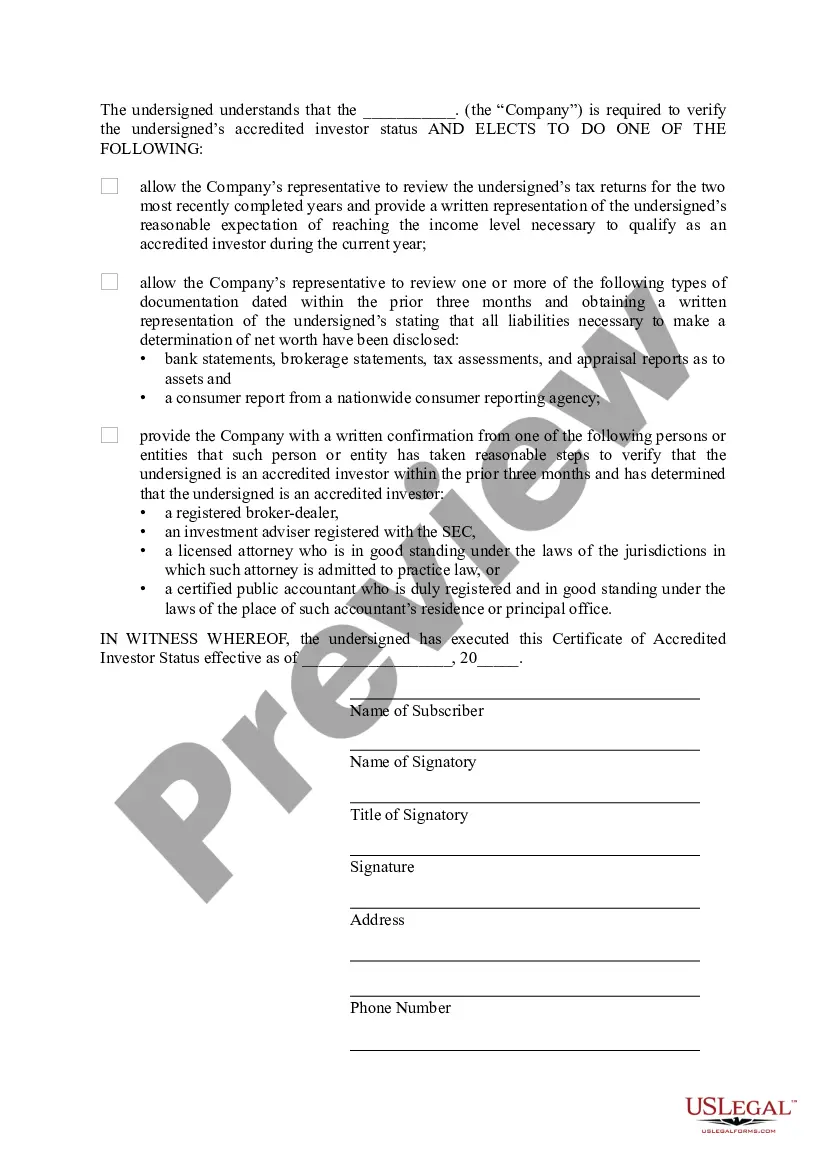

Virgin Islands Certificate of Accredited Investor Status

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Certificate Of Accredited Investor Status?

Are you currently in a place that you will need paperwork for both organization or individual reasons virtually every day time? There are a lot of legitimate papers templates available on the net, but finding kinds you can trust isn`t easy. US Legal Forms gives thousands of develop templates, just like the Virgin Islands Certificate of Accredited Investor Status, that happen to be written to satisfy federal and state needs.

Should you be presently acquainted with US Legal Forms site and possess an account, simply log in. Following that, you can acquire the Virgin Islands Certificate of Accredited Investor Status format.

If you do not offer an account and wish to begin using US Legal Forms, abide by these steps:

- Discover the develop you will need and ensure it is to the appropriate metropolis/state.

- Utilize the Preview option to check the shape.

- Read the outline to ensure that you have chosen the right develop.

- When the develop isn`t what you are searching for, utilize the Research industry to find the develop that fits your needs and needs.

- Whenever you discover the appropriate develop, click on Purchase now.

- Opt for the prices plan you desire, submit the necessary details to produce your money, and purchase the transaction with your PayPal or bank card.

- Decide on a hassle-free document format and acquire your copy.

Locate all of the papers templates you have bought in the My Forms food list. You can get a further copy of Virgin Islands Certificate of Accredited Investor Status at any time, if possible. Just select the essential develop to acquire or produce the papers format.

Use US Legal Forms, the most considerable selection of legitimate types, to save lots of some time and steer clear of faults. The support gives professionally produced legitimate papers templates which you can use for an array of reasons. Produce an account on US Legal Forms and start making your daily life easier.

Form popularity

FAQ

The simplest way to attain ?accredited investor? status is to ask for a 3rd party verification letter from a registered broker dealer, an attorney or a certified public accountant.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

For the net worth test, you (or you and a spouse or spousal equivalent) must show enough assets to evidence a net worth of at least $1,000,000 USD ignoring the value of your primary residence and after discounting all your other liabilities (including liabilities exceeding the value of your primary residence and ...

Reviewing bank statements, brokerage statements, and other similar reports to determine net worth. Obtaining written confirmation of the investor's accredited investor status from one of the following persons: a registered broker-dealer, an investment adviser registered with the SEC, a licensed attorney, or a CPA.

This certificate can be used in an issuer's private placement of securities to determine whether a potential investor is an accredited investor. This Standard Document has integrated notes with important explanations and drafting tips.

If that type of official documentation is not available, you may be able to provide evidence through earnings statements, pay stubs, a letter from your employer certifying your income, or perhaps bank statements that show that you receive that income.

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

The SEC's Rule 506 allows self-certification of investors in order for them to become accredited.

Among other categories, the SEC now defines accredited investors to include the following: Individuals who have certain professional certifications, designations, or credentials. Individuals who are ?knowledgeable employees? of a private fund. SEC- and state-registered investment advisers5.

Accredited Investor Verification In a Rule 506(b) offering, the issuer may take the investor's word that he, she, or it is accredited, unless the issuer has reason to believe the investor is lying. In a Rule 506(c) offering, the issuer must take reasonable steps to verify that every investor is accredited.