Are you in the position that you require papers for both company or individual uses almost every time? There are a lot of legitimate record web templates available on the net, but locating ones you can rely on is not straightforward. US Legal Forms offers a large number of develop web templates, like the Vermont Beneficiary Deed, which are published in order to meet federal and state demands.

When you are already informed about US Legal Forms site and also have an account, simply log in. Following that, you are able to acquire the Vermont Beneficiary Deed format.

If you do not come with an accounts and want to begin to use US Legal Forms, adopt these measures:

- Discover the develop you will need and make sure it is for your right area/region.

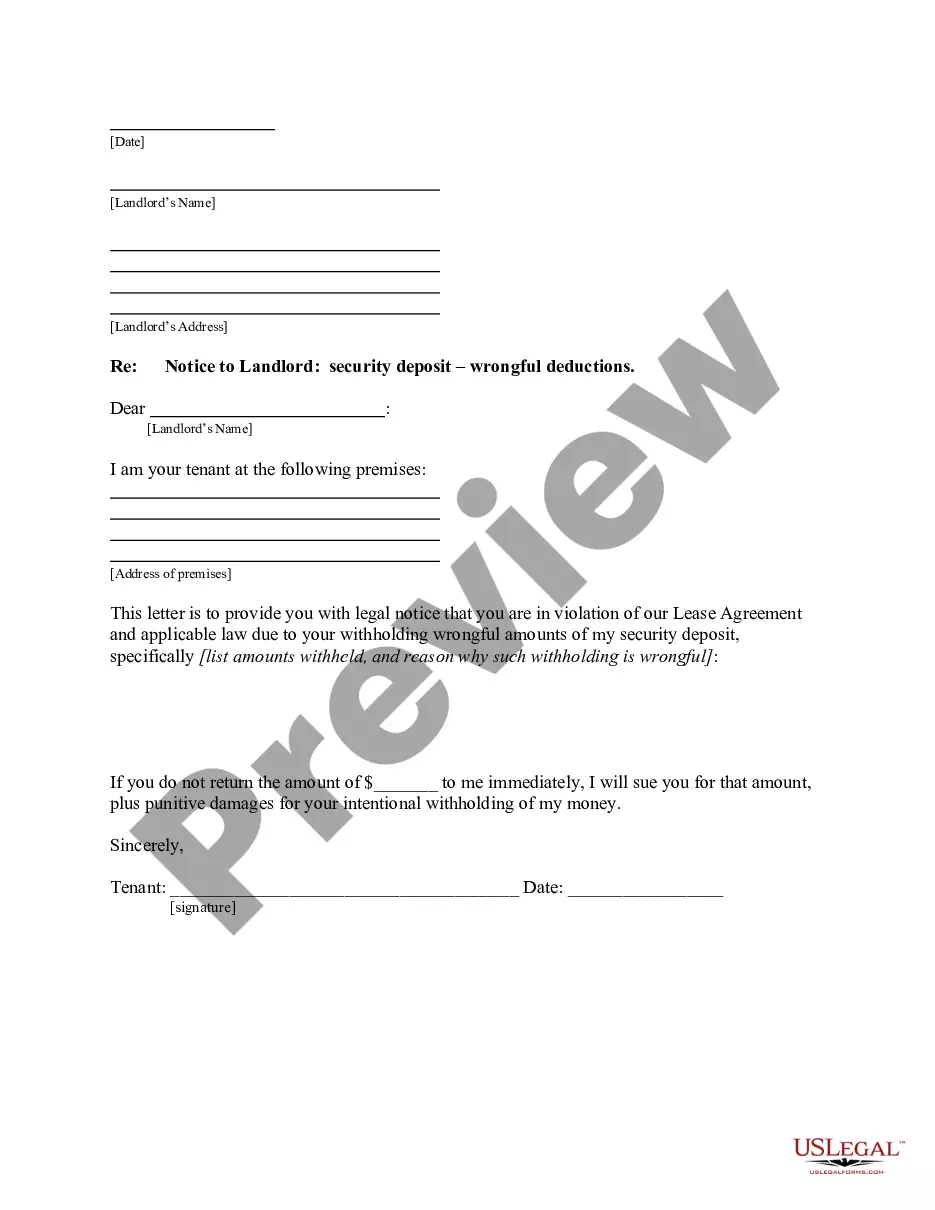

- Take advantage of the Review button to check the shape.

- Look at the information to actually have chosen the correct develop.

- In case the develop is not what you`re looking for, use the Look for industry to obtain the develop that suits you and demands.

- Whenever you obtain the right develop, click Get now.

- Choose the pricing prepare you want, fill in the required info to create your bank account, and pay for an order utilizing your PayPal or Visa or Mastercard.

- Decide on a hassle-free document file format and acquire your version.

Find all the record web templates you might have purchased in the My Forms menus. You can obtain a additional version of Vermont Beneficiary Deed at any time, if possible. Just select the necessary develop to acquire or print out the record format.

Use US Legal Forms, one of the most extensive collection of legitimate types, to save lots of some time and avoid errors. The services offers professionally made legitimate record web templates which you can use for a range of uses. Make an account on US Legal Forms and initiate generating your lifestyle easier.