Virgin Islands Affidavit of Heirship for the Owner of the Property

Description

How to fill out Affidavit Of Heirship For The Owner Of The Property?

Finding the right legitimate file design can be a struggle. Of course, there are a variety of themes available on the net, but how can you discover the legitimate develop you need? Make use of the US Legal Forms internet site. The service delivers thousands of themes, such as the Virgin Islands Affidavit of Heirship for the Owner of the Property, that you can use for company and personal requirements. All of the varieties are inspected by experts and meet up with federal and state demands.

If you are already registered, log in in your bank account and then click the Down load key to obtain the Virgin Islands Affidavit of Heirship for the Owner of the Property. Use your bank account to appear from the legitimate varieties you have purchased in the past. Visit the My Forms tab of your bank account and have another backup in the file you need.

If you are a fresh consumer of US Legal Forms, here are basic recommendations that you can adhere to:

- Very first, ensure you have chosen the right develop for your metropolis/state. You can check out the shape while using Preview key and look at the shape explanation to make certain it is the best for you.

- If the develop is not going to meet up with your needs, utilize the Seach area to find the appropriate develop.

- Once you are certain that the shape would work, click the Get now key to obtain the develop.

- Choose the costs program you need and enter the needed details. Build your bank account and purchase the order utilizing your PayPal bank account or charge card.

- Pick the document formatting and acquire the legitimate file design in your device.

- Full, revise and printing and indication the received Virgin Islands Affidavit of Heirship for the Owner of the Property.

US Legal Forms may be the largest library of legitimate varieties that you will find a variety of file themes. Make use of the service to acquire expertly-made files that adhere to express demands.

Form popularity

FAQ

This document ensures the legal transfer or clean chain of transfer of the property's title. Title companies require a clean train of title transfer to insure the property for sale, and most title companies will accept an affidavit of heirship.

All beneficiaries must agree to the terms of the sale, and the purchase must be made at fair market value.

The Declaration of Heirs aims to legally establish the quality of heirs who succeed in an inheritance, establishing their legitimacy to proceed to the division of that inheritance. As a rule, the declaration is made to designate the heirs; and not some legatees who also succeed in that inheritance.

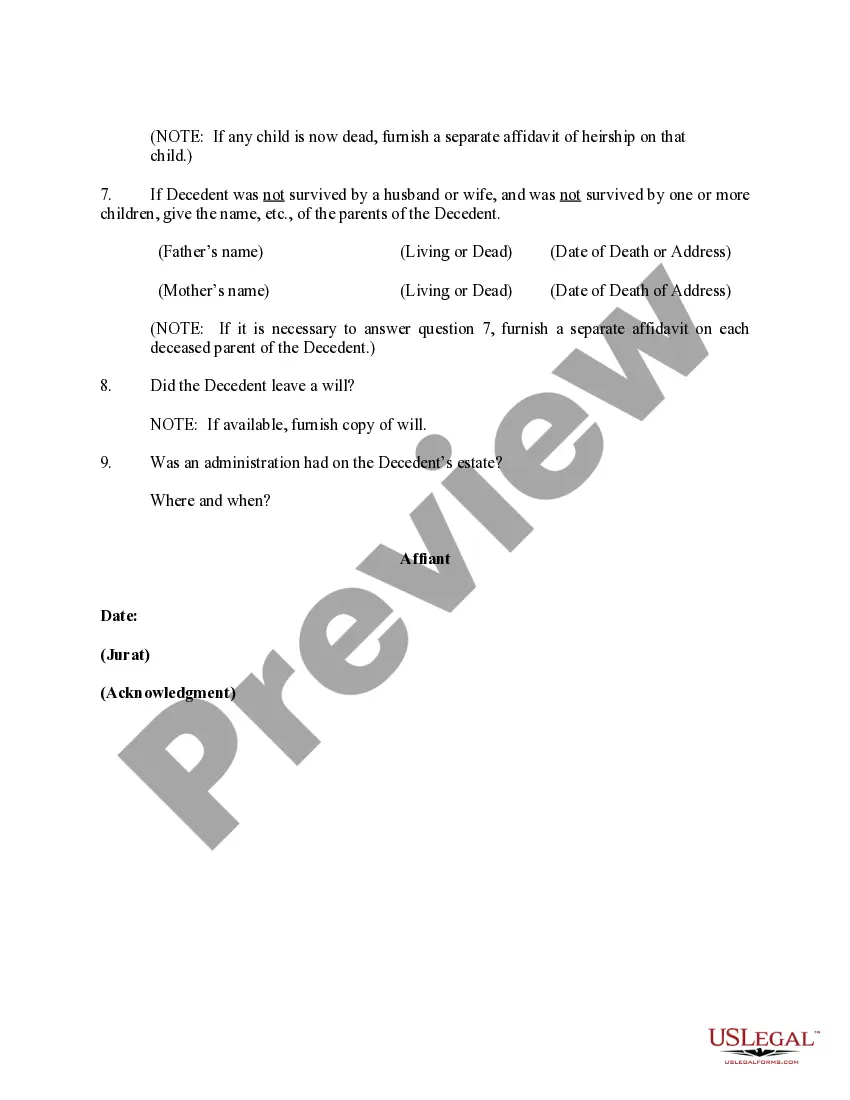

The affidavit must include the name, address, and age of the decedent, plus a listing of all their assets. You will also need to provide information about their closest relatives, including spouses and children. Finally, the document should list the names and addresses of all the heirs.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

Specific information is needed to determine the identity of the Heirs at Law of the Heir Property. A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death.

An affidavit of heirship is a document used to give property to the heirs of a person who has died. It may be needed if the person did not have a will, or if the will was not approved within four years of their death.

What is an heir property owner? You are considered to be an heir property owner if you inherited your primary residence (also called a ?residence homestead?) by (1) will, (2) transfer on death deed, or (3) intestacy ? regardless of whether your ownership interest is recorded in the county's real property records.