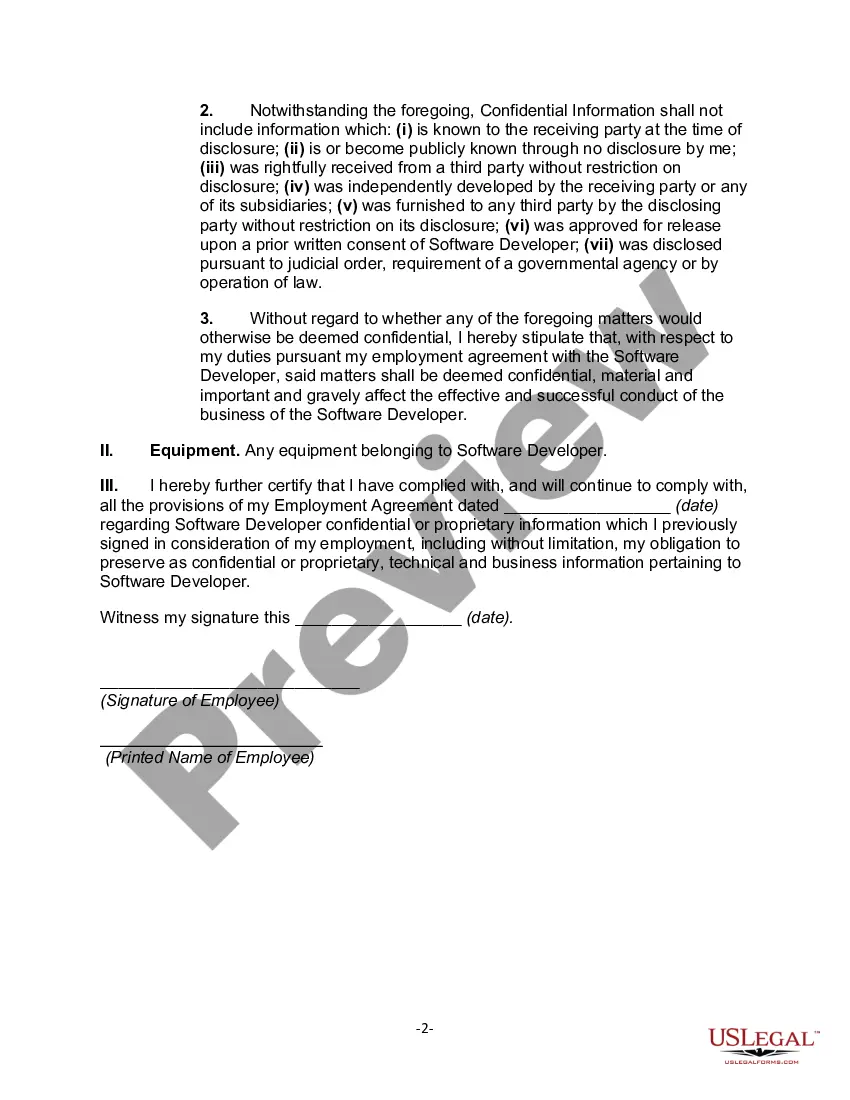

Virgin Islands Termination Statement by Employee to Software Developer regarding return of Equipment, and Confidential Information

Description

How to fill out Termination Statement By Employee To Software Developer Regarding Return Of Equipment, And Confidential Information?

US Legal Forms - one of the largest collections of legal documents in the U.S. - provides a range of legal document templates that you can obtain or print. By utilizing the website, you can access numerous forms for both business and personal use, organized by categories, states, or keywords.

You can quickly find the latest editions of forms like the Virgin Islands Termination Statement by Employee to Software Developer concerning the return of Equipment and Confidential Information.

If you already have an account, Log In and obtain the Virgin Islands Termination Statement by Employee to Software Developer regarding the return of Equipment and Confidential Information from your US Legal Forms library. The Download button will appear on every form you view.

If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the pricing plan you wish to choose and provide your details to register for an account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase. Choose the file format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Virgin Islands Termination Statement by Employee to Software Developer regarding the return of Equipment and Confidential Information. Each template included in your purchase has no expiration date and is yours indefinitely. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Virgin Islands Termination Statement by Employee to Software Developer regarding the return of Equipment and Confidential Information with US Legal Forms, the most extensive library of legal document templates. Utilize numerous professional and state-specific templates that fulfill your business or personal requirements.

- You can access all previously purchased forms in the My documents section of your account.

- If you would like to use US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your area/state.

- Click the Preview button to review the form's details.

- Read the form description to confirm that you have picked the correct form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

Form popularity

FAQ

When you're unsuccessful at e-filing a return, the system is set up to generate a reject code so that you know exactly what information is missing or needs to be corrected. Just make the corrections, and you'll be able to make a second attempt at e-filing.

Generally, backup withholding applies only to U.S. citizens and resident aliens, and not to nonresident aliens (NRA).

U.S. citizens and U.S. residents who are officers, directors, or shareholders in certain foreign corporations are responsible for filing Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations.

You should receive an explanation of why your return was rejected. If you made a mistake in entering a social security number, a payer's identification number, omitted a form, or misspelled a name, you can correct these errors and electronically file your tax return again.

FTI is any return or return information received from the IRS or any secondary source which is protected by the confidentiality provisions of Internal Revenue Code section 6103. FTI includes any information created by the Marketplace that is derived from return or return information.

The Internal Revenue Service limits the amount of time you have to file a 1040-X to the later of three years from the date you file the original tax return, or two years from the time you pay the tax for that year.

Providers and Large Taxpayers authorized to participate in the Internal Revenue Service e-file program can file Forms 1120 (U.S. Corporation Income Tax Return), 1120S (U.S. Income Tax Return for an S Corporation), and 1120-F (U.S. Income Tax Return of a Foreign Corporation) through Modernized e-File.

Tax form 1120-F, U.S. Income Tax Return of a Foreign Corporation, is used by foreign corporations. Your business may have to file this form if: You had U.S. source income, the tax on which hasn't fully been paid, You're making a protective filing. You're making treaty-based claims.

If you receive a rejection of your e-filed return by the day after the filing deadline (usually April 15), the IRS gives you a rejection grace period of five days to refile a timely filed rejected return.

A foreign corporation that maintains an office or place of business in the United States must generally file Form 1120-F by the 15th day of the 4th month after the end of its tax year.