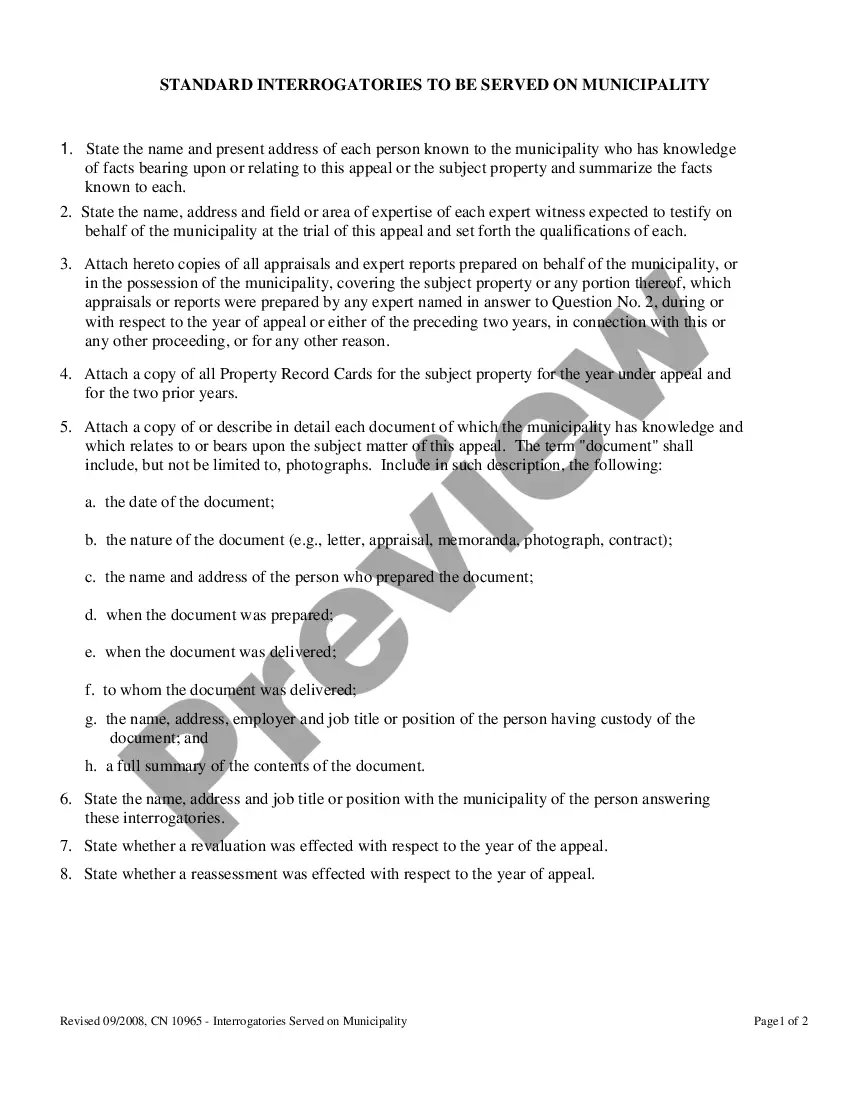

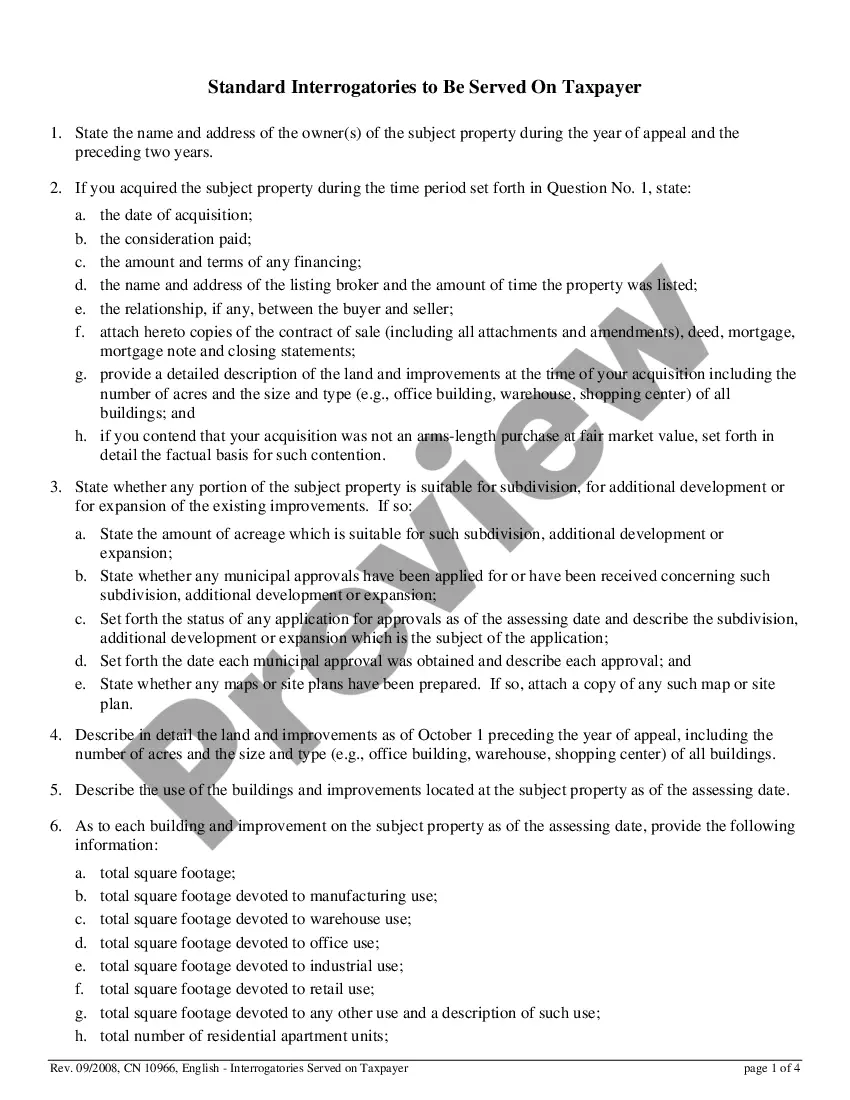

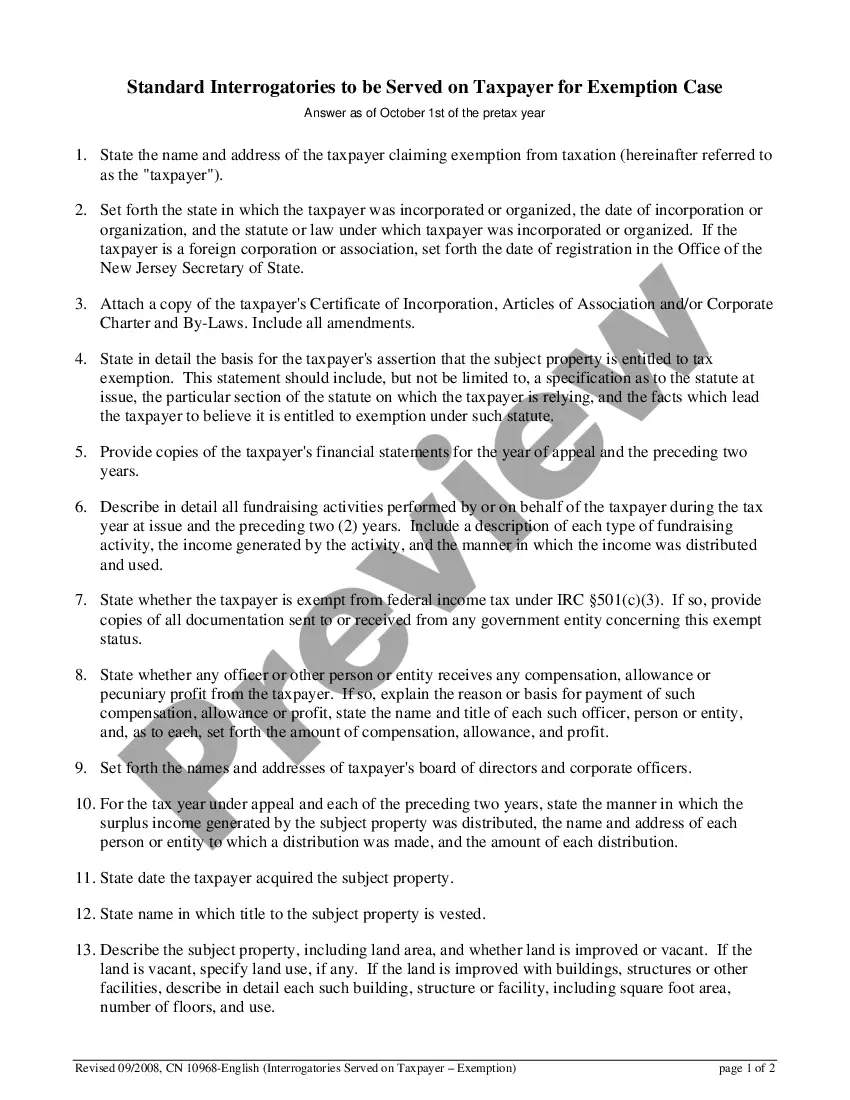

New Jersey Standard Interrogatories to be Served on Taxpayer are a set of written questions that must be answered by the taxpayer in order to provide information for a legal or tax dispute. The interrogatories are part of the discovery process and are used to gather facts that can be used to prove or defend a case. The questions are generally related to the subject of the dispute, such as income, assets, and expenses. The interrogatories must be answered in writing, under oath, and must be signed by the taxpayer. There are two types of New Jersey Standard Interrogatories to be Served on Taxpayer: 1. Interrogatories for Taxpayer's Financial Affairs: These interrogatories seek information about the taxpayer's income, assets, expenses, and other financial matters. This includes questions about income sources, assets, liabilities, and other financial documents. 2. Interrogatories for Taxpayer's Business Affairs: These interrogatories seek information about the taxpayer's business activities, including questions about the nature of the business, customers, accounts receivable, accounts payable, and other business documents.

New Jersey Standard Interrogatories to be Served on Taxpayer

Description

How to fill out New Jersey Standard Interrogatories To Be Served On Taxpayer?

If you’re searching for a way to appropriately prepare the New Jersey Standard Interrogatories to be Served on Taxpayer without hiring a legal professional, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every personal and business scenario. Every piece of paperwork you find on our online service is designed in accordance with nationwide and state regulations, so you can be sure that your documents are in order.

Adhere to these simple instructions on how to acquire the ready-to-use New Jersey Standard Interrogatories to be Served on Taxpayer:

- Make sure the document you see on the page complies with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Type in the document title in the Search tab on the top of the page and choose your state from the dropdown to locate an alternative template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to get your New Jersey Standard Interrogatories to be Served on Taxpayer and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Any party may serve upon any other party written interrogatories relating to any matters which may be inquired into under R. -2. The interrogatories may include a request, at the propounder's expense, for a copy of any paper.

If we represent the spouse who has not had access to the assets or finances of the marriage, the answers to Interrogatories are one way that we can obtain a disclosure of the marital assets and protect you in the event your spouse has concealed or failed to disclose assets.

RULE -2 - Time to Serve Interrogatories Interrogatories may, without leave of court, be served upon the plaintiff or answers demanded pursuant to R. -1(b) after commencement of the action and served upon or demanded from any other party with or after service of the summons and complaint upon that party.

The propounder of a question answered by a statement that it is improper may, within 20 days after being served with the answers, serve a notice of motion to compel an answer to the question, and, if granted, the question shall be answered within such time as the court directs.

-1(b)(2), the party served with interrogatories shall serve answers thereto upon the party propounding them within 60 days after being served with the interrogatories. For good cause shown the court may enlarge or shorten such time upon motion on notice made within the 60-day period.

-1(b)(2), the party served with interrogatories shall serve answers thereto upon the party propounding them within 60 days after being served with the interrogatories.

(c)Each party may serve on each adverse party no more than 15 interrogatories, including subparts, unless another limit is stipulated by the parties or ordered by the court.

RULE -6 - Limitation of Interrogatories Except as otherwise provided by R. -1(b), the number of interrogatories or of sets of interrogatories to be served is not limited except as required to protect the party from annoyance, expense, embarrassment, or oppression.