Virgin Islands Release of Liability Form for Homeowner

Description

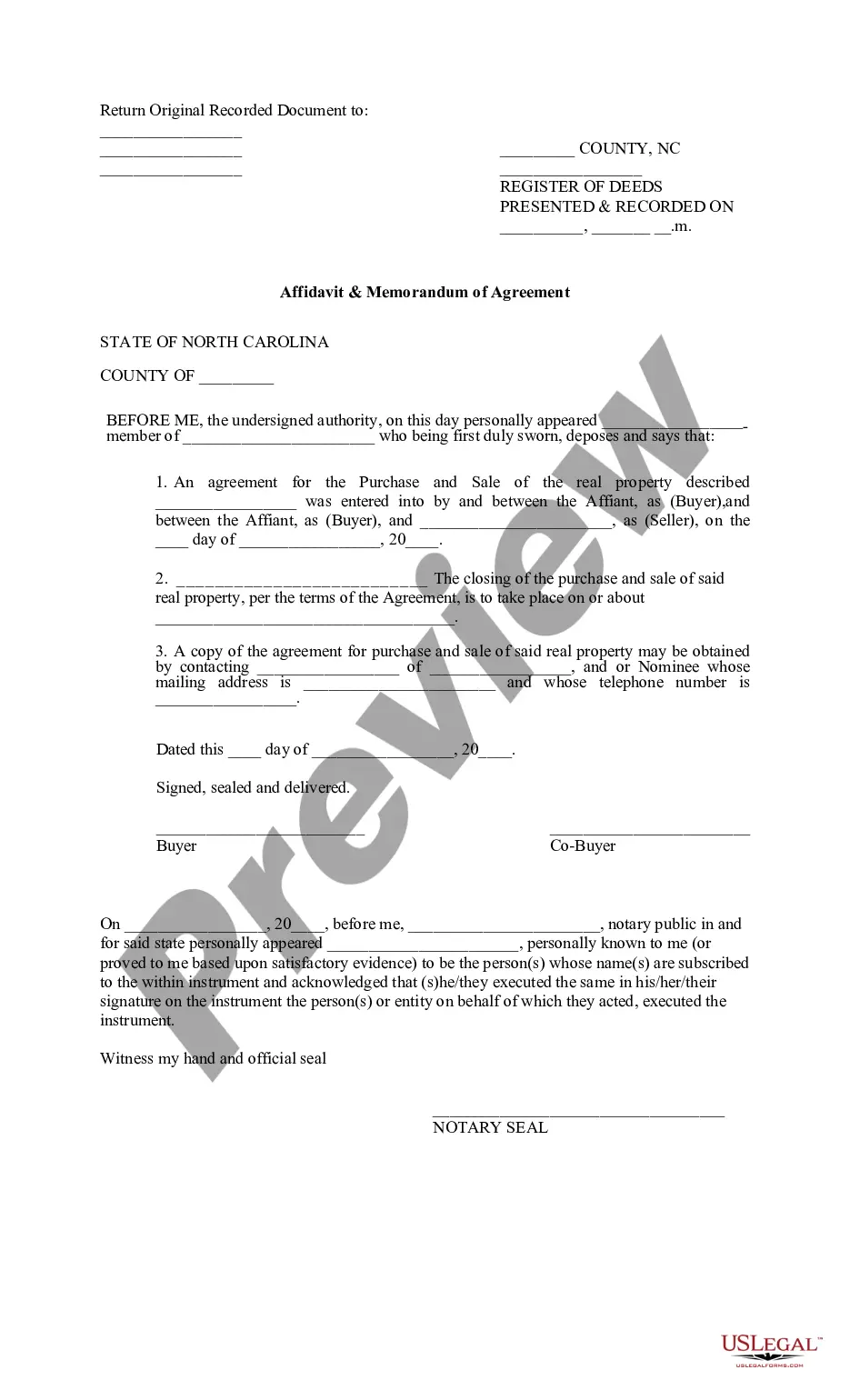

How to fill out Release Of Liability Form For Homeowner?

If you aim to finalize, acquire, or print authentic document templates, make use of US Legal Forms, the foremost compilation of valid forms, accessible online.

Utilize the site’s straightforward and efficient search feature to find the documents you require. Numerous templates for business and personal applications are categorized by types and suggestions, or keywords.

Leverage US Legal Forms to locate the Virgin Islands Release of Liability Form for Homeowner with just a few clicks.

Every legal document template you purchase is yours forever. You will have access to every form you downloaded through your account. Navigate to the My documents section and select a form to print or download again.

Be proactive and download, and print the Virgin Islands Release of Liability Form for Homeowner with US Legal Forms. There are millions of professional and jurisdiction-specific forms that you can use for your business or personal necessities.

- If you are already a US Legal Forms customer, Log In to your account and then click the Acquire button to obtain the Virgin Islands Release of Liability Form for Homeowner.

- You can also access forms you have previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Preview option to review the form's details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have identified the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, print, or sign the Virgin Islands Release of Liability Form for Homeowner.

Form popularity

FAQ

The timeline for receiving a mortgage lien release can vary based on several factors, including the lender and state regulations. Typically, it can take anywhere from a few weeks to several months after the final payment is made. After submitting the necessary documentation, it's important to follow up with your lender for status updates. For clarity on the lien release process, consider referring to the Virgin Islands Release of Liability Form for Homeowner available on the US Legal Forms platform.

If you split up with a co-borrower on a mortgage, you may need to negotiate the terms regarding ownership and payments. You can either keep the home jointly until sold or one party can buy out the other’s share. Financial factors, such as credit scores and income, will play a role in this decision. The Virgin Islands Release of Liability Form for Homeowner can be a useful tool in formalizing any agreements you reach during this process.

Notarization of release of liability forms, such as the Virgin Islands Release of Liability Form for Homeowner, is not always required. However, having a notarized document can strengthen its legal standing and provide additional proof of authenticity. It’s wise to check local laws or consult a legal expert to confirm requirements in your situation. By using the US Legal Forms platform, you can access the necessary templates and guidance to ensure proper execution.

A release of liability for a homeowner is a legal document that protects the homeowner from claims and lawsuits arising from injuries or damages that occur on their property. It specifies the terms under which participants acknowledge the risks involved in activities conducted on the homeowner's premises. Having a Virgin Islands Release of Liability Form for Homeowner is crucial for safeguarding your interests and ensuring a secure environment.

To obtain a release of liability on your mortgage, you will typically need to contact your lender and request the form or documentation required. This process may vary based on your lender's policies, and it might include submitting a formal request for modification. Utilizing a Virgin Islands Release of Liability Form for Homeowner can also protect you from future liabilities during interactions with the lender.

The primary purpose of the Virgin Islands Release of Liability Form for Homeowner is to protect homeowners from legal liability in case of accidents or injuries. This document allows participants to agree to waive their right to sue for damages that may arise during a specified activity. This mutual understanding fosters trust while helping homeowners manage risk effectively.

Parties often seek a release from liability before engaging in activities that involve potential risk, such as recreational activities, property rentals, or renovations. This form protects homeowners from legal claims should an incident occur. By using a Virgin Islands Release of Liability Form for Homeowner, you can ensure all participants understand and acknowledge the risks involved.

Creating a Virgin Islands Release of Liability Form for Homeowner is straightforward. First, clearly outline the activities or services for which liability is being waived. Then, include sections for participant details, signatures, and dates. You can also use platforms like USLegalForms, which provide templates and guidance to simplify the process.

Generally, a release of liability form does not need to be notarized to be valid, but having it notarized can enhance its legitimacy. For the Virgin Islands Release of Liability Form for Homeowner, notarization can provide additional assurance for all parties involved. While not mandatory, it may be a good practice, especially for larger agreements or when dealing with significant risks. Always check local laws to ensure compliance.

The primary purpose of a release of liability form is to protect homeowners from legal claims related to incidents on their property. The Virgin Islands Release of Liability Form for Homeowner plays a crucial role in outlining the agreed-upon risks and responsibilities. This clarity helps to prevent misunderstandings and legal disputes later on. Using this form effectively establishes trust between homeowners and guests or service providers.