format that fits your needs and needs.

- Upon having identified the format you want, just click Purchase now to carry on.

- Choose the rates strategy you want, type your accreditations, and sign up for a merchant account on US Legal Forms.

- Comprehensive the deal. You can utilize your bank card or PayPal profile to purchase the lawful kind.

- Choose the structure in the document and obtain it for your product.

- Make changes for your document if required. You may comprehensive, modify and indication and print out Vermont Receipt and Release Personal Representative of Estate Regarding Legacy of a Will.

Download and print out a large number of document templates making use of the US Legal Forms website, that offers the biggest collection of lawful forms. Use specialist and condition-certain templates to handle your small business or personal requirements.

Form popularity

FAQ

Vermont Inheritance Law and Spouses If you die intestate in Vermont, which is not a community property state, your spouse will inherit everything if you have no children, or if your only descendants are with your spouse. Descendants include children, grandchildren, and great-grandchildren.

Any assets with a beneficiary, such as a life insurance policy, will automatically avoid probate. Create a living trust. By establishing a trust and naming a successor trustee (the person who will take over as trustee when you die), you can protect just about any asset, including real estate and bank accounts.

As stated in Section 103 of Title 14 of Chapter 3 of Vermont probate laws, the individual with custody of the will has to file with a court within 30 days of learning about the death. You do not need to file a petition to open probate at the same time as filing, but you can complete both simultaneously.

What is the Inheritance Tax in Vermont? Since Vermont is not a state that imposes an inheritance tax, the inheritance tax in 2023 is 0% (zero). As a result, you won't owe Vermont inheritance taxes.

The general requirements for a valid Will are usually as follows: (a) the document must be written (meaning typed or printed), (b) signed by the person making the Will (usually called the ?testator? or ?testatrix?, and (c) signed by two witnesses who were present to witness the execution of the document by the maker ...

For instance, property, which you or your spouse inherits, is considered marital property, and property given to you or your spouse by a family member is also considered marital property. The court can also divide property which either spouse owned before the marriage.

Formal Probate If the person who died owned real estate or if the estate is worth more than $45,000.