Vermont Convertible Note Agreement

Description

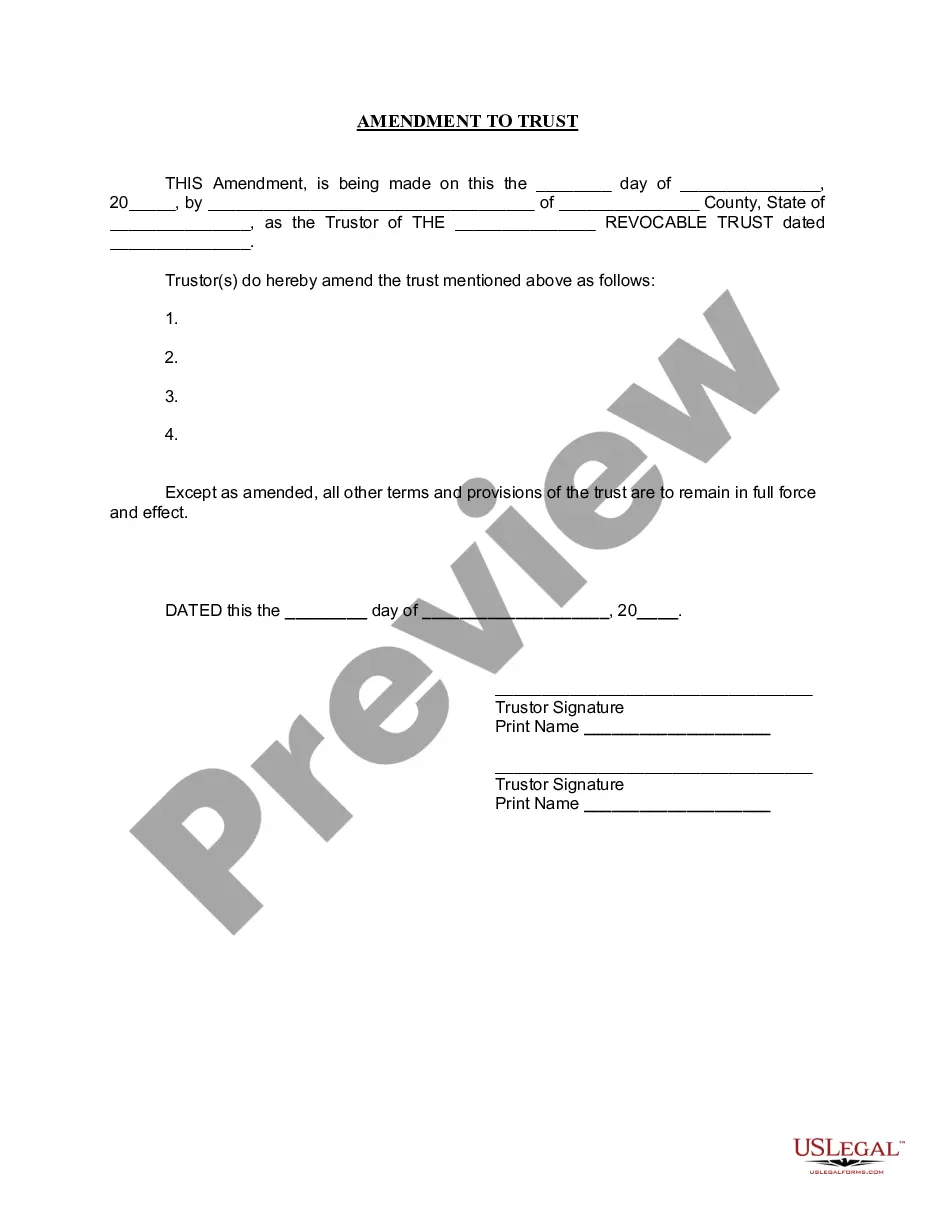

How to fill out Convertible Note Agreement?

If you need to acquire, obtain, or produce legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Use the site's straightforward and convenient search feature to find the documents you need.

A variety of templates for business and personal purposes are categorized by groups, states, or keywords.

Step 4. Once you find the form you need, select the Buy now option. Choose the payment plan you prefer and provide your details to create an account.

Step 5. Complete the payment. You can use your Visa or Mastercard or PayPal account to finalize the purchase.

- Utilize US Legal Forms to obtain the Vermont Convertible Note Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to receive the Vermont Convertible Note Agreement.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to check the form's details. Remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

A convertible note certificate is a formal document that outlines the terms of a Vermont Convertible Note Agreement. This certificate details the principal amount, interest rate, and conversion terms that define how the debt converts into equity. Having a well-prepared convertible note certificate is essential, as it provides clarity and legal protection to both the investor and the company.

The procedure for issuing convertible notes typically involves drafting a Vermont Convertible Note Agreement, negotiating terms with potential investors, and ensuring compliance with state laws. Once the agreement is finalized, both parties should sign it to make it legally enforceable. Additionally, consider utilizing platforms like uslegalforms to simplify the process and ensure legal compliance.

Convertible notes carry some risk, particularly if the issuing company fails to grow or achieve a successful exit. Investors may find themselves holding a debt rather than equity if the terms of the Vermont Convertible Note Agreement are not favorable. It's essential to assess the company's potential before investing in these types of securities.

Convertible notes can come with disadvantages such as uncertain valuation and the potential for debt repayment if they don't convert. In a Vermont Convertible Note Agreement, both parties must clearly outline their expectations to avoid misunderstandings. Additionally, the lack of fixed timeframe for conversion can create ambiguity for investors.

Downside protection in a convertible note refers to provisions ensuring that the lender has some security in case the investment does not perform as expected. This protection can take the form of a cap or discount in a Vermont Convertible Note Agreement, offering the lender favorable terms during conversion. Always consider these protections when negotiating terms.

Writing a convertible note involves understanding the key components of a Vermont Convertible Note Agreement, such as the amount borrowed, interest rate, and conversion terms. Start with a clear introduction, followed by the main terms and conditions. Ensure to include signatures from both the lender and the borrower to make the agreement legally binding.

If a convertible note never converts, the borrower may owe the principal plus accrued interest to the lender at maturity. In the case of a Vermont Convertible Note Agreement, it's crucial to be aware of the terms regarding repayment versus conversion. Understandably, failing to convert might lead to financial obligations that pose a burden on both parties.

To calculate interest on a convertible note, you first need the principal amount and the interest rate specified in the Vermont Convertible Note Agreement. Multiply the principal by the interest rate, and then divide by the number of periods, usually in years. Keep in mind that most convertible notes accrue interest until conversion or maturity, so regular tracking is essential.

Issuing a Vermont Convertible Note Agreement involves drafting the note with all key terms, such as interest rate and conversion mechanics. Next, you should consult with legal and financial advisors to ensure compliance and clarity. Once the note is finalized, it can be presented to investors for financing, establishing a mutual understanding of expected returns.

A convertible note deed formalizes the agreement between the borrower and lender regarding the terms of a convertible note. In the context of a Vermont Convertible Note Agreement, this deed ensures that both parties clearly understand their rights and obligations. This legal documentation plays a vital role in preventing disputes down the line.