Virgin Islands Amendment to Section 5(c) of Employment Agreement with copy of Agreement - Blank

Description

How to fill out Amendment To Section 5(c) Of Employment Agreement With Copy Of Agreement - Blank?

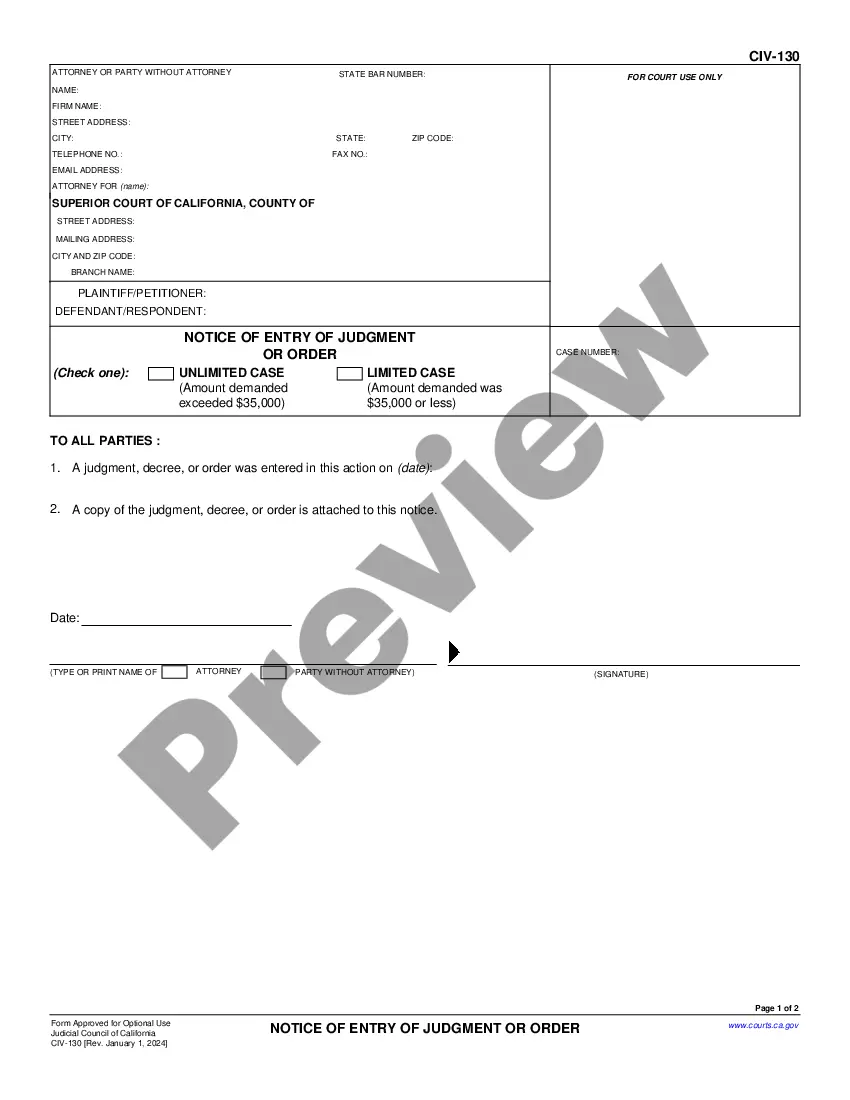

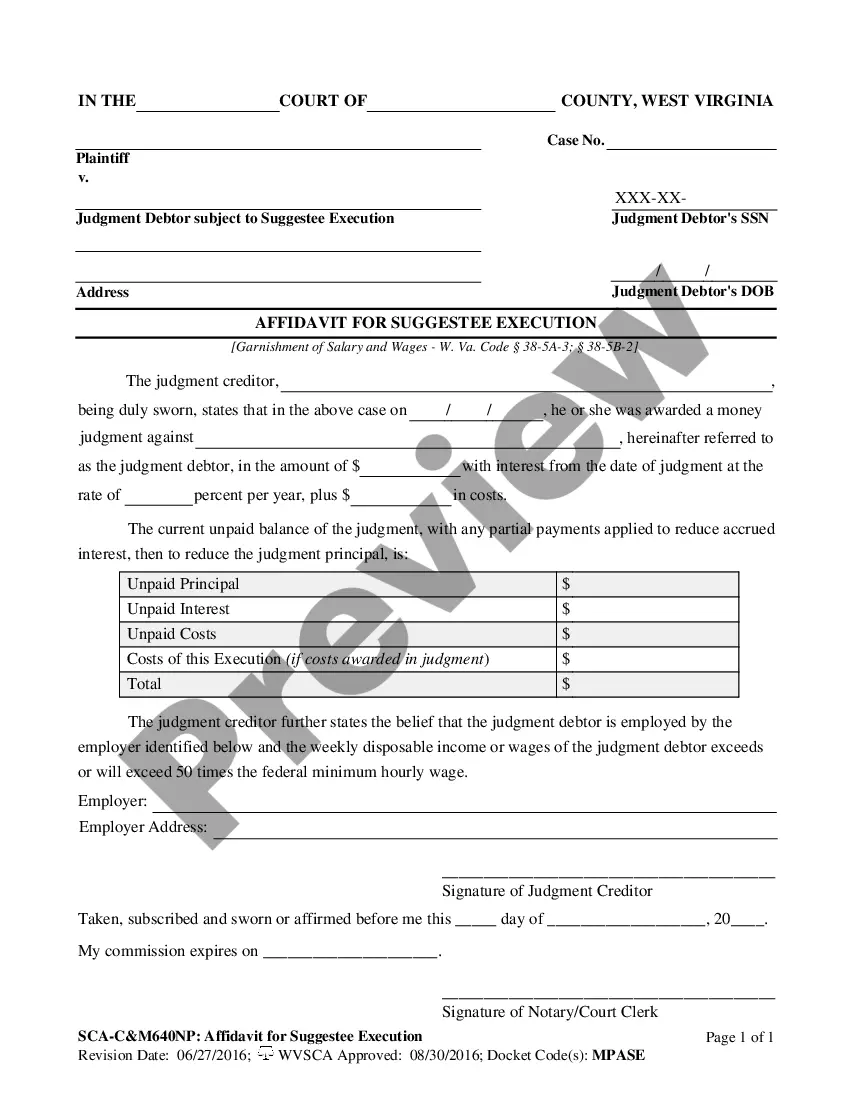

You can dedicate several hours online trying to locate the legal document template that meets the federal and state requirements you desire.

US Legal Forms provides a multitude of legal documents that can be reviewed by professionals.

It's easy to obtain or print the Virgin Islands Amendment to Section 5(c) of Employment Agreement with a copy of Agreement - Blank from our service.

First, ensure that you have chosen the correct document template for your region/city that you select. Review the form description to confirm you have chosen the correct form. If available, use the Preview button to check the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Acquire button.

- After that, you can complete, modify, print, or sign the Virgin Islands Amendment to Section 5(c) of Employment Agreement with a copy of Agreement - Blank.

- Every legal document template you purchase is yours permanently.

- To obtain another version of any purchased form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

A modification of contract is any change, in part or whole, occurring to a legally binding agreement between two or more parties. Any contract can be modified before or after signing the agreement, but all parties must agree to the changes. If any party doesn't agree to the modification, the changes are invalid.

Contract modifications require both your consent and that of your employer. Therefore, any changes made without you agreeing to them are null and void. Depending on the magnitude of changes made, the court might nullify the employment contract entirely.

Record and Report Payments If you make the final payment to the deceased employee's estate, list the estate's tax identification number instead. At the end of the year, file Form W-2 with the IRS to report all wages and withholding for the deceased employee.

9 Form InstructionsLine 1 Name.Line 2 Business name.Line 3 Federal tax classification.Line 4 Exemptions.Lines 5 & 6 Address, city, state, and ZIP code.Line 7 Account number(s)Part I Taxpayer Identification Number (TIN)Part II Certification.

Follow these steps: Use a paper return to amend a Form 940 filed under an electronic filing program. Check the amended return box in the top right corner of Form 940, page 1, box a, Fill in all the amounts that should have been on the original form. Sign the form .

How to fill out Form W-2Box A: Employee's Social Security number.Box B: Employer Identification Number (EIN)Box C: Employer's name, address, and ZIP code.Box D:Boxes E and F: Employee's name, address, and ZIP code.Box 1: Wages, tips, other compensation.Box 2: Federal income tax withheld.Box 3: Social Security wages.More items...?

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Form W-2, also known as the Wage and Tax Statement, is the document an employer is required to send to each employee and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees' annual wages and the amount of taxes withheld from their paychecks.

How to fill out Form W-2Box A: Employee's Social Security number.Box B: Employer Identification Number (EIN)Box C: Employer's name, address, and ZIP code.Box D:Boxes E and F: Employee's name, address, and ZIP code.Box 1: Wages, tips, other compensation.Box 2: Federal income tax withheld.Box 3: Social Security wages.More items...?

As a contract exists as a legally binding agreement between interested parties, it can be legally modified after being signed. But this happens only with the agreement of all the parties and by adding an extra section, called a 'rider'.