Virgin Islands Purchase Order for Non Inventory Items

Description

How to fill out Purchase Order For Non Inventory Items?

Are you currently in a situation where you need documents for either professional or personal reasons almost every day.

There are many legal document templates accessible online, but finding reliable versions is not straightforward.

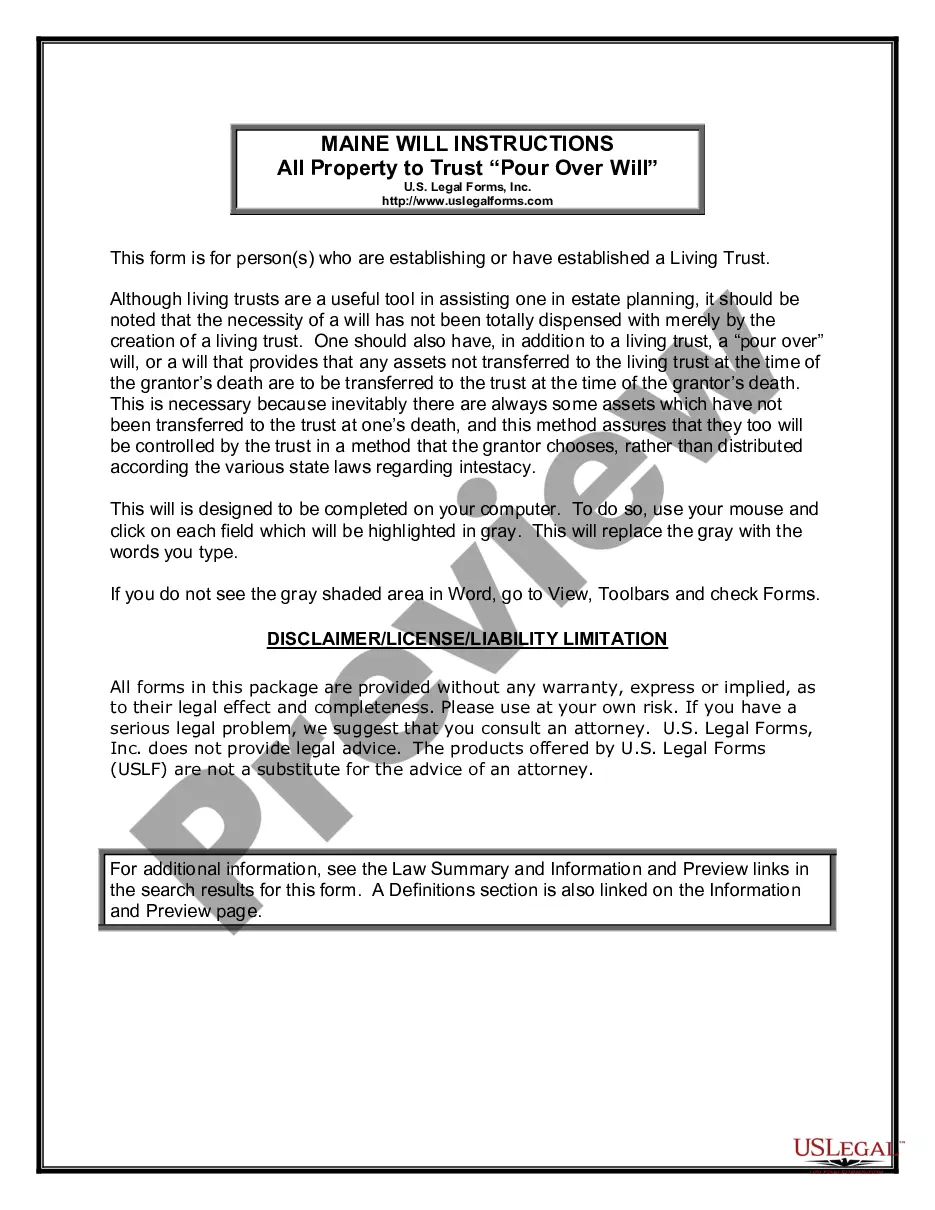

US Legal Forms offers thousands of form templates, such as the Virgin Islands Purchase Order for Non-Inventory Items, designed to meet federal and state requirements.

Once you find the correct form, click on Buy now.

Choose the pricing plan you desire, fill in the required information to create your account, and pay for the order using your PayPal or credit card. Select a convenient document format and download your copy. You can find all the document templates you have purchased in the My documents section. You can always get another copy of the Virgin Islands Purchase Order for Non-Inventory Items if needed. Just select the necessary form to download or print the document template. Use US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes. The service provides properly crafted legal document templates that you can utilize for a wide range of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- After that, you can download the Virgin Islands Purchase Order for Non-Inventory Items template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct region/county.

- Utilize the Preview button to review the form.

- Check the description to ensure you have selected the right form.

- If the form isn't what you're looking for, use the Search field to find the form that fits your needs.

Form popularity

FAQ

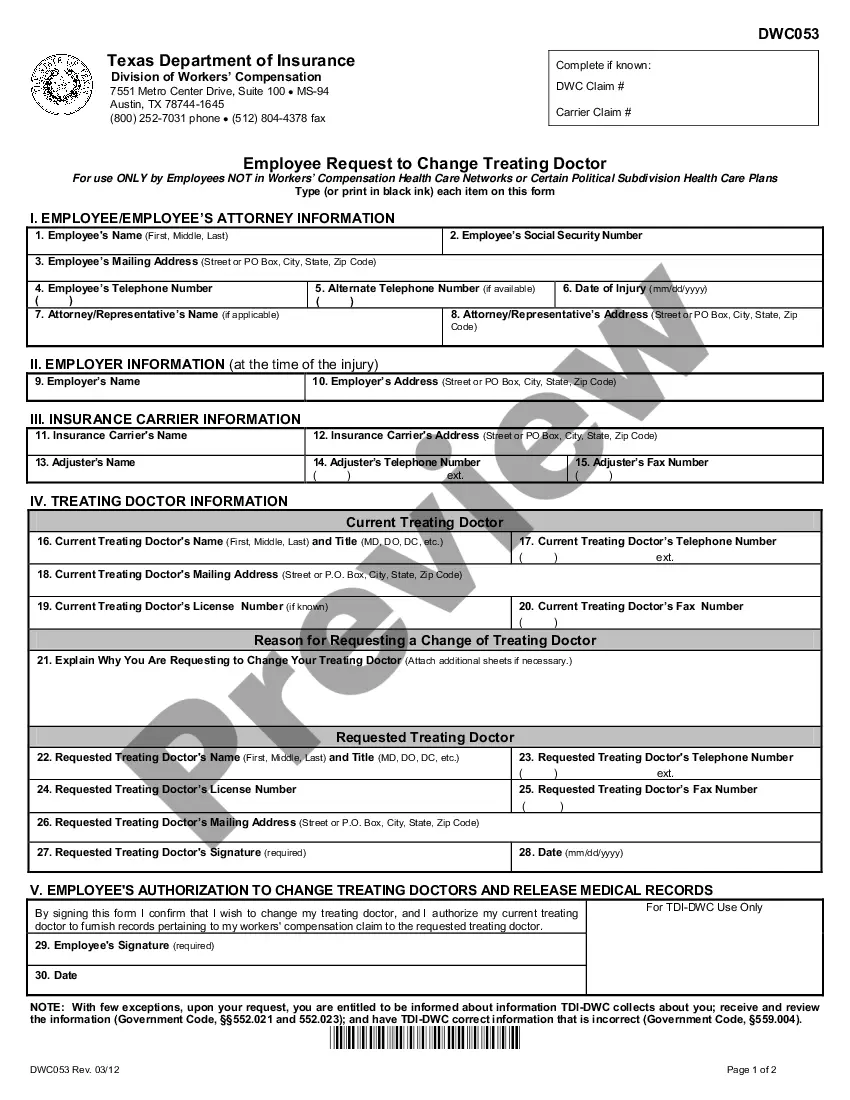

The products marked as 'Non-Inventory' in QuickBooks are products of which the inventory isn't tracked. This means that when a product is sold or added, its quantity available doesn't change nor does the inventory quantity automatically sync to the Onsight app.

Non-inventory items can only be used in Purchase Orders, Customer Orders, and Invoices (can be bought and sold). Non-inventory items cannot be used in BOMs, Manufacturing Orders, Shipments. These items are not part of inventory or inventory management - these items do not have stock lots, bookings, etc.

If you don't inventory an item it expenses the item when it is purchased and records income when it is sold. Debits the assigned Expense account.

Non-inventory items can only be used in Purchase Orders, Customer Orders, and Invoices (can be bought and sold). Non-inventory items cannot be used in BOMs, Manufacturing Orders, Shipments. These items are not part of inventory or inventory management - these items do not have stock lots, bookings, etc.

Here How:Go to the Lists menu, then select Item List.Look for the non-inventory item, then double-click it.Tick the checkbox labeled This item is used in assemblies or purchased for a specific customer:job.Enter the necessary information in the cost, accounts and etc.Press OK when done.

Examples of non-inventory items include:items purchased for a specific job and then quickly sold or invoiced to a customer.items that your organisation sells but does not purchase, including Bill of Material (BOM) items.items that your organisation purchases but does not resell, including office supplies.More items...

Non-Inventory Item is a type of product that is purchased or sold but whose quantity is not tracked. This type of items are purchased for company use or custom product purchased for Projects. Non-Inventory Items appear in sales process (on Sales Quotes, Sales Orders, Sales Invoices, or customer Credit Notes).

Non-Inventory Items are tracked as a current cost (Cost of Goods Sold) and they are recorded on your Profit & Loss statement when they are purchased. You will only see the cost of your Non-Inventory items on your Profit & Loss statement after the items associated with them have been sold.

Examples of non-inventory items include:items purchased for a specific job and then quickly sold or invoiced to a customer.items that your organisation sells but does not purchase, including Bill of Material (BOM) items.items that your organisation purchases but does not resell, including office supplies.More items...