Virgin Islands Exemption Statement

Description

How to fill out Exemption Statement?

Are you within a place that you need to have paperwork for sometimes enterprise or individual uses virtually every day? There are tons of lawful record layouts available on the net, but finding ones you can trust isn`t simple. US Legal Forms provides thousands of type layouts, much like the Virgin Islands Exemption Statement - Texas, that happen to be written in order to meet state and federal demands.

If you are already informed about US Legal Forms website and have a merchant account, just log in. Afterward, you may acquire the Virgin Islands Exemption Statement - Texas template.

Unless you have an bank account and would like to begin using US Legal Forms, adopt these measures:

- Obtain the type you want and make sure it is for your proper area/region.

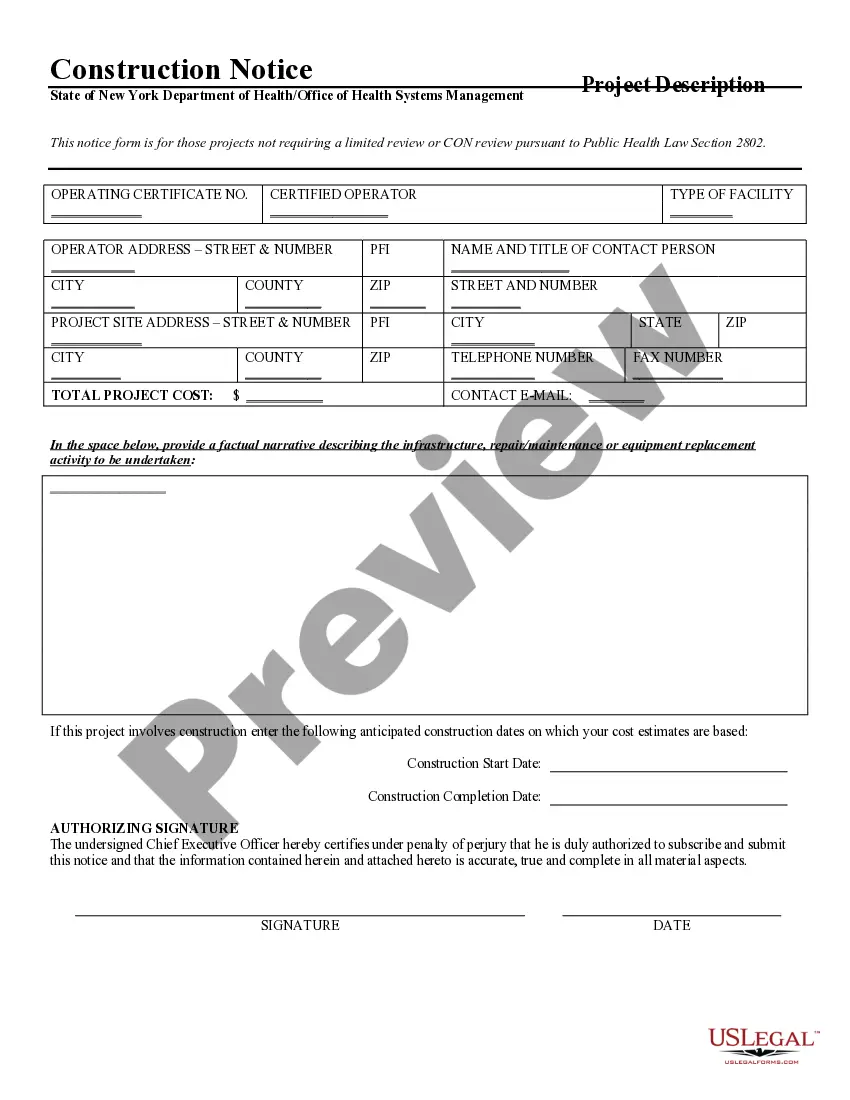

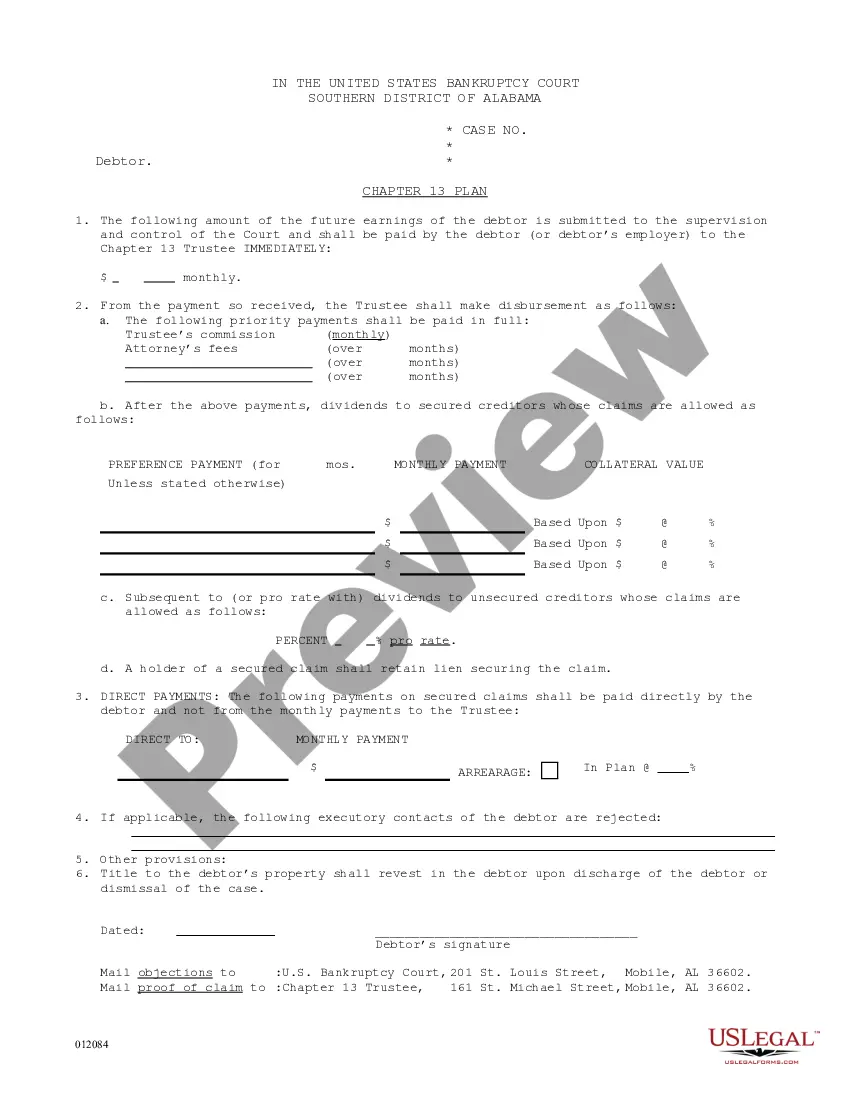

- Utilize the Preview key to examine the shape.

- Browse the outline to ensure that you have chosen the right type.

- In the event the type isn`t what you`re seeking, use the Look for discipline to obtain the type that suits you and demands.

- If you obtain the proper type, click on Purchase now.

- Opt for the pricing plan you desire, fill in the required information to create your money, and pay money for an order making use of your PayPal or credit card.

- Pick a convenient file file format and acquire your duplicate.

Get every one of the record layouts you might have bought in the My Forms food list. You may get a additional duplicate of Virgin Islands Exemption Statement - Texas at any time, if possible. Just click the essential type to acquire or print out the record template.

Use US Legal Forms, by far the most substantial selection of lawful varieties, to conserve efforts and avoid faults. The services provides expertly produced lawful record layouts which can be used for an array of uses. Make a merchant account on US Legal Forms and start generating your daily life a little easier.

Form popularity

FAQ

A taxpayer must file identical tax returns with the United States and the USVI. If they're not enclosing a check or money order, they should file the original Form 1040 (including Form 8689) with the Department of the Treasury, Internal Revenue Service Center, Austin, TX 73301-0215 USA.

TurboTax does not support the Form 8689, however you can enter the credit that you compute on the Form 8689 (line 40) in TurboTax Deluxe. You won't have to upgrade. Enter in the Other Credits section under Deductions and Credits.

Possible reasons for the rejection include reporting the wrong amount on your tax return, inputting the wrong W-2 amounts when transferring the information electronically or just math errors.

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption ? Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

The Virgin Islands Bureau of Internal Revenue and the IRS are not the same entity although the same tax rates and laws apply. If you are a US resident with income allocable to the Virgin Islands, file Form 8689 with your regular 1040 tax return.

If you decide to electronically file the Federal return, Form 8689 will be sent with that submission. If you decide to paper file the return, the return will need to be sent to the IRS address as outlined in the Form 8689 instructions under the section titled Where to File.

Forms you can e-file for an individual: Form 540 , California Resident Income Tax Return. Form 540 2EZ , California Resident Income Tax Return. Form 540NR , California Nonresident or Part-Year Resident Income Tax Return. Form 592-B , Resident and Nonresident Withholding Tax Statement.

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.