Virgin Islands List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005

Description

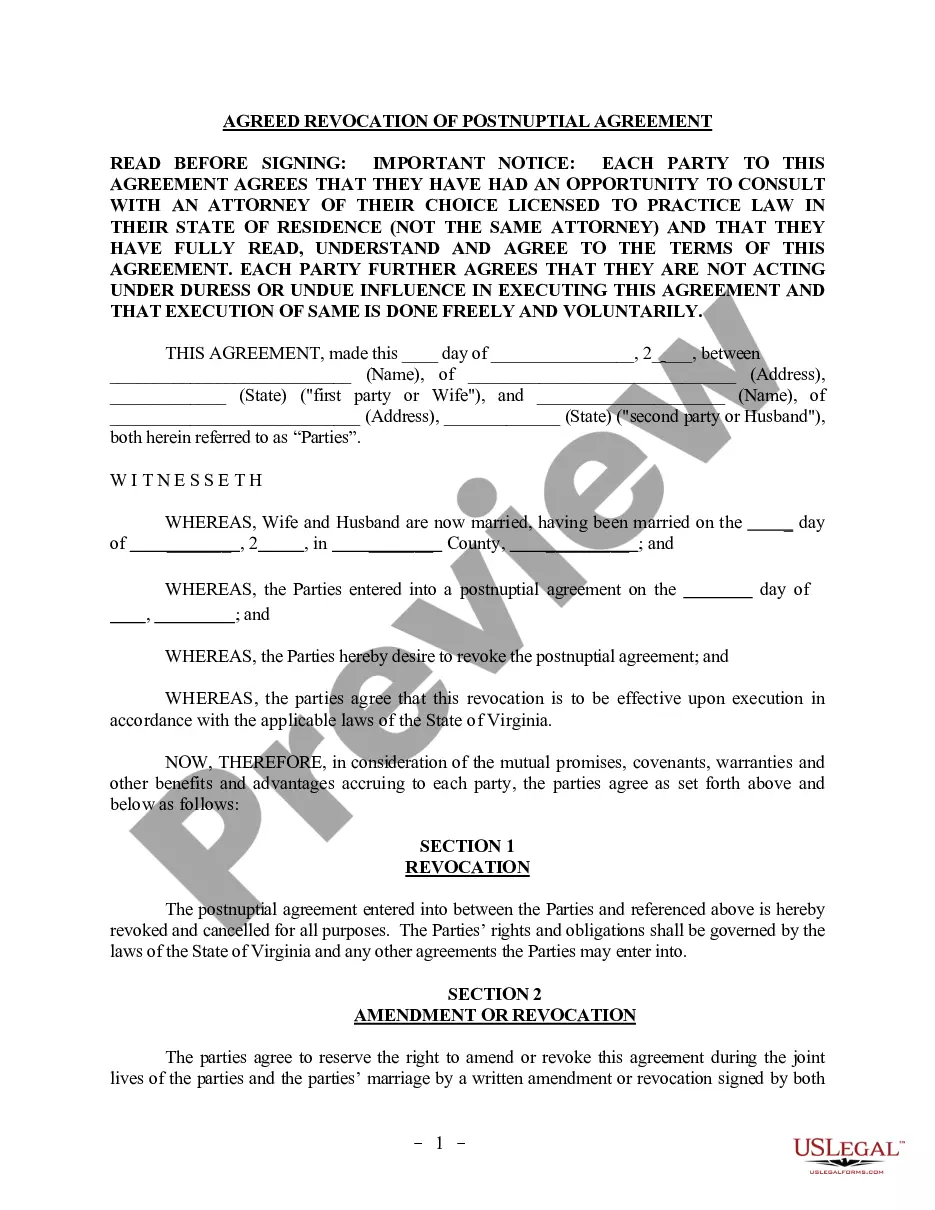

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

Choosing the best legal papers web template might be a have a problem. Of course, there are plenty of templates available on the Internet, but how can you get the legal type you want? Take advantage of the US Legal Forms web site. The service provides a large number of templates, such as the Virgin Islands List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005, that you can use for organization and personal requires. All the kinds are checked out by professionals and meet up with state and federal specifications.

Should you be presently authorized, log in to your bank account and click the Acquire key to obtain the Virgin Islands List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005. Make use of your bank account to look through the legal kinds you have acquired earlier. Visit the My Forms tab of your respective bank account and get an additional version of your papers you want.

Should you be a fresh consumer of US Legal Forms, allow me to share easy instructions that you can adhere to:

- Very first, make certain you have chosen the appropriate type to your town/area. You may look over the form making use of the Review key and read the form outline to ensure this is the right one for you.

- If the type will not meet up with your requirements, take advantage of the Seach industry to get the proper type.

- Once you are certain the form would work, select the Acquire now key to obtain the type.

- Choose the prices plan you desire and type in the necessary info. Build your bank account and pay for the transaction utilizing your PayPal bank account or bank card.

- Opt for the data file structure and down load the legal papers web template to your device.

- Total, modify and printing and indicator the obtained Virgin Islands List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005.

US Legal Forms is the most significant collection of legal kinds that you will find numerous papers templates. Take advantage of the company to down load professionally-produced documents that adhere to condition specifications.

Form popularity

FAQ

It's true that even if a debtor is completely honest in their Chapter 7 bankruptcy filing, their case can still be dismissed for technical reasons. The 1% of Chapter 7 bankruptcy cases that are dismissed are typically due to technicalities.

Unsecured creditors can include suppliers, customers, HMRC and contractors. They rank after secured and preferential creditors in an insolvency situation. Preferential creditors are generally employees of the company, entitled to arrears of wages and other employment costs up to certain limits.

Some of the most common types of unsecured creditors include credit card companies, utilities, landlords, hospitals and doctor's offices, and lenders that issue personal or student loans (though education loans carry a special exception that prevents them from being discharged).

Experiencing a bankruptcy dismissal can be an overwhelming experience, especially when creditors start reaching out to you for payment. In such situations, one way to handle this is through debt settlement. Debt settlement is negotiating with creditors to reorganize the debt by agreeing on a payment schedule.

Unsecured creditors can include suppliers, customers, HMRC and contractors. They rank after secured and preferential creditors in an insolvency situation. Preferential creditors are generally employees of the company, entitled to arrears of wages and other employment costs up to certain limits.

The good news is that if you ? or the attorney you hire ? gets the paperwork right and the case moves through the court to the point where debt discharge is determined, the U.S. Bankruptcy Courts says that 99% of Chapter 7 cases succeed. Unfortunately, many don't make it that far and their petition is denied.

On a company's insolvency creditors will rank in the following order of priority: Liquidator's fees and expenses of the winding up. Preferential debts (rent due to a landlord, wages and salaries, unpaid income tax and social security contributions). Unsecured debts. Postponed debts.

During compulsory and voluntary liquidation proceedings, unsecured creditors have the right to form a creditors' liquidation committee. This usually consists of between three and five members, their role being to oversee the liquidation process on behalf of unsecured creditors as a group.