Vermont Stock Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Stock Dividend - Resolution Form - Corporate Resolutions?

Are you in a situation where you require documents for potential business or particular tasks almost every working day.

There are numerous legal document templates accessible on the web, but locating ones you can trust is not straightforward.

US Legal Forms offers thousands of form templates, including the Vermont Stock Dividend - Resolution Form - Corporate Resolutions, designed to meet federal and state standards.

Once you find the correct form, click Get now.

Select your desired pricing plan, fill in the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you will be able to download the Vermont Stock Dividend - Resolution Form - Corporate Resolutions template.

- If you don't possess an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

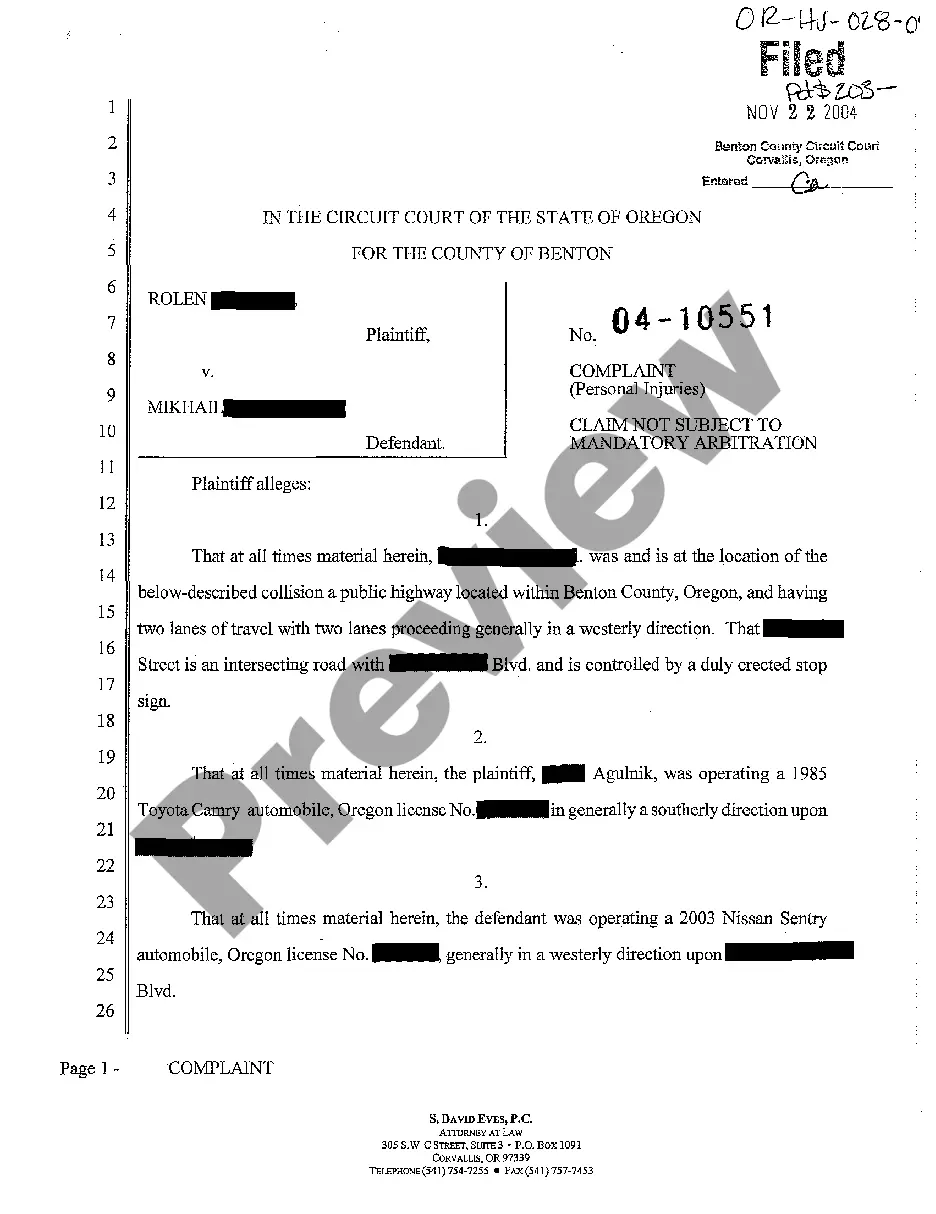

- Utilize the Review button to examine the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and specifications.

Form popularity

FAQ

The Vermont tax form in-111 is used for filing personal income taxes within the state. This form helps taxpayers report their income and calculate their liabilities accurately. When considering corporate tax implications, especially involving stock dividends, using the Vermont Stock Dividend - Resolution Form - Corporate Resolutions can clarify your standing.

In Vermont, the property tax exemption form allows certain properties to qualify for tax relief. This form is essential for homeowners and businesses seeking to reduce their tax burden. If your business is incorporating stock dividends, consider the relevance of the Vermont Stock Dividend - Resolution Form - Corporate Resolutions in the context of property tax assessments.

111 income tax refers to the tax obligations tied to the Vermont tax form in-111, which is crucial for reporting personal income. Understanding this tax form helps individuals and businesses better manage their finances and avoid penalties. When distributing stock dividends, the Vermont Stock Dividend - Resolution Form - Corporate Resolutions becomes a part of this process.

Yes, Vermont does tax Global Intangible Low-Taxed Income (GILTI) as part of its corporate income tax framework. Businesses with foreign subsidiaries should be aware of how GILTI impacts their overall tax obligations. Incorporating the Vermont Stock Dividend - Resolution Form - Corporate Resolutions may help you navigate these complex tax rules effectively.

Vermont has a corporate income tax that is structured progressively, meaning higher income levels face higher tax rates. Businesses operating in Vermont are required to file their tax returns regularly to remain compliant. For corporations dealing with stock dividends, utilizing the Vermont Stock Dividend - Resolution Form - Corporate Resolutions is essential for proper documentation.

The tax form in-111 is Vermont's personal income tax return form. It is crucial for residents and part-year residents to report their income accurately. When dealing with corporate resolutions, including the Vermont Stock Dividend - Resolution Form - Corporate Resolutions, it's important to consider how these forms impact your overall tax responsibilities.

You can obtain Vermont tax forms directly from the Vermont Department of Taxes website. Additionally, many local offices and libraries also provide physical copies of these forms. If you need a Vermont Stock Dividend - Resolution Form - Corporate Resolutions, you may find it available through various online resources, including US Legal Forms.

A corporate resolution to sell stock is an official record that authorizes a company to sell its shares under specific conditions. This resolution clarifies who has the authority to execute the sale and the terms involved. The Vermont Stock Dividend - Resolution Form - Corporate Resolutions can significantly simplify this process, ensuring that all legal protocols are followed. This form helps your company maintain transparency during stock transactions.

The corporate resolution form is a document that confirms important company decisions, such as the appointment of officers or approval of contracts. This form provides a written record that helps verify the authority of actions taken on behalf of the company. With the Vermont Stock Dividend - Resolution Form - Corporate Resolutions, your organization can easily customize and create these essential documents. Utilizing this form streamlines corporate governance and record-keeping.

The resolution form signifies the formal adoption of decisions by a company’s governing body. This form encapsulates the discussions and outcomes of meetings or shareholder votes. The Vermont Stock Dividend - Resolution Form - Corporate Resolutions serves as an effective template for crafting these documents, guaranteeing that all necessary information is preserved. It plays a crucial role in maintaining a company’s legal and operational integrity.