Virgin Islands Assignment of LLC Company Interest to Living Trust

Description

How to fill out Assignment Of LLC Company Interest To Living Trust?

It is feasible to spend time online searching for the official document template that matches the state and federal requirements you need.

US Legal Forms offers thousands of authentic forms that can be reviewed by experts.

You can download or print the Virgin Islands Assignment of LLC Company Interest to Living Trust from my services.

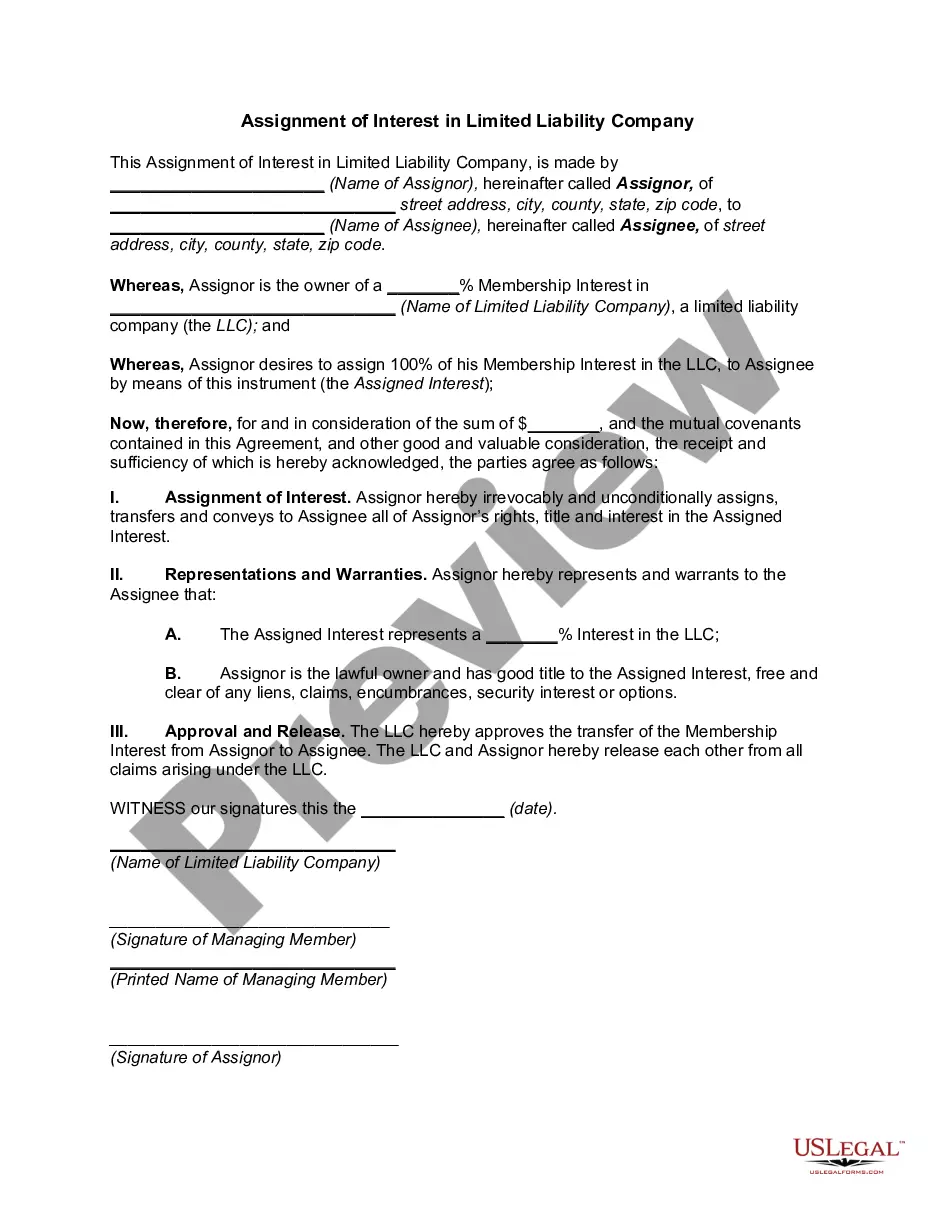

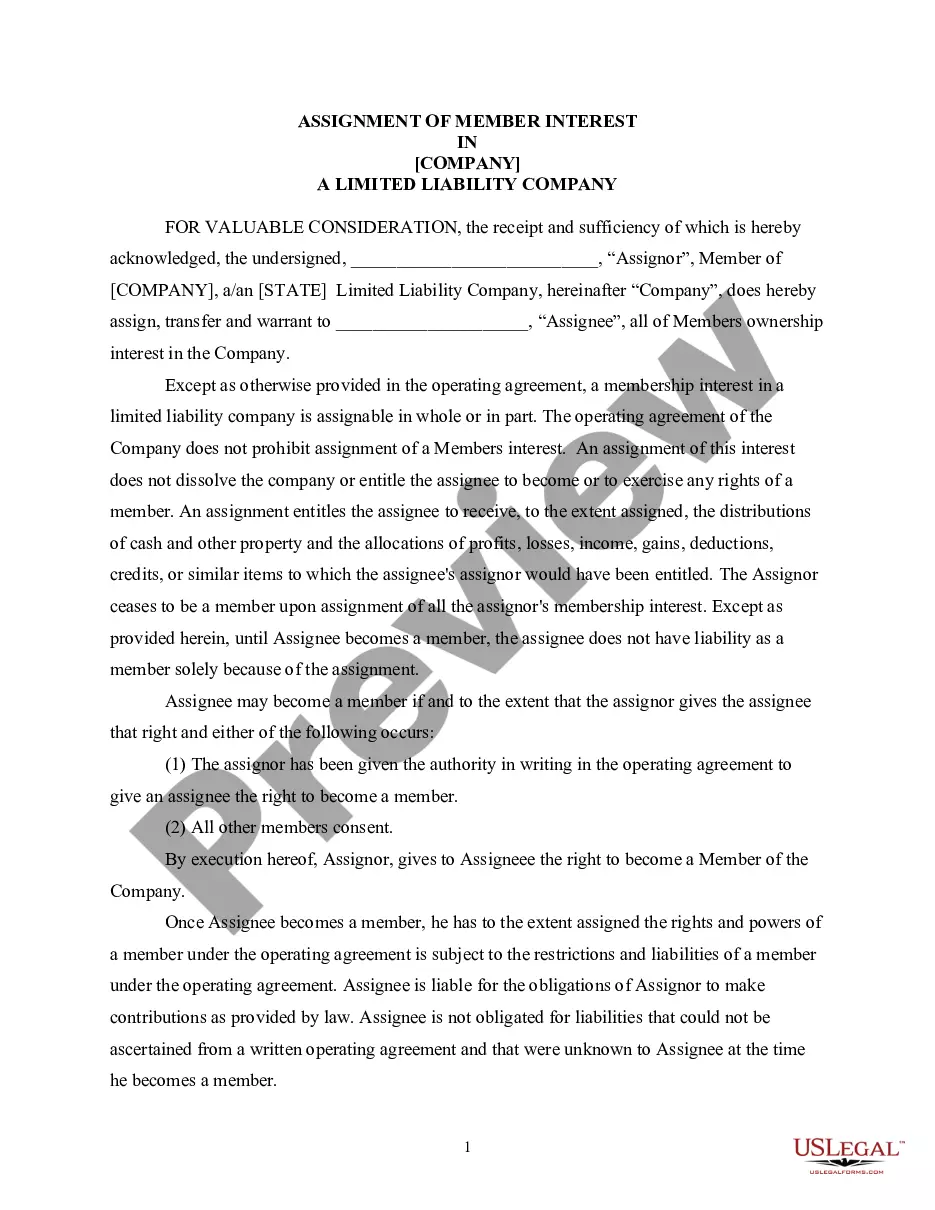

If available, use the Preview button to look over the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, edit, print, or sign the Virgin Islands Assignment of LLC Company Interest to Living Trust.

- Each legal document template you obtain is yours to keep for a long time.

- To get an additional copy of any purchased form, visit the My documents tab and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the correct document template for your state/city of choice.

- Review the form details to confirm you have selected the correct template.

Form popularity

FAQ

To start a business in the U.S. Virgin Islands you will need to obtain a business license from the Department of Licensing and Consumer Affairs (DLCA). DLCA will complete the "One Step" review process with the following government agencies: Police Department. VI Bureau of Internal Revenue (tax clearance)

Offshore LLC is a legal form of business, which gives limited liability to its owners (members). It is not a corporation, but, like a regular corporations, offshore LLCs share limited liability. Offshore LLC shares the availability of pass-through income taxation with a partnership.

If an LLC member's interest is held in a trust, then the administrator, sometimes called a "trustee," will vote and otherwise exercise the duties and rights of the LLC member. Transferring the membership interest to the trust could require an official transfer document, which is similar to a bill of sale.

The Nevis LLC is a business entity that provides an alternative to those who might consider using corporations or partnerships. An LLC formed under the Nevis Limited Liability Company Ordinance (NLLCO) shall be a legal entity with separate rights and liabilities, distinct from its managers or members.

To get started:Create a business plan.Register your trade name and/or corporation with the Office of the Lieutenant Governor.Select a good location and obtain a copy of an unsigned lease or letter of intent from the owner.Obtain a business license from the V.I. Department of Licensing and Consumer Affairs (DLCA)

ProcessSTEP 1 SUBMIT INCORPORATION ORDER FORM FOR BVI COMPANY INCORPORATION. Please provide us your email address in the package details and we will email you the necessary incorporation forms.STEP 2 MAKE PAYMENT FOR OFFSHORE COMPANY.STEP 3 INCORPORATE BRITISH VIRGIN ISLANDS COMPANY.

The answer is yes, a trust can own an LLC, either as the sole owner or as one of many owners.

By placing a business into a living trust -- a trust that is created for you and your family's benefit while you are alive -- you transfer legal ownership of your business to the trustee, which is usually a third party but can also be the business owner.

Here is how you can transfer your LLC to your Trust:Draft and Execute the Transfer Document.Draft and File an Amendment to your Articles of Organization with the Arizona Corporation Commission.Amend the Operating Agreement.Have LLC Members Sign a Resolution Accepting Transfer.

The answer is yes. First, trust law permits trusteeswho are acting on behalf of trusts, including revocable truststo own any asset, or almost any asset, that an individual can own, and this includes an interest in an LLC, which qualifies as an asset.