Virgin Islands Sample Letter for Detailed Discussion of Items regarding Case

Description

How to fill out Sample Letter For Detailed Discussion Of Items Regarding Case?

Are you presently in the situation that you will need documents for either enterprise or individual functions virtually every time? There are a lot of legitimate document themes available online, but locating ones you can depend on is not simple. US Legal Forms delivers a huge number of kind themes, like the Virgin Islands Sample Letter for Detailed Discussion of Items regarding Case, that happen to be composed in order to meet state and federal specifications.

Should you be previously knowledgeable about US Legal Forms website and get a free account, simply log in. Next, you can download the Virgin Islands Sample Letter for Detailed Discussion of Items regarding Case template.

Should you not offer an bank account and would like to start using US Legal Forms, abide by these steps:

- Get the kind you want and ensure it is to the proper town/county.

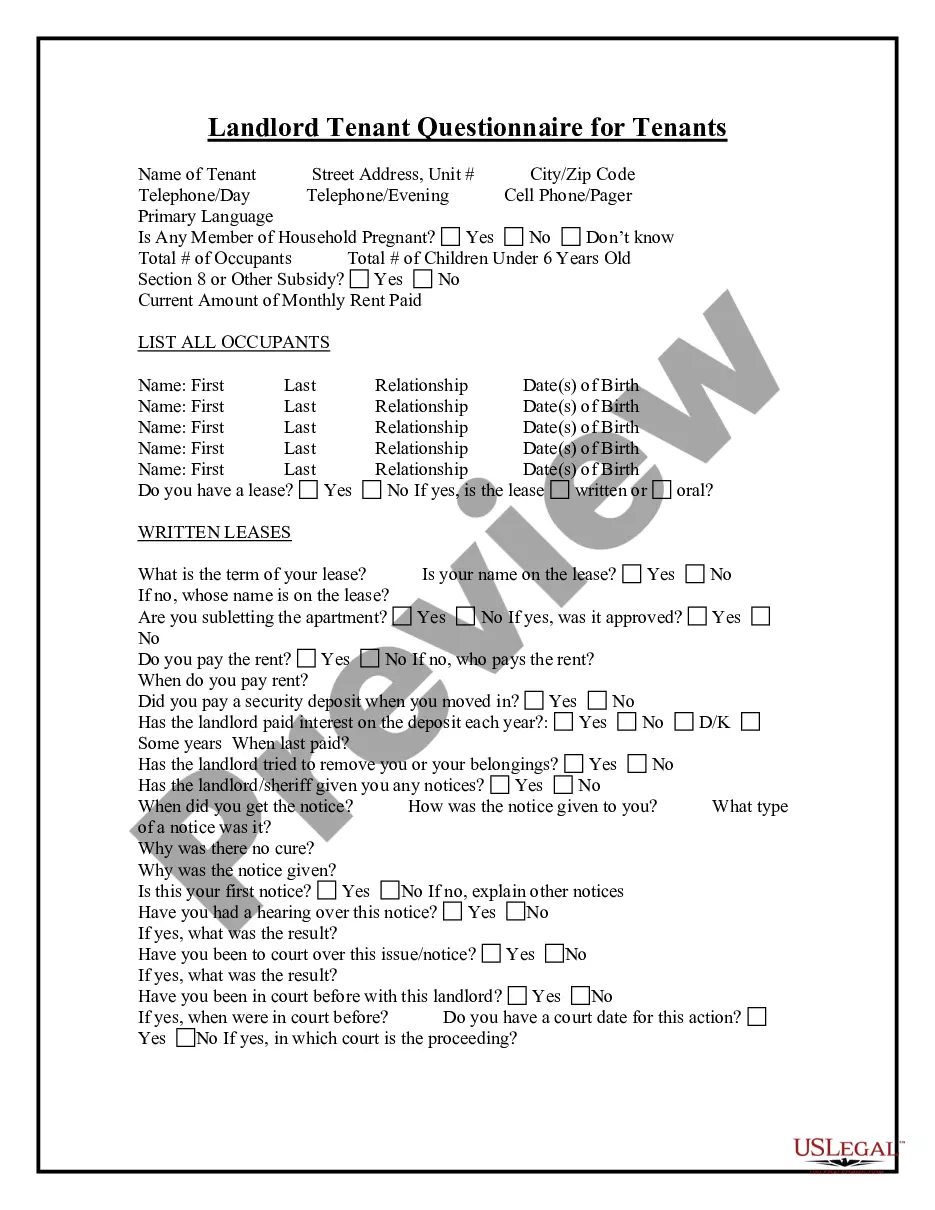

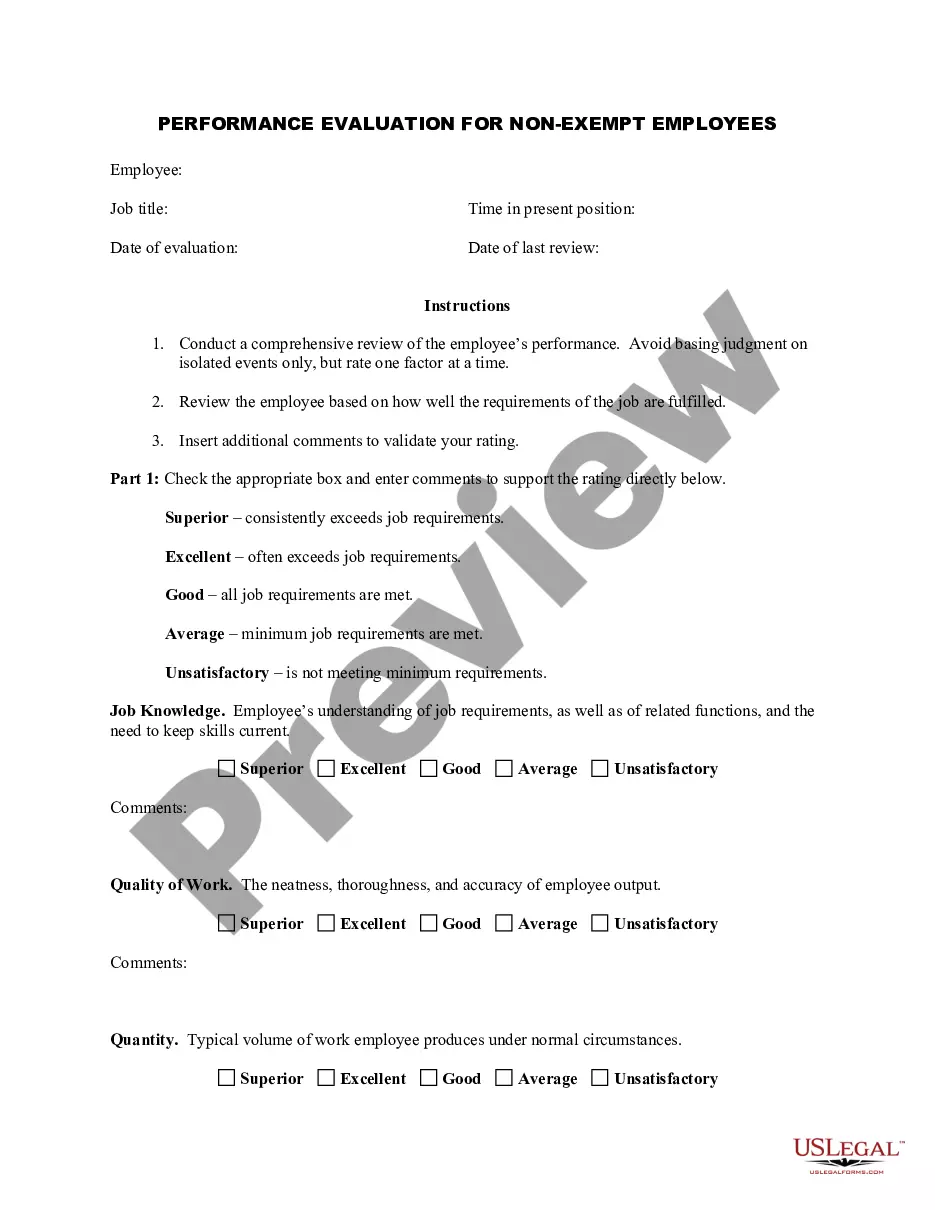

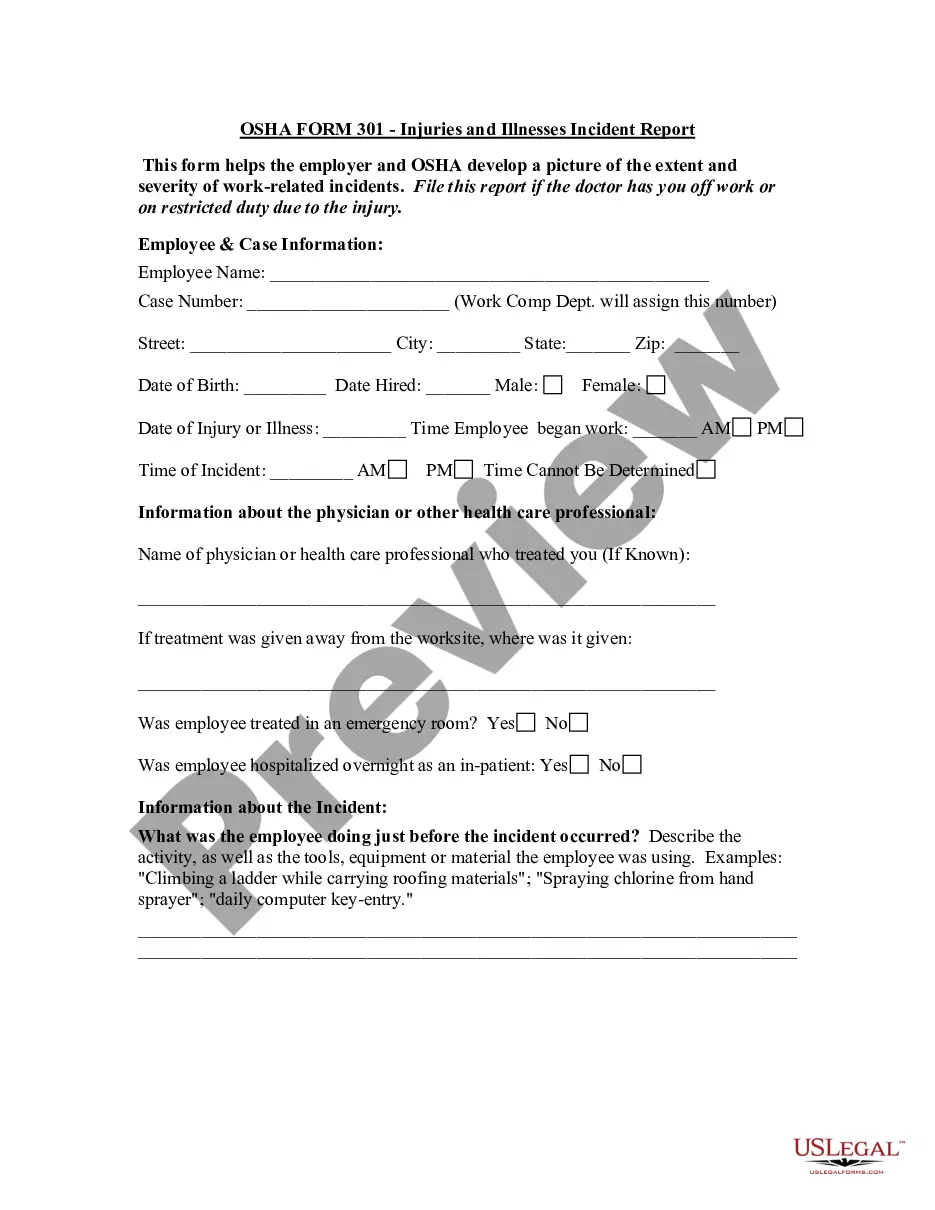

- Utilize the Preview key to examine the shape.

- Look at the information to actually have chosen the appropriate kind.

- In the event the kind is not what you are trying to find, make use of the Search area to discover the kind that suits you and specifications.

- If you get the proper kind, click on Acquire now.

- Opt for the rates strategy you want, fill in the specified information and facts to create your account, and pay money for the transaction utilizing your PayPal or Visa or Mastercard.

- Select a convenient document file format and download your version.

Locate all of the document themes you possess purchased in the My Forms food list. You can obtain a more version of Virgin Islands Sample Letter for Detailed Discussion of Items regarding Case anytime, if possible. Just click on the required kind to download or print the document template.

Use US Legal Forms, probably the most extensive variety of legitimate kinds, to save efforts and avoid blunders. The support delivers expertly created legitimate document themes that can be used for a range of functions. Make a free account on US Legal Forms and commence creating your lifestyle easier.

Form popularity

FAQ

Individuals who are bona fide residents of the Virgin Islands file Form 1040 with the Virgin Islands and pay tax on their worldwide income to the Virgin Islands.

TurboTax does not support the Form 8689, however you can enter the credit that you compute on the Form 8689 (line 40) in TurboTax Deluxe. You won't have to upgrade. Enter in the Other Credits section under Deductions and Credits.

Form 8689 is a tax form distributed by the Internal Revenue Service (IRS) for use by U.S. citizens and resident aliens who earned income from sources in the U.S. Virgin Islands (USVI) but are not bona fide residents. The U.S. Virgin Islands are considered an unincorporated territory of the United States.

A U.S. citizen or resident alien (other than a bona fide resident of the U.S. Virgin Islands (USVI)) with income from sources in the USVI or income effectively connected with the conduct of a trade or business in the USVI uses this form to figure the amount of U.S. tax allocable to the USVI.

An individual who qualifies as a bona fide resident of the U.S. Virgin Islands (or who files a joint U.S. return with a U.S. citizen or resident with U.S. Virgin Islands income) will generally have no U.S. tax liability so long as the taxpayer reports all income from all sources on the return filed with the U.S. Virgin ...

You are allowed to travel freely within the U.S. Virgin Islands. Unless you are given permission in advance by the judge in your case, any requests to travel outside of these islands must be approved in advance by your U.S. Probation officer. Failure to do so may result in a violation of your super vision.

US Virgin Islands does not use a state withholding form because there is no personal income tax in US Virgin Islands.

USVI Tax System The US Congress has granted USVI the authority to allow a lowered tax rate to bona fide residents of the USVI. Any income related to a USVI business is also taxed at a lower rate. Bona fide USVI residents pay taxes to the Virgin Islands Bureau of Internal Revenue (BIR) instead of the IRS.