Virgin Islands Notice of Redemption of Preferred Stock

Description

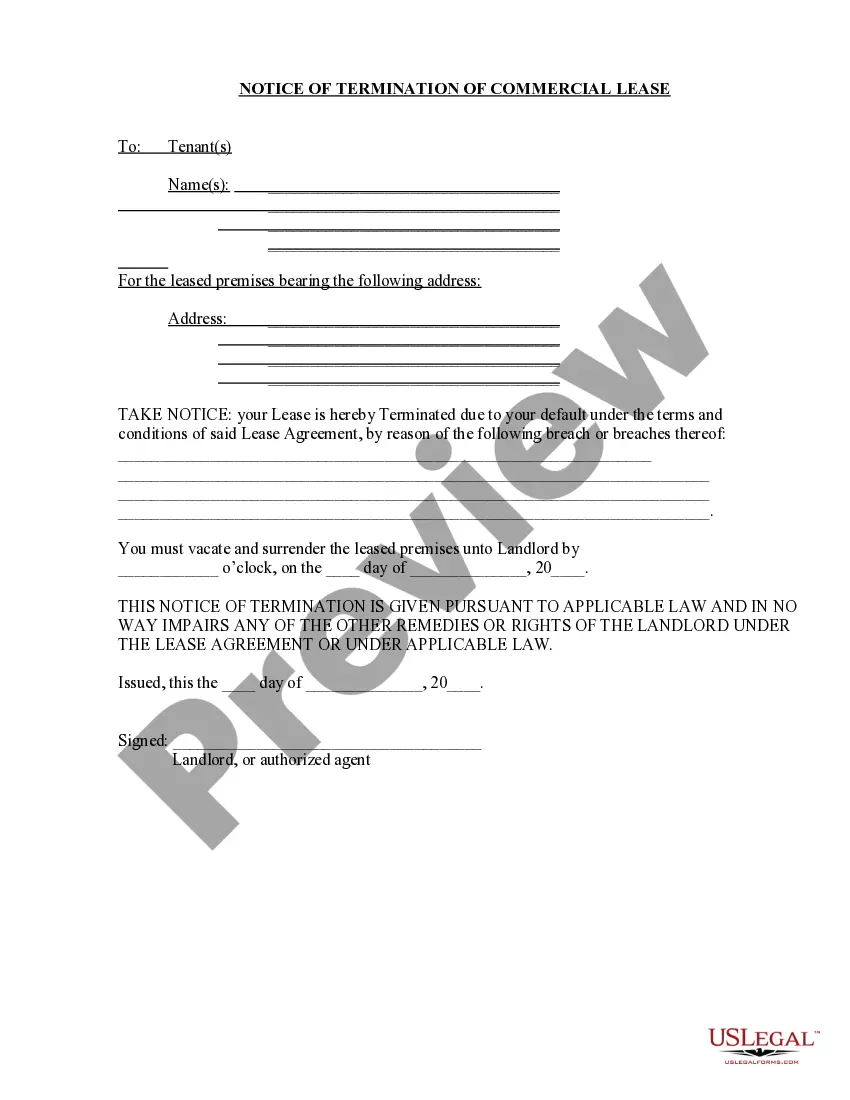

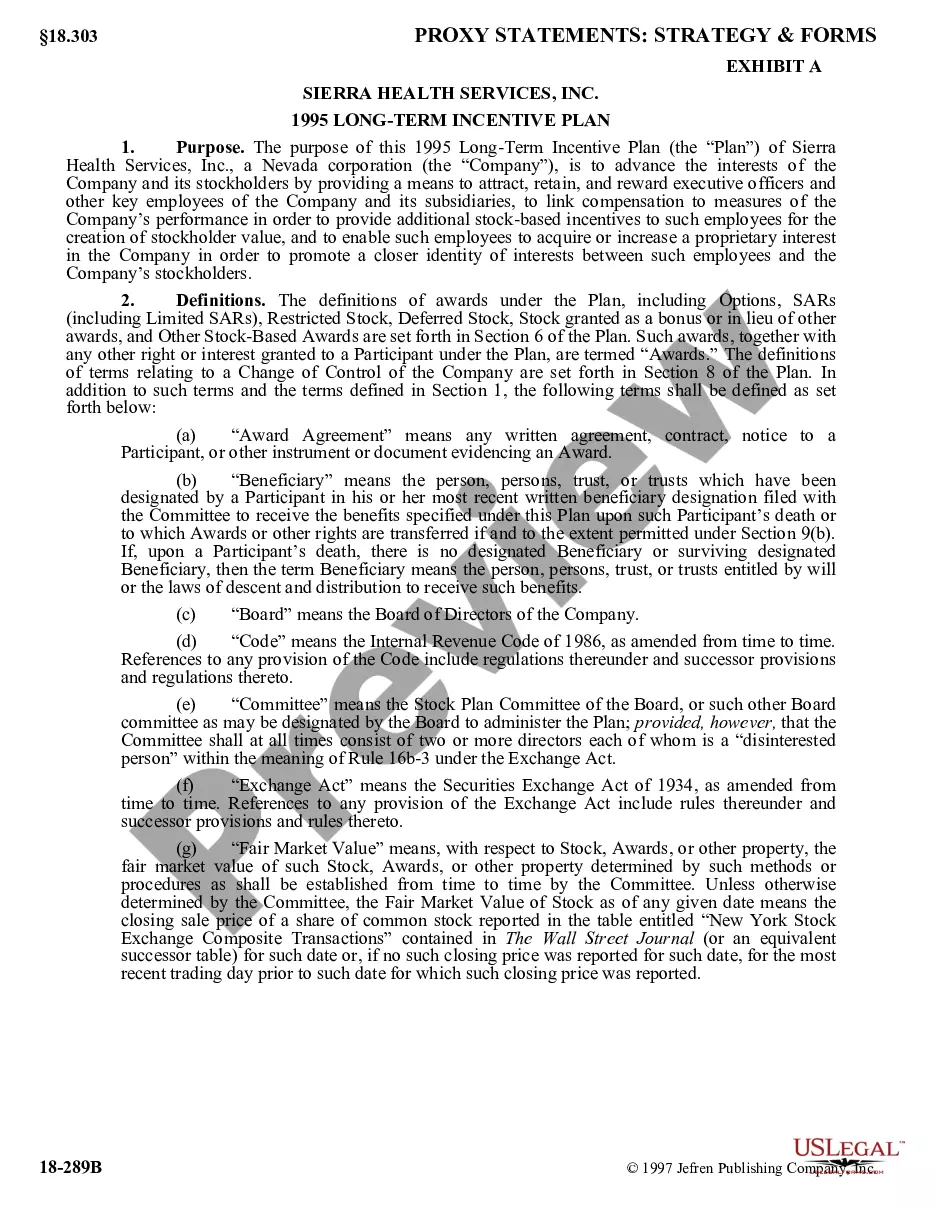

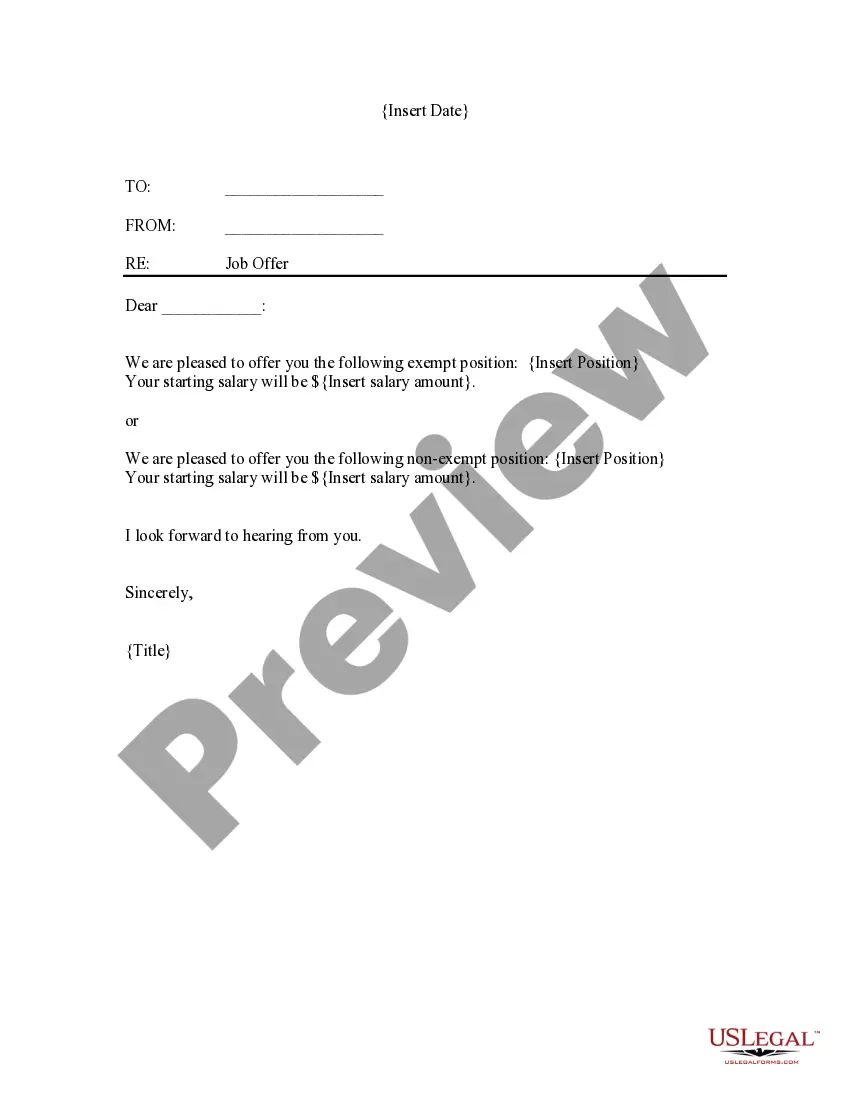

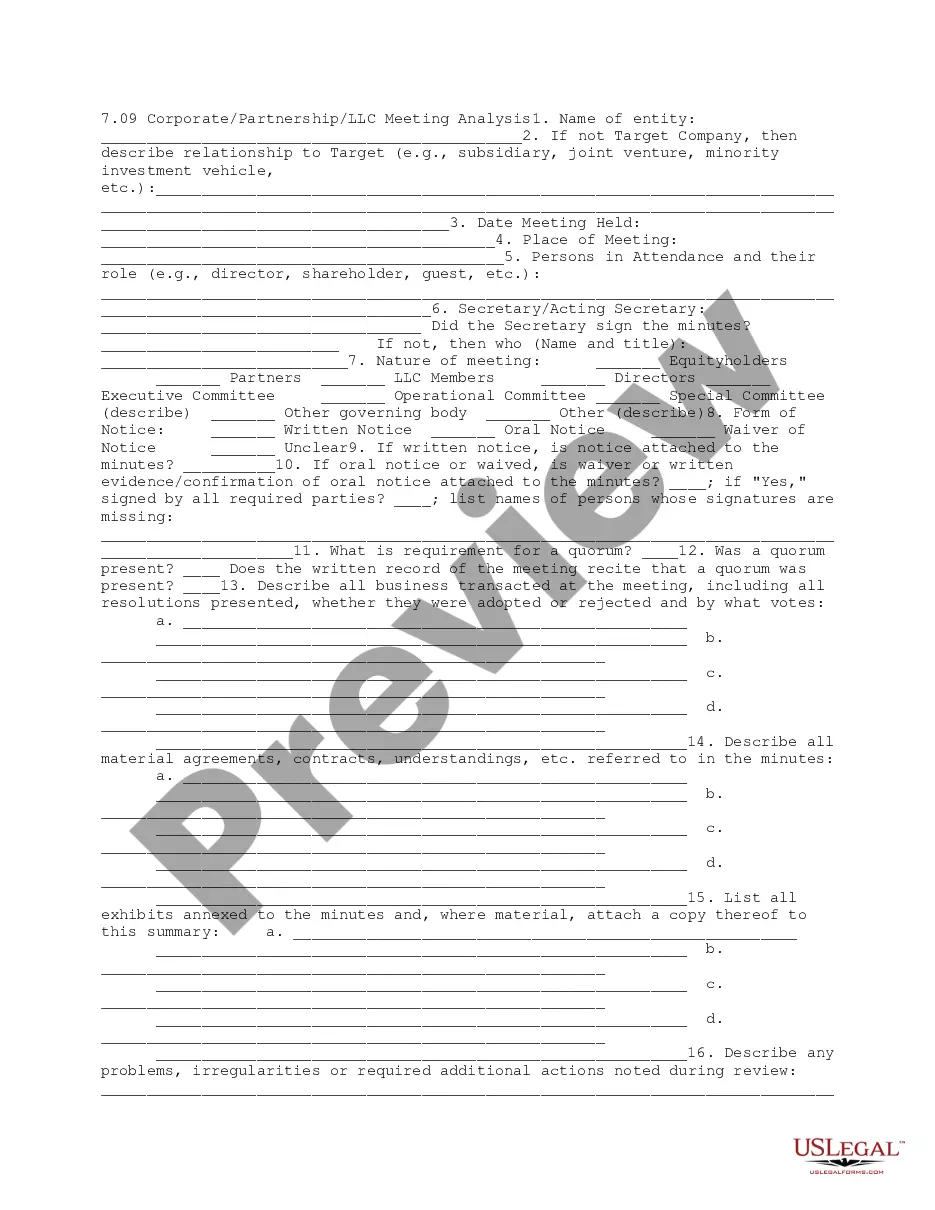

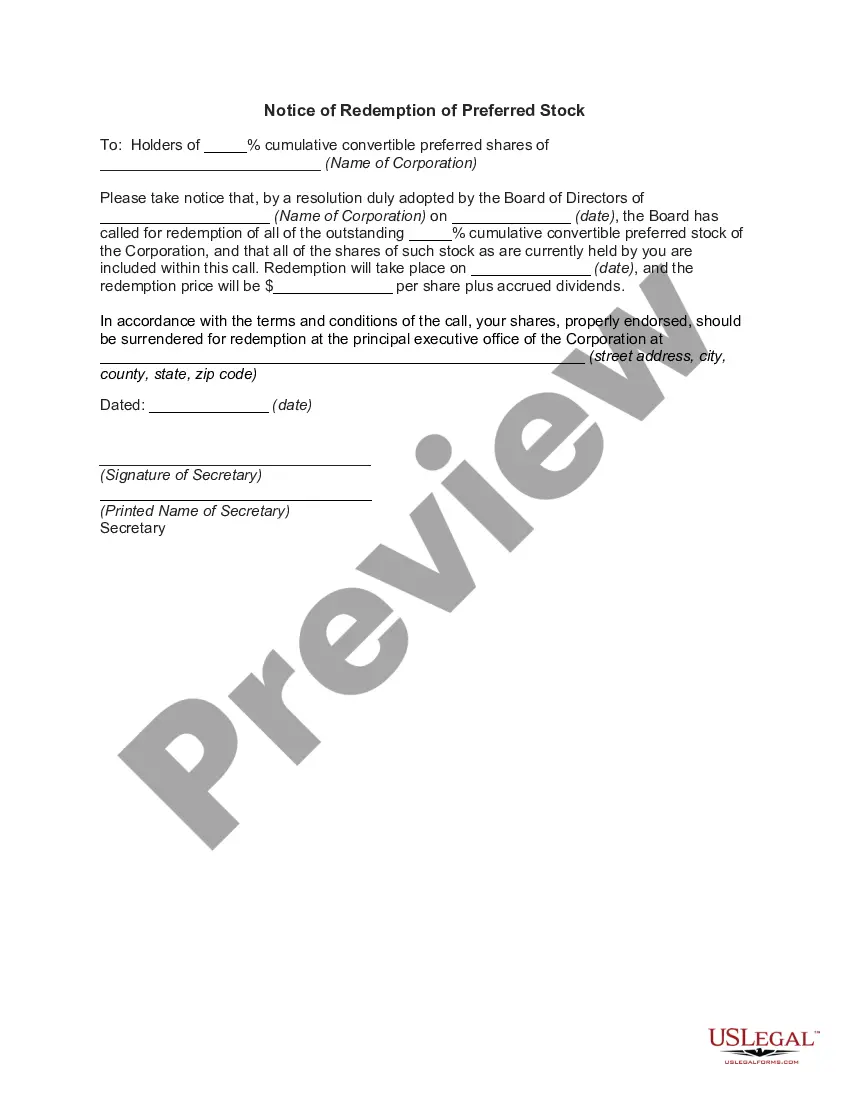

How to fill out Notice Of Redemption Of Preferred Stock?

If you have to total, download, or produce lawful document layouts, use US Legal Forms, the most important variety of lawful types, that can be found on the Internet. Make use of the site`s simple and easy hassle-free research to obtain the paperwork you need. Various layouts for company and individual purposes are categorized by types and claims, or key phrases. Use US Legal Forms to obtain the Virgin Islands Notice of Redemption of Preferred Stock within a number of clicks.

When you are presently a US Legal Forms consumer, log in in your account and click the Down load switch to find the Virgin Islands Notice of Redemption of Preferred Stock. You can also accessibility types you formerly delivered electronically within the My Forms tab of your account.

Should you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Make sure you have selected the shape for that appropriate town/land.

- Step 2. Use the Preview method to look over the form`s content material. Don`t forget about to learn the explanation.

- Step 3. When you are unhappy with all the develop, take advantage of the Research field near the top of the display to discover other types from the lawful develop web template.

- Step 4. After you have located the shape you need, go through the Purchase now switch. Select the prices prepare you like and put your references to register for an account.

- Step 5. Procedure the transaction. You can utilize your bank card or PayPal account to finish the transaction.

- Step 6. Choose the format from the lawful develop and download it on your own gadget.

- Step 7. Comprehensive, revise and produce or indication the Virgin Islands Notice of Redemption of Preferred Stock.

Every single lawful document web template you purchase is your own for a long time. You might have acces to each develop you delivered electronically in your acccount. Click on the My Forms area and choose a develop to produce or download again.

Contend and download, and produce the Virgin Islands Notice of Redemption of Preferred Stock with US Legal Forms. There are many skilled and express-certain types you can utilize for your company or individual demands.

Form popularity

FAQ

Convertible preferred shares can be converted into common stock at a fixed conversion ratio. Once the market price of the company's common stock rises above the conversion price, it may be worthwhile for the preferred shareholders to convert and realize an immediate profit.

Redeemable preferred stock is a type of preferred stock that allows the issuer to buy back the stock at a certain price and retire it, thereby converting the stock to treasury stock. These terms work well for the issuer of the stock, since the entity can eliminate equity if it becomes too expensive.

Why do companies issue redeemable shares? A company may wish to issue redeemable shares so that it has an alternative way to return surplus capital to shareholders without having to carry out a purchase of its own shares (also known as a share buyback) or pay a dividend.

Preferred shares are so called because they give their owners a priority claim whenever a company pays dividends or distributes assets to shareholders. They offer no preference, however, in corporate governance, and preferred shareholders frequently have no vote in company elections.

Why would a company issue redeemable preferred stock? Flexibility in Capital Structure: Companies can issue redeemable preferred stock with the idea of buying it back later, perhaps when they have more available cash or when they can issue debt at a lower interest rate.

Issuing preferred stock provides a company with a means of obtaining capital without increasing the company's overall level of outstanding debt. This helps keep the company's debt to equity (D/E) ratio, an important leverage measure for investors and analysts, at a lower, more attractive level.

Redeemable preferred shares trade on many public stock exchanges. These preferred shares are redeemed at the discretion of the issuing company, giving it the option to buy back the stock at any time after a certain set date at a price outlined in the prospectus.

Typically, retractable preferred shares are issued with a maturity date and when the maturity date comes preferred shareholders can exercise their right to redeem their shares for the cash (face value), or possibly for common shares of the issuer if that option is available.