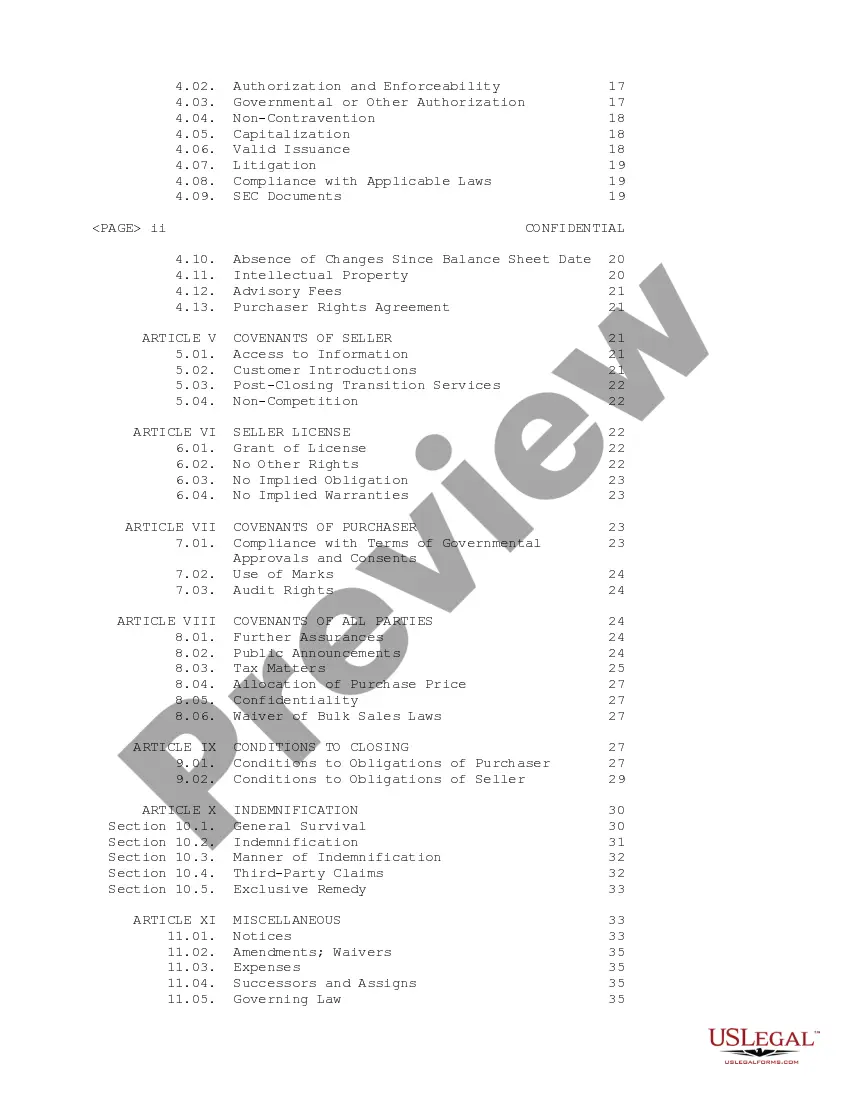

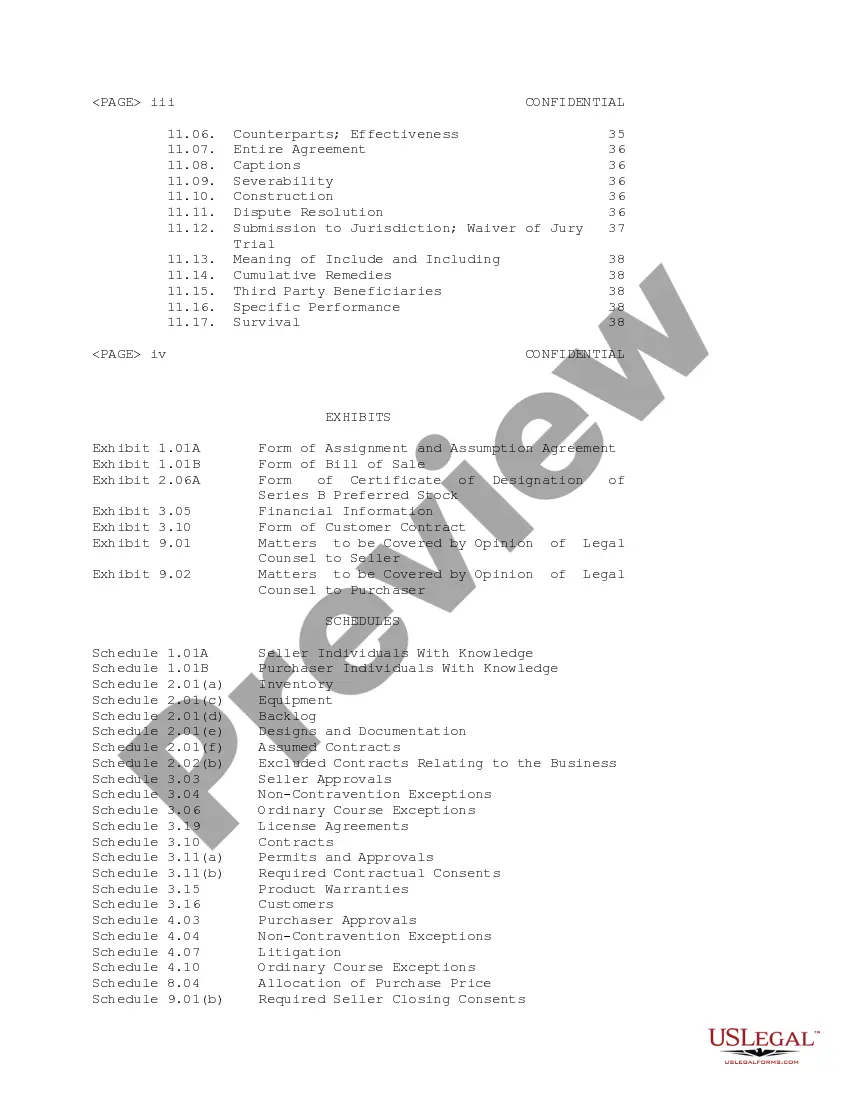

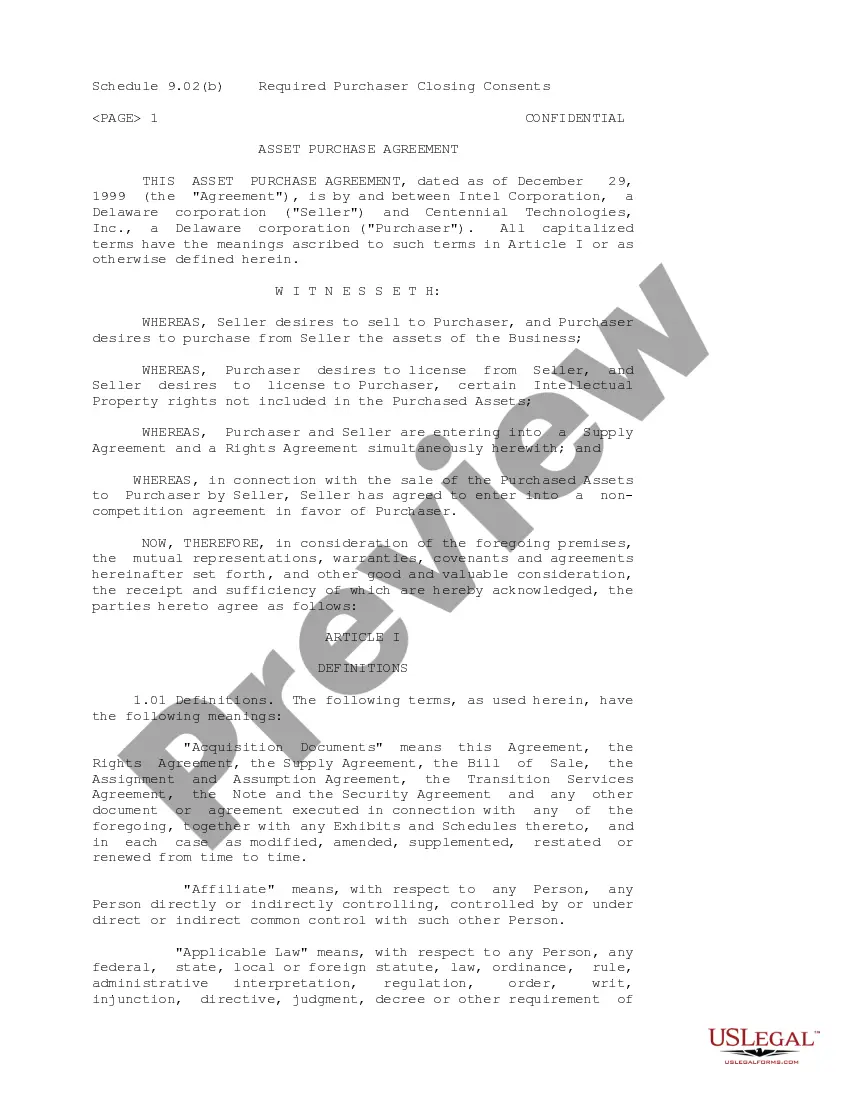

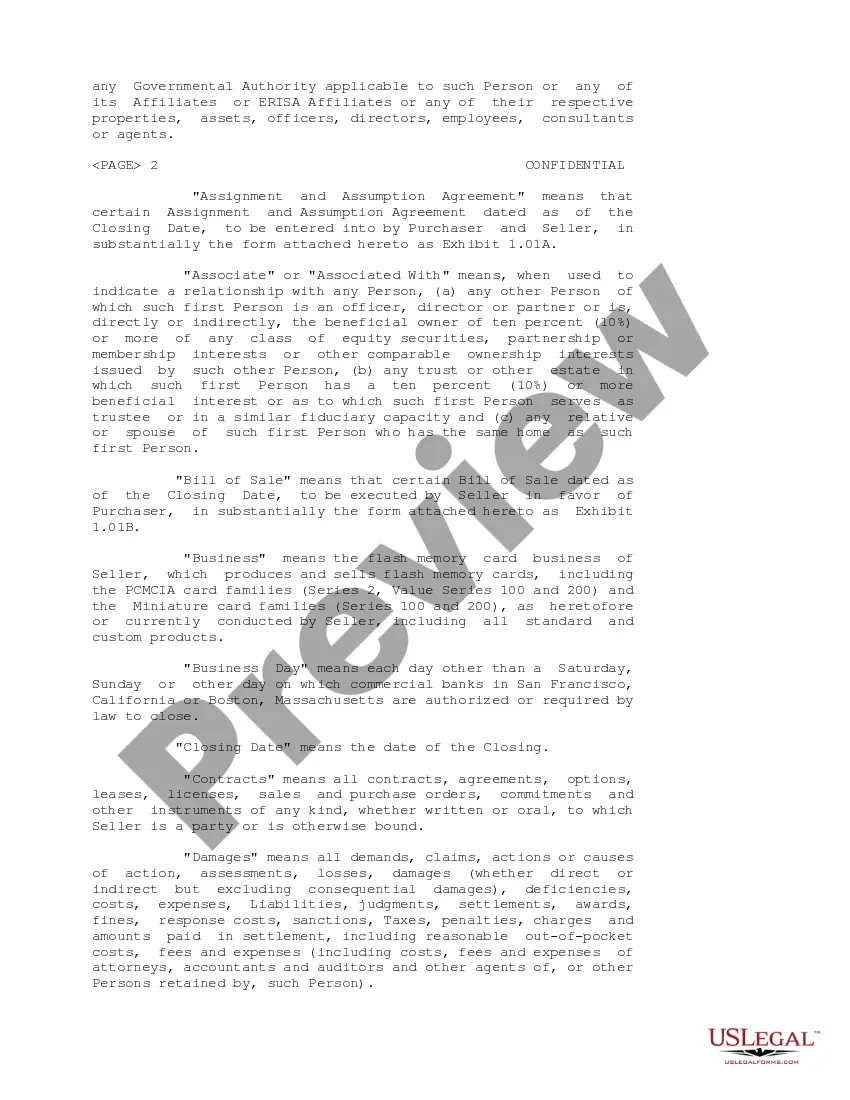

Virgin Islands Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample

Description

How to fill out Sample Asset Purchase Agreement Between Centennial Technologies, Inc. And Intel Corporation - Sample?

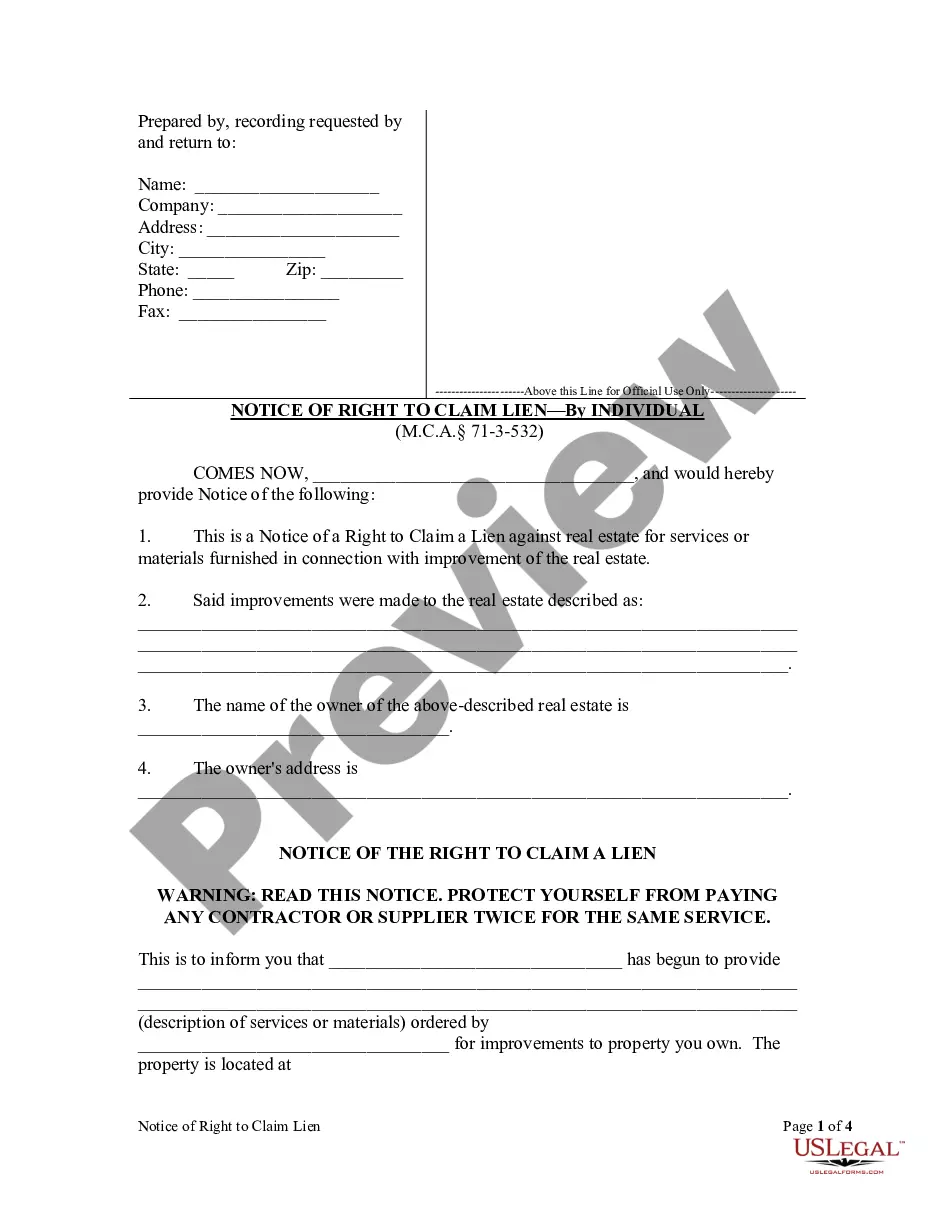

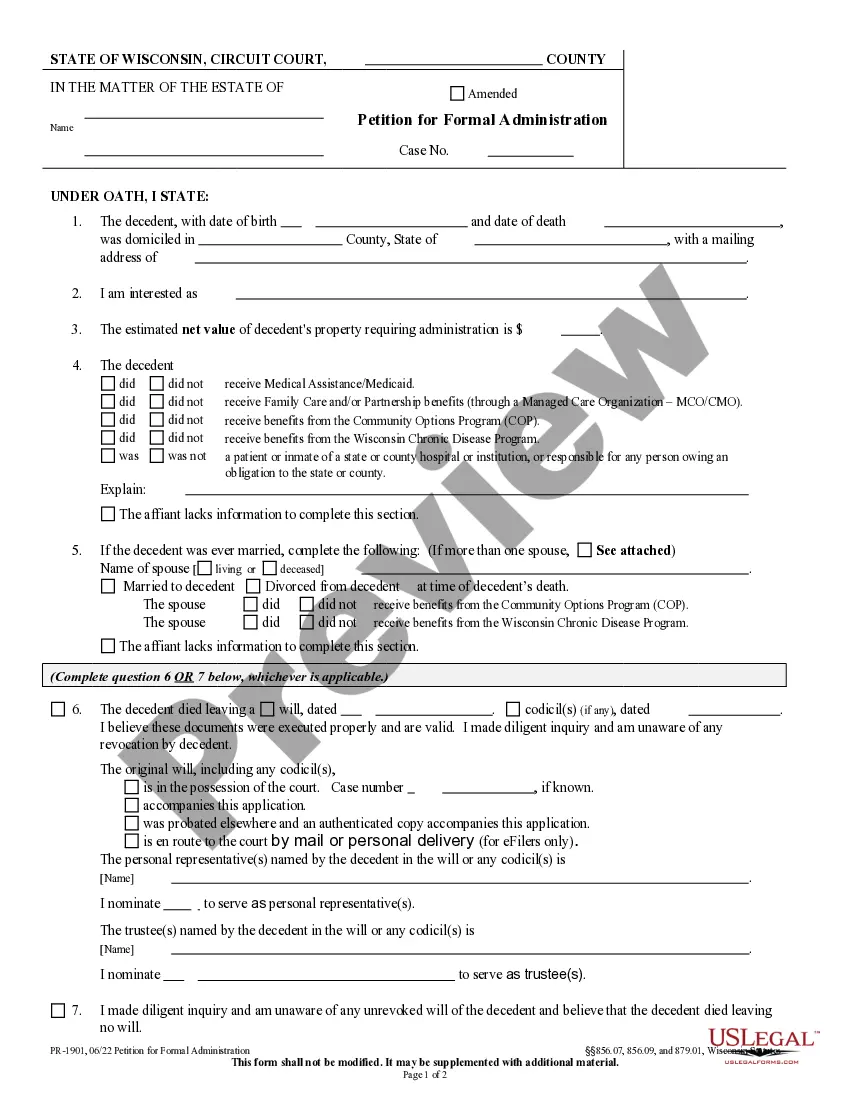

Are you currently in a place the place you require documents for sometimes organization or person functions nearly every day time? There are plenty of legal file themes accessible on the Internet, but discovering types you can trust is not effortless. US Legal Forms offers thousands of develop themes, much like the Virgin Islands Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample, which are written to meet federal and state needs.

Should you be previously acquainted with US Legal Forms site and also have a merchant account, merely log in. Following that, you are able to download the Virgin Islands Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample web template.

Unless you have an account and want to start using US Legal Forms, adopt these measures:

- Obtain the develop you will need and make sure it is for the right town/county.

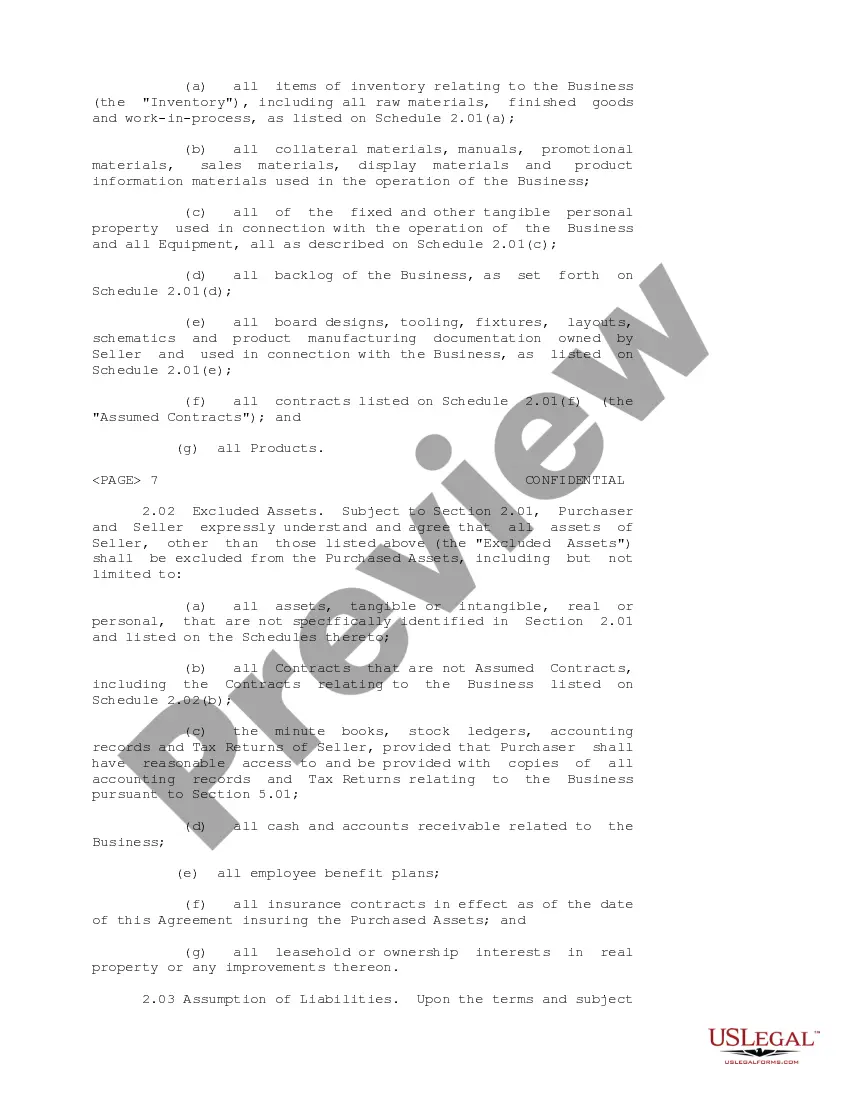

- Use the Review option to examine the shape.

- See the explanation to actually have selected the proper develop.

- If the develop is not what you`re searching for, take advantage of the Search area to obtain the develop that meets your needs and needs.

- Whenever you find the right develop, click on Purchase now.

- Choose the pricing plan you desire, complete the necessary info to produce your money, and pay money for your order using your PayPal or charge card.

- Select a convenient file file format and download your copy.

Locate all of the file themes you have bought in the My Forms menu. You can get a extra copy of Virgin Islands Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample anytime, if needed. Just select the essential develop to download or printing the file web template.

Use US Legal Forms, by far the most extensive selection of legal types, to conserve some time and avoid faults. The assistance offers professionally produced legal file themes which can be used for an array of functions. Produce a merchant account on US Legal Forms and initiate generating your lifestyle a little easier.