Virgin Islands Bond Claim Notice

Description

How to fill out Bond Claim Notice?

US Legal Forms - among the biggest libraries of lawful kinds in the USA - delivers a wide range of lawful papers layouts you are able to acquire or print out. Using the website, you can get thousands of kinds for business and personal reasons, categorized by classes, suggests, or keywords.You can get the most recent types of kinds just like the Virgin Islands Bond Claim Notice in seconds.

If you already possess a subscription, log in and acquire Virgin Islands Bond Claim Notice from your US Legal Forms library. The Down load option will appear on every single kind you see. You have accessibility to all formerly saved kinds within the My Forms tab of your bank account.

If you want to use US Legal Forms for the first time, here are basic instructions to help you get began:

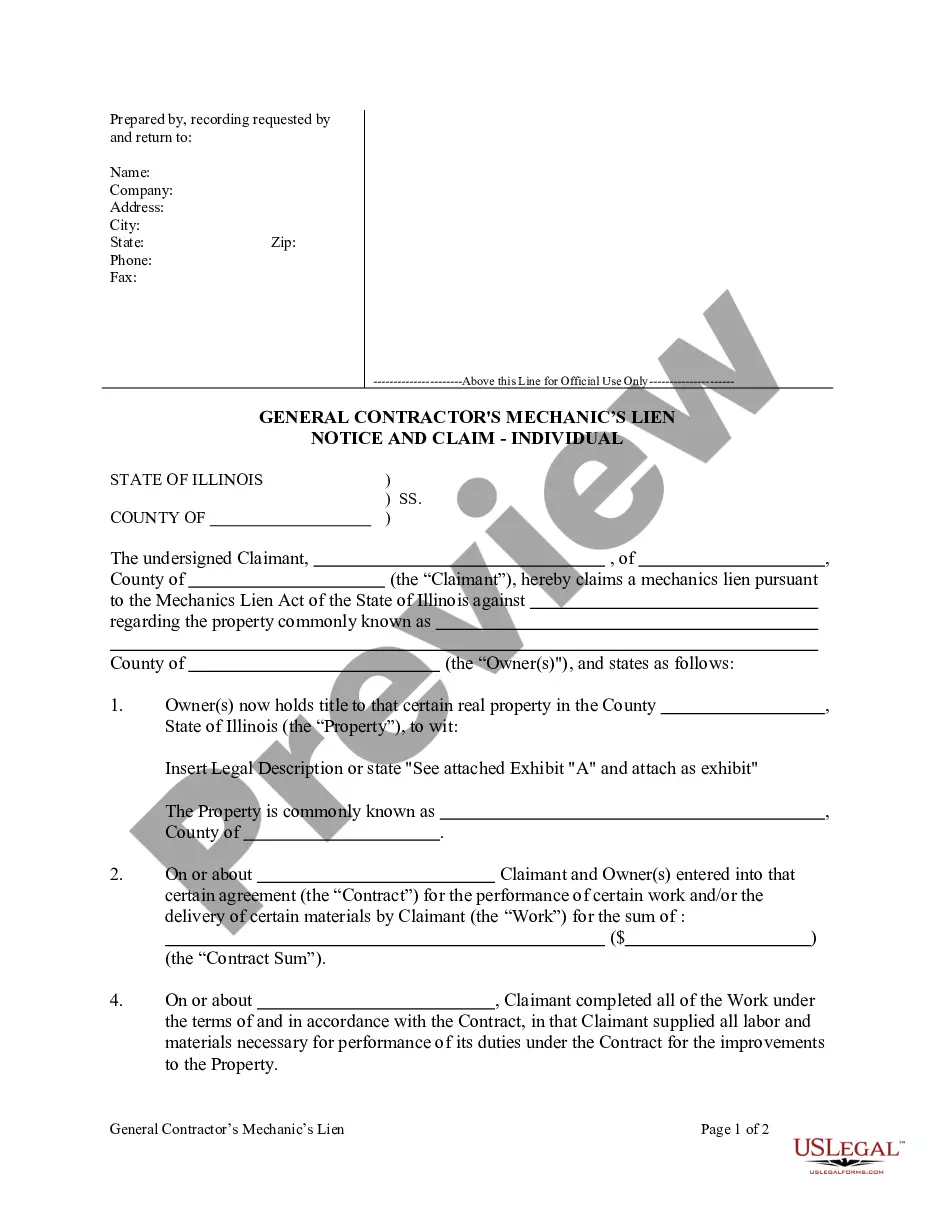

- Be sure to have picked out the best kind for your personal metropolis/state. Click on the Review option to examine the form`s content material. Browse the kind outline to actually have chosen the correct kind.

- In case the kind doesn`t satisfy your specifications, use the Research discipline at the top of the screen to obtain the one that does.

- In case you are happy with the shape, affirm your selection by visiting the Get now option. Then, choose the pricing prepare you want and provide your qualifications to sign up for an bank account.

- Procedure the transaction. Make use of your charge card or PayPal bank account to finish the transaction.

- Find the structure and acquire the shape in your gadget.

- Make modifications. Load, edit and print out and indication the saved Virgin Islands Bond Claim Notice.

Every single web template you added to your money does not have an expiration time which is yours for a long time. So, in order to acquire or print out an additional version, just check out the My Forms section and then click about the kind you need.

Obtain access to the Virgin Islands Bond Claim Notice with US Legal Forms, the most comprehensive library of lawful papers layouts. Use thousands of professional and status-specific layouts that meet up with your business or personal requirements and specifications.

Form popularity

FAQ

While all licensed California contractors are required to carry a $25,000 contractor license bond, certain contractor licenses may require a $25,000 Bond of Qualifying Individual, a $100,000 LLC Employee/Worker Bond, or a Disciplinary Bond depending on their license status.

Filing a Bond Claim If the contractor does not comply with the conditions of the bond, a claim can be filed with the surety company. The consumer will contact the surety directly to engage this process.

The Little Miller Act is a state-specific statute that acts as an extension of the federal Miller Act of 1935. The Miller Act states that all prime contractors on government construction projects are required to obtain bonds that guarantee both performance and payment for the invested parties.

If the surety does not voluntarily pay the claim, a lawsuit must be filed against the payment bond surety as follows: (a) if the public entity files a notice of completion or cessation notice, thirty (30) days six plus (6) months after the notice is filed or (b) if neither a notice of completion or cessation is filed, ...

Filing a Bond Claim The consumer will contact the surety directly to engage this process. Claims against a surety company may be filed by homeowners, any person damaged by a willful and deliberate violation of a construction contract or by employees damaged by the contractor's failure to pay wages.