Vermont Auto Expense Travel Report

Description

How to fill out Auto Expense Travel Report?

If you need to finalize, secure, or produce legal document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Utilize the site`s straightforward and efficient search feature to find the documents you require.

A range of templates for business and personal purposes are categorized and organized by themes or keywords.

Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other types of your legal form design.

Step 4. Once you find the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Utilize US Legal Forms to obtain the Vermont Auto Expense Travel Report with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to get the Vermont Auto Expense Travel Report.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

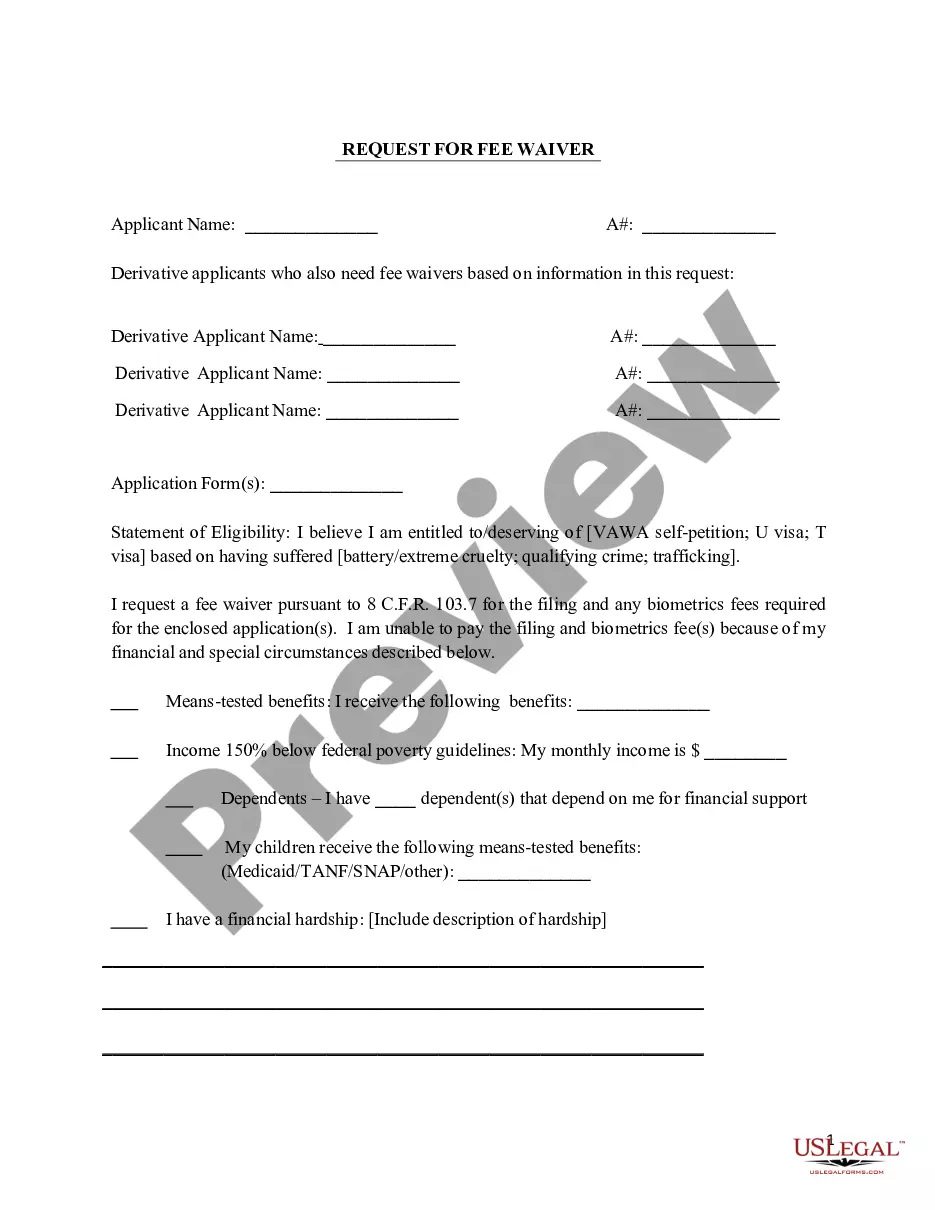

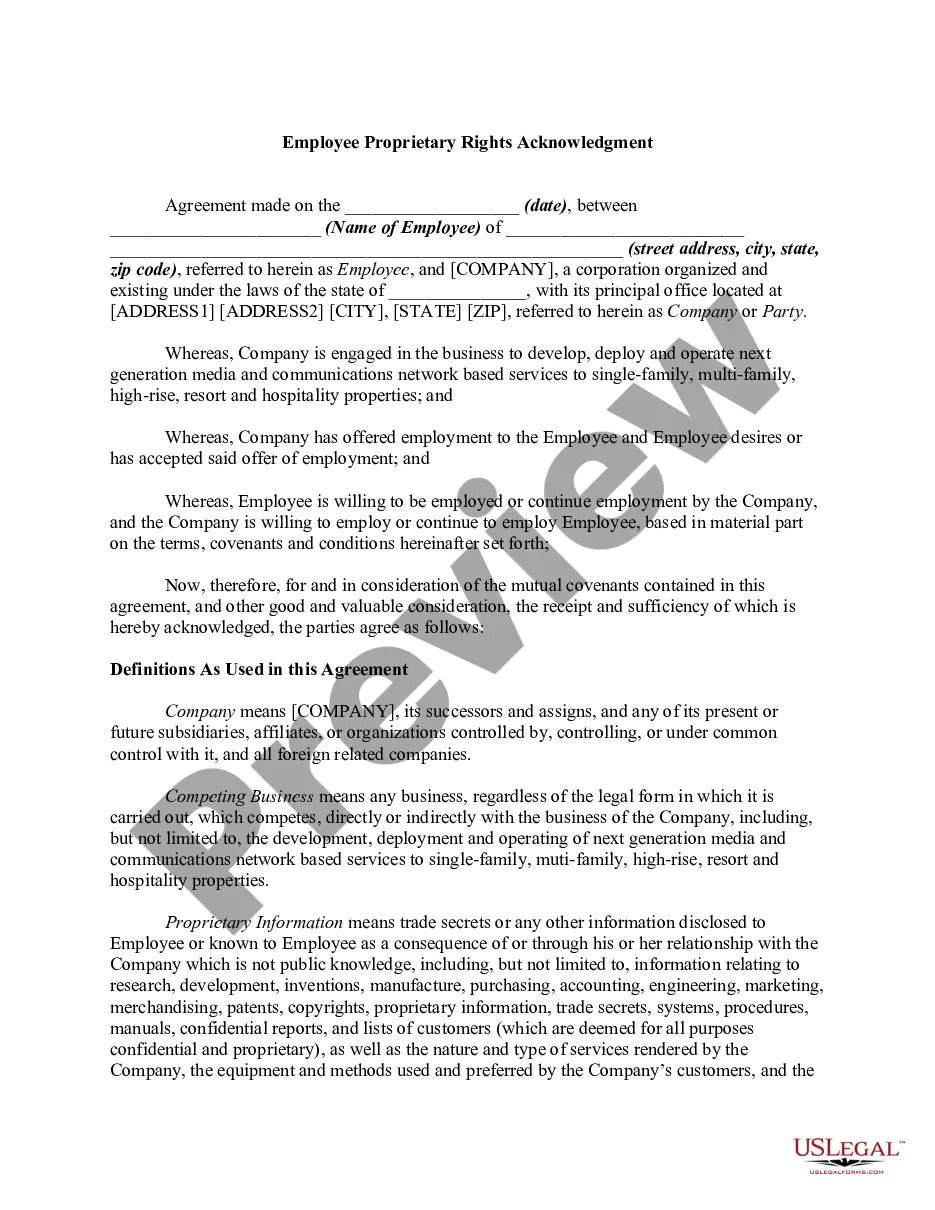

- Step 2. Use the Review option to preview the form`s content. Be sure to read the description.

Form popularity

FAQ

The standard travel reimbursement rate can vary based on location and the company's specific policies. In the United States, government rates are often a benchmark for employees, typically covering meals, lodging, and transportation costs. Familiarizing yourself with the Vermont Auto Expense Travel Report will help you understand these rates and ensure you receive fair compensation for your travel expenses.

A staged expense report refers to a multi-step process where expenses are submitted and approved in phases. This method helps organizations manage and review costs effectively as they occur, rather than in a single bulk submission. Using a tool like the Vermont Auto Expense Travel Report can facilitate this staged approach, making tracking and approval more manageable for everyone involved.

To fill out a travel expense report, begin by collecting all necessary receipts and documentation related to your travel costs. Include essential details such as travel dates, purpose, and the costs associated with each aspect of your trip. By following a structured format, like that used in the Vermont Auto Expense Travel Report, you can ensure that your submission is clear and compliant with company policies.

Filling out an expense form requires several simple steps. Start by entering your personal information, such as your name and contact details. Next, list each expense incurred during your business trip, including dates, amounts, and descriptions. Utilizing a reliable resource like the Vermont Auto Expense Travel Report can streamline this process, ensuring accuracy and efficiency.

Mileage reimbursement in Vermont is typically in line with the standard rate set by the IRS, which adjusts based on economic factors. This reimbursement aims to cover the costs associated with operating a vehicle for business purposes. A Vermont Auto Expense Travel Report can assist in documenting these miles accurately, making it easier to receive your due reimbursement.

A travel expense report is a document used to detail and itemize expenses incurred during business travel. It typically includes information about lodging, meals, mileage, and other costs related to work assignments. Utilizing a Vermont Auto Expense Travel Report can make it easier to track these expenses and ensure timely reimbursement from employers.

The state of Vermont has guidelines in place for travel reimbursement, which cover various aspects including per diem, mileage, and other travel-related expenses. Employers are encouraged to adhere to these guidelines to ensure fair compensation. Using a Vermont Auto Expense Travel Report streamlines the process to ensure compliance and efficiency.

The standard reimbursement rate in Vermont aligns with the IRS-approved amount, which is updated annually. Generally, this figure encompasses costs related to fuel, wear and tear, and other vehicle-related expenses. Incorporating this information into your Vermont Auto Expense Travel Report helps to ensure accurate expense claims.

In Vermont, the mileage reimbursement law stipulates that employers must reimburse employees for travel expenses incurred during work-related tasks. This includes business trips and client visits. To efficiently manage these reimbursements, utilizing a Vermont Auto Expense Travel Report can simplify tracking and claiming mileage expenses.

The per diem rate in Vermont is determined by various factors including the location and type of expenses incurred. It generally covers lodging, meals, and incidentals. For those navigating the Vermont Auto Expense Travel Report, it is important to check the most current rate set by the federal government or local authorities to ensure proper budgeting.