Virgin Islands Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc.

Description

How to fill out Agreement And Plan Of Merger By Filtertek, Inc., Filtertek De Puerto Rico, And Filtertek USA, Inc.?

If you have to full, acquire, or produce legitimate papers layouts, use US Legal Forms, the largest variety of legitimate kinds, which can be found on-line. Use the site`s basic and hassle-free look for to find the paperwork you want. Numerous layouts for company and personal purposes are categorized by categories and suggests, or key phrases. Use US Legal Forms to find the Virgin Islands Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc. in a handful of mouse clicks.

If you are previously a US Legal Forms client, log in to your bank account and click on the Acquire option to obtain the Virgin Islands Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc.. Also you can entry kinds you previously downloaded in the My Forms tab of your bank account.

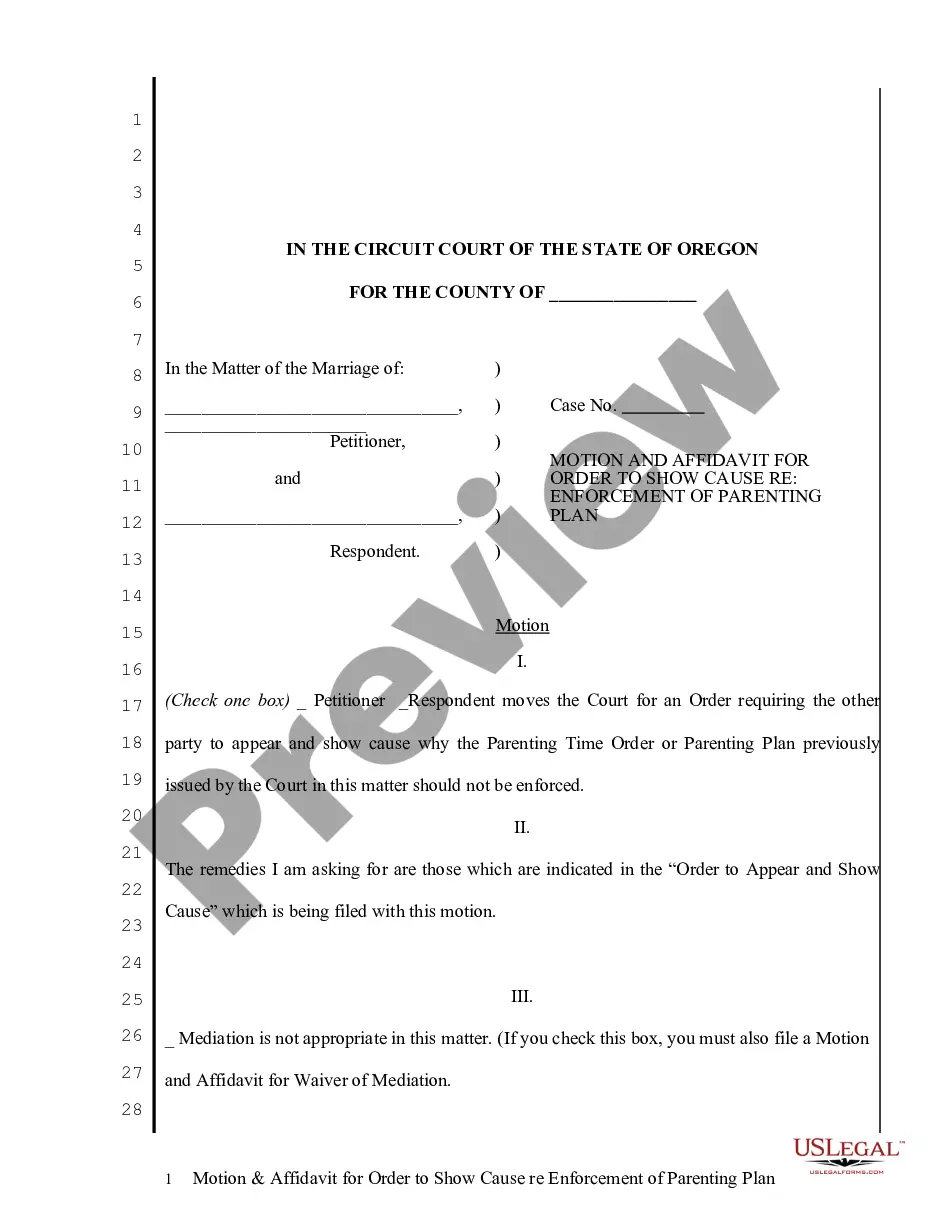

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have selected the form to the proper city/region.

- Step 2. Take advantage of the Preview choice to look over the form`s articles. Don`t forget about to see the explanation.

- Step 3. If you are not happy together with the develop, use the Search area on top of the display to find other models in the legitimate develop design.

- Step 4. Upon having discovered the form you want, go through the Buy now option. Select the prices strategy you choose and add your references to sign up to have an bank account.

- Step 5. Process the purchase. You can utilize your charge card or PayPal bank account to accomplish the purchase.

- Step 6. Choose the formatting in the legitimate develop and acquire it on your gadget.

- Step 7. Complete, change and produce or indicator the Virgin Islands Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc..

Every single legitimate papers design you acquire is yours for a long time. You possess acces to each and every develop you downloaded with your acccount. Click the My Forms portion and decide on a develop to produce or acquire once again.

Be competitive and acquire, and produce the Virgin Islands Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc. with US Legal Forms. There are thousands of skilled and express-specific kinds you may use for the company or personal requirements.