Virgin Islands Waiver of Preemptive Rights with copy of restated articles of organization

Description

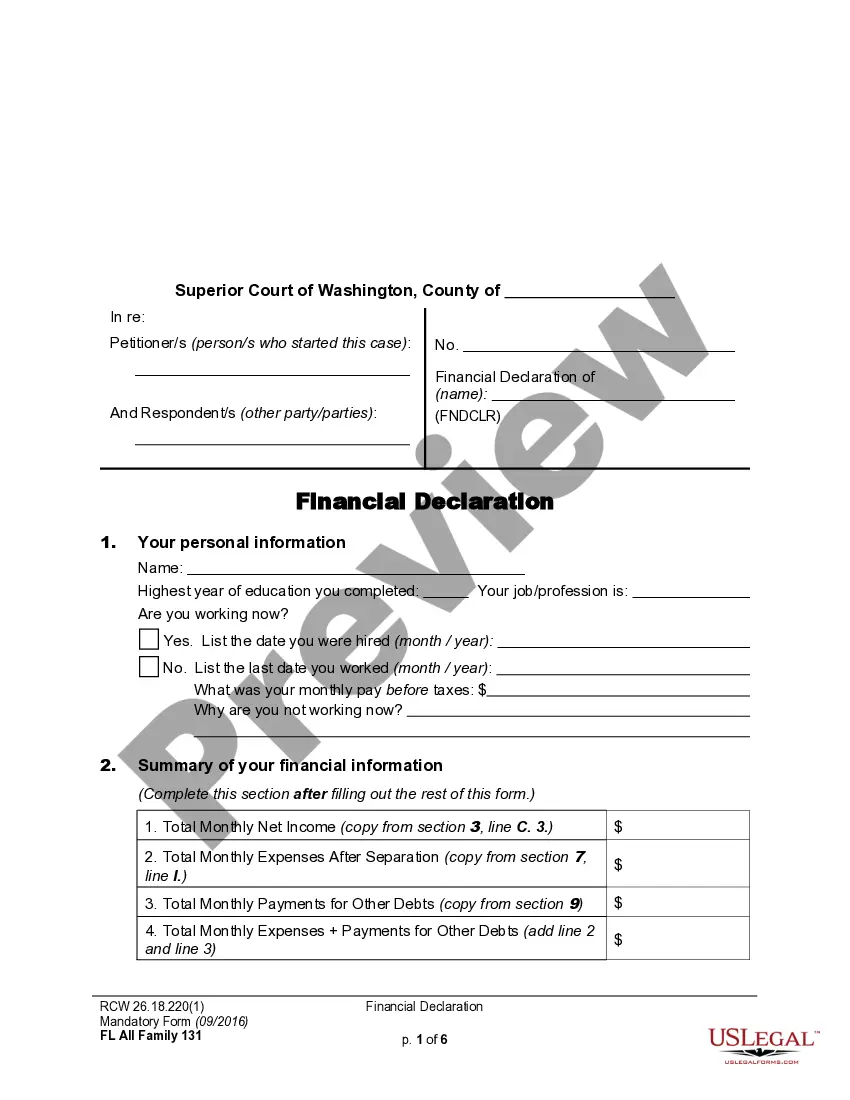

How to fill out Waiver Of Preemptive Rights With Copy Of Restated Articles Of Organization?

If you have to comprehensive, obtain, or produce lawful file web templates, use US Legal Forms, the largest variety of lawful kinds, that can be found on the Internet. Make use of the site`s simple and convenient lookup to discover the paperwork you will need. A variety of web templates for organization and person functions are sorted by classes and states, or key phrases. Use US Legal Forms to discover the Virgin Islands Waiver of Preemptive Rights with copy of restated articles of organization with a number of click throughs.

In case you are previously a US Legal Forms buyer, log in to the account and then click the Obtain option to obtain the Virgin Islands Waiver of Preemptive Rights with copy of restated articles of organization. You can also gain access to kinds you earlier delivered electronically from the My Forms tab of your respective account.

If you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Make sure you have selected the form for that correct town/country.

- Step 2. Make use of the Review choice to look over the form`s content material. Never neglect to learn the description.

- Step 3. In case you are not satisfied using the develop, use the Research area on top of the screen to find other models of the lawful develop web template.

- Step 4. Upon having located the form you will need, select the Purchase now option. Choose the costs program you like and include your accreditations to sign up to have an account.

- Step 5. Procedure the transaction. You should use your charge card or PayPal account to accomplish the transaction.

- Step 6. Choose the format of the lawful develop and obtain it on the system.

- Step 7. Comprehensive, modify and produce or indication the Virgin Islands Waiver of Preemptive Rights with copy of restated articles of organization.

Each and every lawful file web template you buy is your own property eternally. You may have acces to each develop you delivered electronically with your acccount. Go through the My Forms section and pick a develop to produce or obtain yet again.

Be competitive and obtain, and produce the Virgin Islands Waiver of Preemptive Rights with copy of restated articles of organization with US Legal Forms. There are millions of expert and state-particular kinds you can use for the organization or person needs.

Form popularity

FAQ

The basics: This waiver of pre-emption rights template is a letter under which an existing shareholder agrees to waive any rights (known as 'pre-emption rights' or 'rights of first refusal') they may have to be offered shares that are being transferred by another existing shareholder to someone else or which are being ...

A letter for waiver of shareholders' preemptive rights is a binding statement by the shareholders that they wish to forfeit their right of preemption, effectively stating that they do not intend to take part in the purchase of additional shares.

A preemptive right is a right of existing shareholders in a corporation to purchase newly issued stock before it is offered to others. The right is meant to protect current shareholders from dilution in value or control. Preemptive rights, if recognized, are usually set forth in the corporate charter.

The basics: This waiver of pre-emption rights template is a letter under which an existing shareholder agrees to waive any rights (known as 'pre-emption rights' or 'rights of first refusal') they may have to be offered shares that are being transferred by another existing shareholder to someone else or which are being ...

If a pre-emption right on an issue of shares or on a transfer of shares arises under the articles of association, they can be waived using a special resolution which will need to be signed by the holders of no less than 75% of the company's issued shares.

Initially, this right was recognized by the courts as mandatory. However, in recent times most state laws deny a preemptive right unless it is specifically granted by corporate charter.

Disapplication of Pre-emption Rights ? Deed of Waiver This form of letter is designed to be signed by all the company's shareholders. The shareholders under this deed are waiving their pre-emption rights in respect of a proposed allotment of shares to be issued by the company.