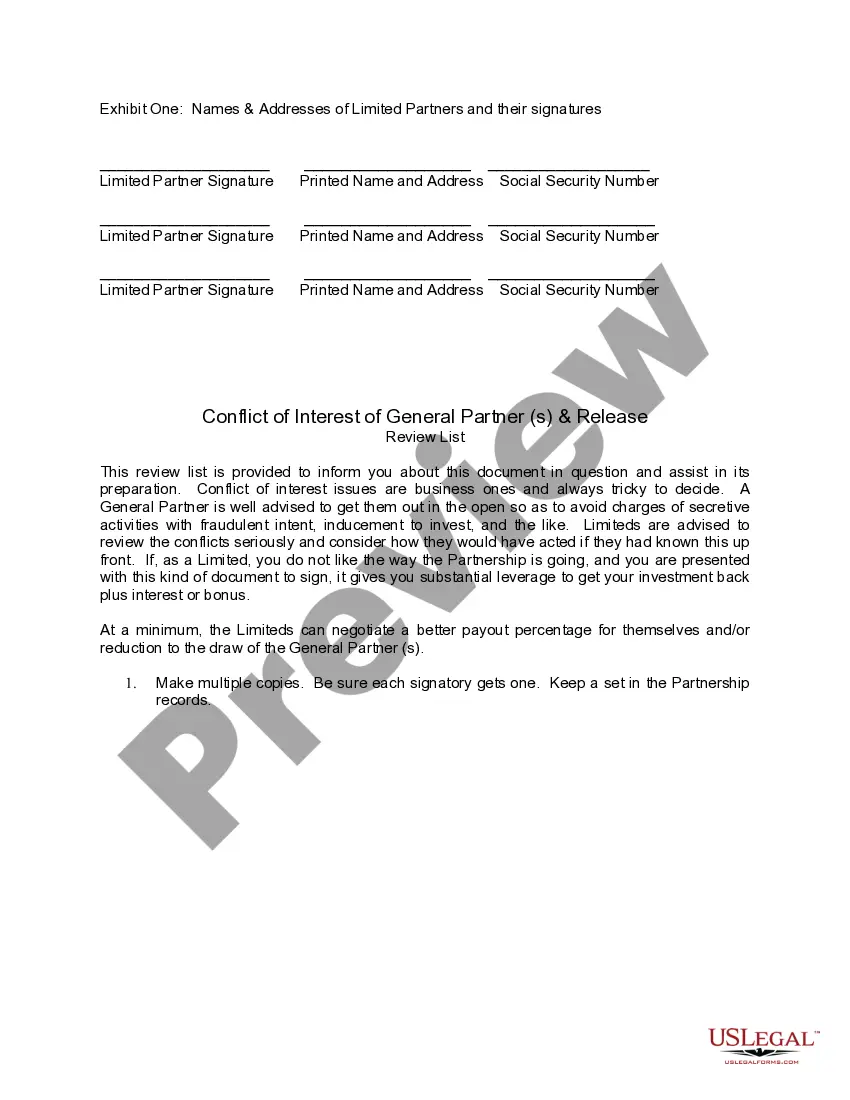

Virgin Islands Conflict of Interest of General Partner and Release

Description

How to fill out Conflict Of Interest Of General Partner And Release?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides an extensive selection of legal form templates that you can download or create.

By utilizing the website, you can find thousands of forms for both business and personal use, organized by categories, states, or keywords.

You can access the most recent versions of documents like the Virgin Islands Conflict of Interest of General Partner and Release in moments.

Check the form description to confirm that you have selected the right document.

If the form does not meet your needs, utilize the Search field at the top of the page to find the one that does.

- If you already possess a subscription, Log In and download the Virgin Islands Conflict of Interest of General Partner and Release from your US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously saved forms within the My documents section of your account.

- If you are using US Legal Forms for the first time, here are straightforward instructions to help you get started.

- Ensure you have selected the correct form for your area/county.

- Click the Review button to view the form's content.

Form popularity

FAQ

General partners are responsible for the daily management of the limited partnership and are liable for the company's financial obligations, including debts and litigation.

General partners are responsible for the daily management of the limited partnership and are liable for the company's financial obligations, including debts and litigation.

In a general partnership: all partners (called general partners) are personally liable for all business debts, including court judgments. each individual partner can be sued for the full amount of any business debt (though that partner can in turn sue the other partners for their share of the debt), and.

They do not require registration or a lot of paperwork. But all partnerships benefit from having a partnership agreement in place. In a general partnership, partners are all personally liable for the business's obligations. So, your personal assets could be at risk if someone sues your general partnership.

A limited partner who participates in a partnership for more than 500 hours in a year may be viewed as a general partner. Some states allow limited partners to vote on issues affecting the basic structure or the continued existence of the partnership.

In a partnership, each partner has a legal duty to act in the partnership's best interests, as well as the best interest of the other partners. There's also the legal duty of individual personal liability for partnership obligations. General partners are liable for all contracts entered into by other partners.

Partners are 'jointly and severally liable' for the firm's debts. This means that the firm's creditors can take action against any partner. Also, they can take action against more than one partner at the same time. This applies even if there is a partnership agreement that says otherwise.

Any General Partner may be removed by the vote or written consent of Partners holding not less than 80% of the total number of votes eligible to be cast by all Partners.

A limited partner shall not become liable as a general partner unless, in addition to the exercise of his rights and powers as a limited partner, he takes part in the control of the business.

A general partnership is an unincorporated business with two or more owners who share business responsibilities. Each general partner has unlimited personal liability for the debts and obligations of the business. Each partner reports their share of business profits and losses on their personal tax return.