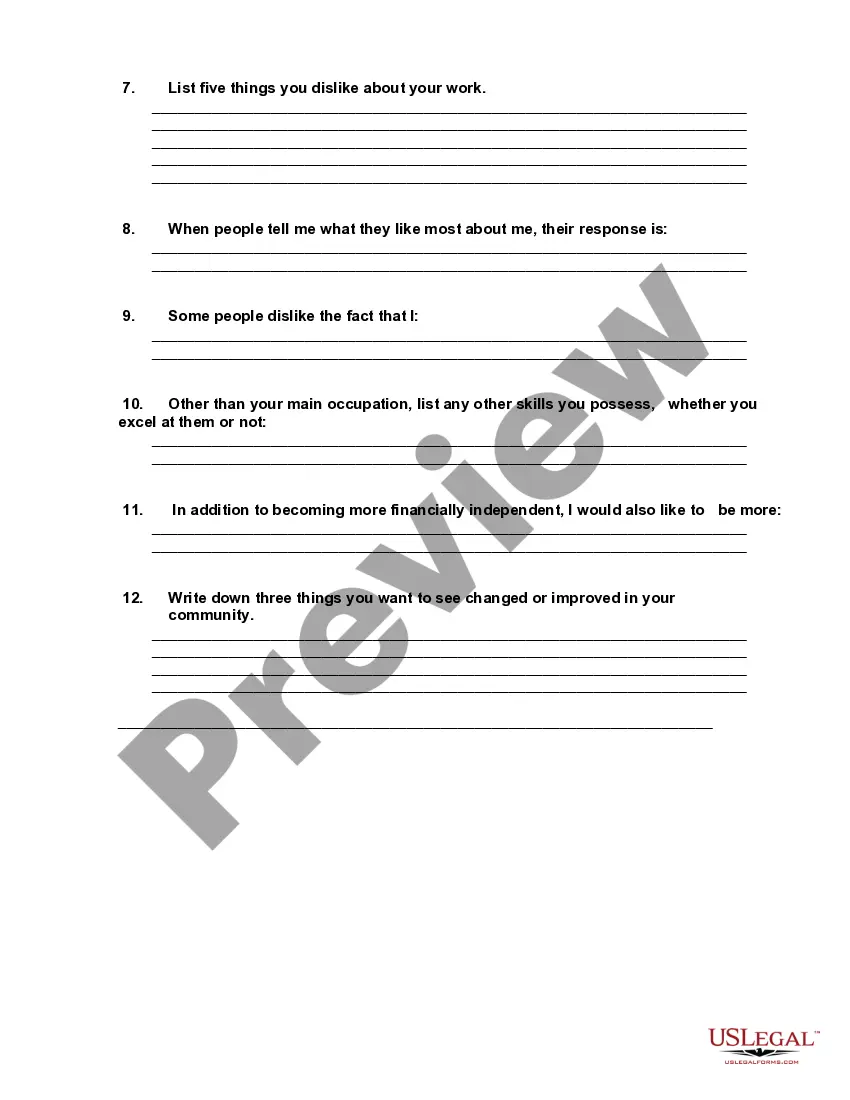

Virgin Islands Self-Assessment Worksheet

Description

How to fill out Self-Assessment Worksheet?

If you desire to finalize, download, or print legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site’s straightforward and user-friendly search to locate the documents you need.

Numerous templates for commercial and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Virgin Islands Self-Assessment Worksheet in just a few clicks.

Step 5. Process the payment. You may use your credit card or PayPal account to complete the transaction.

Step 6. Select the format of your legal form and download it to your device. Step 7. Complete, modify, and print or sign the Virgin Islands Self-Assessment Worksheet. Every legal document template you acquire is yours permanently. You have access to all forms you saved in your account. Click on the My documents section and select a form to print or download again. Compete, download, and print the Virgin Islands Self-Assessment Worksheet using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and then click the Download button to acquire the Virgin Islands Self-Assessment Worksheet.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to check the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search bar at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, select the Purchase now option. Choose the payment plan you prefer and enter your information to register for an account.

Form popularity

FAQ

The Virgin Islands offers various tax credits designed to encourage economic growth and support residents. These credits can offset your overall tax liability and enhance financial benefits for eligible individuals and businesses. Utilizing the Virgin Islands Self-Assessment Worksheet will help reveal any applicable tax credits you may qualify for.

Corporations operating in the U.S. Virgin Islands must file Form 1120 if they earn income. This includes both domestic and foreign corporations whose income is sourced to the Virgin Islands. By completing the Virgin Islands Self-Assessment Worksheet, you can determine your obligations to file this form accurately.

Form 1120 F is used by foreign corporations to report income earned in the U.S. Virgin Islands. It is essential for maintaining compliance with local tax laws. Understanding this form's requirements is key, and utilizing the Virgin Islands Self-Assessment Worksheet can guide you in preparing the needed documentation.

You should file your U.S. Virgin Islands tax return with the Virgin Islands Bureau of Internal Revenue. It's essential to ensure you follow the local guidelines for submission. The Virgin Islands Self-Assessment Worksheet can help you gather the necessary information before filing.

assessment worksheet is a form used to estimate your tax liabilities based on your income and deductions. This worksheet helps you organize your financial information, making it easier to calculate your taxes. For residents in the U.S. Virgin Islands, the Virgin Islands SelfAssessment Worksheet is an invaluable tool for accurate tax preparation.

Yes, the U.S. Virgin Islands is a U.S. territory, and it follows specific tax laws that can affect your filing. For many residents and businesses, understanding how these laws apply is crucial. Utilizing tools like the Virgin Islands Self-Assessment Worksheet can simplify the process of determining your tax situation.

The mailing address is 9601 Estate Thomas, St. Thomas, VI 00802.

The amount of tax paid to the Virgin Islands is reported on Line 46. This amount is then reported on Line 33 of your Form 1040 and taken as a credit.

To qualify as a bona fide resident of the U.S Virgin Islands, a person must meet the physical presence test. They cannot have a tax home outside of the Virgin Islands or have a closer connection to the mainland U.S. or another country than they do with the U.S. Virgin Islands.

An applicant for permanent residence must reside in the Virgin Islands consecutively for a period of 20 years before application can be considered. An applicant can only be absent from the Territory for 90 days in any calendar year except when pursuing further education or as a result of illness.