Virgin Islands Credit Inquiry

Description

How to fill out Credit Inquiry?

You can spend hours online trying to locate the official document template that complies with the federal and state requirements you need.

US Legal Forms provides a vast array of official forms that are reviewed by experts.

You can easily download or print the Virgin Islands Credit Inquiry from our platform.

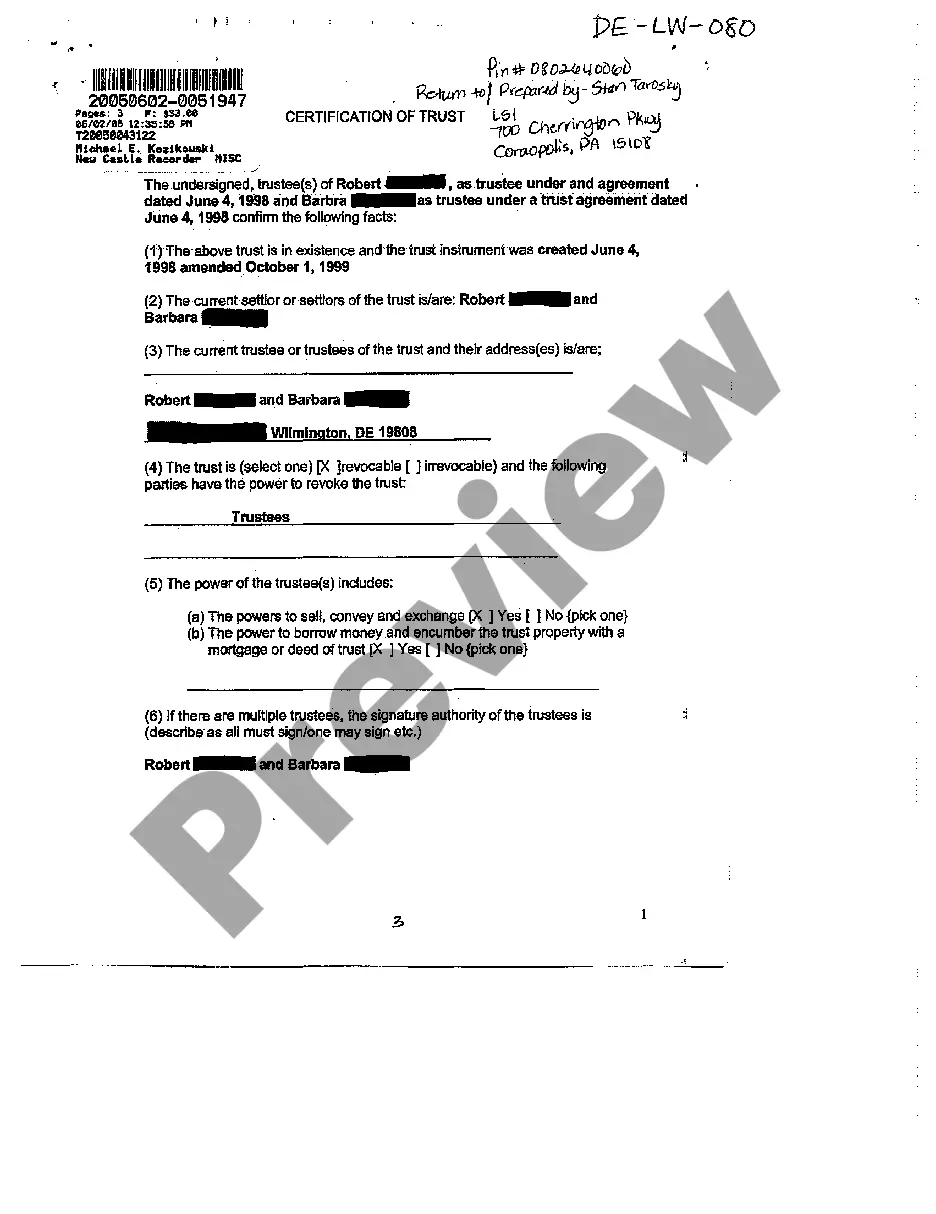

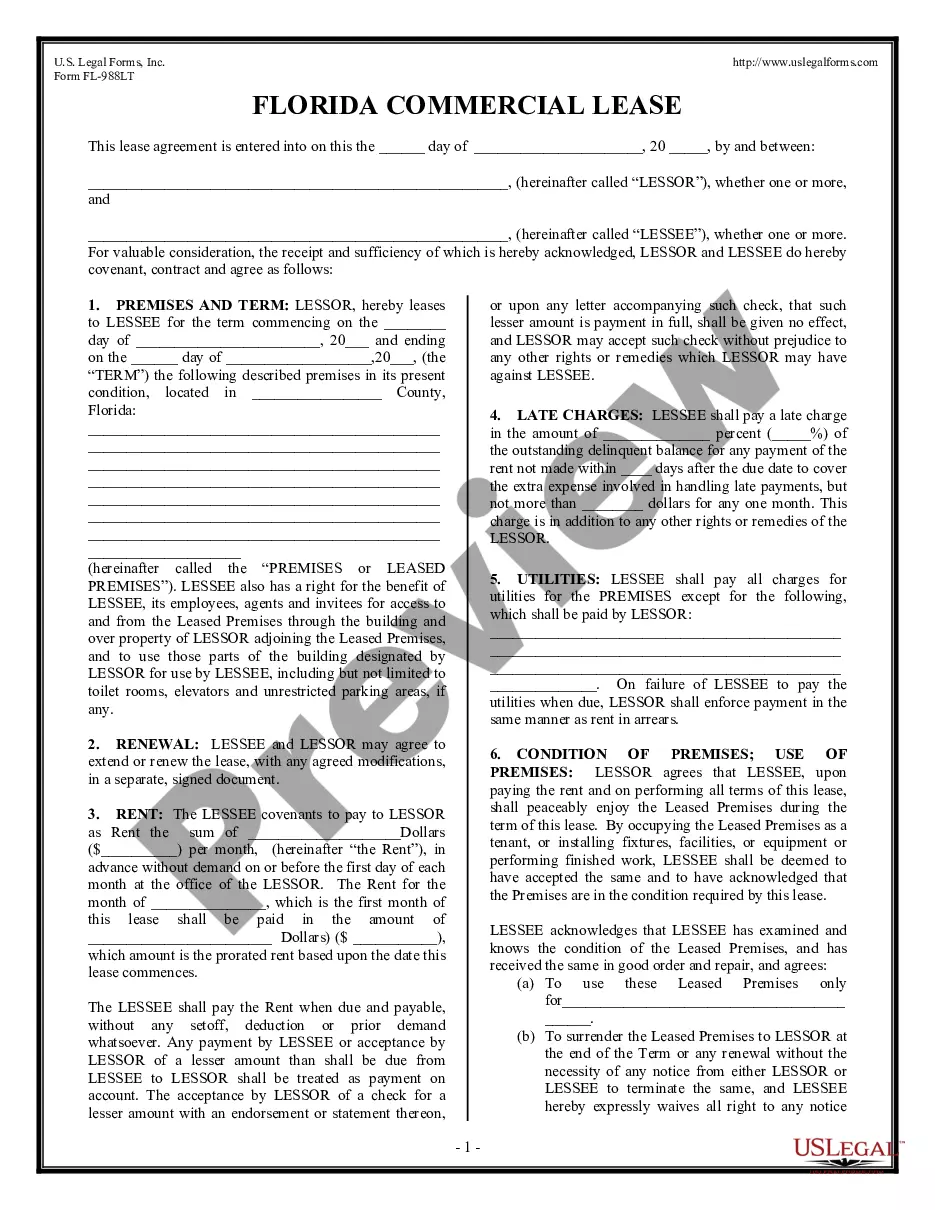

Check the form description to verify that you have chosen the right form. If available, use the Review button to view the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can complete, modify, print, or sign the Virgin Islands Credit Inquiry.

- Every official document template you obtain is yours permanently.

- To obtain another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region or area of your choice.

Form popularity

FAQ

Filing taxes in the U.S. Virgin Islands requires you to follow specific guidelines set forth by the local government. You typically need to gather your documents, including income statements, and complete the necessary tax forms. For a seamless process, consider using resources available through platforms like USLegalForms, which can simplify your tax filing experience and assist during a Virgin Islands Credit Inquiry.

Credit inquiries usually remain on your credit report for up to two years. Hard inquiries, which occur when a lender reviews your credit for lending purposes, can slightly impact your credit score. It is essential to monitor these inquiries, especially if you're looking into loans or credit products related to Virgin Islands Credit Inquiry. Regular checking can help you maintain a healthier credit profile.

The mailing address is 9601 Estate Thomas, St. Thomas, VI 00802.

A U.S. citizen or resident alien (other than a bona fide resident of the U.S. Virgin Islands (USVI)) with income from sources in the USVI or income effectively connected with the conduct of a trade or business in the USVI uses this form to figure the amount of U.S. tax allocable to the USVI.

The amount of tax paid to the Virgin Islands is reported on Line 46. This amount is then reported on Line 33 of your Form 1040 and taken as a credit.

Where to file. You must file identical tax returns with the United States and the USVI. If you are not enclosing a check or money order, file your original tax return (including Form 8689) with the Department of the Treasury, Internal Revenue Service Center, Austin, TX 73301-0215 USA.

You should pay any tax due to the Virgin Islands when you file your return with the Virgin Islands Bureau of Internal Revenue. You receive credit for taxes paid to the Virgin Islands by including the amount on Form 8689, line 32, in the total on Form 1040, line 65.

An applicant for permanent residence must reside in the Virgin Islands consecutively for a period of 20 years before application can be considered. An applicant can only be absent from the Territory for 90 days in any calendar year except when pursuing further education or as a result of illness.

To take the credit, you must complete Form 8689 and attach it to your Form 1040 or 1040-SR. Add line 41 and line 46 of Form 8689 and include the amount in the total on Form 1040 or 1040-SR, Total payments line. On the dotted line next to it, enter Form 8689 and the amount paid.

Taxes imposed on residents of the Virgin Islands include: Federal Income Tax (same as US mainland) Property Tax. Employers are required to remove social security, Medicare and income tax from employee pay.