Virgin Islands Specialty Services Contact - Self-Employed

Description

How to fill out Specialty Services Contact - Self-Employed?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Virgin Islands Specialty Services Contact - Self-Employed in moments.

If you currently hold a subscription, Log In and download the Virgin Islands Specialty Services Contact - Self-Employed from the US Legal Forms library. The Download button will show up on each form you view. You can access all previously acquired forms in the My documents section of your account.

Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Make edits. Fill out, modify, print, and sign the acquired Virgin Islands Specialty Services Contact - Self-Employed. Every document added to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Virgin Islands Specialty Services Contact - Self-Employed with US Legal Forms, the most extensive library of legal document templates. Utilize a vast array of professional and state-specific templates that fulfill your business or personal needs.

- To use US Legal Forms for the first time, here are simple steps to help you get started.

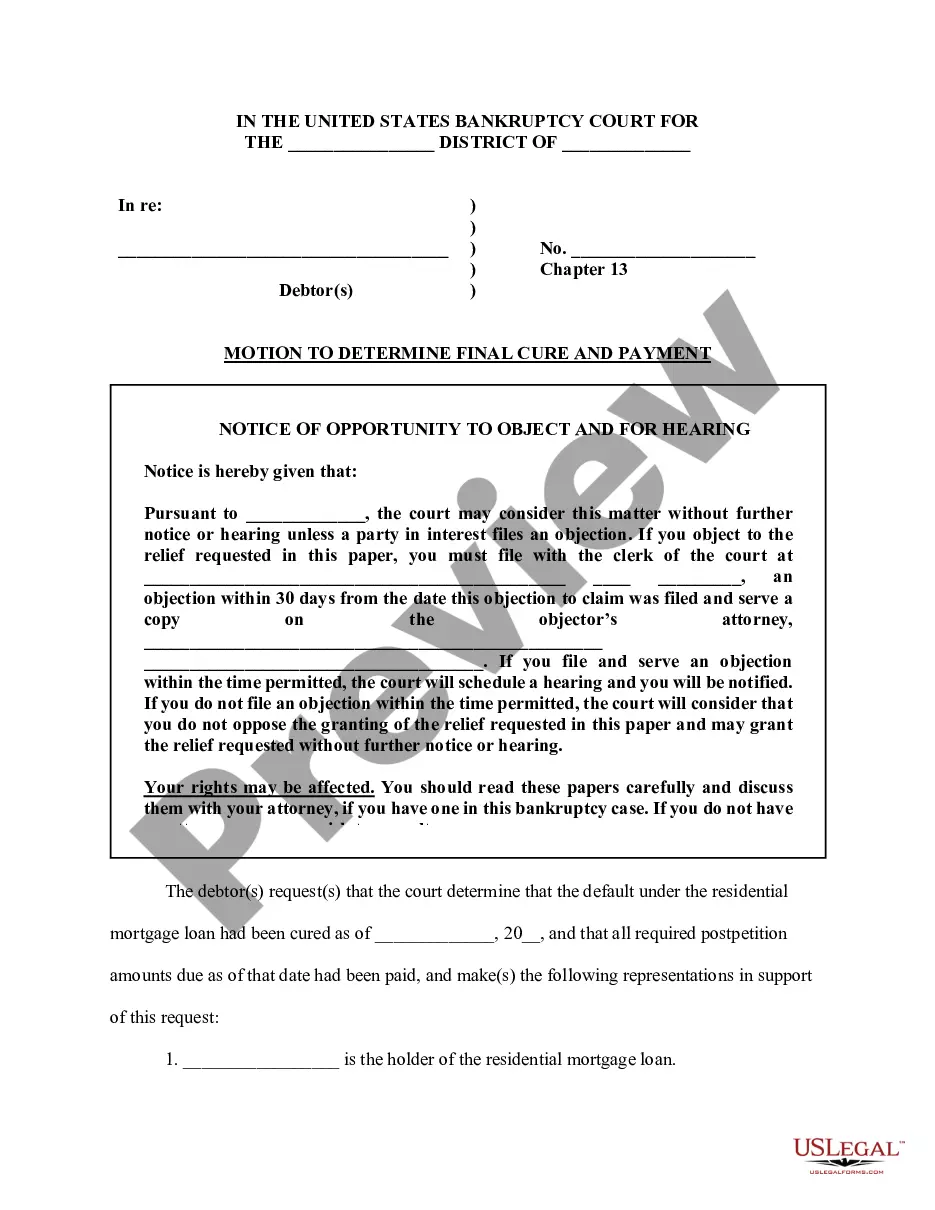

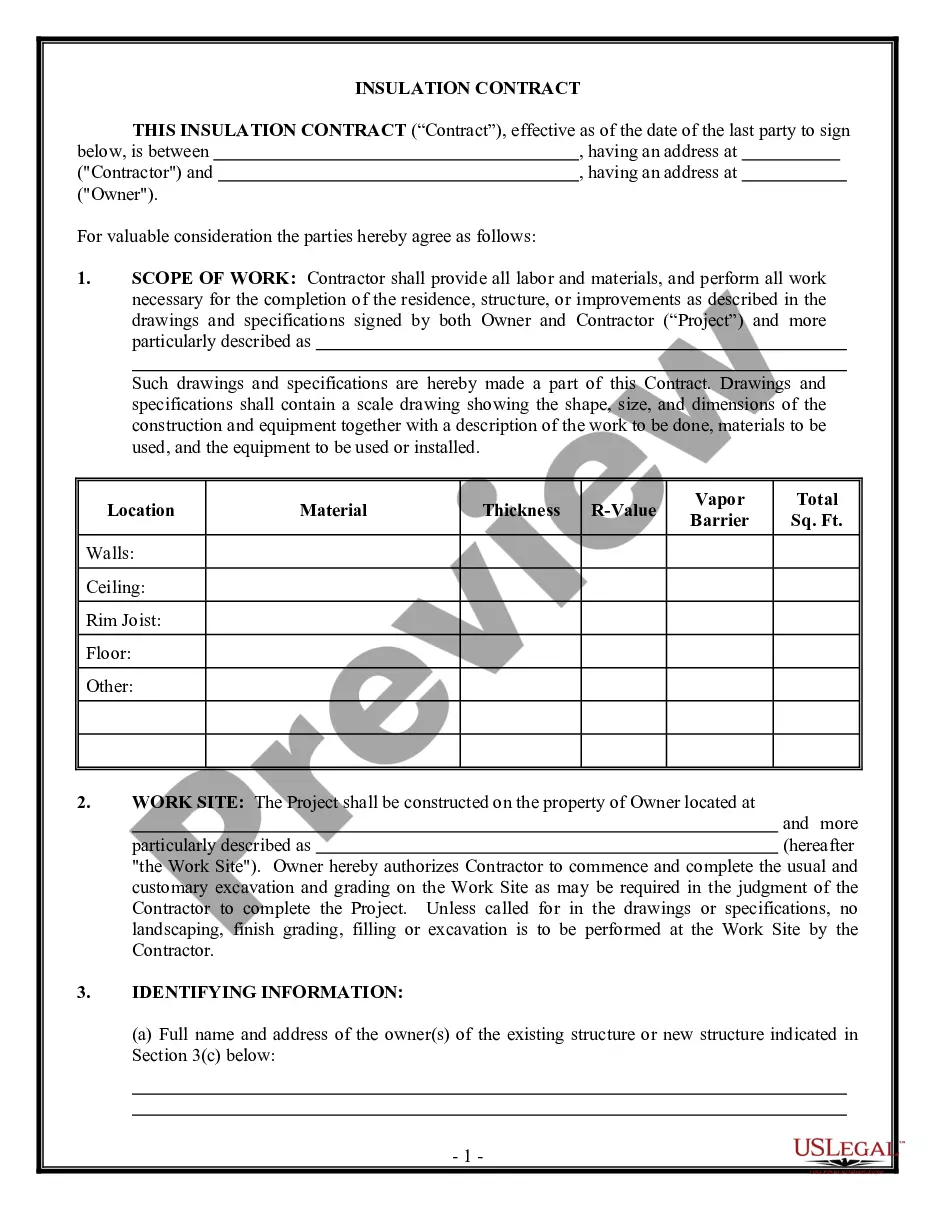

- Ensure you have selected the correct form for your locality. Click the Preview button to check the form’s details.

- Review the form description to confirm that you have chosen the right document.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, affirm your choice by clicking the Buy now button.

- Then, select your preferred pricing plan and provide your information to sign up for an account.

Form popularity

FAQ

When filling out self-employment forms, you’ll need to provide details such as your business name, income earned, and expenses incurred. You'll also report your net profit or loss on a Schedule C. This information is essential in determining your tax obligations. For support throughout this process, connect with Virgin Islands Specialty Services Contact - Self-Employed.

To prove your self-employment, you can provide documentation such as your Schedule C, 1099 forms, or bank statements showing business income. Additionally, you may include invoices or contracts from clients. Compiling organized records will make it easier for you to present your proof when needed. For assistance in preparing this documentation, reach out to Virgin Islands Specialty Services Contact - Self-Employed.

For self-employment, you'll primarily file a Schedule C, which details your income and expenses from your business. This form accompanies your standard Form 1040 when you file your taxes. It’s important to keep thorough records of your financial transactions. To navigate this process smoothly, consider contacting Virgin Islands Specialty Services Contact - Self-Employed.

The W-4 form is typically used by employees to determine tax withholding from their paychecks. Self-employed individuals do not fill out a W-4 since they do not have an employer withholding taxes. Instead, self-employed persons manage their own tax payments throughout the year. For more tailored support, check with Virgin Islands Specialty Services Contact - Self-Employed.

Even if you earned less than $5000, you generally must file a tax return if your self-employment income exceeds a certain threshold. This threshold can vary based on your total income and other factors. Filing taxes can help you keep accurate records and ensure you remain compliant. For specific guidance, reach out to Virgin Islands Specialty Services Contact - Self-Employed.

Self-employed individuals typically file a Form 1040, which is the standard individual income tax return. If you earn income as a contractor or freelancer, you may also receive a 1099 form from clients, detailing your earnings. In summary, while 1099 forms report income, Form 1040 is your primary filing form. For assistance on this process, consider using Virgin Islands Specialty Services Contact - Self-Employed.

The Virgin Islands offer attractive tax incentives, making them appealing to self-employed individuals and businesses. While there is no federal income tax, certain qualifications determine your tax responsibilities. It’s crucial to understand the local tax laws fully. Consulting with Virgin Islands Specialty Services Contact - Self-Employed can provide clarity on how to benefit from these tax advantages.

To set up an LLC in the Virgin Islands, start by choosing a unique name that complies with local naming regulations. Next, you'll need to file your Articles of Organization with the Division of Corporations. Don't overlook the requirement to appoint a registered agent. For expert guidance, consider reaching out to the Virgin Islands Specialty Services Contact - Self-Employed to help you with this process effectively.

Opening a business in the Virgin Islands involves several key steps. First, you need to decide on the type of business structure you want to establish. Then, you must register your business name and obtain the necessary licenses and permits. Utilizing Virgin Islands Specialty Services Contact - Self-Employed can streamline your process and ensure compliance with local regulations.

To visit the Virgin Islands, you need a valid passport. Depending on your nationality, you might also require a visa. Be sure to check the specifics based on your country of origin. Understanding the Virgin Islands Specialty Services Contact - Self-Employed can assist you in navigating these requirements smoothly.