Virgin Islands Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

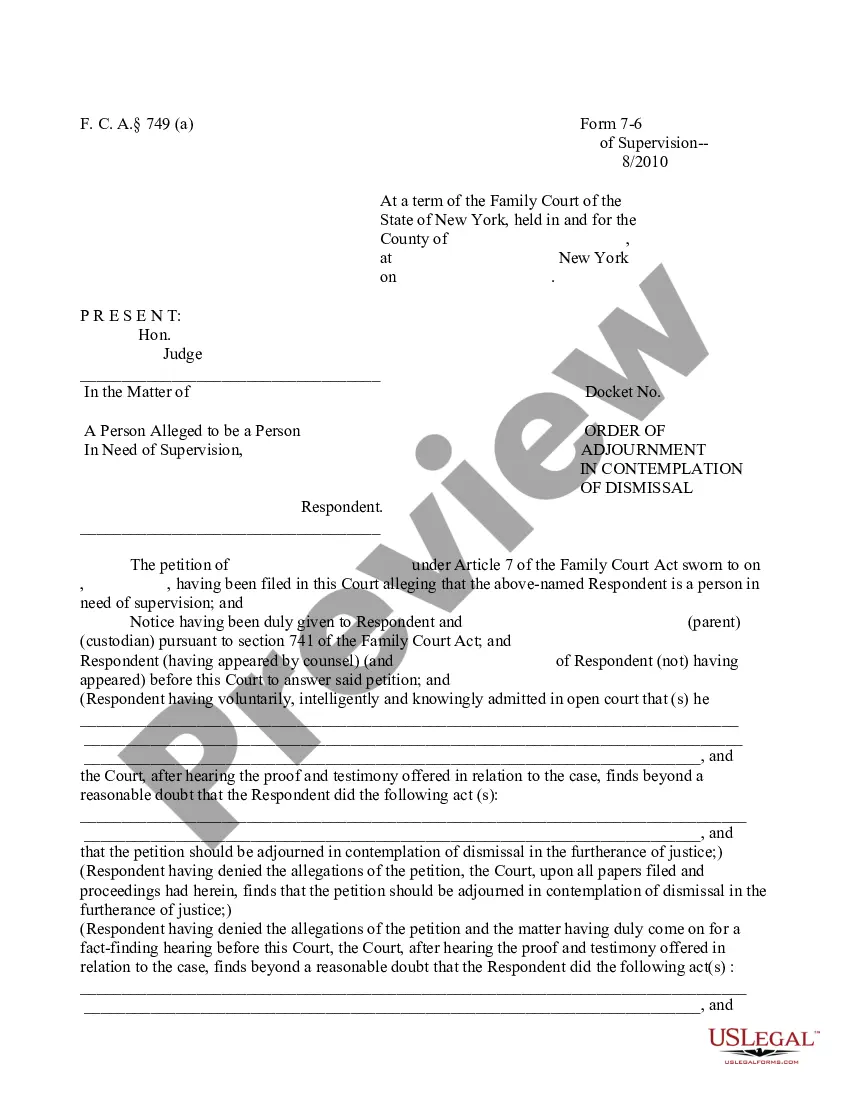

How to fill out Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

Are you in a role that you require documents for either organizational or personal purposes nearly every day.

There are many legal document templates available online, but locating trustworthy ones can be challenging.

US Legal Forms offers a vast selection of templates, such as the Virgin Islands Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status, which can be designed to meet state and federal requirements.

Once you find the right document, click on Buy now.

Choose the pricing plan you need, fill in the required information to create your account, and purchase the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Virgin Islands Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and ensure it corresponds with your specific city/state.

- Use the Preview button to review the form.

- Check the details to confirm you have selected the correct document.

- If the document is not what you’re looking for, use the Lookup field to find the form that meets your needs.

Form popularity

FAQ

To take the credit, you must complete Form 8689 and attach it to your Form 1040 or 1040-SR. Add line 41 and line 46 of Form 8689 and include the amount in the total on Form 1040 or 1040-SR, Total payments line. On the dotted line next to it, enter Form 8689 and the amount paid.

Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or other specified purposes and that meet certain other requirements are tax exempt under Internal Revenue Code Section 501(c)(3).

Delinquent Form 3520 Submission: The IRS Delinquency Procedures aka Delinquent International Information Return Submission Procedures (DIIRSP) were used as a way to submit previously unreported information returns such as Form 3520. In November, the IRS modified the program into a regular reasonable cause submission.

Within the United States, you should find the 501(c)(3) tax code. When determining the nonprofit status of an organization, begin by using the IRS Select Check database. The IRS provides an Exempt Organization List on its website. You can also ask the nonprofit for proof of their status.

No. Your EIN is the only number issued to your organization by the federal government. When your nonprofit's 501(c)(3) status is approved by the IRS, you will receive a written notice, known as a letter of determination.

File Form 1023 with the IRS. Most nonprofit corporations apply for tax-exempt status under Sec. 501(c)(3).

Form 8689 is a tax form distributed by the Internal Revenue Service (IRS) for use by U.S. citizens and resident aliens who earned income from sources in the U.S. Virgin Islands (USVI) but are not bona fide residents. The U.S. Virgin Islands are considered an unincorporated territory of the United States.

For the purposes of PSLF, eligible not-for-profit organizations include a organizations that are tax exempt under section 501(c)(3) of the Internal Revenue Code (IRC), or other not-for-profit organizations that provide a qualifying service.

Exemption Requirements - 501(c)(3) Organizations To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.

To take the credit, you must complete Form 8689 and attach it to your Form 1040 or 1040-SR. Add line 41 and line 46 of Form 8689 and include the amount in the total on Form 1040 or 1040-SR, Total payments line. On the dotted line next to it, enter Form 8689 and the amount paid.