Vermont Pool Services Agreement - Self-Employed

Description

How to fill out Pool Services Agreement - Self-Employed?

Selecting the appropriate authentic document template can be challenging. Obviously, there are numerous designs accessible on the web, but how will you locate the genuine form you require? Visit the US Legal Forms website.

The service offers thousands of designs, such as the Vermont Pool Services Agreement - Self-Employed, that can be utilized for both business and personal needs. All the forms are vetted by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to find the Vermont Pool Services Agreement - Self-Employed. Use your account to browse through the official forms you may have previously purchased. Go to the My documents tab of your account and download another copy of the document you require.

Fill out, modify, print, and sign the obtained Vermont Pool Services Agreement - Self-Employed. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to acquire professionally crafted paperwork that adheres to state requirements.

- If you are a new user of US Legal Forms, here are basic instructions that you should follow.

- First, ensure you have chosen the correct form for your locality/state. You can browse the form using the Review button and read the form description to confirm it is appropriate for you.

- If the form does not satisfy your needs, use the Search field to find the right form.

- When you are confident that the form is correct, select the Purchase now button to obtain the form.

- Choose the pricing plan you want and enter the required information. Create your account and pay for the transaction using your PayPal account or credit card.

- Select the format and download the legitimate document template for your device.

Form popularity

FAQ

Pooling agreements and voting trusts serve different purposes and are not the same. While pooling agreements, like the Vermont Pool Services Agreement - Self-Employed, focus on service arrangements, voting trusts relate to shareholders' rights in corporate settings. Understanding these distinctions is crucial for anyone navigating legal agreements, ensuring clarity in their specific context.

A rental pool arrangement refers to a system where property owners collectively manage rental agreements for various properties, which differs from a Vermont Pool Services Agreement - Self-Employed focused on service delivery. In this context, multiple parties combine resources to streamline management and share profits. Understanding such arrangements helps clarify the role of each participant in the pool.

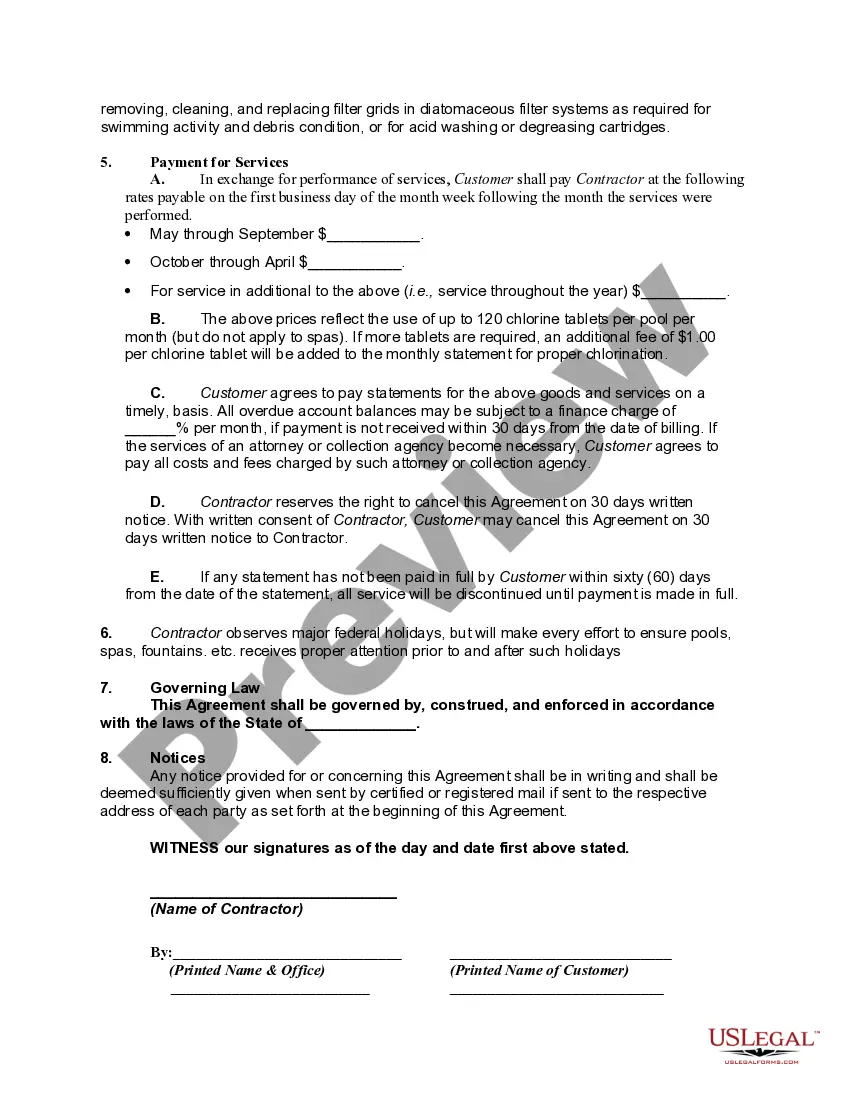

Pool contracts are essential for any self-employed individual offering pool services, as seen in the Vermont Pool Services Agreement - Self-Employed. These contracts typically cover service scope, responsibilities, and payment structures. They serve as a safeguard for both clients and service providers by establishing clear expectations and legal protections.

A pooling service agreement, like the Vermont Pool Services Agreement - Self-Employed, defines the working relationship between a self-employed pool service provider and clients. This agreement details the scope of work, payment terms, and duration of services. Such clarity protects both parties and fosters trust in the arrangement.

A pool contract, often referred to in the context of a Vermont Pool Services Agreement - Self-Employed, outlines the responsibilities and expectations between parties involved in pool services. This type of document clarifies terms, payment schedules, and service details to ensure both the service provider and customer are aligned. These contracts help prevent misunderstandings and establish a professional relationship.

VT Form 113 is used to report income tax withheld from employees and independent contractors in Vermont. If you work under a Vermont Pool Services Agreement - Self-Employed, understanding this form is essential for compliance with state withholding laws. Accurate filing ensures both you and your clients remain compliant.

Non-residents earning income in Vermont must complete the Non-Resident Individual Income Tax Return, also known as Form NR-1040. If you are engaged in a Vermont Pool Services Agreement - Self-Employed, this form is necessary for reporting your Vermont income. Ensuring that you file the correct forms will help you meet your tax responsibilities.

The household income for a homestead declaration in Vermont is defined as the total income of all members living in the household. This calculation impacts your eligibility for property tax benefits. Knowing how your Vermont Pool Services Agreement - Self-Employed earnings contribute to your total household income is essential for accurate declarations.

To file independent contractor income, you should use Schedule C when filing your personal tax return. Report your earnings from your Vermont Pool Services Agreement - Self-Employed on this form. Ensuring accurate reporting will help you avoid tax issues in the future.

The voluntary disclosure program in Vermont provides a pathway for individuals who may have unreported income to rectify their tax status. It allows taxpayers to come forward without facing penalties on their Vermont Pool Services Agreement - Self-Employed earnings. Participating in this program can be beneficial in achieving peace of mind regarding your tax obligations.