Vermont Sample Letter for Payroll Dispute

Description

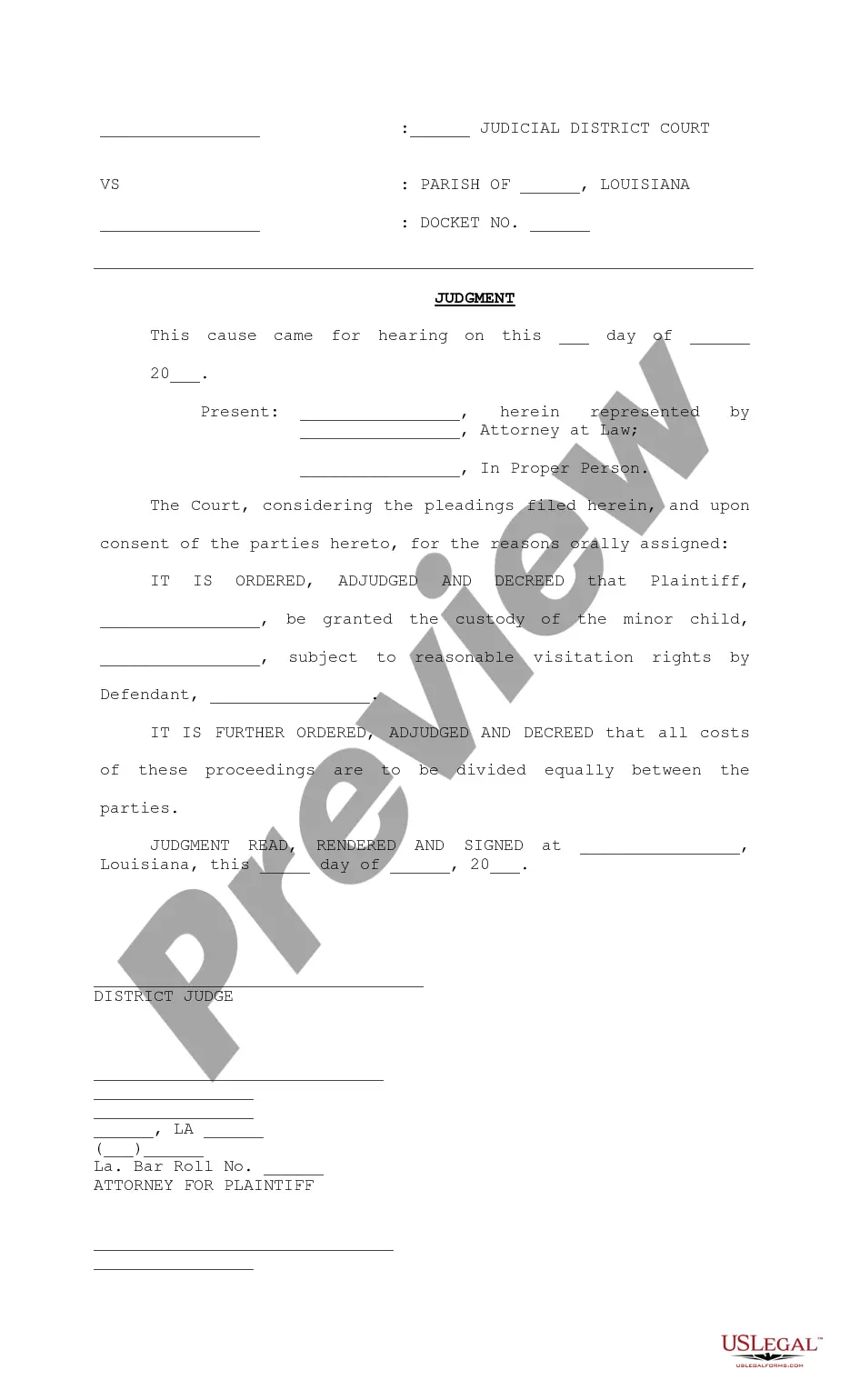

How to fill out Sample Letter For Payroll Dispute?

It is possible to devote hrs online trying to find the legal file format that meets the federal and state demands you will need. US Legal Forms supplies 1000s of legal varieties that happen to be examined by pros. You can easily obtain or print out the Vermont Sample Letter for Payroll Dispute from our support.

If you already have a US Legal Forms accounts, you may log in and click the Obtain button. Following that, you may comprehensive, change, print out, or signal the Vermont Sample Letter for Payroll Dispute. Each legal file format you buy is the one you have for a long time. To have yet another duplicate of the obtained develop, proceed to the My Forms tab and click the related button.

If you work with the US Legal Forms internet site the first time, stick to the straightforward recommendations below:

- Very first, ensure that you have selected the correct file format to the region/city of your choosing. Browse the develop description to make sure you have selected the appropriate develop. If offered, take advantage of the Review button to search through the file format as well.

- If you would like locate yet another variation from the develop, take advantage of the Look for discipline to obtain the format that suits you and demands.

- After you have found the format you want, click Purchase now to proceed.

- Choose the costs plan you want, key in your qualifications, and register for a merchant account on US Legal Forms.

- Full the transaction. You can use your bank card or PayPal accounts to cover the legal develop.

- Choose the file format from the file and obtain it for your system.

- Make alterations for your file if needed. It is possible to comprehensive, change and signal and print out Vermont Sample Letter for Payroll Dispute.

Obtain and print out 1000s of file themes using the US Legal Forms website, that offers the most important assortment of legal varieties. Use specialist and condition-certain themes to tackle your business or specific needs.

Form popularity

FAQ

I am writing to you because I am concerned that I have not received my correct pay. I (am/was employed/engaged) by you from (enter date) to the (enter date) as a (enter job title) on a (enter job type - full time, part time or agency/casual) basis. incorrect rates of pay etc. mortgage charges.

Report it right away to your boss or human resources: Assume it's an honest mistake and ask for an immediate correction. You should get your unpaid wages in your next check, if not sooner. Otherwise, you're lending your boss money at no interest.

How to Handle Payroll Errors Step 1: Briefly state the error and apologize. ... Step 2: Describe what caused the error and show the employee exactly how the correct pay should have been calculated. ... Step 3: Explain what steps are being taken to fix the error and to ensure it is not repeated.

If you're an employee and you notice that your paycheck has an error, you should let your employer know right away. Specifically, let them know what the problem is and share a copy of your pay stub as proof. This way, management or human resources (HR) can fix the problem as soon as possible.

You can correct a mistake with an employee's pay or deductions by updating the year-to-date figures in your next regular Full Payment Submission ( FPS ). You can also correct it by sending an additional FPS before your next regular FPS is due.

What to do if your paycheck is wrong: Report it right away to your boss or human resources: Assume it's an honest mistake and ask for an immediate correction. ... Keep your own records: Make a note of when you arrive at work and when you leave.

To write a payroll processing error letter, follow these steps below: Define the error. Explain what led to the error and what you're doing to correct it. Follow up with a formal letter that documents your communication and process for handling the error.