Virgin Islands Community Property Disclaimer

Description

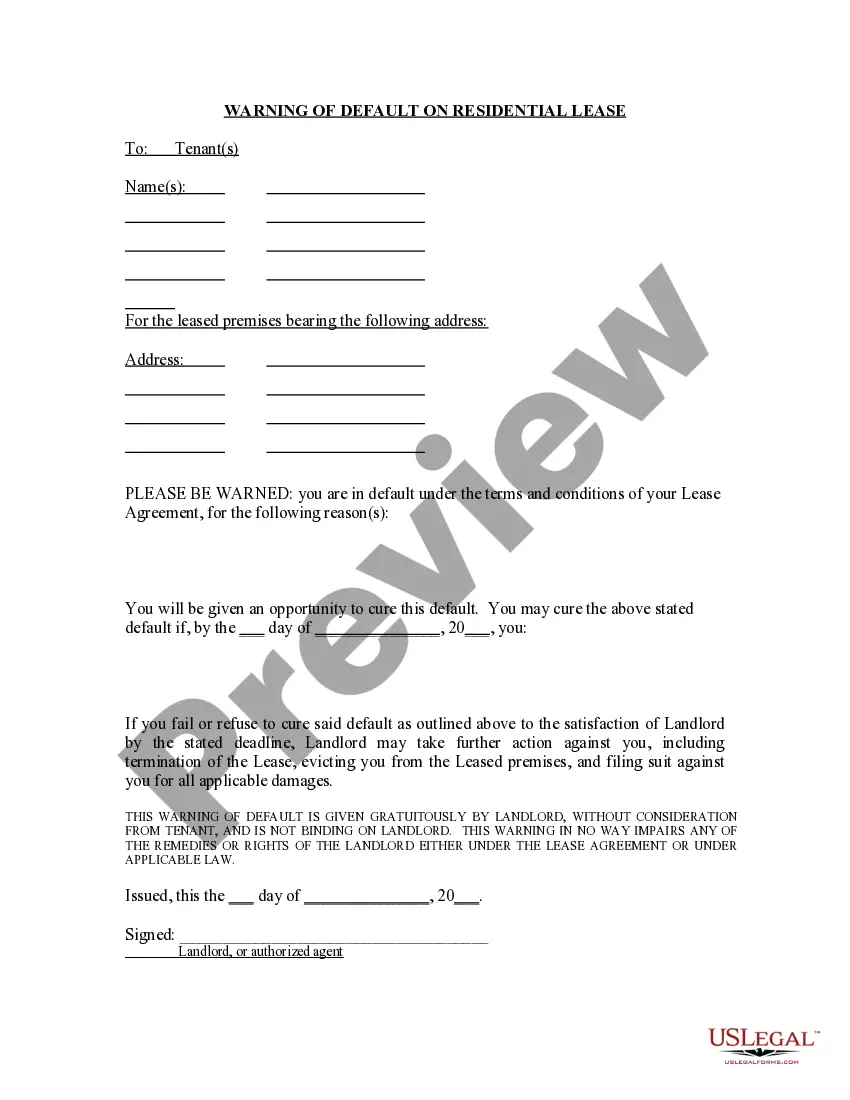

How to fill out Community Property Disclaimer?

If you want to thorough, acquire, or create legal document templates, utilize US Legal Forms, the largest selection of legal documents, which can be accessed online.

Leverage the website's straightforward and efficient search to find the documents you require.

Different templates for business and personal purposes are categorized by types and regions, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Select the payment plan you prefer and enter your details to register for the account.

Step 5. Process the payment. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to locate the Virgin Islands Community Property Disclaimer in just a few clicks.

- If you are presently a US Legal Forms member, sign in to your account and click the Download button to retrieve the Virgin Islands Community Property Disclaimer.

- You can also access documents you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the directions below.

- Step 1. Ensure you have chosen the form for the appropriate city/state.

- Step 2. Use the Review option to examine the form’s content. Remember to read the description.

- Step 3. If you are not content with the form, use the Search field at the top of the screen to find additional models in the legal form type.

Form popularity

FAQ

Yes, Americans can own property in the US Virgin Islands without restrictions. The process allows for both individual and corporate ownership, making it an attractive destination for real estate investment. However, prospective buyers should become familiar with the Virgin Islands Community Property Disclaimer to navigate ownership and inheritance laws smoothly. At USLegalForms, you can find forms and guidance to help protect your interests and ensure compliance.

The US Virgin Islands is a unique territory that has some ties to the United States, but it operates more like a separate jurisdiction concerning tax obligations. It follows its own tax code, which aligns with specific provisions of the Internal Revenue Code. Therefore, individuals and businesses may face different tax responsibilities than they would on the mainland. It's essential to understand the Virgin Islands Community Property Disclaimer when considering investments or property ownership in this region.

The Virgin Islands functions as a community property jurisdiction, similar to community property states on the U.S. mainland. This means that property acquired during marriage is owned jointly by both spouses. It is important for couples to understand these laws clearly; utilizing a Virgin Islands Community Property Disclaimer can help ensure proper asset division.

U.S. laws apply in the Virgin Islands, but local laws also play a significant role. This duality of law means that residents must navigate both federal and local regulations. Familiarizing oneself with the Virgin Islands Community Property Disclaimer can provide clarity on how both sets of laws affect property ownership.

Yes, the U.S. Constitution generally applies to the Virgin Islands, but with certain exceptions. Residents enjoy many constitutional rights, though some liberties may differ from those on the mainland. Understanding the nuances of these rights through a Virgin Islands Community Property Disclaimer is essential for asset protection.

Generally, U.S. laws apply to U.S. territories, including the Virgin Islands. These laws address numerous issues, from taxation to civil rights. However, some local adaptations and interpretations may differ. It's vital to refer to a Virgin Islands Community Property Disclaimer to understand the nuances of property laws.

Yes, the U.S. governs the U.S. Virgin Islands. This territory is under the jurisdiction of the federal government. However, local laws and regulations also apply. Understanding the Virgin Islands Community Property Disclaimer can help clarify how these laws may affect property ownership.

The U.S. Virgin Islands is not classified as a community property state. Instead, it follows different laws of property ownership that reflect its unique legal landscape. To navigate these intricacies, you might consider a Virgin Islands Community Property Disclaimer to help protect your interests and clarify ownership definitions.

The nine community property states in the United States include Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. In these states, property acquired during marriage generally belongs to both partners. Understanding these laws is essential, especially if you're considering a Virgin Islands Community Property Disclaimer that may affect how property is viewed in the Islands.

No, U.S. citizens do not need to go through customs when traveling to the U.S. Virgin Islands, as it is a U.S. territory. Visitors can enjoy straightforward travel without many of the restrictions placed on international border crossings. However, if you have questions about bringing items related to property ownership, consult the Virgin Islands Community Property Disclaimer to ensure compliance.