Virgin Islands Asset Information Sheet

Instant download

Description

This form is used to help a person gather relevant information about their assets.

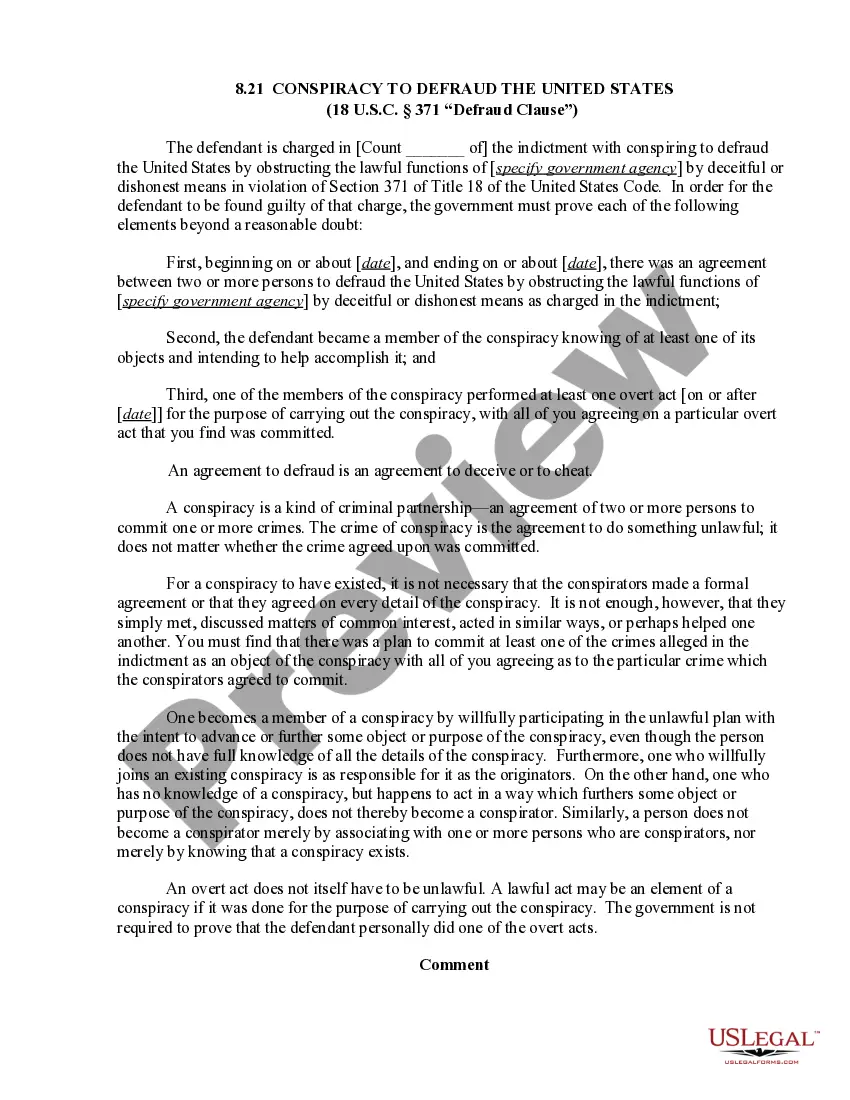

Free preview

How to fill out Asset Information Sheet?

You might dedicate several hours online trying to discover the legal document template that meets the federal and state requirements you require.

US Legal Forms provides thousands of legal forms that are reviewed by experts.

You can conveniently download or produce the Virgin Islands Asset Information Sheet from my service.

If available, use the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, produce, or sign the Virgin Islands Asset Information Sheet.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the appropriate document template for the state/city of your choice.

- Review the form outline to confirm that you have chosen the correct document.