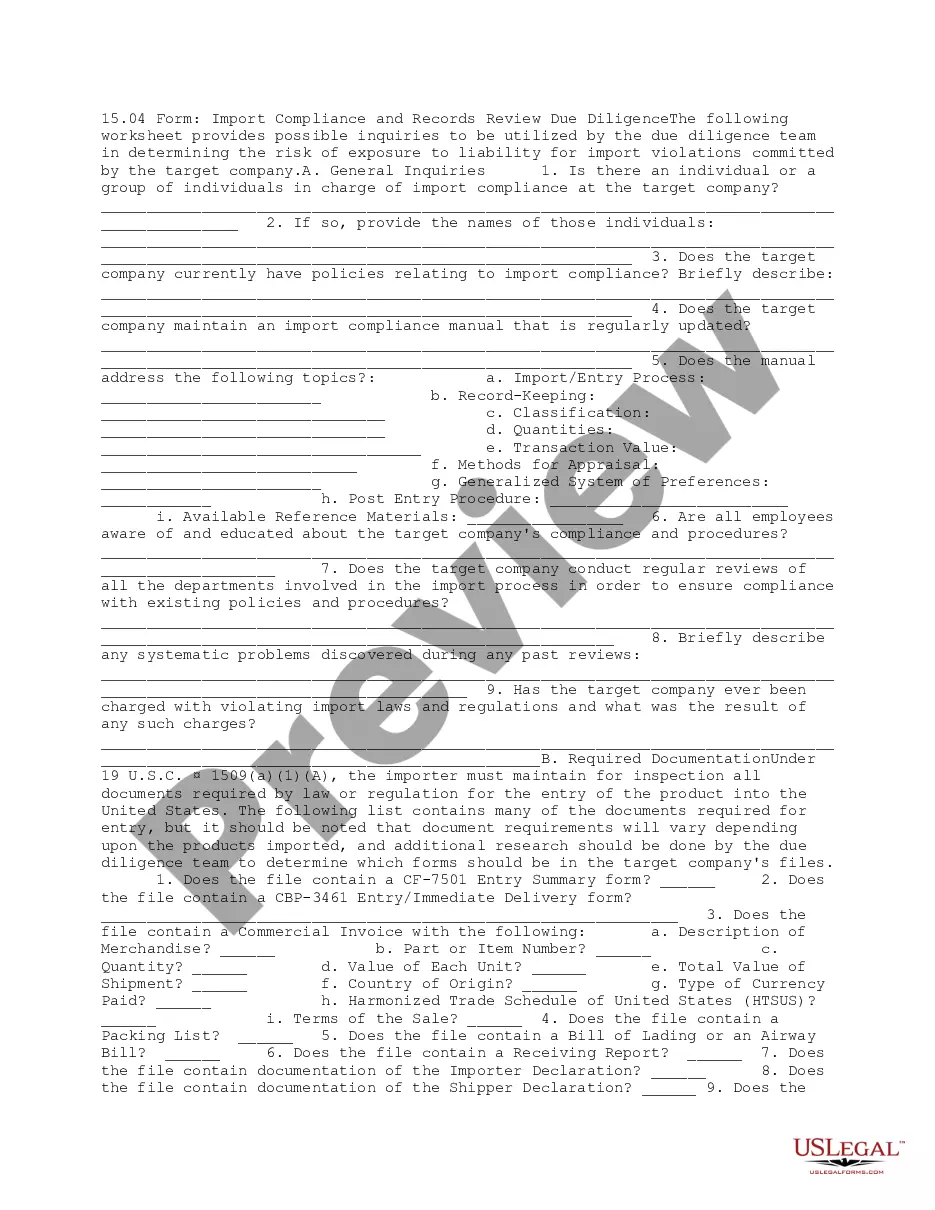

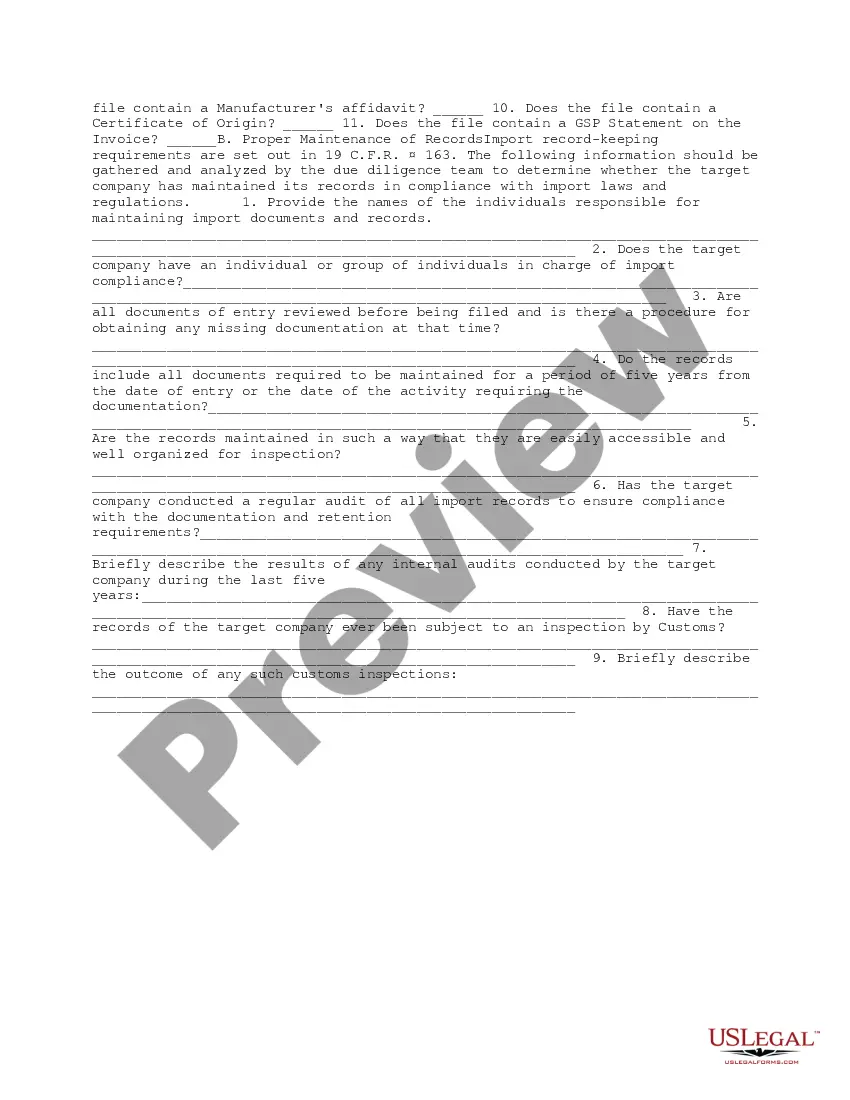

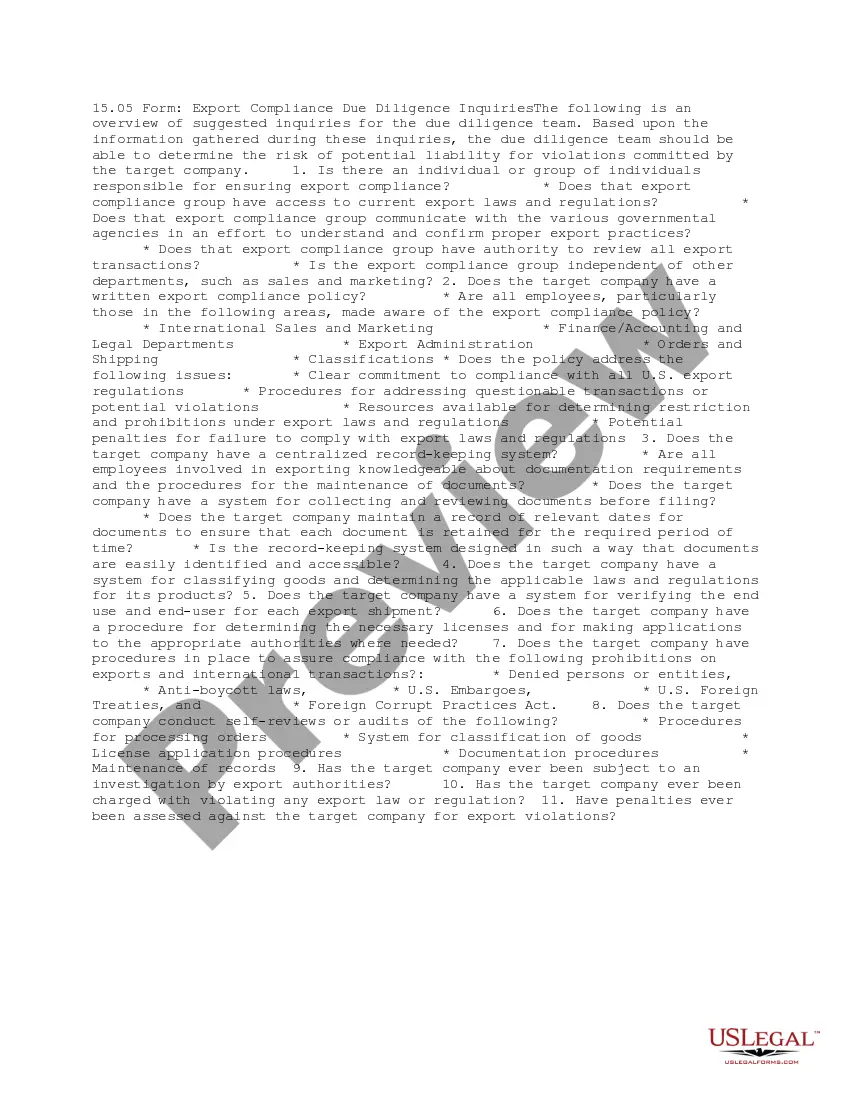

This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

Virgin Islands Import Compliance and Records Review Due Diligence

Description

How to fill out Import Compliance And Records Review Due Diligence?

If you desire to finalize, obtain, or produce sanctioned document templates, utilize US Legal Forms, the most extensive assortment of legal forms available online.

Leverage the site's straightforward and user-friendly search feature to locate the documents you require.

Numerous templates for business and personal purposes are organized by categories and regions or keywords.

Step 4. After finding the form you need, click the Buy now button. Select your preferred pricing plan and input your credentials to register for the account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Employ US Legal Forms to discover the Virgin Islands Import Compliance and Records Review Due Diligence with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Purchase button to find the Virgin Islands Import Compliance and Records Review Due Diligence.

- You can also access forms you have previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, check the guidelines below.

- Step 1. Ensure you have chosen the appropriate form for your relevant area/country.

- Step 2. Utilize the Examine function to review the form's content. Be sure to read the description.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find alternative types of your legal document format.

Form popularity

FAQ

When importing a good or product, it is the responsibility of the importer of record to be compliant with import regulations.

Here's a detailed guide to how the FCL import process works in India for a free on board (FOB) shipment.Origin activities (till vessel departure)In-transit activities.Container movement at destination.Bill of Entry filing.Customs assessment, examination, and clearance.Document handover to the carrier.More items...?

Importers are required to furnish an import declaration in the prescribed bill of entry format, disclosing full details of the value of imported goods. All import documents must be accompanied by any import licenses. This will enable the customs to clear the documents and allow the import without delay.

Documents All Importers NeedBill of lading (can be telex released or the original)Commercial Invoice.Packing List.EORI number.Certificate of Origin/GSP Form A.CE Certificate.Certification for Port Health.Test Certificates.More items...?

In most cases, a power of attorney (POA) provides the authorization to do clearance for an importer. The IOR must ensure all goods are appropriately documented and valued. Furthermore, the Importer of Record is the responsible party for the payment of duties, tariffs, and fees of the imported goods.

List of Documents required for Imports Customs ClearanceBill of Entry.Commercial Invoice.Bill of Lading or Airway Bill.Import License.Certificate of Insurance.Letter of Credit or LC.Technical Write-up or Literature (Only required for specific goods)Industrial License (for specific goods)More items...?17 Sept 2019

Below, we outline the steps involved in importing of goods.Obtain IEC.Ensure legal compliance under different trade laws.Procure import licenses.File Bill of Entry and other documents to complete customs clearing formalities.Determine import duty rate for clearance of goods.

Canadian Import/Export Trade News To help ensure that prohibited and controlled goods are not illegally imported into Canada, the Canada Border Services Agency (CBSA) assists these other federal government departments and agencies by administering and enforcing legislation and regulations on their behalf.

There are four basic import documents you need in order to clear customs quickly and easily.Commercial Invoice. This document is used for foreign trade.Packing List. Provided by the shipper or freight forwarder, the packing list may be used by customs to check the cargo.Bill of Lading (BOL)Arrival Notice.

Generally it has come to mean the following:The country in which the product obtained its essential character is the country of origin, or.The country in which the product takes on its harmonized code (HTS) number is the country of origin.