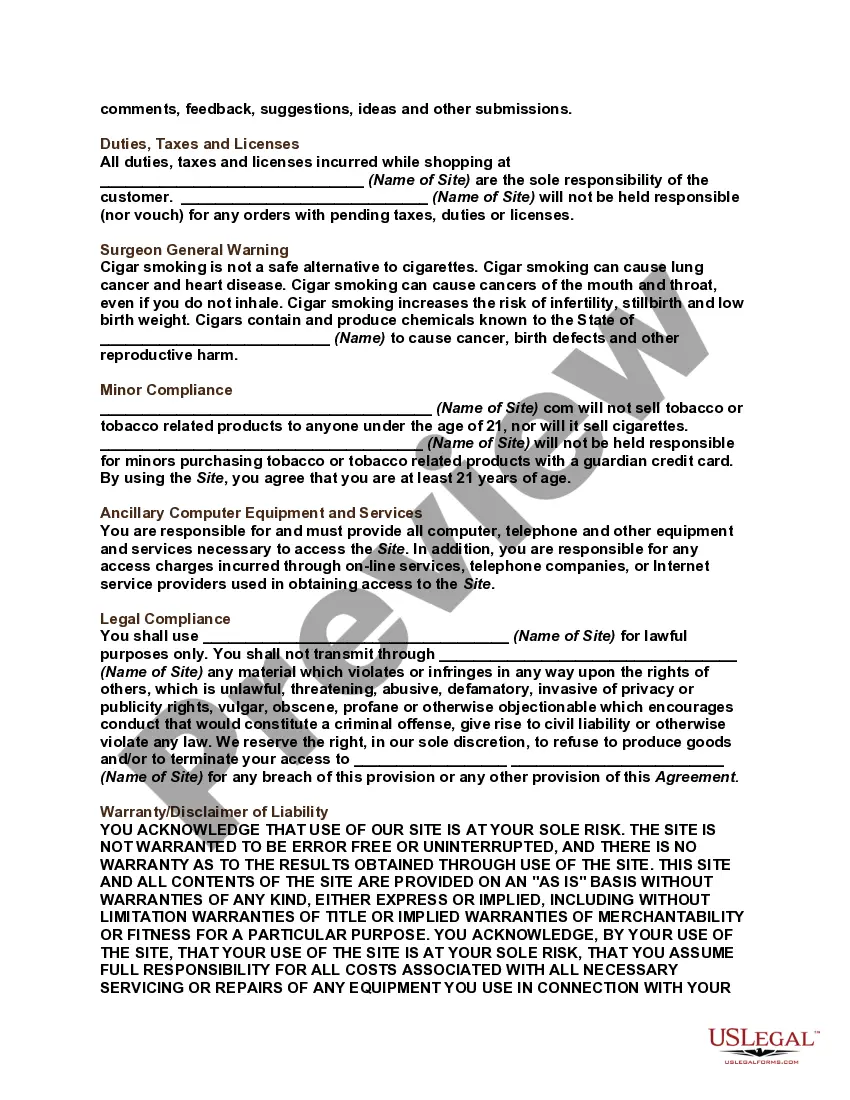

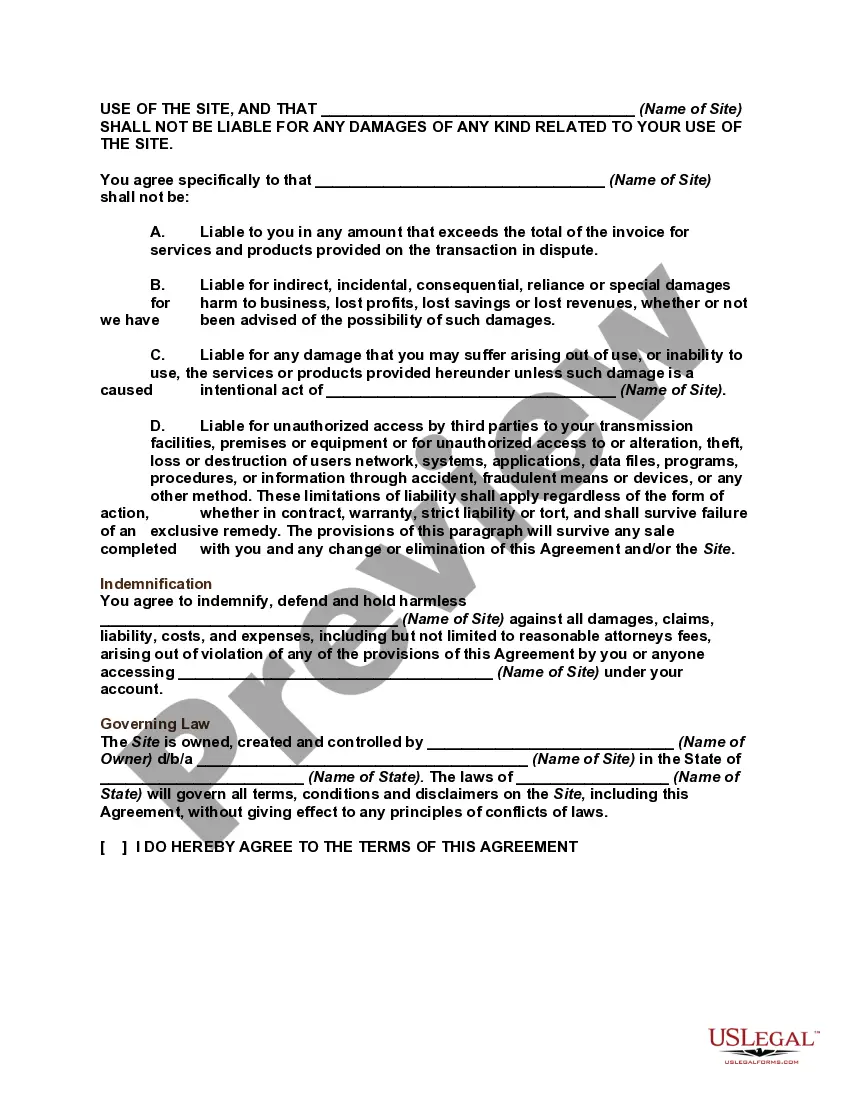

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Vermont Terms of Use Form for an Online Cigar Store

Description

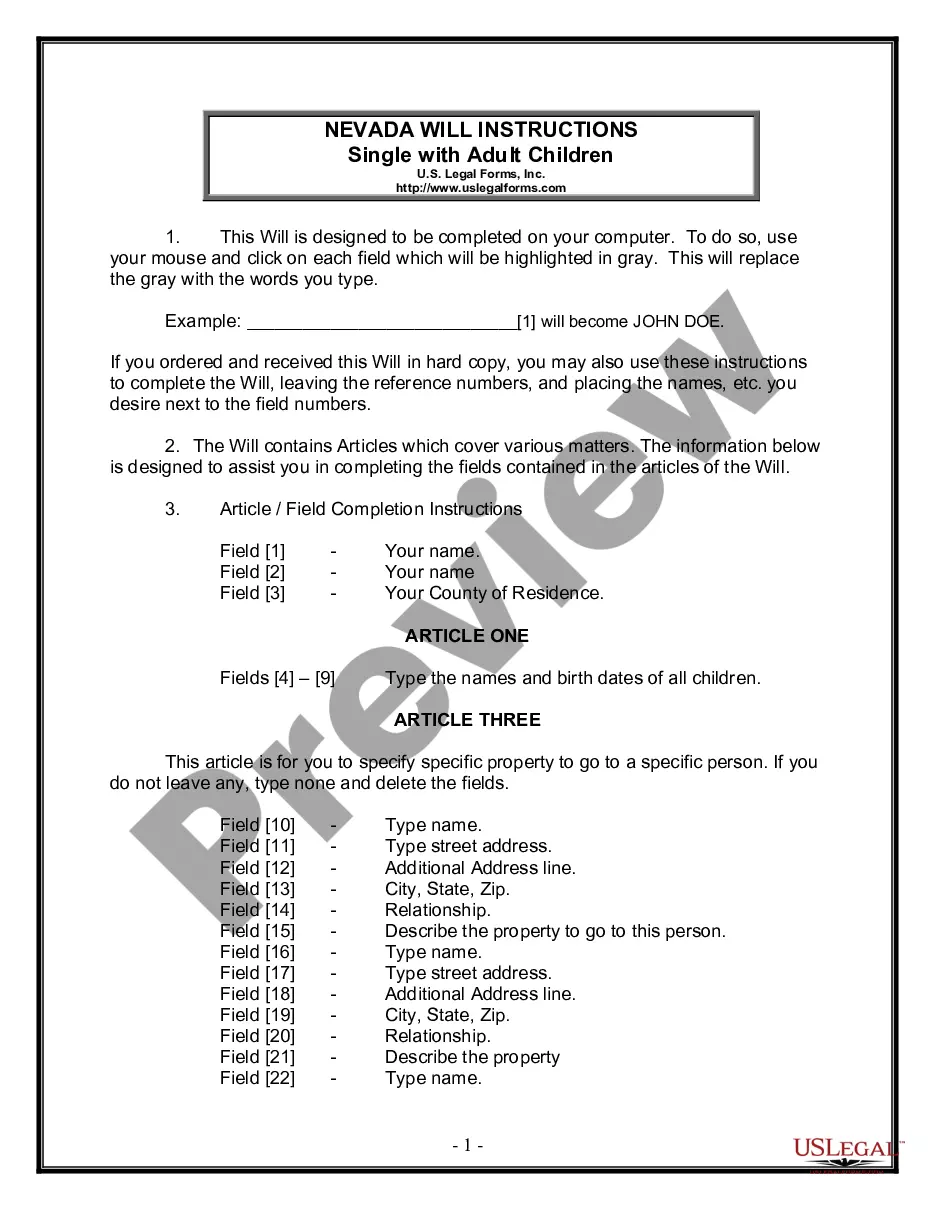

How to fill out Terms Of Use Form For An Online Cigar Store?

In case you need to compile, retrieve, or generate valid document templates, utilize US Legal Forms, the foremost collection of legal documents available online.

Utilize the site's straightforward and convenient search feature to find the forms you need.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After identifying the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to access the Vermont Terms of Use Document for an Online Cigar Store within just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the Vermont Terms of Use Document for an Online Cigar Store.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Confirm that you have selected the form for the appropriate state/country.

- Step 2. Use the Preview option to examine the form's contents. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions in the legal form format.

Form popularity

FAQ

Yes, you can sell cigars online, but it is essential to follow the regulations specific to your state, including Vermont. To ensure compliance, you should complete the Vermont Terms of Use Form for an Online Cigar Store. This form helps clarify the legal obligations and requirements for operating an online cigar business. By using this form, you can navigate the complexities of state law while focusing on delivering a great shopping experience to your customers.

Vermont state imposes a sales tax of 6% on most online purchases, including items from an online cigar store. This tax applies to all tangible personal property sold in the state. When shopping for cigars online, ensuring you’re aware of the sales tax can help streamline your purchasing experience. For clarity, using a Vermont Terms of Use Form for an Online Cigar Store can provide you with the necessary guidelines for any applicable taxes.

Yes, you can buy vapes online in Vermont, provided you follow local regulations. Just like with tobacco products, ensure you are informed about the Vermont Terms of Use Form for an Online Cigar Store. This form will guide you through the legal landscape of purchasing vaping products online.

The IN-111 tax form in Vermont is used for personal income tax returns. If you buy tobacco online and need to report this, understanding tax obligations is important. You can find assistance through platforms such as USLegalForms, which provides reliable legal document resources.

The non-resident tax form for Vermont is typically required for individuals who earn income in the state but reside elsewhere. If you are purchasing tobacco products online, you may need to familiarize yourself with this form. Consulting resources or platforms like USLegalForms can help simplify the process.

Yes, you can legally buy tobacco online in Vermont. When purchasing, make sure to adhere to the Vermont Terms of Use Form for an Online Cigar Store. This form ensures that you understand the legal implications and requirements for purchasing tobacco online.

Delivery of tobacco products is legal in many regions, including Vermont, but specific regulations apply. It is essential to comply with the Vermont Terms of Use Form for an Online Cigar Store, as it specifies the rules around delivery. Ensure that the delivery service is licensed to handle tobacco shipments.

In Vermont, an individual typically needs to make over $100,000 to file taxes, depending on their filing status. If a filer earns below this threshold, they may not be required to submit a return. Including this information in your Vermont Terms of Use Form for an Online Cigar Store can help your customers navigate their financial responsibilities with ease.

For online purchases in Vermont, the sales tax rate is currently set at 6%. Specific rules apply to cigars and tobacco products, and retailers must ensure compliance with the sales tax regulations. Your Vermont Terms of Use Form for an Online Cigar Store should clearly outline these sales tax requirements to inform your customers appropriately.

The salary threshold in Vermont for tax purposes typically aligns with the minimum filing requirements. For single filers, this threshold often ranges around $100,000, creating a baseline for income taxes. By emphasizing these details in your Vermont Terms of Use Form for an Online Cigar Store, you can assist your customers in understanding their tax obligations.