Virgin Islands Leave of Absence Salary Clarification

Description

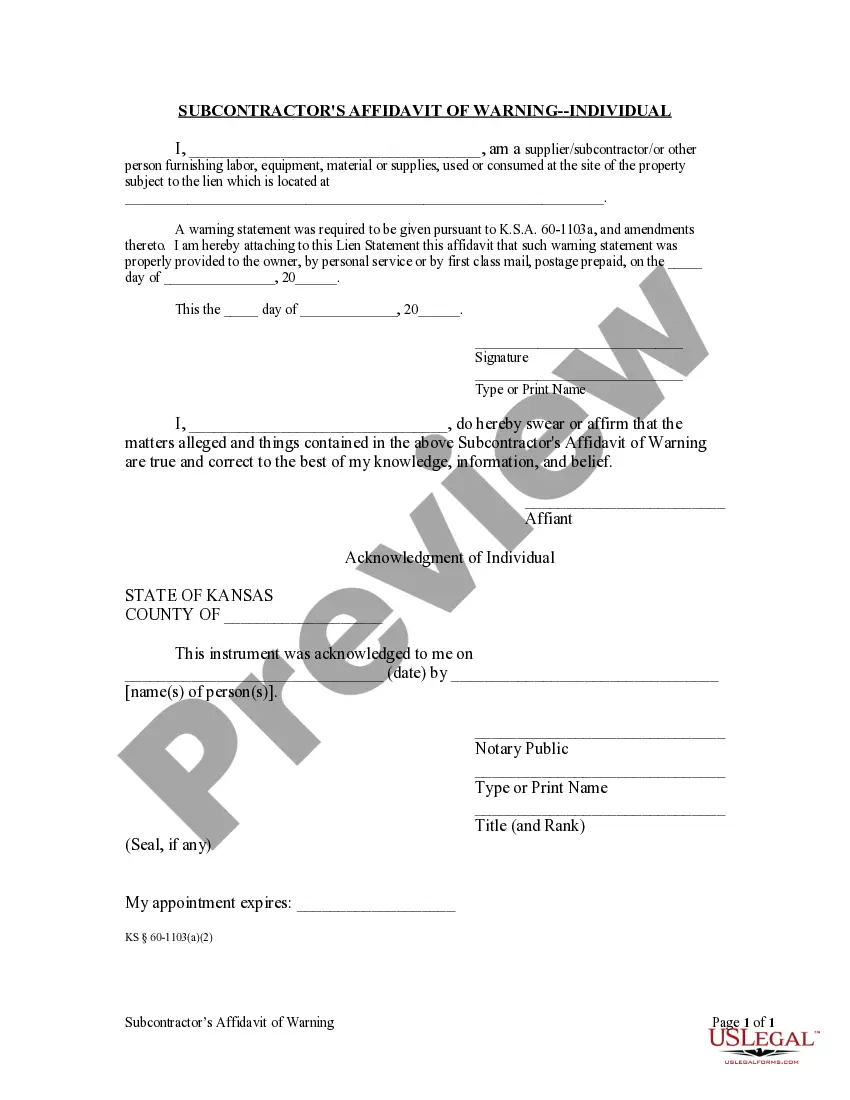

How to fill out Leave Of Absence Salary Clarification?

Are you currently in a situation where you require documents for both professional or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating forms you can trust isn’t simple.

US Legal Forms offers a vast selection of form templates, including the Virgin Islands Leave of Absence Salary Clarification, designed to meet state and federal requirements.

Select the pricing plan you want, provide the necessary information to set up your payment, and complete your order using PayPal or a credit card.

Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Virgin Islands Leave of Absence Salary Clarification at any time, if needed. Just click on the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. This service provides well-crafted legal document templates that can be utilized for a variety of purposes. Create an account on US Legal Forms and start making your life simpler.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Virgin Islands Leave of Absence Salary Clarification template.

- If you don’t have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and make sure it is for the correct city/state.

- Use the Review button to examine the form.

- Check the description to ensure you have selected the correct form.

- If the form isn’t what you are looking for, use the Search box to find the form that suits your needs and requirements.

- Once you find the right form, click on Get now.

Form popularity

FAQ

LOP means Loss Of Pay, It can be stated as for leave taken by the employee when he/she does not have enough leave balance in his/her account and but is given permission to remain absent.

Section 29 CFR 825.105(b) of the FMLA regulations states that the FMLA applies only to employees who are employed within any State of the United States, the District of Columbia or any Territory or possession of the United States. Territories or possessions of the United States include Puerto Rico, the Virgin Islands

Probationary employees can file their absence as VL or SL without pay. Newly regularized employees can avail of their VL and SL as earned otherwise leaves availed will be subject to salary deduction.

Puerto Rico's minimum wage increased from $7.25 to $8.50 effective January 1, 2022. Additional increases are scheduled to take effect on July 1, 2023, when it will be raised to $9.50, and on July 1, 2024, with a raise to $10.50.

Puerto Rico has enacted the Minimum Wage Act, Act No. 47-2021, increasing the Island's minimum wage from $7.25 to $8.50 effective January 1, 2022.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

Puerto Rico is not an 'employment at will' jurisdiction. Thus, an indefinite-term employee discharged without just cause is entitled to receive a statutory discharge indemnity (or severance payment) based on the length of service and a statutory formula.

Nope. With the exception of Title VII, ADA and ADEA, employment laws do not apply to U.S. citizens working outside the country, even if they are working for an American company. So, a U.S. national loses FMLA protection once he steps off U.S. soil.

The minimum wage under the Fair Labor Standards Act (FLSA) is generally applicable to any state, territory, or possession of the United States such as Puerto Rico, the Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands (CNMI).