Virgin Islands Self-Employed Painter Services Contract

Description

How to fill out Self-Employed Painter Services Contract?

Locating the appropriate legal document template can be quite challenging.

Undoubtedly, there are numerous templates available online, but how do you find the legal form you require.

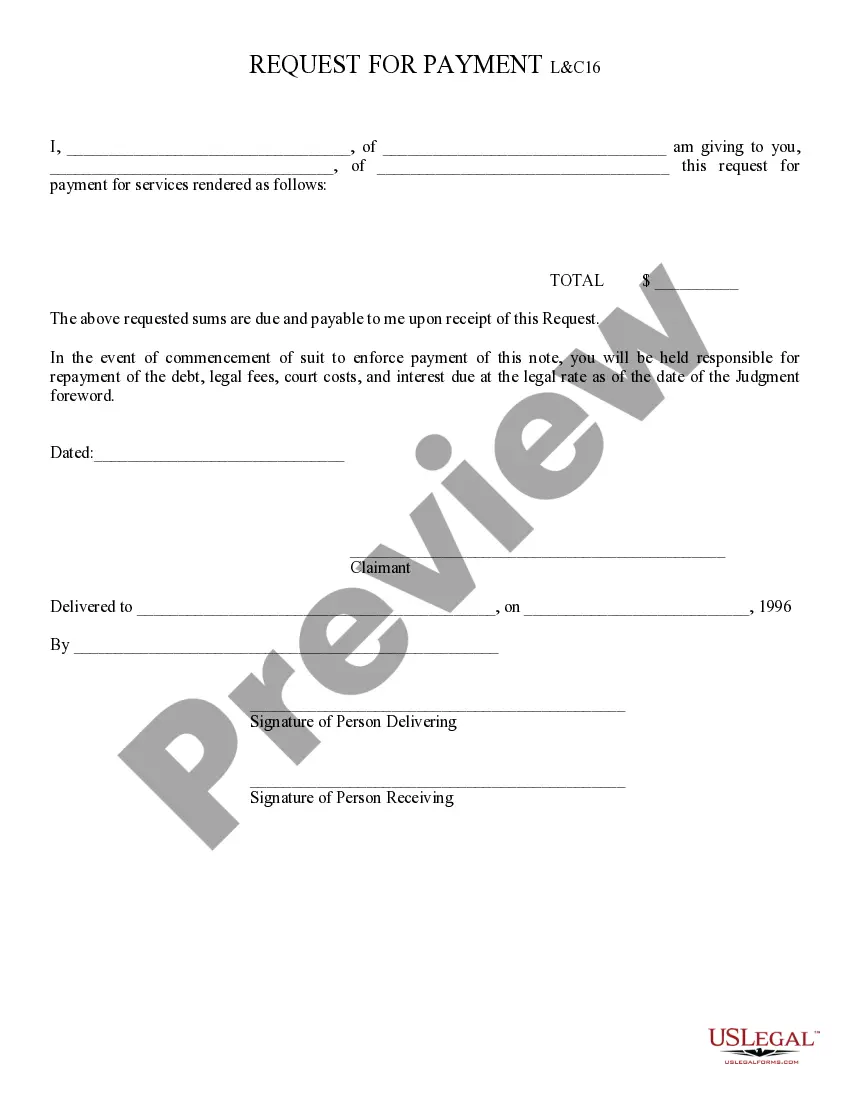

Utilize the US Legal Forms website. The service offers thousands of templates, such as the Virgin Islands Self-Employed Painter Services Contract, which you can employ for business and personal needs.

If the form does not meet your requirements, utilize the Search field to locate the appropriate form. Once you are confident that the form is correct, click the Download now button to obtain the form. Choose the pricing plan you desire and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, edit, print, and sign the obtained Virgin Islands Self-Employed Painter Services Contract. US Legal Forms is the largest collection of legal forms where you will find various document templates. Utilize the service to obtain professionally-created documents that comply with state requirements.

- All of the forms are verified by professionals and meet state and federal requirements.

- If you are currently registered, Log In to your account and click the Download button to obtain the Virgin Islands Self-Employed Painter Services Contract.

- Utilize your account to search through the legal forms you have purchased previously.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple guidelines that you can follow.

- First, ensure you have selected the correct form for your city/state. You can review the form using the Preview button and read the form description to ensure this is suitable for you.

Form popularity

FAQ

If your worldwide gross income is $75,000 or more, you must file Form 8898 for the tax year in which you became or ceased to be a bona fide resident of the U.S. possession. For married individuals, the $75,000 filing threshold applies to each spouse separately.

To order by phone, call 800-908-9946 and follow the prompts in the recorded message. To request a 1040, 1040A or 1040EZ tax return transcript through the mail, complete IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

Use Form 7202 to figure refundable qualified sick and family leave equivalent credits if you were unable to perform services as an eligible self-employed individual due to certain COVID-19 related circumstances between January 1, 2021, and September 30, 2021.

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

If you are a U. S. citizen working for the US Government, including the Foreign Service, and you are stationed abroad, your income tax filing requirements are generally the same as those for citizens and residents living in the United States. You are taxed on your worldwide income, even though you live and work abroad.

Expenses Sole Proprietorship Companies Can "Write Off"Office Space. DO deduct for a designated home office if you don't also have another office you frequent.Banking and Insurance Fees.Transportation.Client Appreciation.Business Travel.Professional Development.

Use Schedule D (Form 1040), Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets when required to report the home sale. Refer to Publication 523 for the rules on reporting your sale on your income tax return.

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

Purpose of Form Use Form 8898 to notify the IRS that you became or ceased to be a bona fide resident of a U.S. possession in accordance with section 937(c). See Bona Fide Residence, later.

More In Forms and Instructions One purpose of the form is to report net earnings from self-employment (SE) to the United States and, if necessary, pay SE tax on that income. The Social Security Administration (SSA) uses this information to figure your benefits under the social security program.