Vermont Articles of Association of Unincorporated Charitable Association

Description

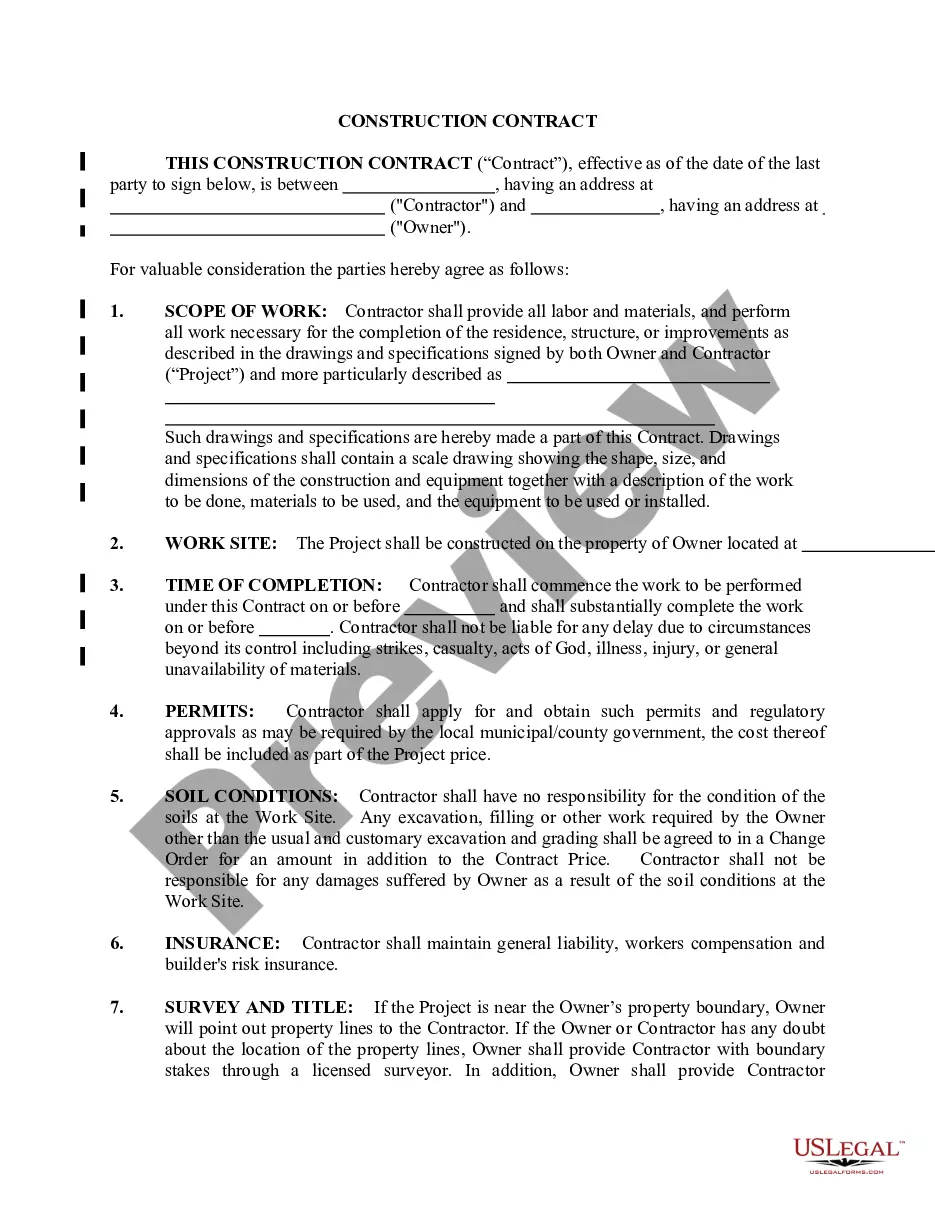

How to fill out Articles Of Association Of Unincorporated Charitable Association?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a wide range of legal document formats that you can download or print.

By utilizing the website, you can access thousands of forms for both business and personal use, organized by categories, states, or keywords.

You can find the latest editions of forms such as the Vermont Articles of Association of Unincorporated Charitable Association in just a few minutes.

When if the form does not meet your requirements, use the Search bar at the top of the screen to find one that does.

Once satisfied with the form, confirm your choice by clicking the Get now button. Then, select your preferred payment plan and provide your details to create an account.

- If you already have an account, Log In to download the Vermont Articles of Association of Unincorporated Charitable Association from your US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If this is your first time using US Legal Forms, here are simple steps to get started.

- Ensure you have selected the correct form for your location/state.

- Click the Preview button to review the form's details.

Form popularity

FAQ

The articles of association for a non-profit organization outline the rules and regulations governing the organization. This foundational document typically includes the organization's mission, governance structure, and operational guidelines. In the context of the Vermont Articles of Association of Unincorporated Charitable Association, it serves as a legal requirement for establishing the organization and ensuring compliance with state laws.

No one person or group of people can own a nonprofit organization. Ownership is the major difference between a for-profit business and a nonprofit organization. For-profit businesses can be privately owned and can distribute earnings to employees or shareholders.

Filing your Vermont Articles of Incorporation requires a fee of $125, whether you file online or by mail. Reserving a business name in Vermont costs $20.

To start a corporation in Vermont, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Secretary of State, Corporations Division. You can file this document online or by mail. The articles cost $125 to file.

You create your nonprofit entity by filing a certificate of incorporation with the Vermont Secretary of State and paying the $125 filing fee (as of July 2020). Your articles of organization must include basic information such as: the name of your nonprofit.

To start a 501(c)(3) tax-exempt nonprofit organization in Vermont, you must first start a Vermont nonprofit according to the rules of the state and then apply for 501(c)(3) status with the IRS. Learn more about 501(c)(3) eligibility in our What is a 501(c)(3) guide.

Nonprofit Organizations are not Required to Incorporate Typically, a nonprofit that depends on minimal funding and conducts limited activities does not need to incorporate.

One way of starting a nonprofit without money is by using a fiscal sponsorship. A fiscal sponsor is an already existing 501(c)(3) corporation that will take a new organization under its wing" while the new company starts up. The sponsored organization (you) does not need to be a formal corporation.

To start a corporation in Vermont, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Secretary of State, Corporations Division. You can file this document online or by mail. The articles cost $125 to file.

An unincorporated association can operate as a tax-exempt nonprofit as long as the purpose of its activity is of public benefit, and annual revenues are less than $5,000. If the association remains small with limited income, the unincorporated association does not need to apply to the IRS for 501(c)(3) status.