Virgin Islands Agreement for Auditing Services between Accounting Firm and Municipality

Description

How to fill out Agreement For Auditing Services Between Accounting Firm And Municipality?

US Legal Forms - one of the largest libraries of legal varieties in the USA - delivers a variety of legal file templates you can download or printing. While using internet site, you can get thousands of varieties for company and specific functions, categorized by groups, claims, or key phrases.You can find the most up-to-date types of varieties such as the Virgin Islands Agreement for Auditing Services between Accounting Firm and Municipality within minutes.

If you currently have a monthly subscription, log in and download Virgin Islands Agreement for Auditing Services between Accounting Firm and Municipality through the US Legal Forms library. The Obtain switch will show up on each develop you perspective. You get access to all earlier downloaded varieties within the My Forms tab of your accounts.

If you would like use US Legal Forms the first time, here are straightforward directions to obtain started:

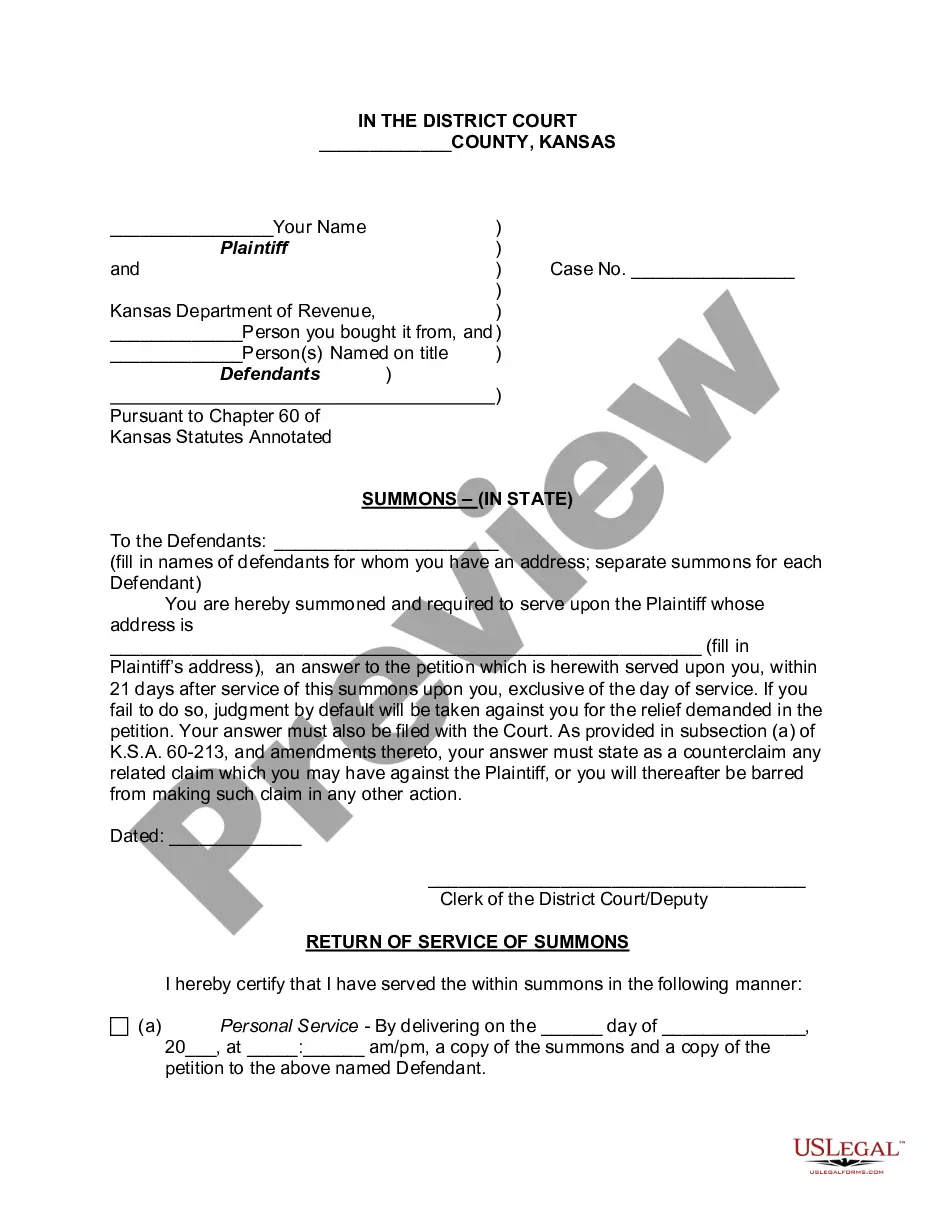

- Make sure you have selected the correct develop for your city/area. Click on the Review switch to review the form`s content. Look at the develop outline to ensure that you have selected the correct develop.

- If the develop doesn`t match your demands, use the Lookup area at the top of the screen to discover the one who does.

- If you are content with the form, validate your decision by clicking the Buy now switch. Then, select the pricing plan you like and provide your accreditations to register on an accounts.

- Process the purchase. Make use of charge card or PayPal accounts to accomplish the purchase.

- Pick the structure and download the form on your product.

- Make changes. Fill out, edit and printing and sign the downloaded Virgin Islands Agreement for Auditing Services between Accounting Firm and Municipality.

Every single design you put into your money lacks an expiry time and is also yours permanently. So, if you wish to download or printing an additional backup, just proceed to the My Forms section and click on around the develop you want.

Gain access to the Virgin Islands Agreement for Auditing Services between Accounting Firm and Municipality with US Legal Forms, by far the most comprehensive library of legal file templates. Use thousands of expert and condition-particular templates that meet up with your company or specific requires and demands.

Form popularity

FAQ

Does a BVI company need an audit? It depends on the size and nature of the BVI company. In general, a the British Virgin Islands company is not required to have an audit if it qualifies as an exempt company.

BVI's Accounting Regulations Requirement to keep proper accounting records: Every BVI company must maintain accurate accounting records of its transactions adequate enough to reflect its financial position and to enable a reasonable judgment to be made. They should be kept for a period of five years.

By law, the annual financial statements of public companies must be audited each year by independent auditors. Public companies are those whose shares are traded on a stock exchange or over-the-counter market.

The engagement letter documents and confirms the auditor's acceptance of the appointment, the objective and scope of the audit, the extent of the auditor's responsibilities to the client and the form of any reports.

Example: ?Licensor shall have the right, which it may exercise no more than [how often audits may occur, such as once in any Contract Year], to audit the books and records of the Licensee to determine if the Licensee's royalty statements are full, fair and accurate.

Steps for conducting a financial audit Understand your goals. ... Decide what to include in your audit. ... Gather and organise your materials. ... Begin data analysis. ... Consider financial security. ... Examine tax reporting status. ... Compile a report.

Companies that require an audit All public and state-owned companies are thus required to be audited. Any other company whose public interest score in that financial year is at least 100 (but less than 350) and whose annual financial statements for that year were internally compiled.

As noted in our article regarding amendments to BVI the Business Companies Act, as of 1 January 2023, BVI companies are required to file an annual return, which contains specific financial information, with their Registered Agent.