Virgin Islands Resolution of Directors of a Close Corporation Authorizing Redemption of Stock

Description

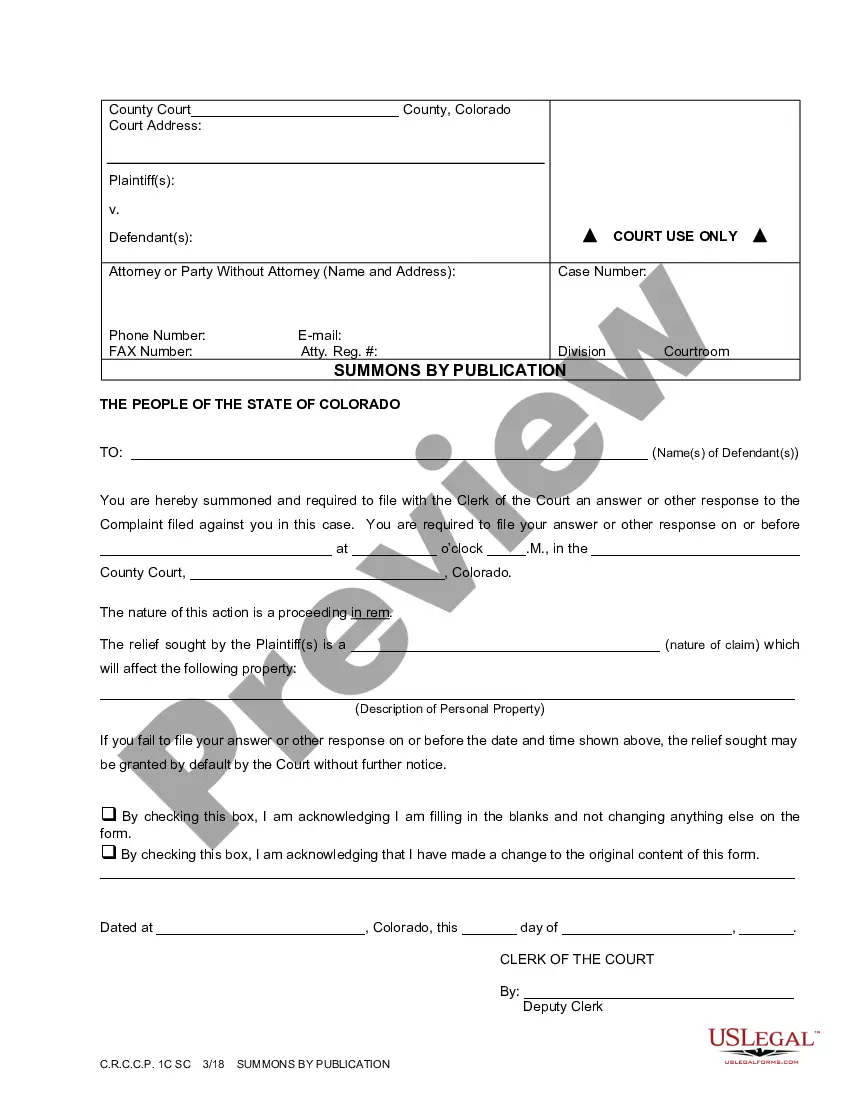

How to fill out Resolution Of Directors Of A Close Corporation Authorizing Redemption Of Stock?

You might invest numerous hours online attempting to locate the approved document template that meets the federal and state requirements you will require.

US Legal Forms provides a wide selection of official forms that are assessed by experts.

You can conveniently download or print the Virgin Islands Resolution of Directors of a Close Corporation Authorizing Redemption of Stock from the service.

If available, use the Review option to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download option.

- Next, you can complete, modify, print, or sign the Virgin Islands Resolution of Directors of a Close Corporation Authorizing Redemption of Stock.

- Every official document template you obtain is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and select the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions listed below.

- First, ensure you have chosen the correct document template for the area/city of your preference.

- Check the form description to confirm you have selected the right form.

Form popularity

FAQ

Yes, BVI companies must have directors, as they are integral to company governance. These directors manage the company's affairs and make strategic decisions. The Virgin Islands Resolution of Directors of a Close Corporation Authorizing Redemption of Stock provides valuable guidance on director appointments and their roles within the corporate structure.

A BVI director has a fiduciary duty to act in the best interests of the company and its shareholders. They are liable for any breach of duty or misconduct during their tenure. Familiarity with the Virgin Islands Resolution of Directors of a Close Corporation Authorizing Redemption of Stock can provide insights into the scope of a director's responsibilities and liabilities.

Transferring shares in a BVI company involves executing a share transfer agreement, which must be documented properly. The existing shares should be registered in the company’s records, and the new details must be updated accordingly. Understanding the legal framework surrounding the Virgin Islands Resolution of Directors of a Close Corporation Authorizing Redemption of Stock can facilitate seamless share transfers.

To liquidate a company in the BVI, you need to follow specific steps laid out by the BVI Business Companies Act. The process generally begins with the appointment of a liquidator and requires the passing of a resolution by the directors. Consulting the Virgin Islands Resolution of Directors of a Close Corporation Authorizing Redemption of Stock can guide you through this process effectively.

A director of a BVI company can be any natural person or legal entity, regardless of nationality. However, at least one director must be appointed, and there are no residency requirements for directors. This flexibility allows for diverse leadership options, which can be beneficial in making a Virgin Islands Resolution of Directors of a Close Corporation Authorizing Redemption of Stock.

You can find directors of a BVI company through the BVI Financial Services Commission’s public register. This resource displays crucial details about the company's directors and their roles. If you need further assistance in navigating the process, the Virgin Islands Resolution of Directors of a Close Corporation Authorizing Redemption of Stock outlines key procedures for such inquiries.

While BVI companies offer various benefits, there are disadvantages to consider. For instance, they may face challenges in regulatory compliance, including adherence to international standards. Additionally, the perception of BVI companies as tax havens may raise skepticism among investors. Understanding the Virgin Islands Resolution of Directors of a Close Corporation Authorizing Redemption of Stock can help mitigate some of these disadvantages.

Nominee shareholders in the British Virgin Islands (BVI) act on behalf of the actual owners of shares in a corporation. These individuals or entities maintain confidentiality for the true investors, providing an added layer of privacy. When setting up a Virgin Islands Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, it is critical to carefully consider the role of nominee shareholders, as they can simplify ownership structures while ensuring compliance with local regulations. By utilizing our platform at uslegalforms, you can easily create necessary resolutions and other documents to facilitate this process.

BVI companies offer several advantages, including tax neutrality, confidentiality, and simplicity of setup. These benefits make BVI an attractive jurisdiction for international business activities. If you are considering forming a BVI company, understanding the Virgin Islands Resolution of Directors of a Close Corporation Authorizing Redemption of Stock can be crucial, and uslegalforms provides essential resources to guide you.

The minimum share capital for a BVI company is typically one share with no nominal value. However, it is advisable to specify a higher share capital to enhance credibility and facilitate future investments. If you're unsure about the best approach for your business, uslegalforms can offer tailored solutions in this area.