Vermont Sample Letter for Request for Tax Clearance Letter

Description

How to fill out Sample Letter For Request For Tax Clearance Letter?

You can spend hours online trying to find the legal document template that meets the federal and state requirements you need. US Legal Forms offers thousands of legal forms that are reviewed by experts.

It is easy to obtain or print the Vermont Sample Letter for Request for Tax Clearance Letter from the service. If you have a US Legal Forms account, you can Log In and click on the Download button. After that, you can complete, edit, print, or sign the Vermont Sample Letter for Request for Tax Clearance Letter.

Every legal document template you purchase is your property forever. To get another copy of any purchased form, go to the My documents tab and click on the corresponding button.

Select the format of your document and download it to your device. Make modifications to your document if necessary. You can complete, edit, sign, and print the Vermont Sample Letter for Request for Tax Clearance Letter. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the basic instructions below.

- First, ensure you have selected the correct document template for the area/town of your choice. Read the form description to make sure you have chosen the right form.

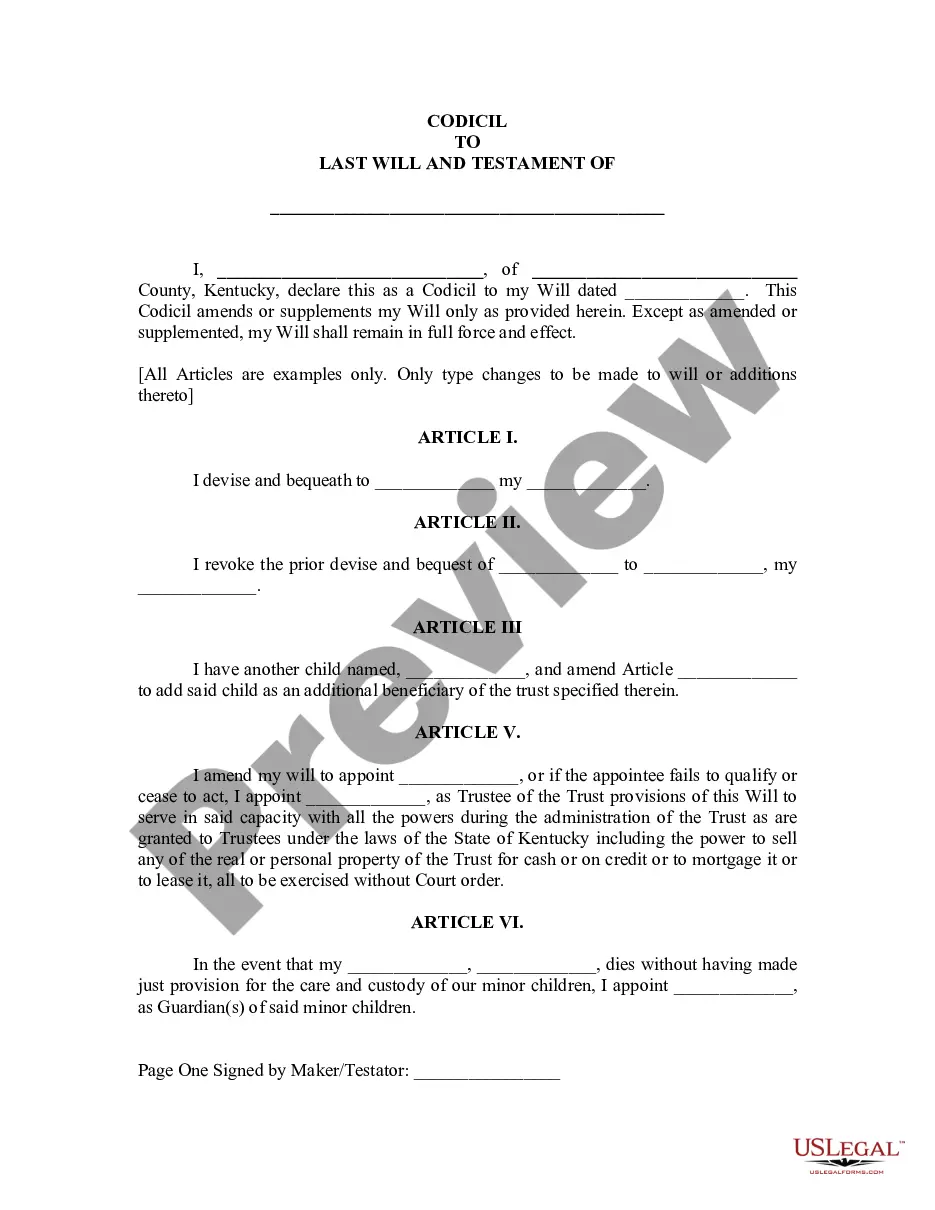

- If available, use the Review button to browse through the document template as well.

- If you want to find another version of the form, use the Search field to locate the template that meets your needs and specifications.

- Once you have found the template you want, click Purchase now to proceed.

- Select the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal form.

Form popularity

FAQ

How to apply for a Tax Clearance? To do this, the employer (usually HR Department) needs to complete one of the following forms: Form CP21 (if you are leaving the country) Form CP22A (for retirement, resignation or termination of employment if you work in the private sector)

For the first three income years, the deceased estate income is taxed at individual income tax rates, with the benefit of the full tax-free threshold, but without the tax offsets (concessional rebates), such as the low-income tax offset. No Medicare levy is payable.

The Vermont Property Transfer Tax is a tax on the sale of Vermont real estate which is paid by the buyer. The tax rate is 1.45% of the sale price, although for property that will be the primary residence of the buyer, the transfer tax is lowered to .

Ways to Get Your. Vermont Income Tax Forms. Download fillable PDF forms from the web. Order forms online. Order forms by email. Order forms by phone. For a faster refund, e-file your taxes! For information on free e-filing and tax assistance for qualified taxpayers, visit .tax.vermont.gov.

Vermont has no inheritance tax, but it does have an estate tax, in addition to the federal estate tax. The estate tax in Vermont affects the estates of state residents, as well as the estates of nonresidents who own tangible personal property, real estate, or income-generating property in the Green Mountain State.

Washington has the highest estate tax at 20%, which is applied to the portion of an estate's value greater than $11,193,000. Inheritance tax rates depend on the beneficiary's relation to the deceased, and, in each state, certain types of relationships are exempt from inheritance tax.

Vermont Estate Tax Rate While many estate taxes are progressive, Vermont's is flat. The state charges a flat rate of 16%. Let's say your total estate is worth $7.25 million. The first $5 million is exempt, leaving a taxable estate of $2.25 million.

If you're a resident or a nonresident alien departing the United States, you usually have to show that you have complied with the U.S. income tax laws before you can depart. You do this by obtaining from the IRS a tax clearance document, commonly called a departure permit or sailing permit.