Virgin Islands Certificate of Trust for Successor Trustee

Description

How to fill out Certificate Of Trust For Successor Trustee?

US Legal Forms - one of the largest libraries of legitimate forms in America - provides a variety of legitimate record layouts it is possible to obtain or produce. Utilizing the site, you can find a large number of forms for organization and person uses, sorted by types, says, or keywords and phrases.You will find the most recent variations of forms like the Virgin Islands Certificate of Trust for Successor Trustee within minutes.

If you already possess a monthly subscription, log in and obtain Virgin Islands Certificate of Trust for Successor Trustee through the US Legal Forms local library. The Obtain option can look on every type you look at. You get access to all earlier delivered electronically forms inside the My Forms tab of your own bank account.

If you would like use US Legal Forms initially, listed here are simple instructions to get you started:

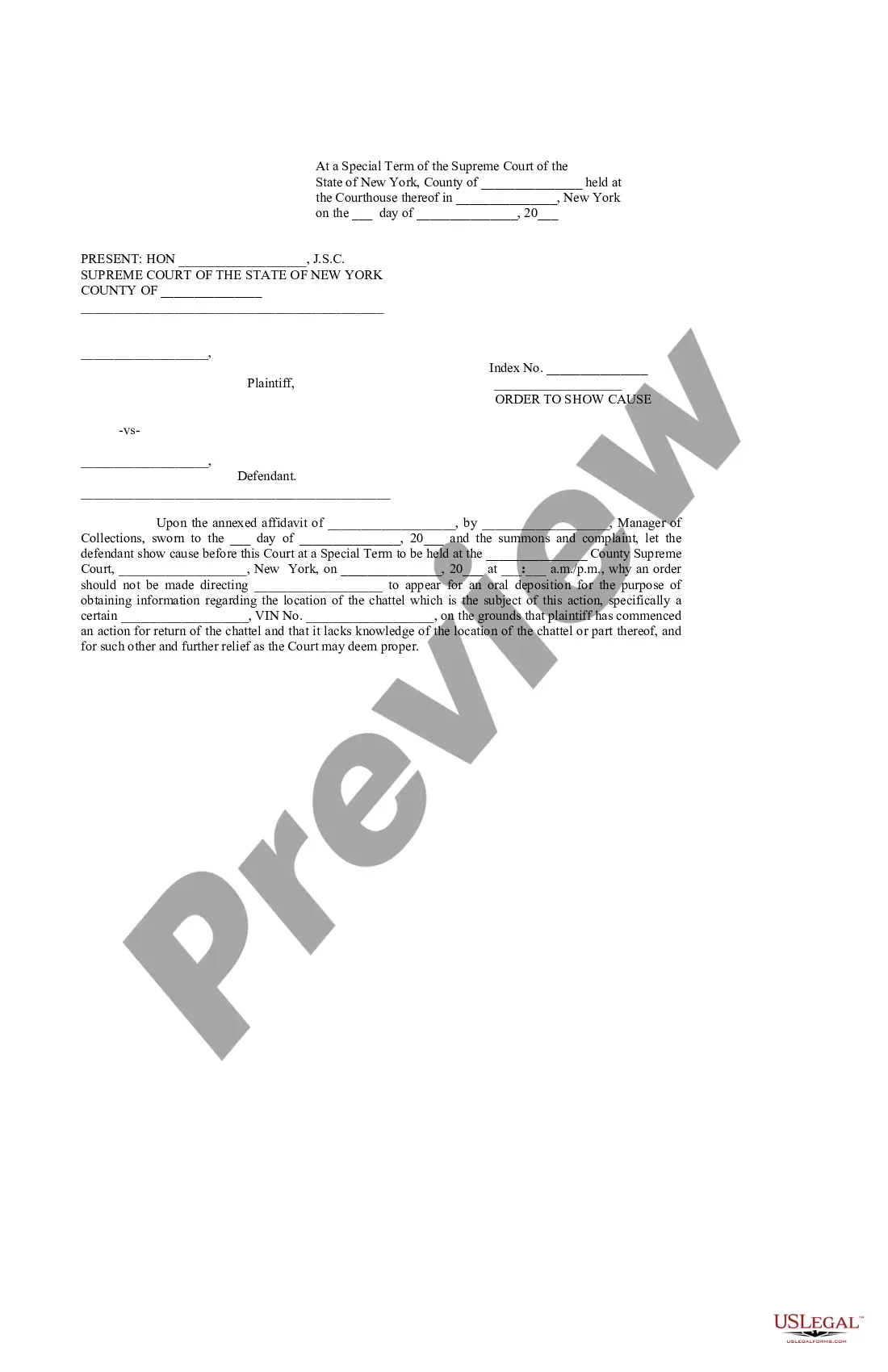

- Ensure you have picked out the best type for your metropolis/area. Click on the Preview option to review the form`s information. Read the type explanation to actually have chosen the correct type.

- When the type does not match your demands, take advantage of the Search industry at the top of the screen to find the the one that does.

- When you are happy with the shape, verify your option by visiting the Purchase now option. Then, opt for the pricing program you favor and supply your credentials to register for an bank account.

- Approach the transaction. Utilize your credit card or PayPal bank account to finish the transaction.

- Pick the structure and obtain the shape in your gadget.

- Make alterations. Fill out, edit and produce and indicator the delivered electronically Virgin Islands Certificate of Trust for Successor Trustee.

Each format you added to your bank account lacks an expiry particular date and is also your own property permanently. So, if you would like obtain or produce another version, just visit the My Forms section and click on the type you require.

Obtain access to the Virgin Islands Certificate of Trust for Successor Trustee with US Legal Forms, one of the most comprehensive local library of legitimate record layouts. Use a large number of skilled and condition-particular layouts that satisfy your small business or person demands and demands.

Form popularity

FAQ

It is not unusual for the successor trustee of a trust to also be a beneficiary of the same trust. This is because settlors often name trusted family members or friends to both manage their trust and inherit from it.

Section 83A (13) as amended in the Amended Act sets out the "firewall" provisions, which provide that subject to any express provision to the contrary in the trust or disposition, no BVI trust or transfers of property held on trust shall be void, voidable, liable to be set aside, or defective in any way, nor is the ...

Limitation periods Contract and tort claims: six years from the date on which the cause of action accrued. Claims brought in respect of deeds: 12 years from the date of breach of the obligation under the deed.

The Trustee (Amendment) Act 2021 entered into force on and brings the BVI trust law in line with international trust law developments. arrangements on behalf of various categories of persons who are themselves unable to provide such approval, such as minors and unborn and unascertained persons.

The term ?trustee succession? refers to the process of having a new ?successor? trustee take over the administration of a trust. Many trusts are managed by their creators while they are still alive. When the original trustee dies or becomes incapacitated, a successor trustee will take over the management of the trust.

Generally, the Trustee of a BVI Trust is a trust company based in the BVI. Under BVI law no company may carry on the business of acting as Trustee without having a trust licence that has been issued by the BVI Financial Services Commission (?FSC?), except for Private Trust Companies.

The Trustees may be individuals, companies licenced as trust companies under the BTCA, or Private Trust Companies established under the Regulations. An individual Trustee does not have to be a BVI resident. Generally, the Trustee of a BVI Trust is a trust company based in the BVI.