Virgin Islands Renunciation of Legacy in Favor of Other Family Members

Description

How to fill out Renunciation Of Legacy In Favor Of Other Family Members?

Discovering the right legitimate document web template could be a struggle. Obviously, there are a variety of themes available on the net, but how would you obtain the legitimate develop you will need? Utilize the US Legal Forms website. The support offers a huge number of themes, such as the Virgin Islands Renunciation of Legacy in Favor of Other Family Members, which can be used for business and private requires. All the kinds are inspected by specialists and fulfill federal and state needs.

When you are currently authorized, log in to your accounts and click the Obtain key to get the Virgin Islands Renunciation of Legacy in Favor of Other Family Members. Make use of accounts to appear with the legitimate kinds you possess purchased formerly. Proceed to the My Forms tab of your respective accounts and acquire yet another duplicate in the document you will need.

When you are a whole new consumer of US Legal Forms, allow me to share easy guidelines that you can stick to:

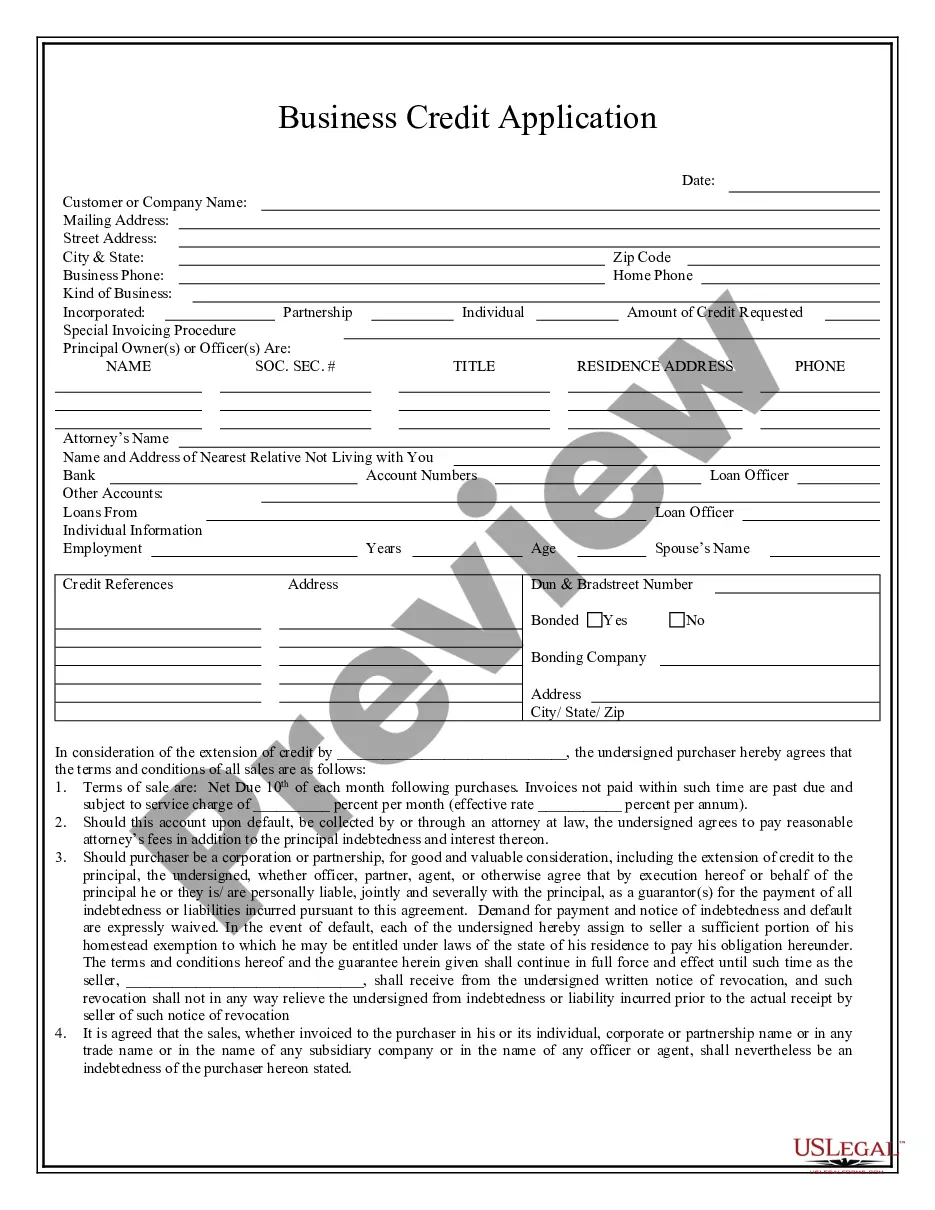

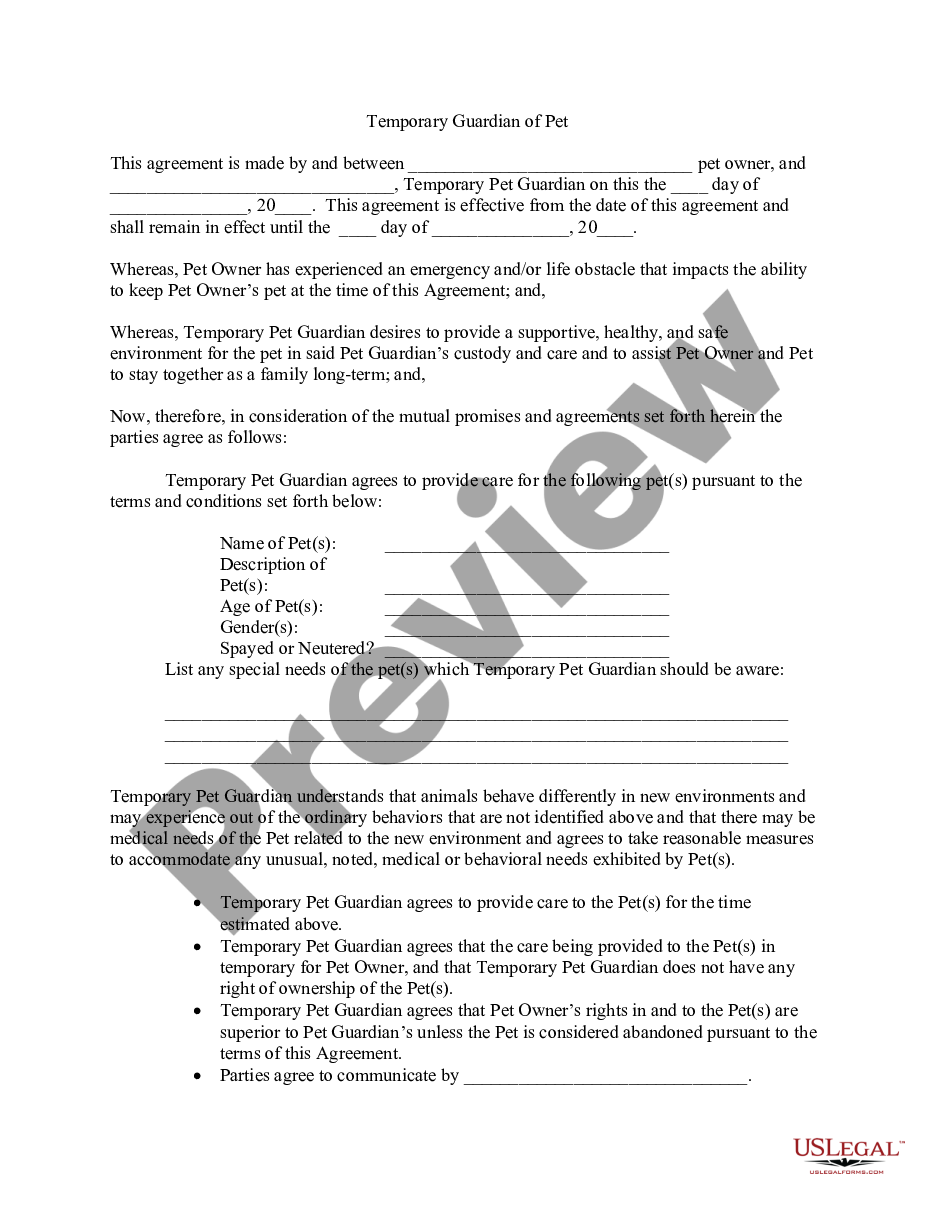

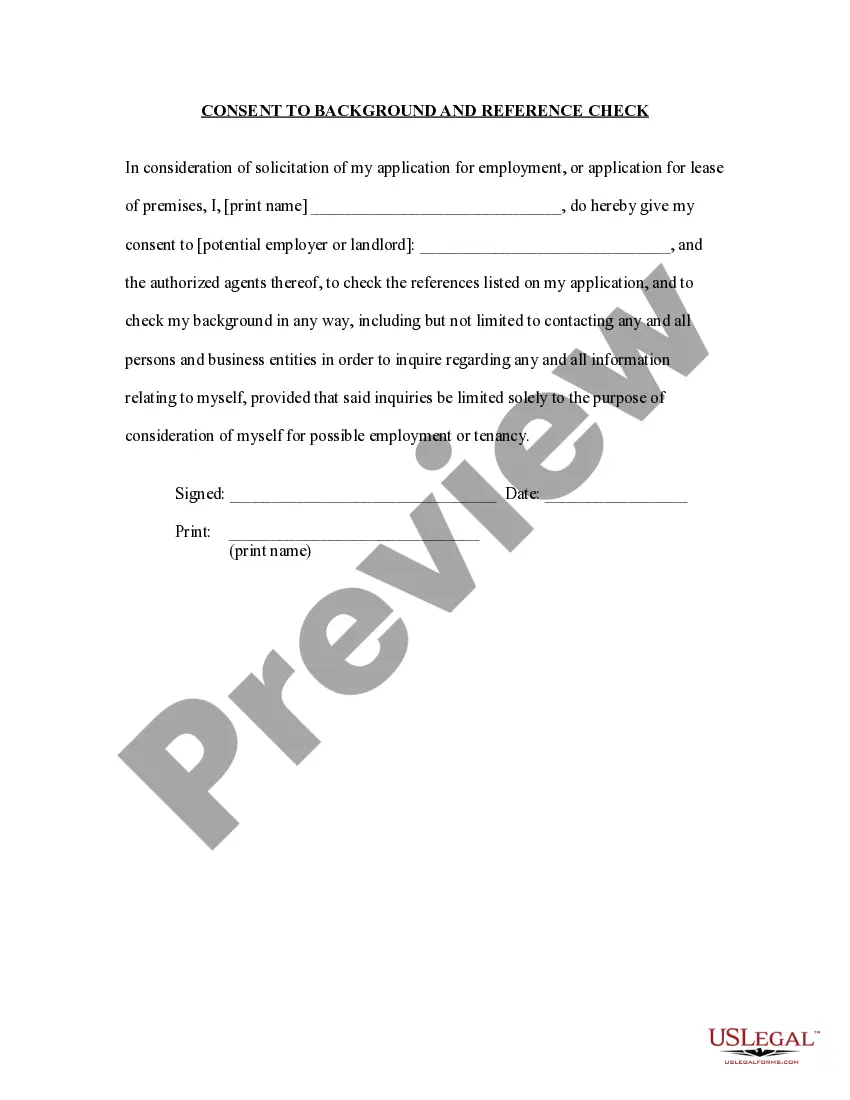

- Very first, make sure you have chosen the right develop for your personal town/area. You may examine the form making use of the Review key and read the form description to make certain it is the right one for you.

- If the develop is not going to fulfill your requirements, take advantage of the Seach industry to discover the right develop.

- Once you are certain the form is acceptable, click the Get now key to get the develop.

- Opt for the costs prepare you desire and enter in the needed information. Create your accounts and purchase an order with your PayPal accounts or bank card.

- Opt for the data file formatting and obtain the legitimate document web template to your system.

- Full, modify and printing and indicator the obtained Virgin Islands Renunciation of Legacy in Favor of Other Family Members.

US Legal Forms is the greatest catalogue of legitimate kinds for which you can see numerous document themes. Utilize the service to obtain professionally-manufactured papers that stick to condition needs.

Form popularity

FAQ

Share of spouse or domestic partner. (5) One-half of any balance of the intestate estate, if one or more of the decedent's surviving descendants are not descendants of the surviving spouse or surviving domestic partner.

Under New York law, regardless of what a will provides, the spouse has the right of election to take a share of his or her spouse's estate. The amount of the spouse's share is the greater of one-third of the net estate, or $50,000. If the estate is less than $50,000, the elective share is the value of the net estate.

Each state defines the elective state differently, but in Florida, a decedent's elective estate includes: The decedent's probate estate. The decedent's interest in property passing by right of survivorship at death (such as in joint tenancy) Property held in any revocable trusts.

Elective Share ? Traditional Election In our above example, all of the assets of the deceased spouse's estate, including the pay-on-death bank accounts, retirement accounts, investment accounts, life insurance, and joint tenancy accounts, are included in calculating the value of the deceased's estate.

The elective share protects a spouse from disinheritance. Example(s): Hal dies and leaves his wife, Jane, $500 in his will. Hal's total estate is worth $100,000. The state in which Hal and Jane lived provides that a spouse is entitled to one-half of the decedent's estate.

We therefore conclude that the phrase ?or to the survivor or survivors thereof? in paragraph A modifies the phrase ?my brother[s] and sisters that survive me,? thereby referring to those of testators' siblings who survived testator, and indicates that testator intended only for her surviving siblings, i.e., not the ...

If a person dies without a will, they are said to have died intestate. Dying ?in intestacy? means that a state probate court will have to determine how their assets are to be distributed.

In most states, the elective share is between one-third and one-half of all the property in the estate, although many states require the marriage to have lasted a certain number of years for the elective share to be claimed, or adjust the share based on the length of the marriage, and the presence of minor children.