Virgin Islands Pre Incorporation Agreement

Description

How to fill out Pre Incorporation Agreement?

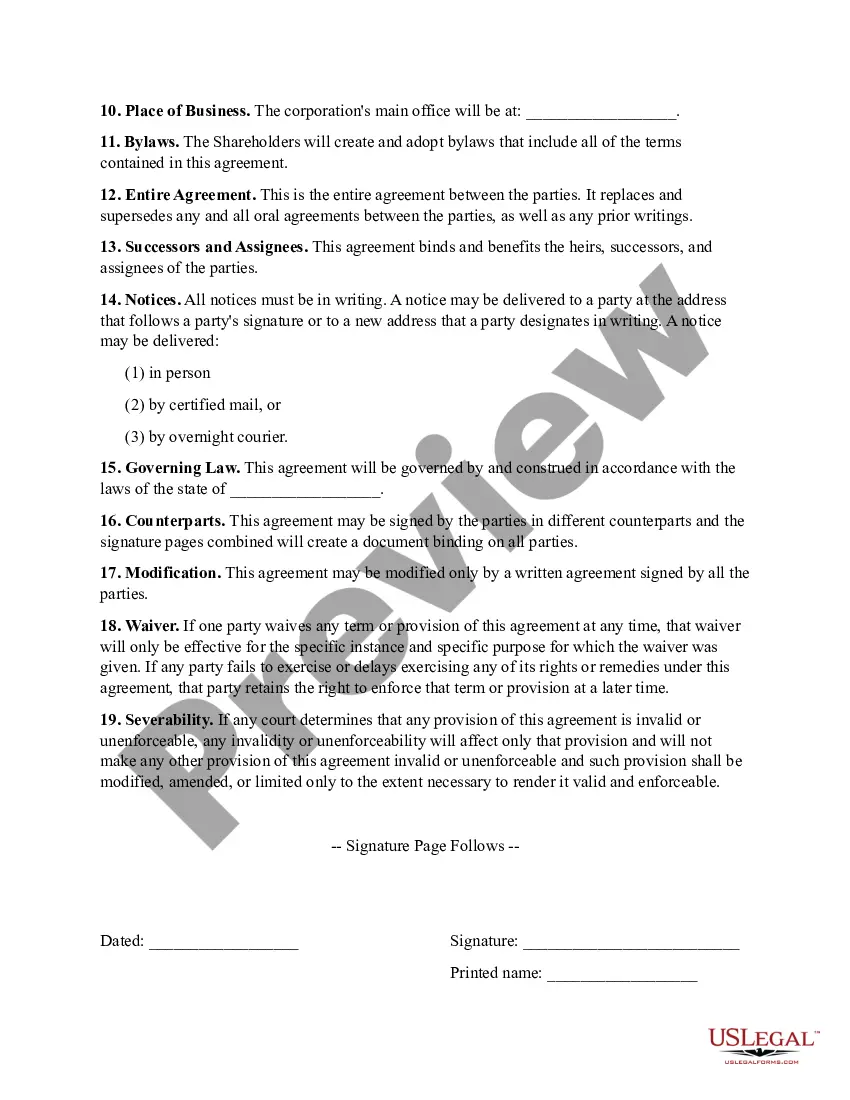

Finding the right legitimate file format can be quite a have difficulties. Of course, there are a variety of themes available on the Internet, but how do you discover the legitimate kind you require? Take advantage of the US Legal Forms internet site. The support delivers a large number of themes, like the Virgin Islands Pre Incorporation Agreement, that you can use for company and private requires. All the kinds are examined by pros and meet federal and state specifications.

Should you be currently signed up, log in to your accounts and click the Obtain switch to have the Virgin Islands Pre Incorporation Agreement. Make use of your accounts to appear through the legitimate kinds you possess acquired formerly. Proceed to the My Forms tab of your own accounts and obtain yet another duplicate of your file you require.

Should you be a brand new customer of US Legal Forms, listed here are straightforward instructions for you to follow:

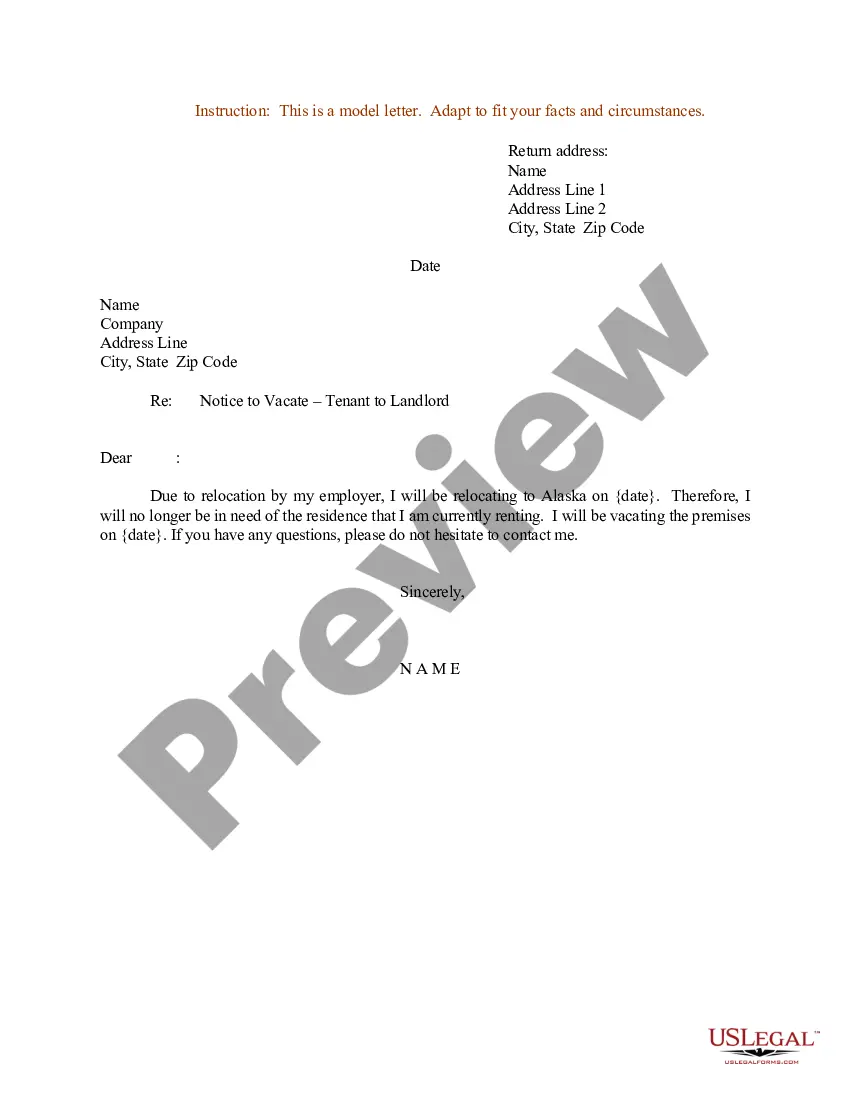

- Initially, make sure you have chosen the right kind for the town/area. You can look through the form using the Preview switch and study the form explanation to make sure this is the best for you.

- In case the kind fails to meet your expectations, use the Seach discipline to find the proper kind.

- When you are sure that the form is suitable, click on the Buy now switch to have the kind.

- Pick the pricing program you want and type in the necessary information and facts. Build your accounts and purchase the order with your PayPal accounts or bank card.

- Select the data file structure and acquire the legitimate file format to your gadget.

- Total, modify and produce and indicator the acquired Virgin Islands Pre Incorporation Agreement.

US Legal Forms will be the greatest collection of legitimate kinds in which you can find numerous file themes. Take advantage of the company to acquire expertly-produced papers that follow state specifications.

Form popularity

FAQ

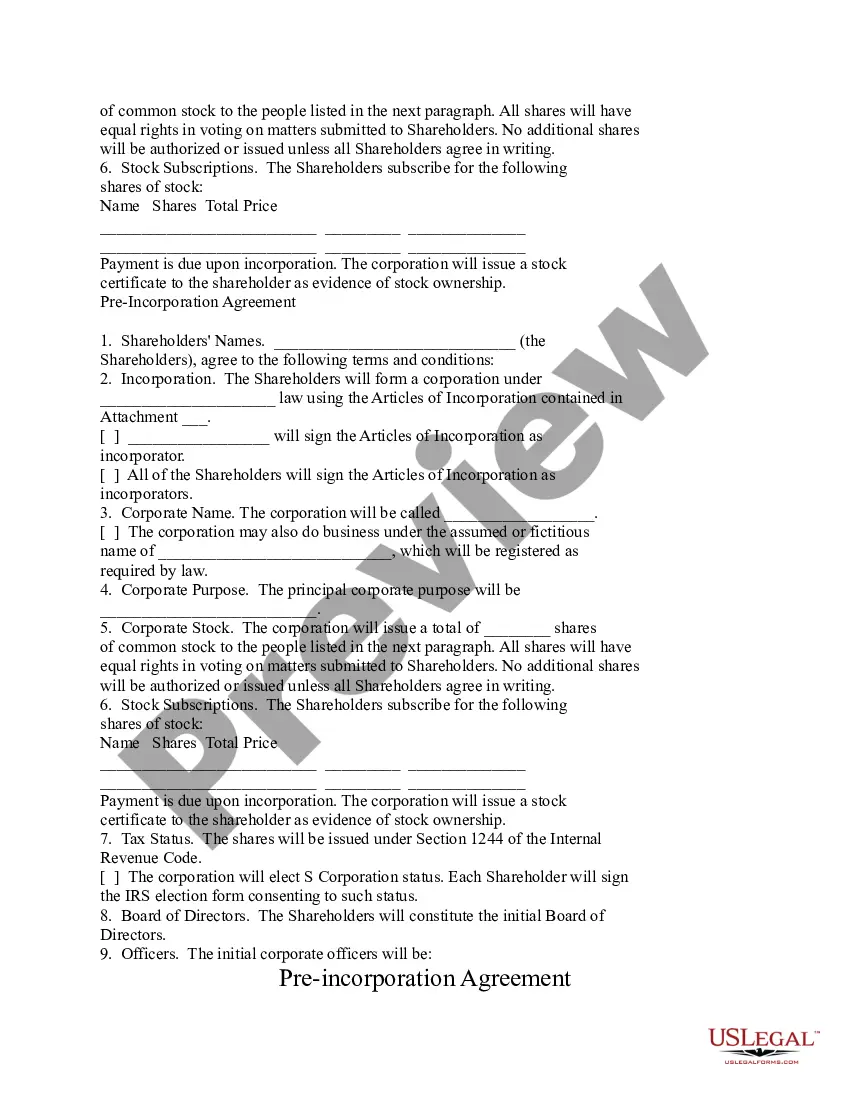

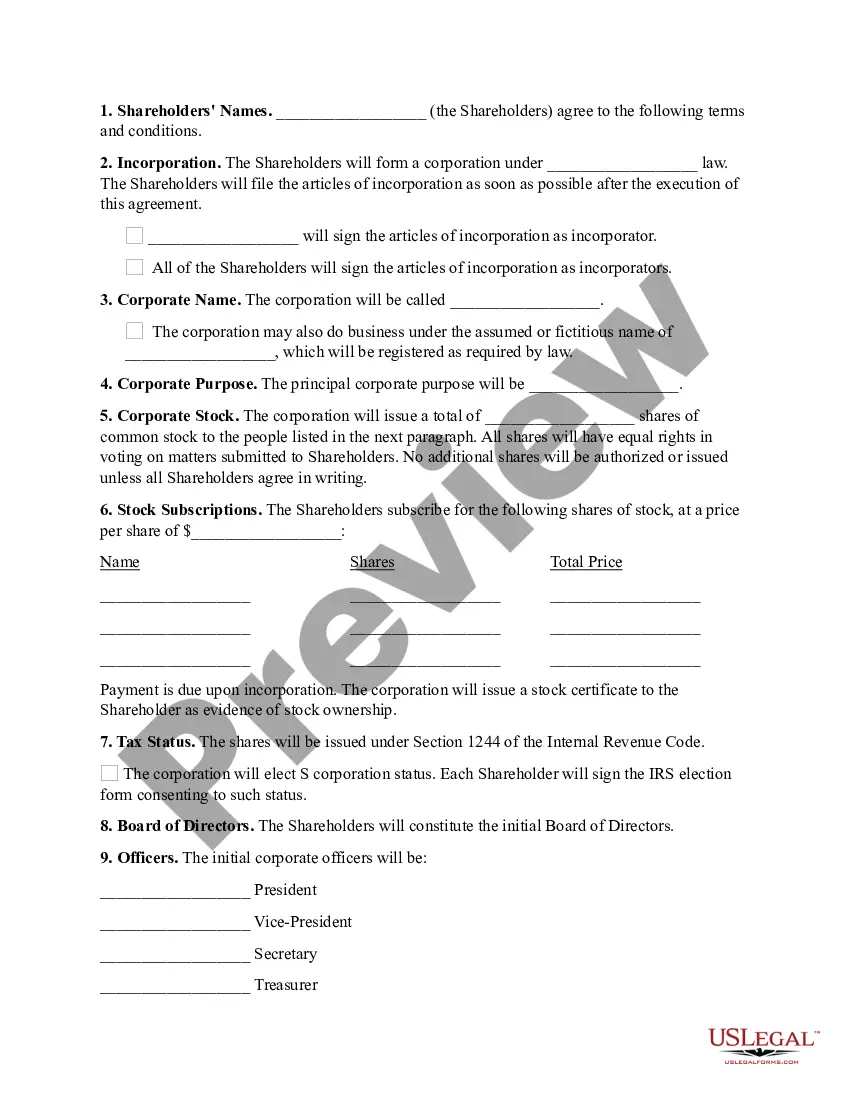

There are various types of pre-incorporation contracts that can be made by a company ing to their need before incorporation, such as a lease agreement, employment agreement, founder's agreement, shareholder agreement, etc.

US corporations which claim US Virgin Islands sourced income are not subject to withholding or gross basis tax. US corporations which hold branches in the US Virgin Islands are not subject to branch profits tax. Resident corporations in the US Virgin Islands are subject to taxation on their worldwide income.

Requirements for Incorporation in the U.S. Virgin Islands. Corporations in the U.S. Virgin Islands are formed by three incorporators who are responsible for electing the company's directors. There is a minimum requirement of one director for every shareholder of the corporation if there are three or fewer shareholders.

The organization of the Government of the Virgin Islands rests upon the Revised Organic Act of 1954 in which the United States Congress declared the U.S. Virgin Islands to be an unincorporated territory of the United States.

Unlike most US states, the USVI requires corporations to have a minimum of three directors, three officers, a president, treasurer and secretary. Corporate directors are not allowed. Stock must also be registered and there is a minimum capital requirement of $1,000.

US Virgin Islands is not a tax haven or offshore jurisdiction, but USVI companies (or corporations) could be established as "USVI Exempt Companies" with partial or full exemption from local and US federal income taxes.

To start a business in the U.S. Virgin Islands you will need to obtain a business license from the Department of Licensing and Consumer Affairs (DLCA). DLCA will complete the "One Step" review process with the following government agencies: Police Department. VI Bureau of Internal Revenue (tax clearance)

The USVI has its own income tax system based on the same laws and tax rates that apply in the United States. An important factor in USVI taxation is whether, during the entire tax year, you are a bona fide resident of the USVI.