Vermont Receipt for Payment of Rent

Description

How to fill out Receipt For Payment Of Rent?

You can allocate time on the internet searching for the appropriate legal document template that meets the federal and state regulations you need.

US Legal Forms provides thousands of legal documents that have been reviewed by professionals.

You can download or print the Vermont Receipt for Payment of Rent from their service.

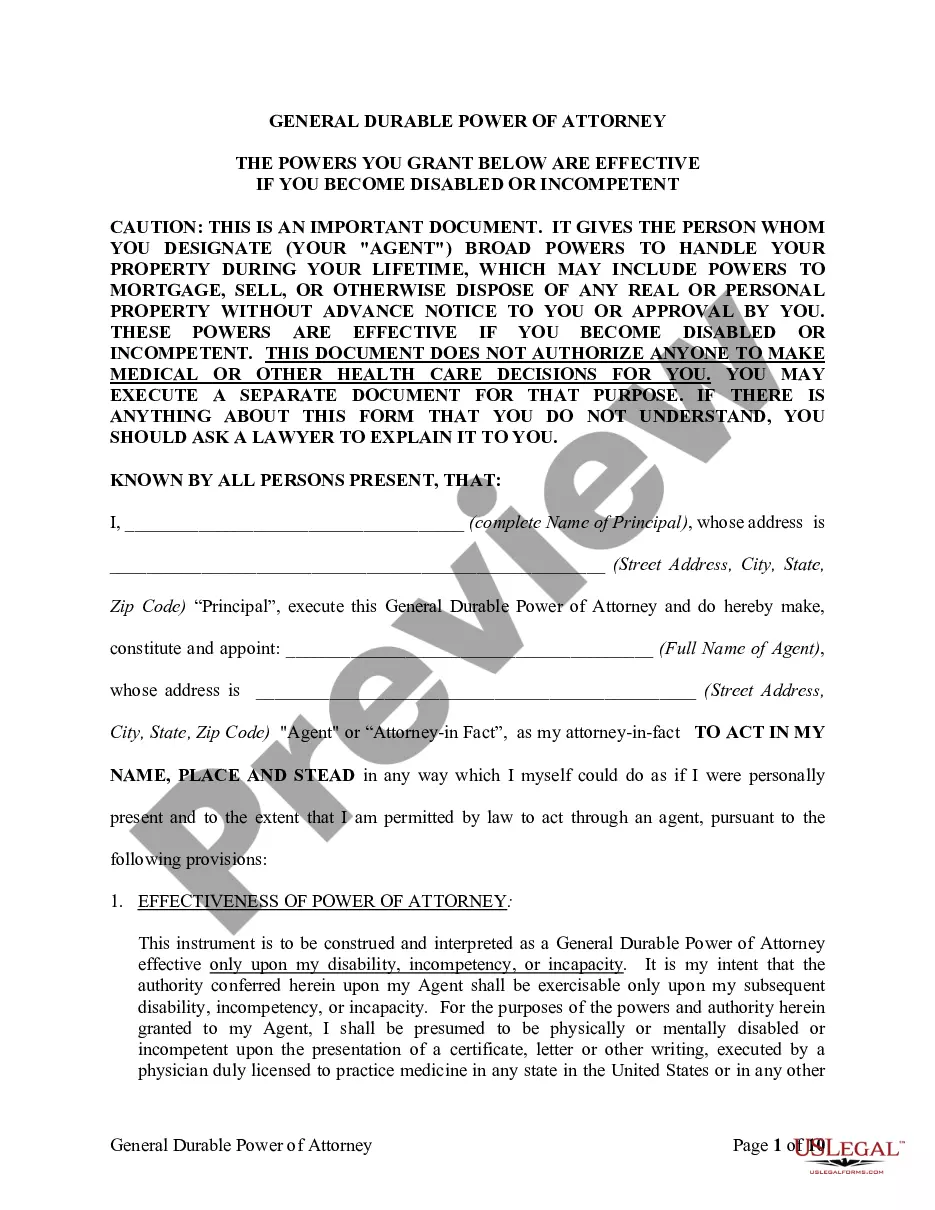

If available, utilize the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Vermont Receipt for Payment of Rent.

- Every legal document template you acquire is yours forever.

- To obtain an additional copy of any document you acquired, visit the My documents tab and click the relevant button.

- If you're using the US Legal Forms site for the first time, adhere to the simple instructions below.

- First, ensure you have selected the correct document template for the region/city of your preference.

- Read the document description to confirm you have selected the right template.

Form popularity

FAQ

The form for Vermont renter's rebate is known as the Homestead Declaration and Property Tax Adjustment form. This form allows eligible renters to apply for a rebate based on their income and rent payments. Correctly filling out this form is essential, and including your Vermont Receipt for Payment of Rent will support your application. Utilize resources like US Legal Forms to ensure that you submit a complete and accurate application.

A writ of possession in Vermont is a legal order that allows a landlord to evict a tenant and regain possession of the rental unit. It typically follows legal proceedings initiated for non-payment of rent or lease violations. This document serves as the final step in the eviction process, ensuring that landlords can reclaim their property. Understanding the implications of a writ can be crucial if you are managing a rental property.

A landlord certificate in Vermont serves as a formal document confirming the rental relationship between the landlord and tenant. This certificate typically includes essential details such as the tenant's name, rental address, and payment history. It can be pivotal in securing renter benefits or validating rental agreements. Having a Vermont Receipt for Payment of Rent can enhance the credibility of this certificate.

The name on the rent receipt should typically be that of the tenant who made the payment. It's essential to ensure accuracy, as incorrect names can lead to confusion or disputes later. Additionally, include the landlord's name or business name on the receipt, allowing for better record-keeping and recognition.

In Vermont, a landlord can request the first and last month's rent along with a security deposit, but there are regulations to follow. The total amount should not exceed the equivalent of two months' rent as a security deposit. Always ensure that these terms are clearly stated in the rental agreement to avoid misunderstandings.

Yes, rental income is taxable in Vermont and must be reported on your Vermont income tax return. Landlords are required to accurately report the income along with appropriate deductions. Keeping a Vermont Receipt for Payment of Rent can be beneficial for tracking your rental income and ensuring compliance with tax regulations.

To get a receipt for your rent payment, simply ask your landlord for one as they should provide it automatically after payment. If they do not, you can create your own Vermont Receipt for Payment of Rent using a template or guide from US Legal Forms. This approach ensures you have proper documentation for your records.

To write a receipt for a payment received, make sure to include the date, the payer's name, the amount received, and a brief description of the payment purpose. It's also important to reference that it's a Vermont Receipt for Payment of Rent, if applicable. Using US Legal Forms can provide you with professional templates that ensure you include all necessary details.

To file a renters rebate in Vermont, you will need to complete the Renter Rebate Application, which allows eligible renters to claim a rebate based on their rental payments. Prepare to provide proof of your Vermont Receipt for Payment of Rent as supporting documentation. For ease, consider using services like US Legal Forms to access the necessary forms and guidance.

Vermont form LC 142 is the official form used for reporting rent payments in Vermont. It helps both landlords and tenants document rent received in compliance with state laws. If you require a streamlined way to manage your rent payments, consider using US Legal Forms for easy access to necessary documents like this one.