Vermont Option For the Sale and Purchase of Real Estate - Commercial Lot or Land

Description

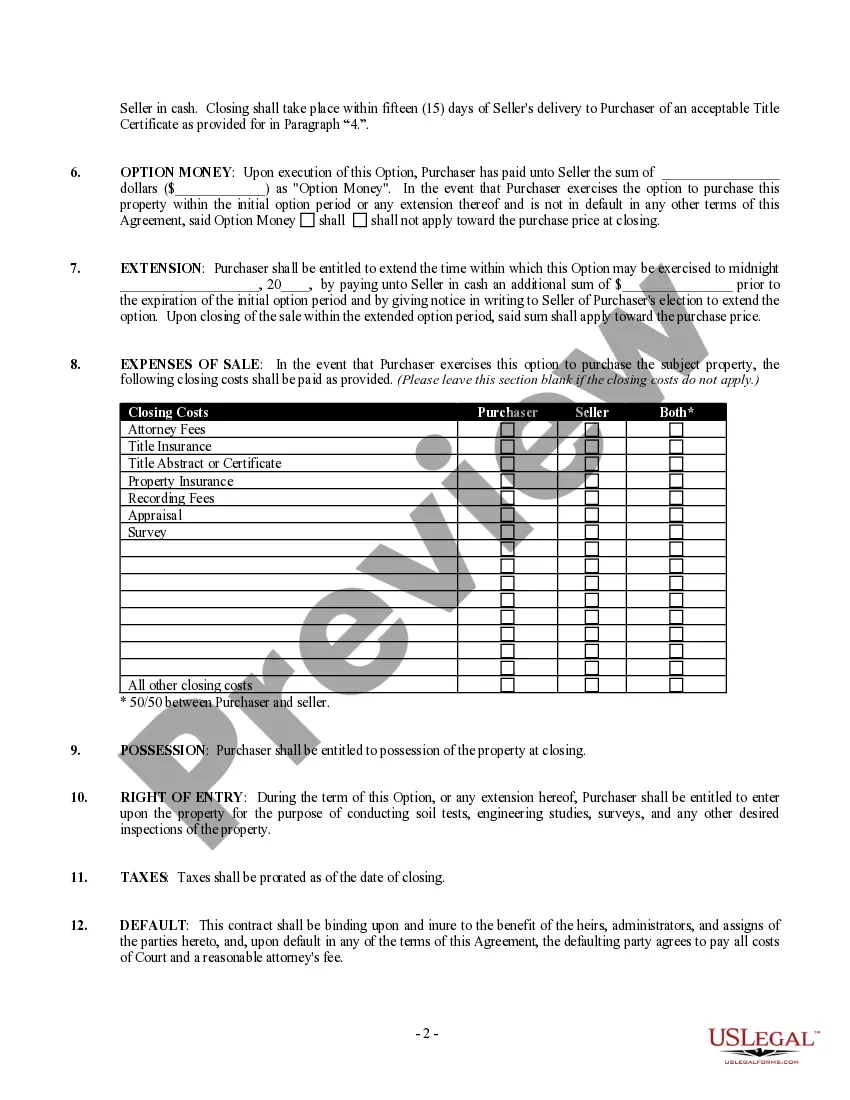

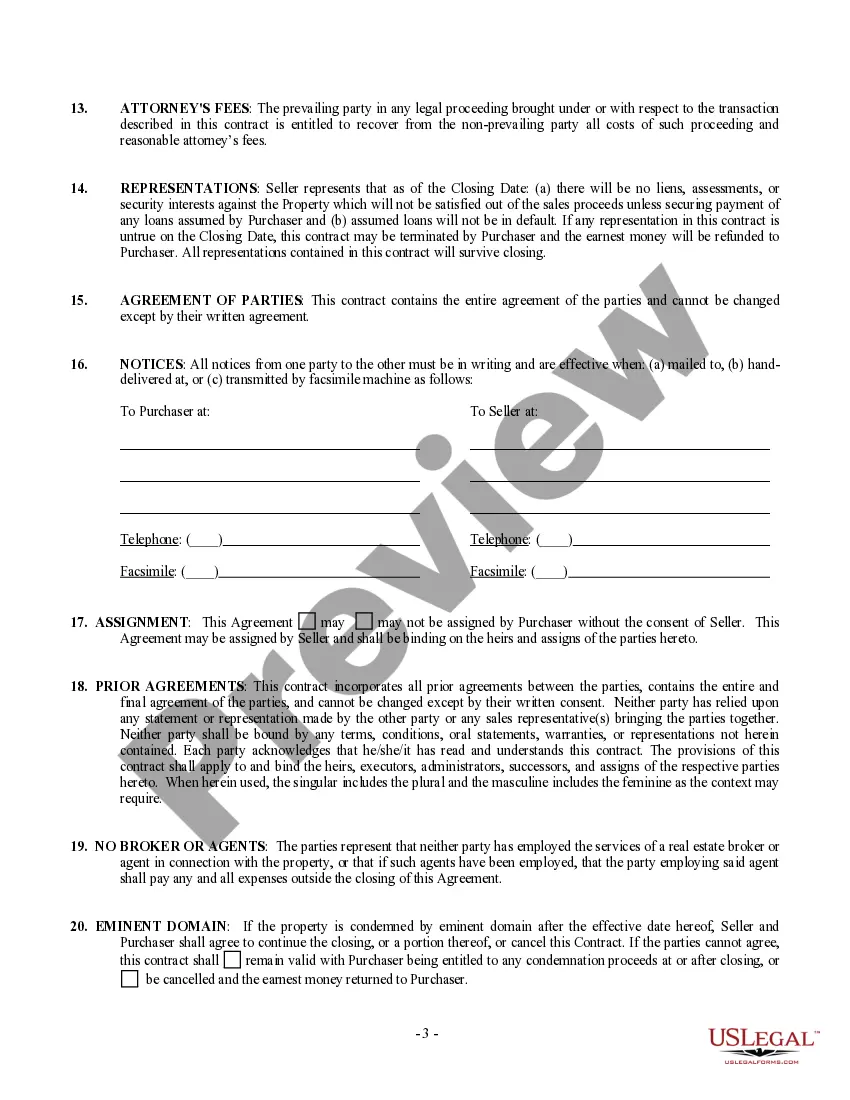

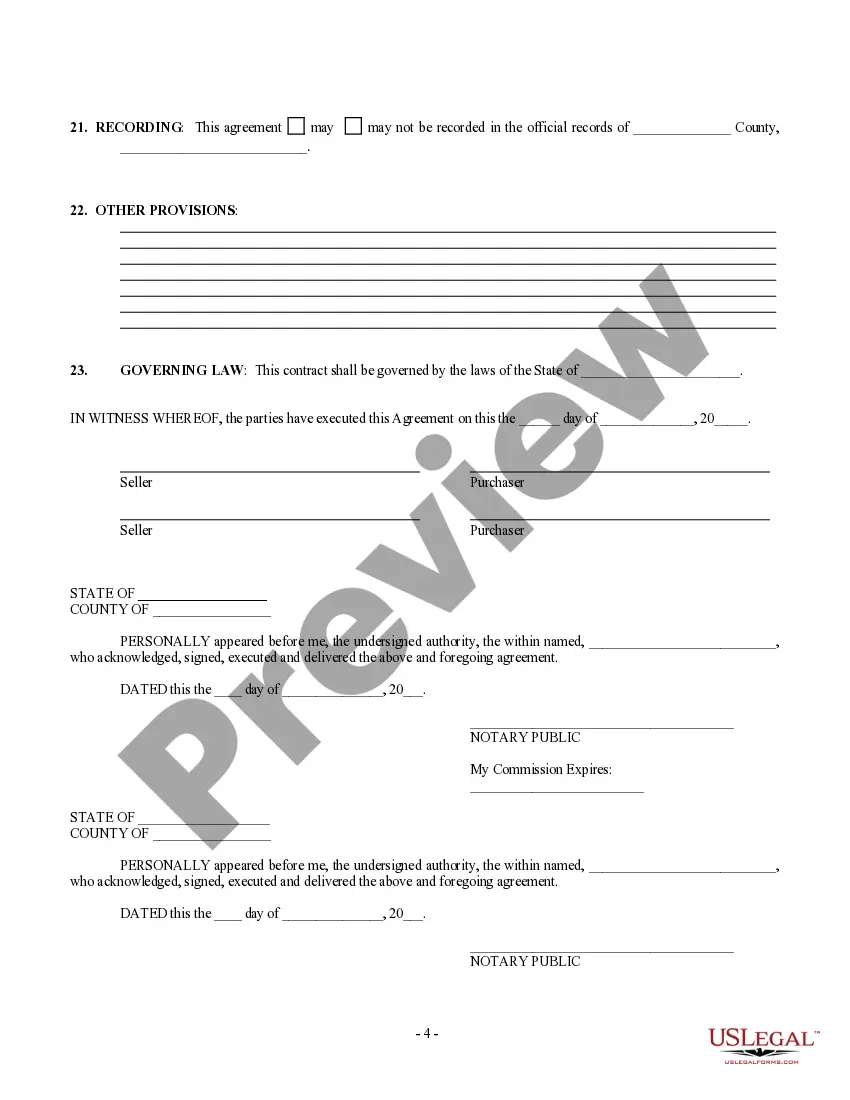

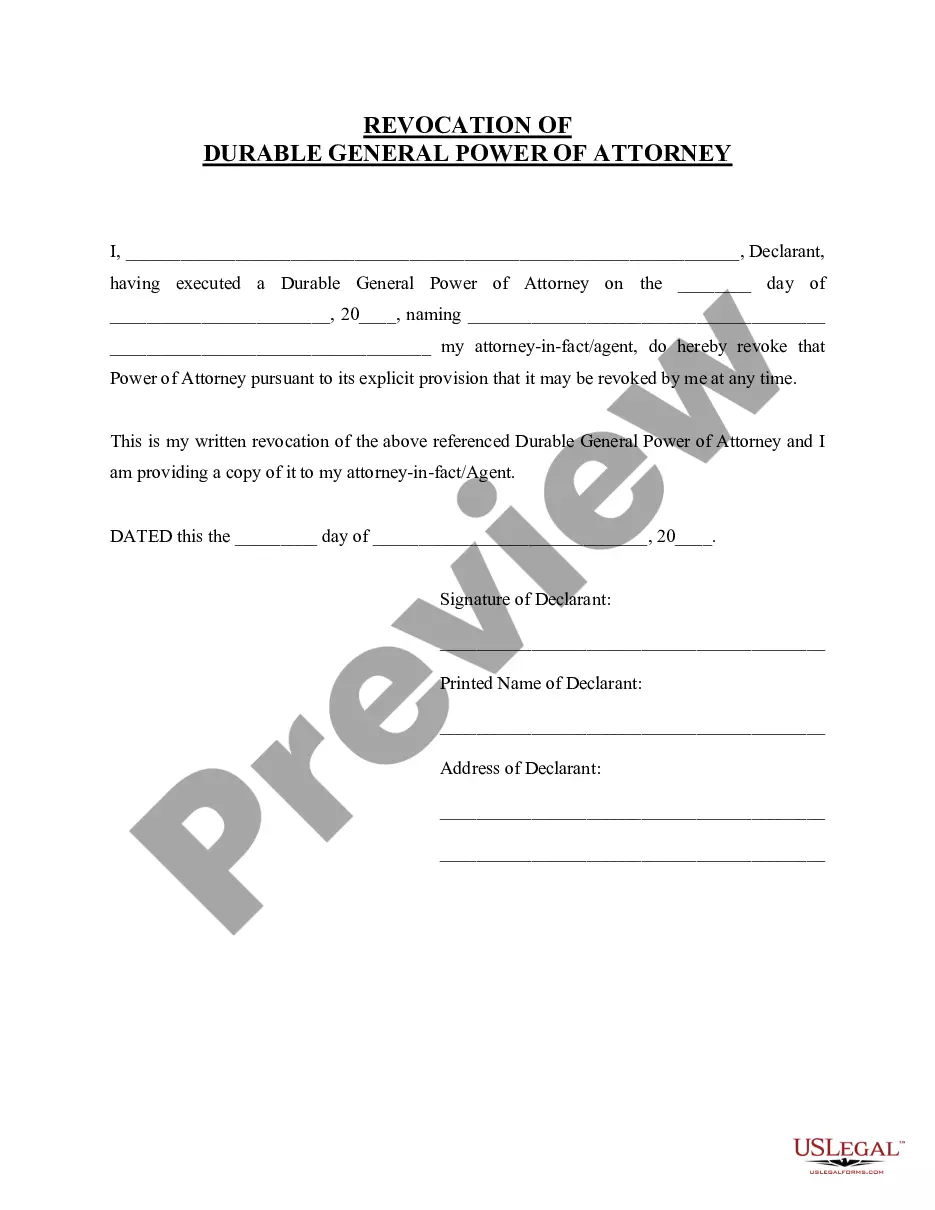

How to fill out Option For The Sale And Purchase Of Real Estate - Commercial Lot Or Land?

It is feasible to spend hours online seeking the legal document template that satisfies the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that can be reviewed by experts.

You can download or print the Vermont Option For the Sale and Purchase of Real Estate - Commercial Lot or Land from my service.

If available, utilize the Preview button to browse the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- Next, you can complete, edit, print, or sign the Vermont Option For the Sale and Purchase of Real Estate - Commercial Lot or Land.

- Every legal document template you obtain is your property permanently.

- To acquire another version of a purchased form, navigate to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Check the form description to confirm you have chosen the correct type.

Form popularity

FAQ

Most capital gains in Vermont are subject to the personal income tax rates of 3.35% - 8.75%. This includes all short-term gains, but long term-gains may be eligible for an exclusion. Since 2014, taxpayers have been able to claim an exclusion of up to $5,000 on their federal net adjusted capital gains.

The seller retains the exemption certificate for at least three years from the date of the last sale covered by the certificate. Exemption certificates are not filed with the Vermont Department of Taxes, but the seller must produce an exemption certificate when it is requested by the Department.

Vermont Capital Gains TaxMost capital gains in Vermont are subject to the personal income tax rates of 3.35% - 8.75%. This includes all short-term gains, but long term-gains may be eligible for an exclusion.

Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law. The sales tax rate is 6%. Vermont Use Tax is imposed on the buyer at the same rate as the sales tax.

Online. Taxpayers may file returns and pay tax due for Sales and Use Tax using myVTax, our free, secure, online filing site. Commissioner's Mandate for Multiple Locations: If you pay Sales and Use Tax for multiple locations, the Commissioner of Taxes has mandated that you must file and pay electronically.

FOOD, FOOD PRODUCTS, AND BEVERAGES - TAXABLE Food, food products, and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 V.S.A. § 9741(13) with the exception of soft drinks.

You must file an income tax return in Vermont: if you are a resident, part-year resident of Vermont or a nonresident, and. if you are required to file a federal income tax return, and. you earned or received more than $100 in Vermont income, or.

You may file your Vermont income tax return either on a paper form or electronically through commercial vendor software. You also may choose to hire a tax professional to prepare the return for you, either on paper or e-file.

When a home purchase closes, the home buyer is required to pay, among other closing costs, the Vermont Property Transfer Tax. The buyer is taxed is at a rate of 0.5% of the first $100,000 of the home's value and 1.45% of the remaining portion of the value.

Most businesses operating in or selling in the state of Vermont are required to purchase a resale certificate annually. Even online based businesses shipping products to Vermont residents must collect sales tax. Obtaining your sales tax certificate allows you to do so.