This form is a list of requested due diligence documents for hospital acquisition. The list consists of documents and information to be submitted to the due diligence team.

Virgin Islands Due Diligence Document Request List for Hospital Acquisition

Description

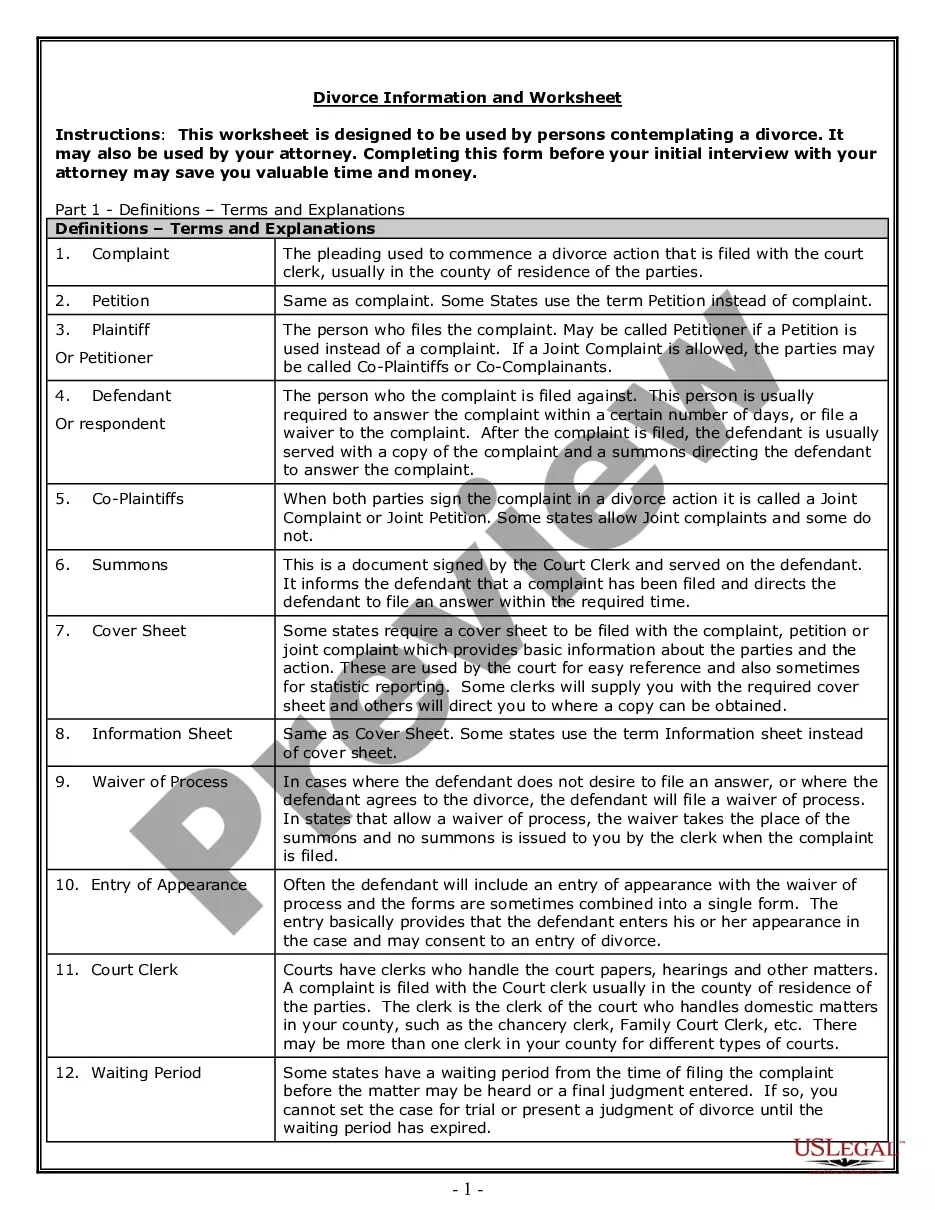

How to fill out Due Diligence Document Request List For Hospital Acquisition?

Selecting the appropriate legal document template can be a challenge. Certainly, there are numerous templates available online, but how can you find the legal form you require? Utilize the US Legal Forms website.

The service offers thousands of templates, including the Virgin Islands Due Diligence Document Request List for Hospital Acquisition, which can be utilized for business and personal purposes. All forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Virgin Islands Due Diligence Document Request List for Hospital Acquisition. Use your account to browse the legal forms you have purchased previously. Proceed to the My documents tab in your account to download another copy of the document you need.

Complete, edit, print, and sign the downloaded Virgin Islands Due Diligence Document Request List for Hospital Acquisition. US Legal Forms is the largest repository of legal forms, offering numerous document templates. Use the service to download properly crafted documents that adhere to state regulations.

- If you are a new user of US Legal Forms, here are some simple steps for you to follow.

- First, ensure you have selected the correct form for your city/state. You can preview the form using the Review button and read the form description to confirm it is suitable for your needs.

- If the form does not meet your requirements, use the Search field to find the correct form.

- Once you are sure that the form is appropriate, click the Get now button to acquire the form.

- Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

An acquisition checklist is a structured guide that outlines all necessary steps and documents needed before completing a deal. In the context of acquiring a hospital in the Virgin Islands, this checklist ensures thorough due diligence is completed. It encompasses financial, operational, and legal aspects vital for a successful acquisition. Creating an acquisition checklist associated with your due diligence requests ensures a smoother and effective transaction.

A CDD checklist refers to a Customer Due Diligence checklist that helps assess the risk associated with a business relationship. In the context of hospital acquisition in the Virgin Islands, a CDD checklist can identify factors like financial stability and legal compliance. It is crucial for ensuring that your virgin islands due diligence document request list for hospital acquisition includes all vital risk factors. This checklist aligns with regulatory requirements and helps safeguard your investment.

Yes, a buyer can back out of a deal after due diligence if they uncover significant issues. The findings from the virgin islands due diligence document request list for hospital acquisition may reveal critical financial, operational, or legal problems. It is essential for buyers to have clear exit strategies in place. Knowing when to walk away protects their investment and minimizes potential losses.

A due diligence checklist is a comprehensive tool that helps ensure all necessary areas are covered during the due diligence phase. In the context of the Virgin Islands due diligence document request list for hospital acquisition, this checklist can include items related to financial review, operational assessments, and regulatory compliance. Utilizing a checklist promotes thoroughness and reduces the chances of overlooking critical factors in the acquisition process.

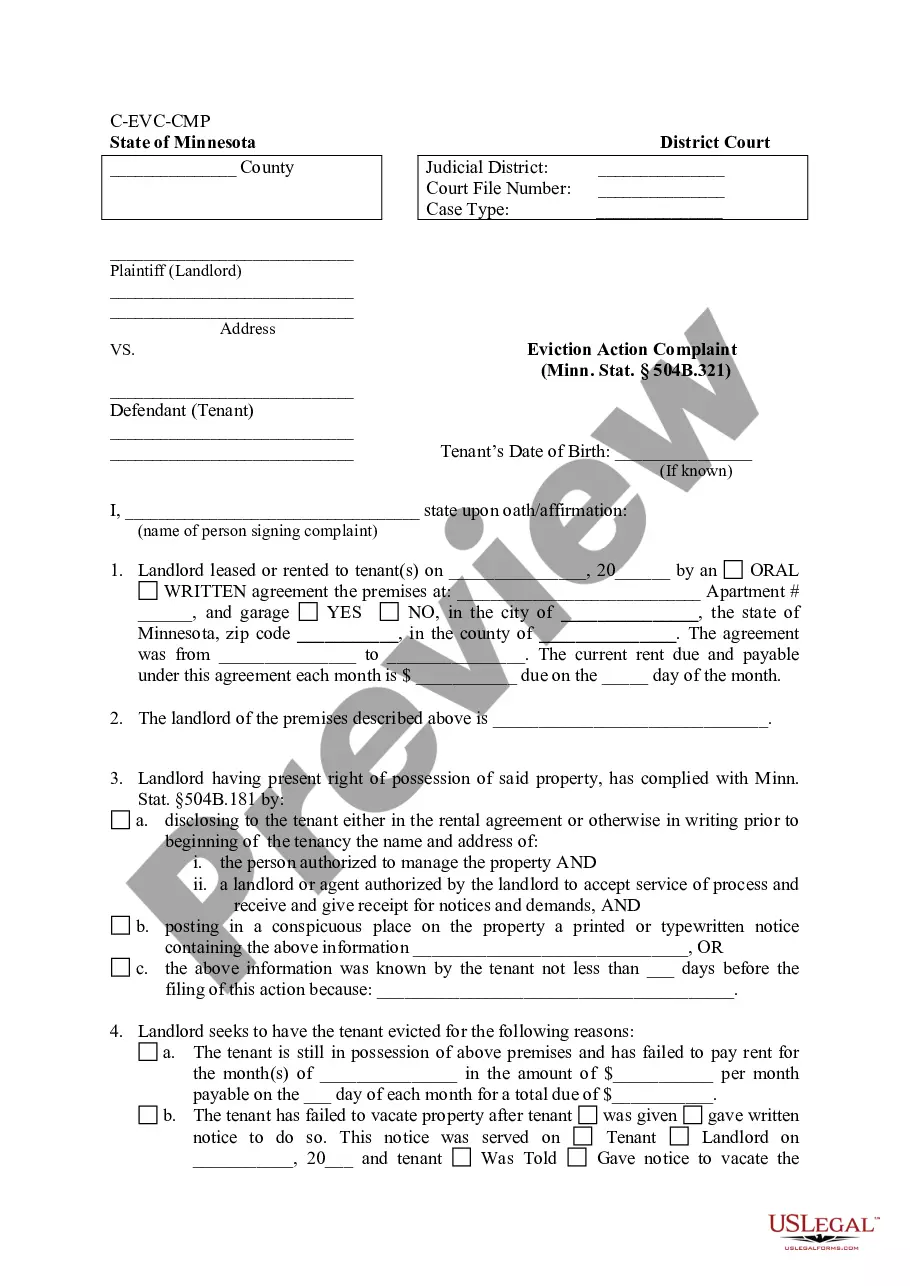

A due diligence request list outlines the specific documents and information needed during the due diligence process. For a hospital acquisition in the Virgin Islands, this list serves as a roadmap for gathering essential data. It typically includes financial records, employee agreements, and regulatory compliance documents. Having a clear request list streamlines the process and minimizes delays.

In the context of the Virgin Islands due diligence document request list for hospital acquisition, several key documents are required. These might include financial statements, tax returns, legal contracts, and operational policies. Gathering these documents helps you gain a comprehensive view of the hospital's financial and operational health. A well-prepared request list ensures nothing crucial is overlooked.

A due diligence request is a formal inquiry to collect specific information and documents for review during a transaction. In the context of the Virgin Islands due diligence document request list for hospital acquisition, this process will help you assess risks and verify claims about the hospital's operations. It aims to uncover potential issues that could affect the transaction. Properly managing this request is critical for successful due diligence.

The 4 P's of due diligence are Purpose, People, Processes, and Products. Understanding the purpose of your virgin islands due diligence document request list for hospital acquisition is essential, as it guides the entire process. Evaluating the people involved helps identify key stakeholders, while assessing processes ensures operational efficiency. Lastly, examining products relates to the essential services or goods the hospital offers.

To prepare a due diligence checklist, start by identifying the key documents and areas of concern relevant to your acquisition. Craft your Virgin Islands Due Diligence Document Request List for Hospital Acquisition by including items like financial statements, regulatory compliance documents, and operational policies. This proactive preparation makes the due diligence process more efficient and effective.

Structuring due diligence involves organizing information into clear categories and timelines. For your Virgin Islands Due Diligence Document Request List for Hospital Acquisition, consider dividing the process into legal, financial, and operational segments. This structured approach not only simplifies the analysis but also ensures that critical areas are thoroughly explored.