Virgin Islands Employee Referral Statement

Description

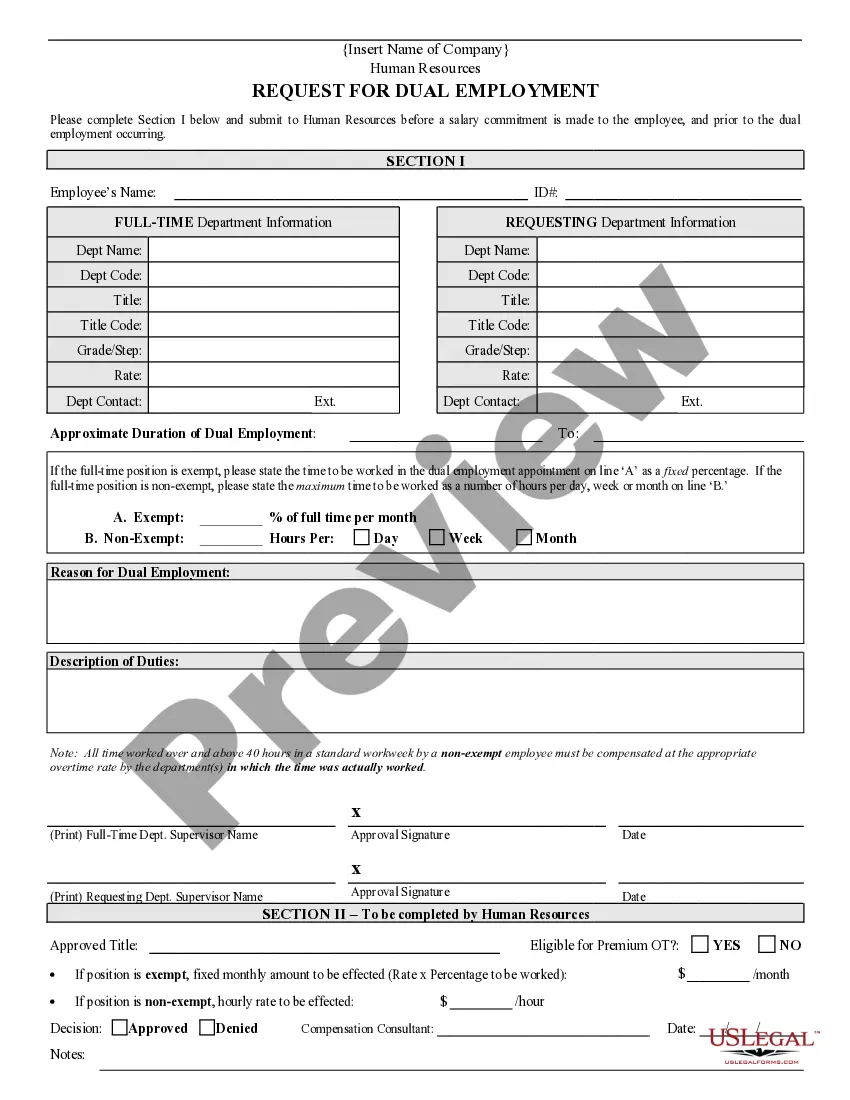

How to fill out Employee Referral Statement?

US Legal Forms – one of the largest collections of legal documents in the United States – offers a vast selection of legal document templates you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Virgin Islands Employee Referral Statement in just minutes.

If you already have a subscription, Log In and download the Virgin Islands Employee Referral Statement from your US Legal Forms library. The Download button will appear on each form you review. You can access all previously downloaded forms from the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the payment.

Choose the format and download the form to your device. Make modifications. Complete, amend and print and sign the downloaded Virgin Islands Employee Referral Statement. Each form you add to your account has no expiration date and is yours permanently. So, if you wish to download or print an additional copy, simply go to the My documents section and click on the form you need. Access the Virgin Islands Employee Referral Statement with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are some simple steps to get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the content of the form.

- Check the description of the form to make sure you have chosen the right one.

- If the form does not meet your needs, use the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Form W-2, also known as the Wage and Tax Statement, is the document an employer is required to send to each employee and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees' annual wages and the amount of taxes withheld from their paychecks.

To file a UI claim online, visit .

How to fill out Form W-2Box A: Employee's Social Security number.Box B: Employer Identification Number (EIN)Box C: Employer's name, address, and ZIP code.Box D:Boxes E and F: Employee's name, address, and ZIP code.Box 1: Wages, tips, other compensation.Box 2: Federal income tax withheld.Box 3: Social Security wages.More items...?

The Maximum Weekly Benefit Amount (MWBA) in the Virgin Islands for the benefit year beginning January 1, 2021, is $677.00 and the Taxable Wage Base (TWB) for employer contributions is $32,500.00.

How to fill out Form W-2Box A: Employee's Social Security number.Box B: Employer Identification Number (EIN)Box C: Employer's name, address, and ZIP code.Box D:Boxes E and F: Employee's name, address, and ZIP code.Box 1: Wages, tips, other compensation.Box 2: Federal income tax withheld.Box 3: Social Security wages.More items...?

9 Form InstructionsLine 1 Name.Line 2 Business name.Line 3 Federal tax classification.Line 4 Exemptions.Lines 5 & 6 Address, city, state, and ZIP code.Line 7 Account number(s)Part I Taxpayer Identification Number (TIN)Part II Certification.

Employers must file Form W-2, the IRS Wage and Tax Statement, for each employee who receives at least $600 in wages from your business, even if you did not withhold any income, Medicare or Social Security tax, though you would have had to withhold income tax if an employee did not claim an exemption from withholding on

The Maximum Weekly Benefit Amount (MWBA) in the Virgin Islands for the benefit year beginning January 1, 2021, is $677.00 and the Taxable Wage Base (TWB) for employer contributions is $32,500.00.

How Do I Apply?You should contact your state's unemployment insurance program as soon as possible after becoming unemployed.Generally, you should file your claim with the state where you worked.When you file a claim, you will be asked for certain information, such as addresses and dates of your former employment.More items...

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.