Virgin Islands Dividend Equivalent Shares

Description

How to fill out Dividend Equivalent Shares?

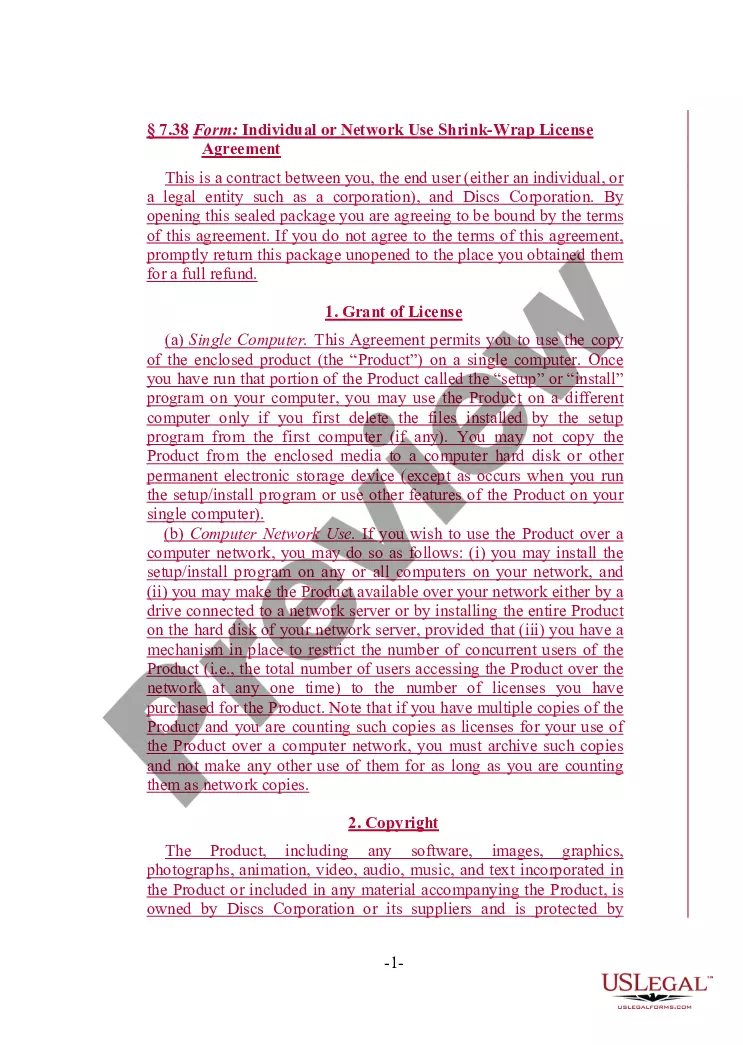

Choosing the right authorized document web template can be a have a problem. Obviously, there are a lot of templates available on the Internet, but how can you obtain the authorized develop you want? Utilize the US Legal Forms website. The assistance gives a large number of templates, for example the Virgin Islands Dividend Equivalent Shares, which you can use for business and private requires. All of the kinds are inspected by specialists and meet federal and state needs.

In case you are presently listed, log in to your accounts and click the Download switch to obtain the Virgin Islands Dividend Equivalent Shares. Utilize your accounts to check with the authorized kinds you may have purchased in the past. Proceed to the My Forms tab of your respective accounts and have one more copy of the document you want.

In case you are a new end user of US Legal Forms, listed below are easy instructions so that you can stick to:

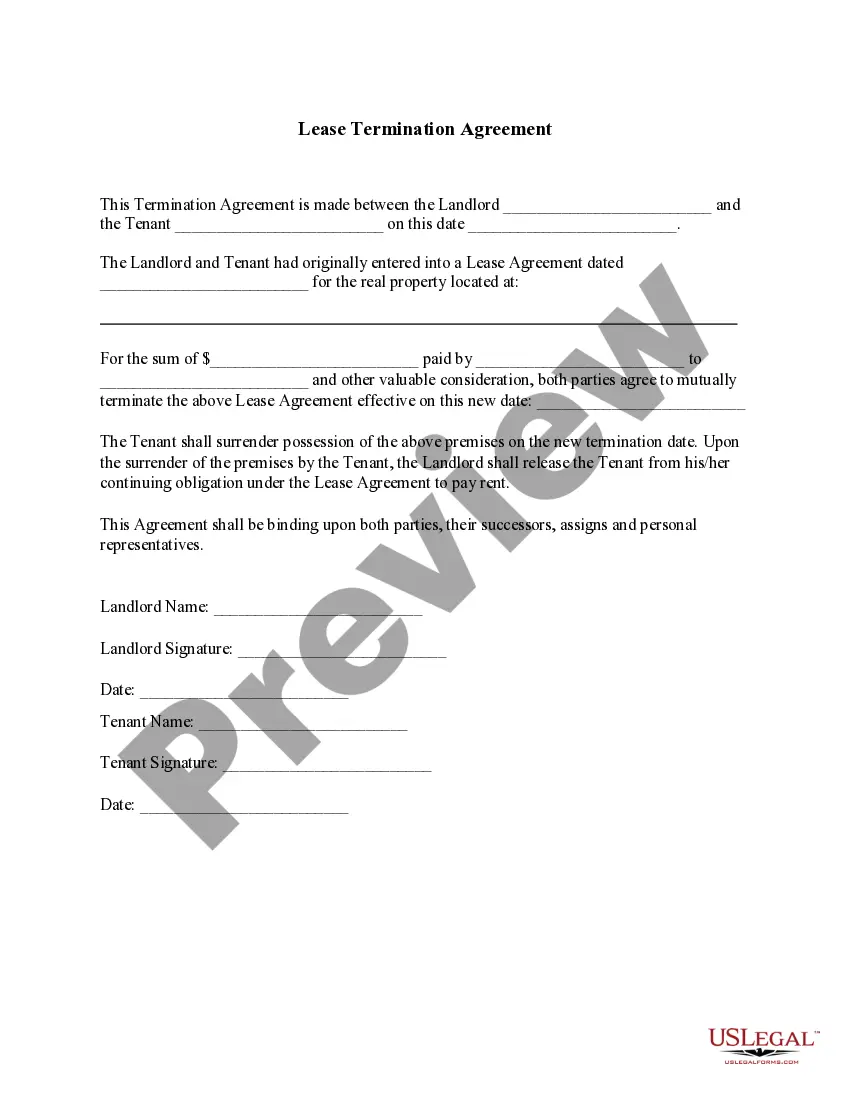

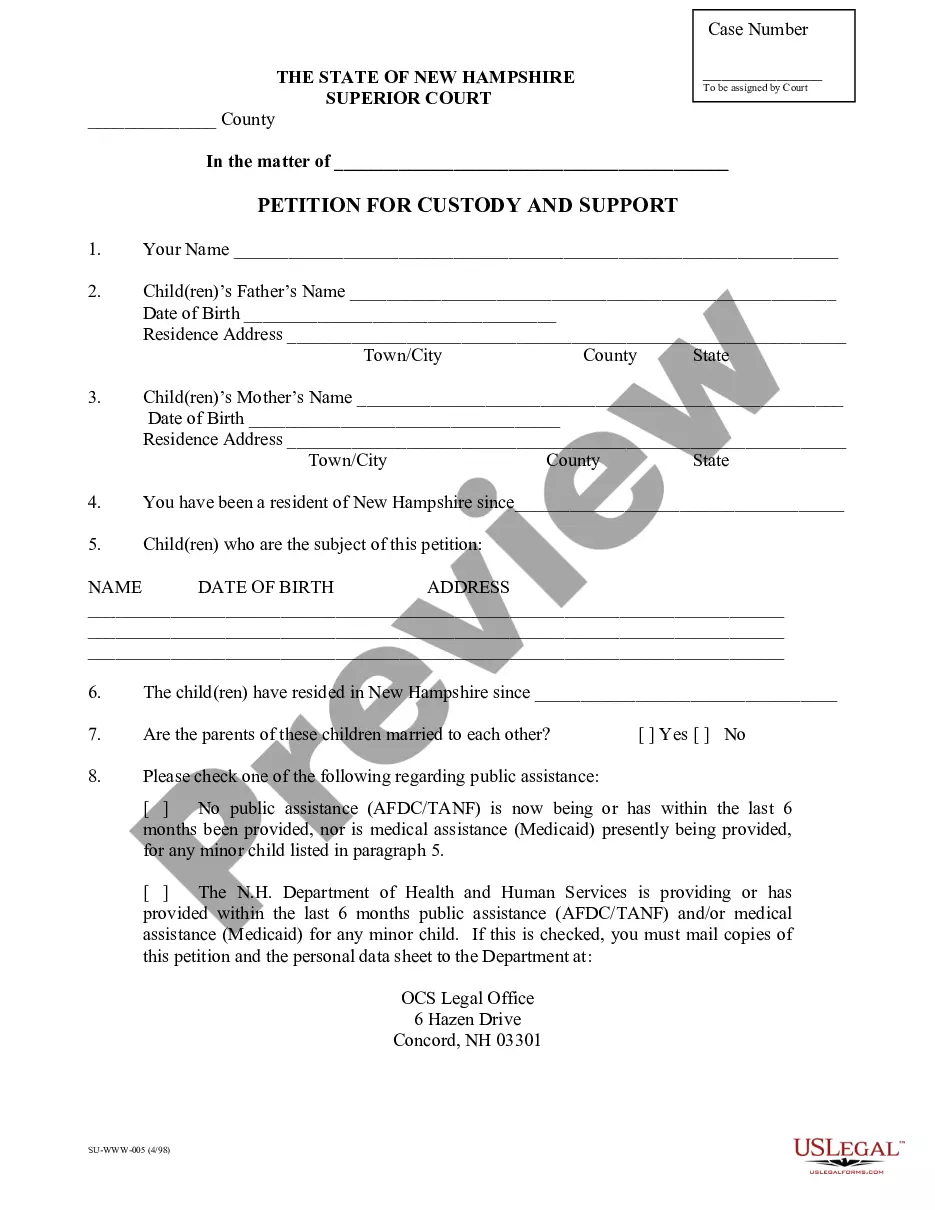

- Very first, make certain you have chosen the right develop for your personal town/area. You can examine the form making use of the Preview switch and browse the form information to make certain it is the right one for you.

- If the develop will not meet your needs, utilize the Seach field to get the right develop.

- Once you are sure that the form is suitable, click on the Buy now switch to obtain the develop.

- Select the prices strategy you desire and enter in the required details. Create your accounts and buy an order utilizing your PayPal accounts or bank card.

- Pick the data file formatting and down load the authorized document web template to your product.

- Total, edit and print out and sign the attained Virgin Islands Dividend Equivalent Shares.

US Legal Forms may be the largest library of authorized kinds where you can find different document templates. Utilize the service to down load skillfully-manufactured paperwork that stick to state needs.

Form popularity

FAQ

As BVI is a tax-neutral jurisdiction, it is a go-to destination for offshore companies. BVI is a tax haven country and does not impose taxes on income, capital gains, or withholding taxes on companies and individuals. No income tax return is filed, or taxes are paid on income.

Information of the Beneficial Owners, Directors and Shareholders are not accessible to the public. There are no accounting and audit requirements.

BVI companies now have to file a new annual return with their registered agent setting out certain financial information, unless they are exempt. The annual return has to be filed within nine months of the calendar year end or at the end of the company's financial year, if different.

Up to 90% reduction in corporate and personal income tax; 100% exemption on other taxes, including business property and gross receipt taxes; U.S. currency, courts, and flag protection; rental space at below market rates in sponsored industrial parks.

BVI is not a tax-free country rather it is a tax-neutral jurisdiction which means that no tax is imposed on income, capital gains, or withholding taxes on companies and individuals. No income tax is required to be paid or any income tax return is required to be filed.

British Virgin Islands is a country famous for having very favorable tax policies, earning the title of a tax haven. What contributes to this state is the absence of a transfer pricing rule, a deduction limitation rule or any anti-hybrid rules. The country does not follow any general anti-avoidance rule.

Domestic as well as foreign dividends received by a resident company are exempt from profit tax. 19% rate applies to manufacturing activities, 23% for construction activities and 26% for other activities.

The BVI was listed because the OECD found in November 2022 it was only ?partially compliant? on international exchange of information requirements. As a rating below ?largely compliant? is one of the criteria that determines the EU List, the BVI was added to Annex I as a formality and matter of process.