Vermont Lease of Machinery for use in Manufacturing

Description

How to fill out Lease Of Machinery For Use In Manufacturing?

Are you presently in a location where you frequently need documents for organizational or personal reasons? There are numerous legal document templates accessible online, but identifying reliable ones isn't easy. US Legal Forms offers a variety of form templates, such as the Vermont Lease of Machinery for use in Manufacturing, which are designed to comply with local and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Then, you can download the Vermont Lease of Machinery for use in Manufacturing template.

If you do not have an account and want to start using US Legal Forms, follow these steps.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Vermont Lease of Machinery for use in Manufacturing anytime if needed. Just click on the necessary document to download or print the template.

Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be employed for various purposes. Create an account on US Legal Forms and start simplifying your life.

- Locate the document you need and verify it is for the correct area/region.

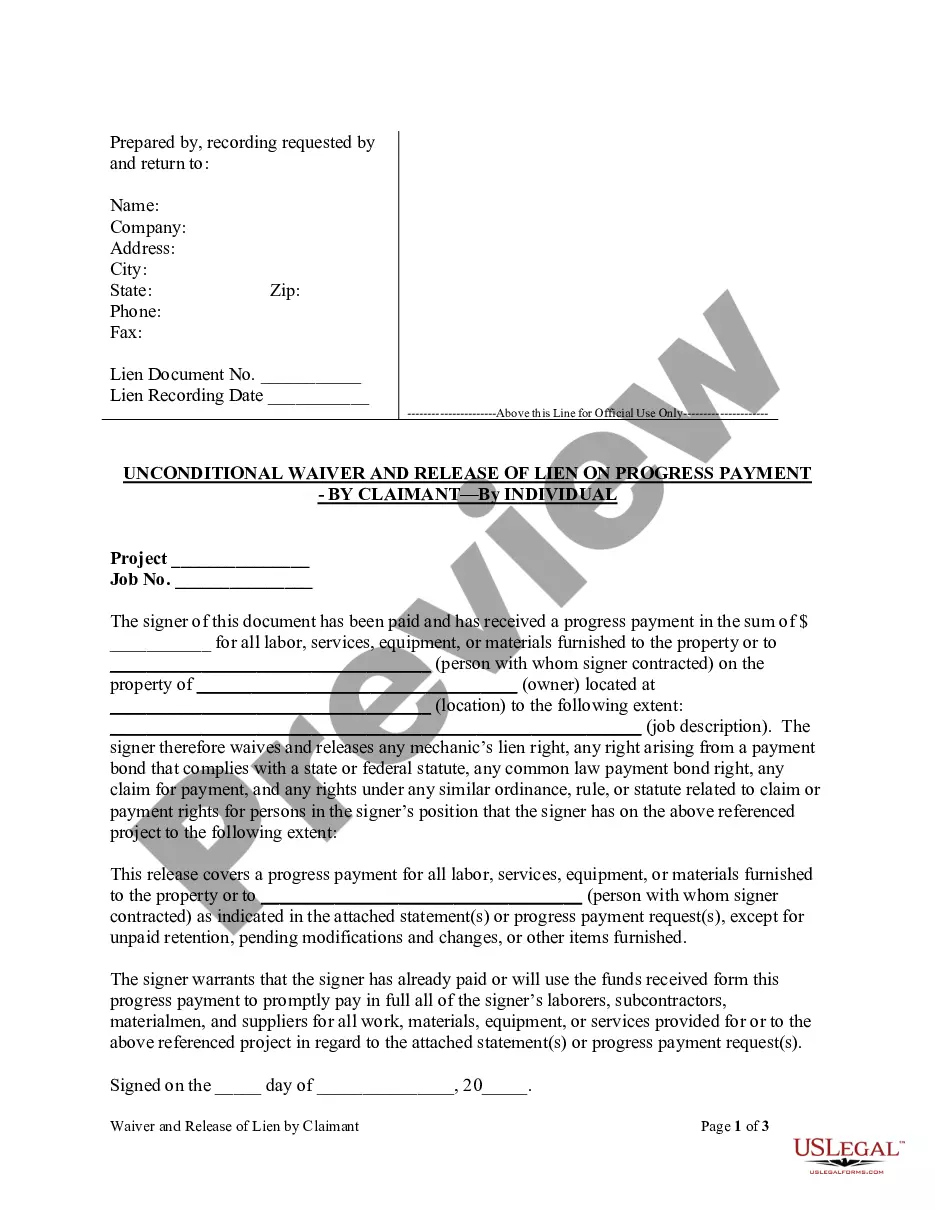

- Utilize the Review feature to examine the form.

- Check the information to ensure you have selected the right document.

- If the document isn't what you need, use the Search box to find a document that meets your requirements and specifications.

- Once you find the correct document, click Get now.

- Choose the pricing plan you want, fill in the required details to create your account, and pay for your order using PayPal or credit card.

- Select a preferred file format and download your copy.

Form popularity

FAQ

Vermont Form HS 122 is a tax return for home and business owners claiming a property tax adjustment. If your business leases machinery under a Vermont Lease of Machinery for use in Manufacturing, you may not file this form directly, but being aware of it could help you leverage property tax benefits. Always consider discussing your situation with a tax expert to get the most accurate advice.

Yes, equipment rental is often taxable in Vermont, including rentals related to manufacturing. If you enter into a Vermont Lease of Machinery for use in Manufacturing, understanding the tax implications is vital. Ensuring compliance will help you navigate any potential tax liabilities related to your rental activities.

Non-resident withholding tax in Vermont generally applies to individuals earning income from Vermont sources. This includes income from leasing agreements, like a Vermont Lease of Machinery for use in Manufacturing. It's essential to know the withholding requirements as a non-resident to avoid any surprise tax liabilities.

The primary tax form for non-residents in Vermont is the PI-1040. This form is necessary for reporting income earned in the state, including income from a Vermont Lease of Machinery for use in Manufacturing. Accurately completing this form ensures you meet your tax obligations while maximizing compliance.

Certain groups, such as non-profit organizations and specific government agencies, can qualify for tax exemptions in Vermont. If your company leases machinery for use in manufacturing and meets exemption criteria, you may benefit from property tax relief. Reviewing regulations and consulting a tax advisor is recommended to ensure your eligibility.

For non-resident income tax filing in Vermont, you must complete Form PI-1040, which captures income earned from Vermont sources. Understanding the implications of a Vermont Lease of Machinery for use in Manufacturing can help you report income accurately. Please keep records of your income related to any leasing activities to simplify your tax filing.

Non-residents must use Form PI-1040 to report their income while working in Vermont. This is essential for individuals involved in the Vermont Lease of Machinery for use in Manufacturing, as it helps ensure accurate tax reporting. Utilizing the correct form enables you to comply with state regulations effectively.

In Vermont, labor is generally not taxable; however, exceptions exist. When you engage in a Vermont Lease of Machinery for use in Manufacturing, the associated labor for installation or maintenance may be considered taxable. It is crucial to consult with a tax professional to understand how these tax regulations may apply to your specific situation.

An equipment lease allows you to use machinery for a predetermined period in exchange for regular payments. You are not responsible for ownership, but you typically must maintain the equipment in good condition. The Vermont Lease of Machinery for use in Manufacturing can provide essential advantages, such as access to advanced technologies while aligning with budget constraints.

Setting up an equipment lease involves identifying the machinery required, contacting a leasing company, and negotiating terms that suit your business needs. It's advisable to prepare financial statements and business plans that demonstrate your ability to uphold lease payments. You can explore options specifically tailored for a Vermont Lease of Machinery for use in Manufacturing on platforms like UsLegalForms.