Vermont Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will)

Description

How to fill out Certificate Of Heir To Obtain Transfer Of Title To Motor Vehicle Without Probate (Vehicle Not Bequeathed In Will)?

If you wish to comprehensive, download, or produce legitimate file web templates, use US Legal Forms, the most important assortment of legitimate kinds, which can be found on the web. Take advantage of the site`s easy and practical lookup to discover the files you require. Various web templates for enterprise and specific uses are categorized by categories and states, or keywords. Use US Legal Forms to discover the Vermont Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will) in just a couple of clicks.

If you are previously a US Legal Forms buyer, log in in your profile and click the Down load option to find the Vermont Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will). You can even accessibility kinds you earlier delivered electronically from the My Forms tab of your own profile.

If you work with US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have chosen the form for your proper city/nation.

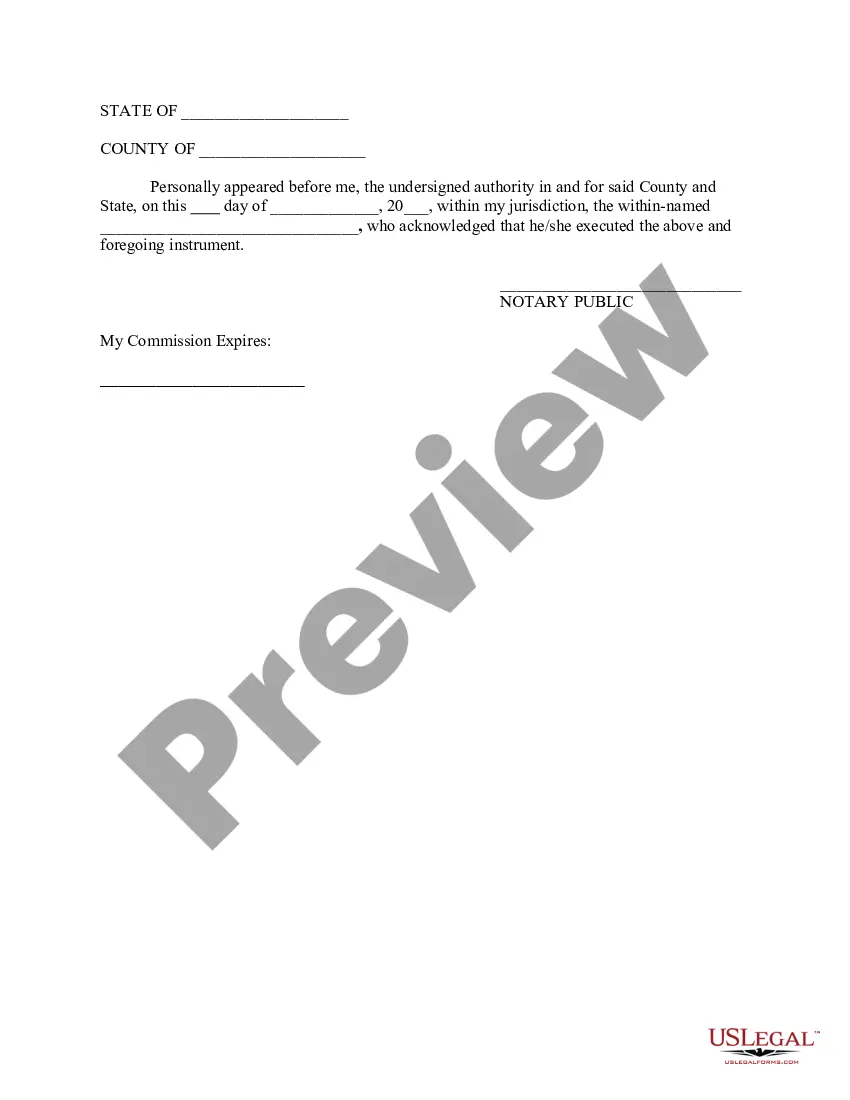

- Step 2. Use the Preview method to examine the form`s information. Don`t overlook to see the information.

- Step 3. If you are not happy using the form, utilize the Search area near the top of the screen to get other types in the legitimate form template.

- Step 4. Upon having identified the form you require, click on the Purchase now option. Choose the rates prepare you prefer and put your references to register for an profile.

- Step 5. Procedure the transaction. You can use your Мisa or Ьastercard or PayPal profile to finish the transaction.

- Step 6. Pick the structure in the legitimate form and download it on your own gadget.

- Step 7. Total, change and produce or signal the Vermont Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will).

Every single legitimate file template you acquire is the one you have forever. You might have acces to each form you delivered electronically within your acccount. Click the My Forms area and decide on a form to produce or download yet again.

Remain competitive and download, and produce the Vermont Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will) with US Legal Forms. There are thousands of skilled and express-specific kinds you can utilize for your personal enterprise or specific requires.

Form popularity

FAQ

The following are the standard vehicle titling fees and taxes you will owe when you are titling a Vermont vehicle: Original vehicle title: $35. Vehicle title transfer: $35. Clear vehicle title after lien removal: $35.

If a person dies intestate, and the person owned a vehicle, the person's spouse automatically becomes the owner of the vehicle. If the decedent owned more than one vehicle, the surviving spouse may choose one of the vehicles.

Registration, Transfer Complete the entire Vermont Motor Vehicle Registration, Tax, and Title Application. Be sure to enter the Plate number that you are transferring. You must complete Section 7 of the Vermont Registration Application or include your current Vermont Registration with the "Transfer Section" completed.

Complete the entire Vermont Motor Vehicle Registration, Tax, and Title Application. Be sure to enter the Plate number that you are transferring. You must complete Section 7 of the Vermont Registration Application or include your current Vermont Registration with the "Transfer Section" completed.

No, you may gift your personally owned vehicle to anyone you choose, but the plates belong to you, not the vehicle. The new owner must apply for new plates and registration under their name. Exception: some low-number plates can be transferred to a family member.

You must have a valid Bill Of Sale to start with, and it MUST include: Date of sale, Seller's name and address, bike's serial number, bike year, make, model & displacement, amount paid, and odometer reading. Or, use the VT form.

There is no gift tax in Vermont. The federal gift tax has a $16,000 exemption per year per recipient in 2022, increasing to $17,000 in 2023. That means you can give up to $17,000 to as many people as you want in a given year without worrying about the gift tax.

If you purchased a car and lacked a title, you could use this loophole by filing a registration application through the state of Vermont via mail. Vermont would then issue a registration document but not a title.